Are you gearing up for an interview for a Income Tax Advisor position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Income Tax Advisor and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

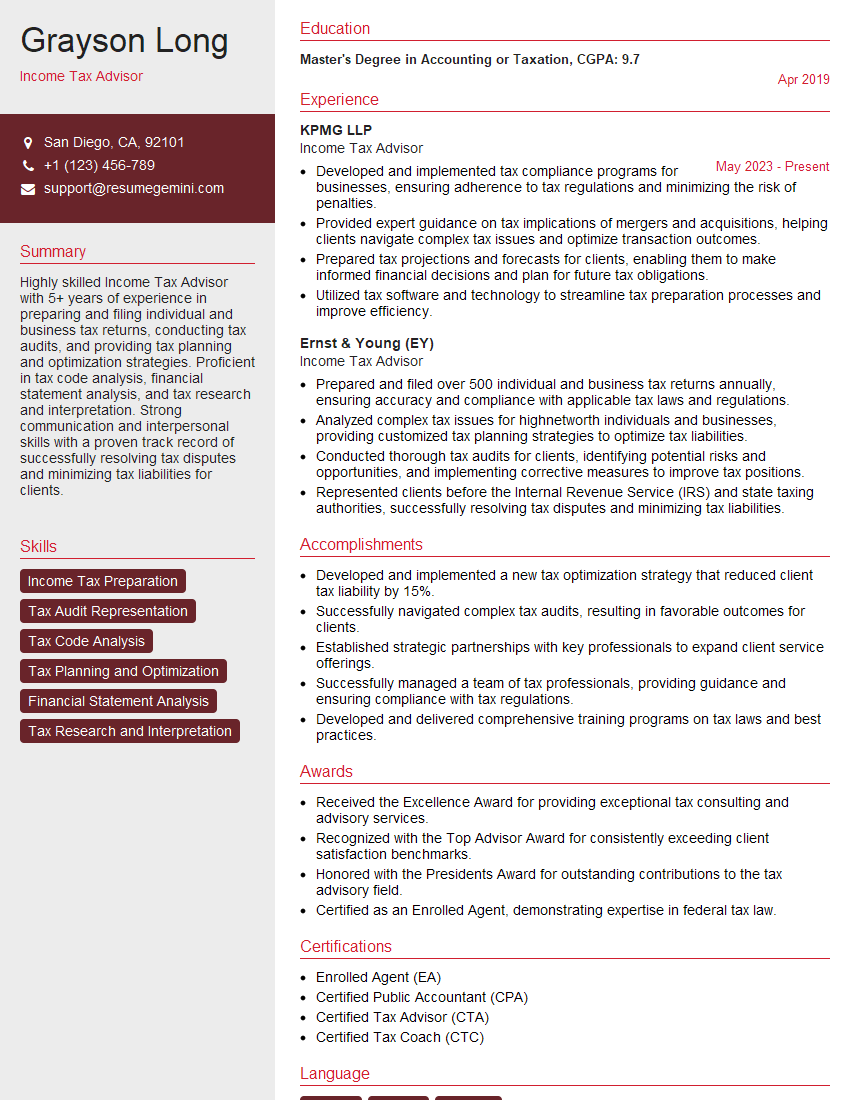

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Income Tax Advisor

1. Explain the concept of double taxation and how it is avoided in India?

- Double taxation refers to a situation where the same income is taxed twice by different taxing authorities.

- In India, double taxation is avoided through the provisions of section 90/91 of the Income Tax Act, 1961, which provides for the deduction of foreign taxes paid on income earned abroad.

2. What are the different types of deductions available under the Income Tax Act?

Exemptions

- Basic exemption limit

- Deduction for standard deduction

- Deduction for professional tax

Deductions

- Deduction under section 80C (Life insurance, PPF, etc.)

- Deduction under section 80D (Health insurance)

- Deduction under section 80E (Interest on education loan)

3. Explain the concept of capital gains and how they are taxed in India?

- Capital gains refer to the profit or loss arising from the sale of a capital asset.

- In India, capital gains are classified into two types: short-term capital gains and long-term capital gains.

- Short-term capital gains are taxed at a flat rate of 15%, while long-term capital gains are taxed at a rate of 10% if the asset is held for more than 12 months.

4. What is the difference between a resident and a non-resident taxpayer in India?

- Resident taxpayer: An individual who has stayed in India for at least 182 days during the financial year is considered a resident taxpayer.

- Non-resident taxpayer: An individual who has not stayed in India for at least 182 days during the financial year is considered a non-resident taxpayer.

5. What are the tax implications of investing in mutual funds in India?

- Mutual funds are taxed based on the type of fund and the investment period.

- Dividend income from equity-oriented mutual funds is tax-free in the hands of the investor.

- Short-term capital gains (less than 12 months) from equity-oriented mutual funds are taxed at 15%, while long-term capital gains (more than 12 months) are taxed at 10%.

- Dividend income from debt-oriented mutual funds is taxed at the applicable income tax slab rate.

- Short-term capital gains (less than 3 years) from debt-oriented mutual funds are taxed at the applicable income tax slab rate, while long-term capital gains (more than 3 years) are taxed at 20% after indexation.

6. Explain the concept of tax audits and the process involved in it?

- Tax audits are conducted by the Income Tax Department to verify the accuracy of the income tax returns filed by taxpayers.

- The process of tax audit involves the following steps:

- Selection of cases for audit

- Issuance of notice to the taxpayer

- Verification of accounts and records

- Preparation of audit report

- Issuance of audit order

7. What are the different types of tax assessments and the procedures for each type?

- Self-assessment: The taxpayer calculates their tax liability and files a return accordingly.

- Regular assessment: The tax authorities assess the tax liability based on the information provided in the tax return and other available information.

- Summary assessment: The tax authorities assess the tax liability based on a summary of the taxpayer’s income and expenses.

- Best judgment assessment: The tax authorities assess the tax liability based on their best judgment in cases where the taxpayer has not provided sufficient information.

8. Explain the concept of GST and its impact on businesses in India?

- GST (Goods and Services Tax) is a comprehensive indirect tax levied on the supply of goods and services in India.

- GST has replaced multiple indirect taxes such as VAT, excise duty, and service tax.

- GST has a significant impact on businesses in India, as it has simplified the tax system, reduced compliance costs, and created a common market for goods and services.

9. What are the different methods of tax planning and how can they help individuals and businesses?

- Tax planning involves the use of legal strategies to reduce tax liability.

- Some common methods of tax planning include:

- Tax deductions and exemptions

- Tax deferrals

- Tax credits

- Tax avoidance

10. Explain the role of technology in tax administration and how it has improved compliance and efficiency?

- Technology has played a significant role in improving tax administration in India.

- The Income Tax Department has implemented various technological initiatives to improve compliance and efficiency, such as:

- Electronic filing of tax returns

- Online tax payment

- Computer-assisted scrutiny of tax returns

- Electronic data exchange with other government agencies

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Income Tax Advisor.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Income Tax Advisor‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities of Income Tax Advisor

Income Tax Advisors play a crucial role in assisting individuals and businesses in navigating the complexities of tax laws and regulations. Their primary responsibilities include:

1. Tax Advisory and Planning

• Providing comprehensive tax advisory services to clients based on their financial situation and tax objectives.

• Developing customized tax plans to optimize tax savings and minimize tax liabilities for individuals and businesses.

2. Tax Preparation and Filing

• Preparing and filing federal, state, and local income tax returns accurately and efficiently.

• Ensuring that all necessary documentation is gathered and organized for timely and compliant tax filing.

3. Tax Audits and Representations

• Representing clients during tax audits and appeals, ensuring their rights are protected.

• Preparing and submitting written responses to audit inquiries and requests for information.

4. Tax Law and Regulation Interpretation

• Staying abreast of the latest tax laws, regulations, and court rulings to provide up-to-date advice to clients.

• Analyzing and interpreting tax laws and regulations to determine the impact on clients’ tax positions.

Interview Preparation Tips for Income Tax Advisor Candidates

To ace an interview for an Income Tax Advisor position, candidates should prepare thoroughly and demonstrate their knowledge, skills, and abilities in tax matters.

1. In-depth Understanding of Tax Laws and Regulations

• Study and familiarize yourself with the relevant tax laws, regulations, and court rulings.

• Demonstrate your ability to apply tax principles to real-world scenarios.

2. Strong Analytical and Problem-Solving Skills

• Highlight your analytical skills and ability to identify and resolve complex tax issues.

• Provide examples of how you have successfully solved tax-related problems for previous clients or in academic settings.

3. Excellent Communication and Interpersonal Skills

• Emphasize your ability to effectively communicate complex tax concepts to clients from diverse backgrounds.

• Demonstrate your interpersonal skills and ability to build strong relationships with clients and colleagues.

4. Up-to-date on Tax Law Changes

• Research and discuss recent changes in tax laws and regulations.

• Explain how these changes might impact the clients you would be advising.

5. Knowledge of Tax Software

• Familiarize yourself with commonly used tax software programs.

• Emphasize your proficiency in using these tools to prepare and file tax returns.

6. Ethical and Professional Conduct

• Highlight your commitment to maintaining ethical and professional standards in your work.

• Discuss how you ensure confidentiality and protect client information.

7. Practice Your Interview Skills

• Prepare answers to common interview questions.

• Practice your responses in front of a mirror or with a friend or family member.

8. Research the Company and Position

• Learn about the company’s business model, tax compliance history, and any industry-specific tax considerations.

• Tailor your answers to the specific requirements of the position you are interviewing for.

Next Step:

Now that you’re armed with the knowledge of Income Tax Advisor interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Income Tax Advisor positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini