Feeling lost in a sea of interview questions? Landed that dream interview for Licensed Tax Consultant but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Licensed Tax Consultant interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

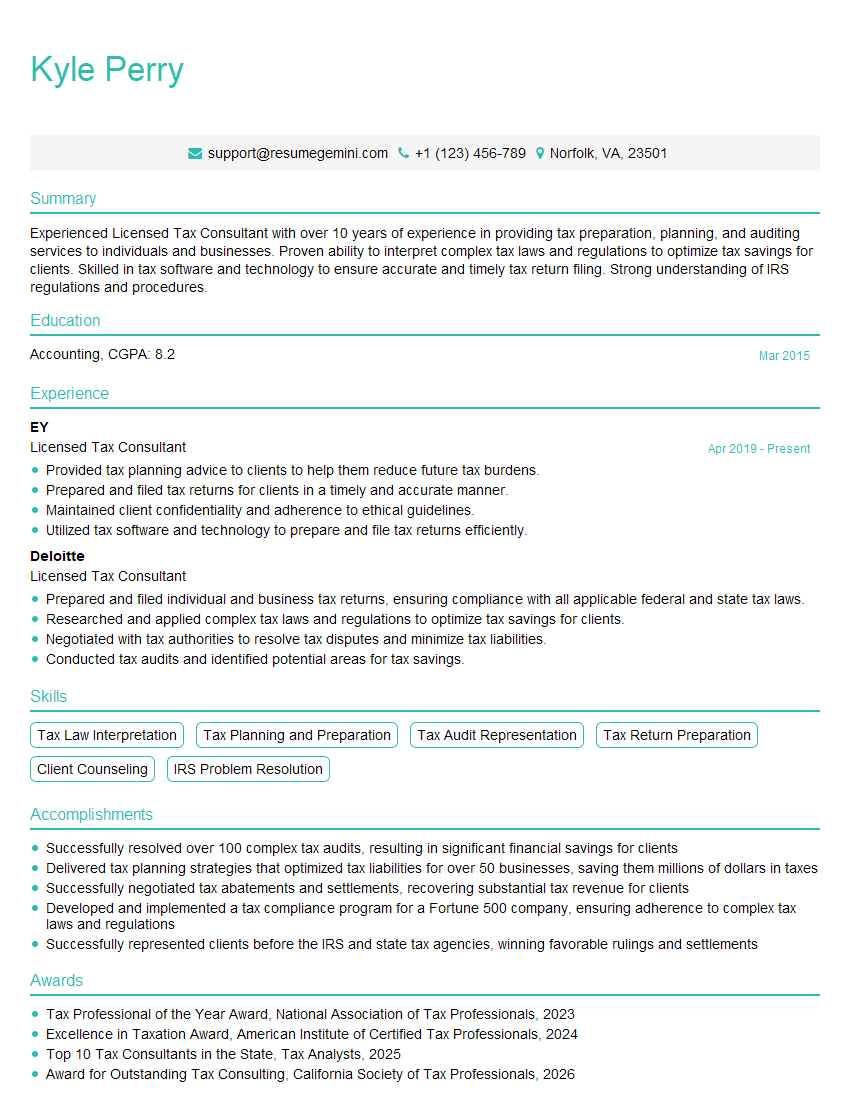

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Licensed Tax Consultant

1. What are the key responsibilities of a Licensed Tax Consultant?

Key responsibilities of a Licensed Tax Consultant include:

- Preparing and filing tax returns for individuals and businesses

- Providing tax advice and guidance to clients

- Representing clients before the Internal Revenue Service (IRS)

- Staying up-to-date on tax laws and regulations

- Maintaining confidentiality of client information

2. What are the different types of tax returns that you have prepared?

Individual Tax Returns

- Form 1040

- Form 1040-EZ

- Form 1040-A

Business Tax Returns

- Form 1120

- Form 1120-S

- Form 1065

3. What are some of the common tax issues that you have encountered in your experience?

Some common tax issues that I have encountered in my experience include:

- The Tax Cuts and Jobs Act

- The Affordable Care Act

- State and local tax issues

- Foreign tax issues

- Estate planning

4. What are your strengths as a Licensed Tax Consultant?

My strengths as a Licensed Tax Consultant include:

- My technical knowledge of tax laws and regulations

- My ability to communicate complex tax information to clients in a clear and concise manner

- My strong analytical and problem-solving skills

- My attention to detail and my ability to meet deadlines

5. What are your weaknesses as a Licensed Tax Consultant?

My weaknesses as a Licensed Tax Consultant include:

- My lack of experience in certain areas of taxation, such as international taxation

- My tendency to be a perfectionist, which can sometimes lead to delays in completing tasks

6. What are your goals for your career as a Licensed Tax Consultant?

My goals for my career as a Licensed Tax Consultant include:

- To continue to develop my technical knowledge of tax laws and regulations

- To build my client base and become a trusted advisor to my clients

- To eventually start my own tax consulting firm

7. What are some of the challenges that you foresee in the tax industry in the next five years?

Some of the challenges that I foresee in the tax industry in the next five years include:

- The increasing complexity of tax laws and regulations

- The impact of technology on the tax industry

- The globalization of the economy

8. What are some of the recent changes in tax laws and regulations that you are aware of?

Some of the recent changes in tax laws and regulations that I am aware of include:

- The Tax Cuts and Jobs Act of 2017

- The Affordable Care Act

- The Foreign Account Tax Compliance Act (FATCA)

9. What are some of the tax planning strategies that you have implemented for your clients?

Some of the tax planning strategies that I have implemented for my clients include:

- Retirement planning

- Education planning

- Estate planning

- Business succession planning

10. How do you stay up-to-date on tax laws and regulations?

I stay up-to-date on tax laws and regulations by:

- Reading tax journals and magazines

- Attending tax conferences and seminars

- Taking continuing education courses

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Licensed Tax Consultant.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Licensed Tax Consultant‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

As a Licensed Tax Consultant, you will have a range of responsibilities related to providing tax consulting and compliance services to various clients in accordance with federal and state tax laws, regulations, and ethical guidelines.

1. Tax Planning and Preparation

Analyze clients’ financial situations and tax implications, develop and implement tax-saving strategies, prepare individual and business tax returns, represent clients before tax authorities during audits, and assist in tax dispute resolution.

2. Consulting and Advisory Services

Provide guidance on complex tax issues, such as business structuring, mergers and acquisitions, and estate planning, assist clients in understanding the impact of tax laws on their financial decisions, and recommend strategies to minimize tax liabilities and optimize tax benefits.

3. Compliance and Reporting

Ensure compliance with tax laws and regulations by advising clients on their reporting obligations, preparing and filing tax returns, and responding to tax notices, assist clients in meeting their tax obligations in a timely and accurate manner, and stay abreast of changes in tax laws and regulations.

4. Research and Education

Stay informed about the latest tax laws and regulations, conduct research on specific tax topics, present educational materials to clients and professional organizations, and participate in continuing professional education to maintain knowledge and skills.

Interview Tips

Preparing thoroughly for your interview is crucial to making a positive impression and increasing your chances of success. Here are some tips to help you prepare:

1. Research the Company and the Role

Take the time to research the company’s website, social media presence, and industry news. Learn about their mission, values, and recent developments, and tailor your answers to show how your skills and experience align with their needs.

2. Review Common Interview Questions

Practice answering common tax-related interview questions, such as “Tell me about your experience in tax planning,” “How do you handle complex tax issues?” and “What are your strengths and weaknesses as a tax consultant?”

3. Highlight Your Relevant Skills and Experience

In your resume and during the interview, emphasize your tax knowledge, technical skills, and experience in providing tax consulting services. Use specific examples to demonstrate your abilities and quantify your accomplishments whenever possible.

4. Prepare Questions to Ask

Asking thoughtful questions at the end of the interview shows that you are engaged and interested in the role. Prepare a few insightful questions about the company, the industry, or the specific responsibilities of the position.

5. Dress Professionally and Be Punctual

First impressions matter, so make sure to dress appropriately for the interview. Arrive on time and be respectful of the interviewer’s time. Maintain a positive and professional demeanor throughout the interview.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Licensed Tax Consultant interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.