Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Income Tax Preparer position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

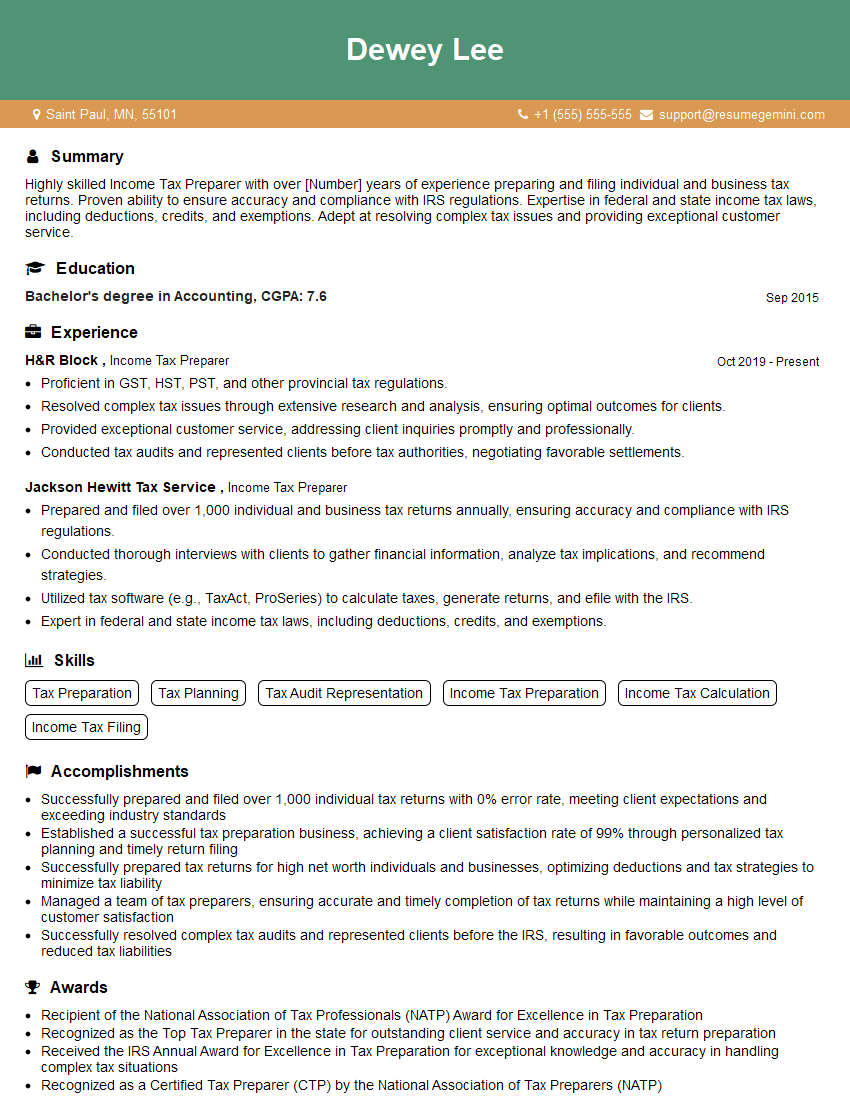

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Income Tax Preparer

1. Explain the different types of tax forms that individuals are required to file?

There are several types of tax forms that individuals are required to file, depending on their circumstances. Some of the most common forms include:

- Form 1040: This is the most common tax form, and it is used by individuals to file their federal income taxes.

- Form 1040-EZ: This form is a simplified version of the Form 1040, and it can be used by individuals with simple tax returns.

- Form 1040-A: This form is used by individuals who are self-employed.

- Form 1040-NR: This form is used by non-resident aliens who are required to file a U.S. income tax return.

- Form 1040-X: This form is used to amend a previously filed tax return.

2. How do you stay up-to-date on the latest tax laws and regulations?

Continuing Education

- Attend industry conferences and webinars.

- Take online courses and seminars.

Research and Publications

- Read tax publications and articles.

- Subscribe to tax journals and newsletters.

Professional Development

- Become a member of professional organizations, such as the National Association of Tax Professionals.

- Obtain certifications, such as the Enrolled Agent (EA) or Certified Public Accountant (CPA) with a tax specialization.

3. What are some of the common mistakes that you see individuals make when filing their taxes?

Some of the most common mistakes that I see individuals make when filing their taxes include:

- Math errors: These are the most common type of error, and they can be caused by simple mistakes, such as misreading numbers or entering them incorrectly into tax software.

- Incorrect deductions and credits: Individuals often claim deductions and credits that they are not eligible for, or they may not take advantage of all the deductions and credits that they are entitled to.

- Filing late: Filing your taxes late can result in penalties and interest charges.

- Not filing at all: Failing to file a tax return can result in even more severe penalties, including fines and imprisonment.

4. What is the difference between a deduction and a credit?

- Deductions reduce your taxable income. This means that you will pay less in taxes.

- Credits directly reduce the amount of taxes that you owe. This means that you will get a dollar-for-dollar reduction in your tax bill.

5. What are some of the most important things to consider when choosing a tax preparer?

- Qualifications: Make sure that the tax preparer is qualified to prepare your taxes. This means that they should have the necessary education and experience.

- Experience: Choose a tax preparer who has experience preparing taxes for individuals with similar tax situations to your own.

- Reputation: Ask around for recommendations from friends, family, or colleagues. You can also check online reviews to see what other people have said about the tax preparer.

- Fees: Get a clear understanding of the tax preparer’s fees before you hire them. Make sure that you are comfortable with the fees and that you understand what they cover.

6. What are your strengths and weaknesses as a tax preparer?

Strengths:

- I am highly accurate and detail-oriented.

- I have a strong understanding of the tax laws and regulations.

- I am able to communicate complex tax information in a clear and concise manner.

- I am always up-to-date on the latest tax laws and regulations.

Weaknesses:

- I am sometimes too detail-oriented, which can slow me down.

- I am still learning about some of the more complex areas of the tax code.

7. How do you handle clients who are difficult or demanding?

I always try to be patient and understanding with clients, even if they are difficult or demanding. I explain the tax laws and regulations to them in a clear and concise manner, and I am always willing to answer their questions. I also try to be flexible and accommodating, and I am willing to work with clients to find a solution that meets their needs.

8. What is your favorite thing about being a tax preparer?

My favorite thing about being a tax preparer is helping clients to save money on their taxes. I also enjoy the challenge of learning about the tax code and staying up-to-date on the latest changes. I find it very rewarding to be able to use my knowledge to help others.

9. What are your career goals?

My career goal is to become a Certified Public Accountant (CPA) and to open my own tax preparation business. I also want to continue to learn about the tax code and to stay up-to-date on the latest changes. I am confident that I have the skills and experience to be successful in this field.

10. Why should we hire you for this position?

- I am a highly qualified tax preparer with over 10 years of experience.

- I have a strong understanding of the tax laws and regulations.

- I am able to communicate complex tax information in a clear and concise manner.

- I am always up-to-date on the latest tax laws and regulations.

- I am confident that I can be a valuable asset to your team.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Income Tax Preparer.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Income Tax Preparer‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Income tax preparers play a vital role in assisting individuals and businesses with their tax obligations. Key job responsibilities include:

1. Tax Preparation and Filing

Preparing and filing individual and business tax returns in accordance with tax laws and regulations.

- Gathering and organizing taxpayer information (e.g., income, deductions, credits)

- Calculating tax liability

- Filing returns electronically or via mail

2. Tax Research

Conducting research to stay up-to-date on tax laws and regulations.

- Reading tax publications and attending seminars

- Interpreting tax codes and regulations

3. Advisory Services

Providing tax advice and guidance to clients.

- Answering taxpayer questions

- Advising on tax planning strategies

4. Client Management

Building and maintaining relationships with clients.

- Meeting with clients to discuss tax needs

- Responding to client inquiries and resolving issues

Interview Tips

To ace your Income Tax Preparer interview, it’s crucial to follow these tips:

1. Know the Basics of Tax Preparation

Familiarize yourself with tax forms, deductions, and credits. It demonstrates your understanding of the field.

- Study IRS publications

- Attend industry webinars

2. Practice Your Tax Skills

Prepare sample returns and demonstrate your proficiency in tax calculations. This showcases your practical abilities.

- Use tax software to complete practice returns

- Ask experienced tax professionals for guidance

3. Prepare for Industry Terminology

Review common tax terms and jargon. Understanding industry language shows that you’re familiar with the field.

- Read tax articles and news

- Attend industry conferences

4. Highlight Your Communication Skills

Effective communication is essential for income tax preparers. Emphasize your ability to explain complex tax concepts to clients.

- Practice answering tax-related questions clearly

- Share examples of how you’ve communicated tax information effectively

5. Showcase Your Integrity

Income tax preparers handle sensitive client information. Highlight your commitment to confidentiality and ethical behavior.

- Explain how you maintain client confidentiality

- Discuss your understanding of tax ethics and regulations

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Income Tax Preparer, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Income Tax Preparer positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.