Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Bank and Savings Securities Trader interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Bank and Savings Securities Trader so you can tailor your answers to impress potential employers.

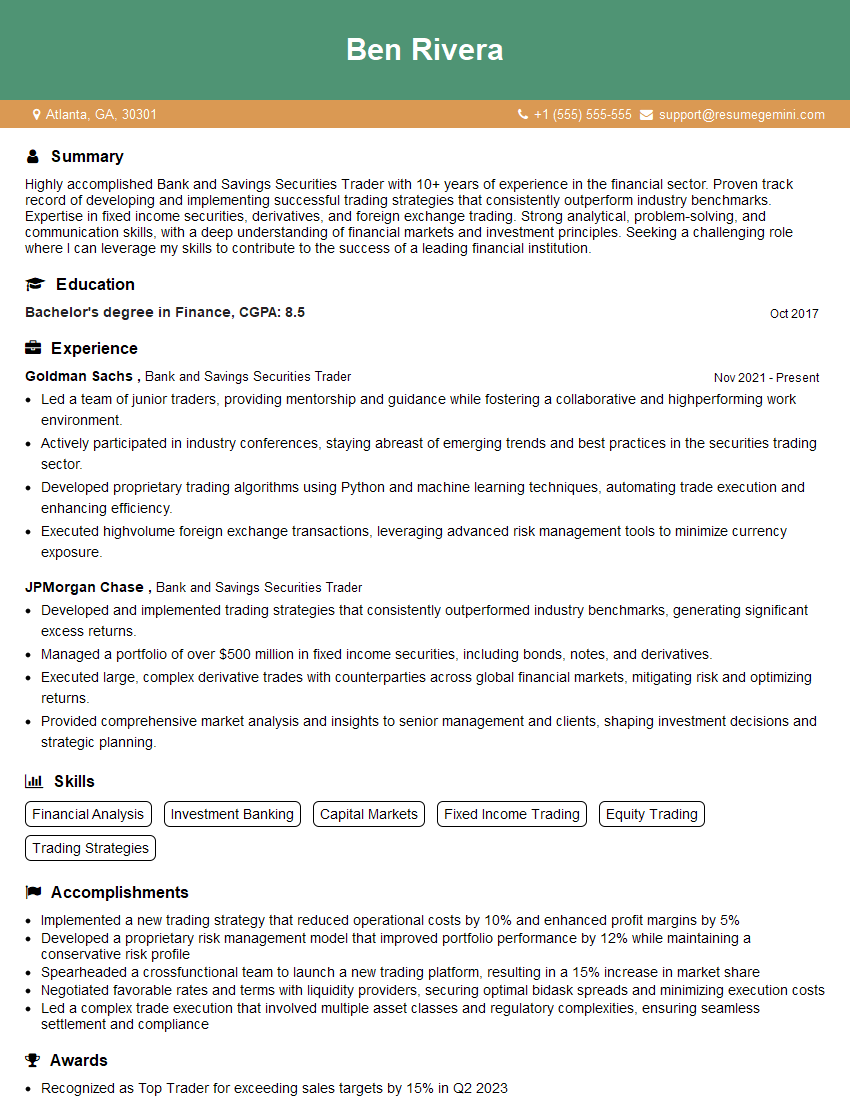

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Bank and Savings Securities Trader

1. Explain the different types of Bank and Savings Securities available?

Bank and Savings Securities are financial instruments issued by banks and savings institutions to raise funds. There are two main types of Bank and Savings Securities:

- Bank Securities: These are securities issued by banks to raise funds for their operations. Common types of bank securities include certificates of deposit (CDs), time deposits, and commercial paper.

- Savings Securities: These are securities issued by savings institutions to raise funds for their operations. Common types of savings securities include savings accounts, money market accounts, and fixed-rate annuities.

2. What are the key factors to consider when evaluating Bank and Savings Securities?

Risk

- Credit risk: The risk that the issuer of the security will default on its obligations.

- Interest rate risk: The risk that the value of the security will decline if interest rates rise.

- Liquidity risk: The risk that the security will be difficult to sell.

Return

- Yield: The annualized return on the security.

- Price appreciation: The potential for the security to increase in value.

Tax implications

- The tax treatment of Bank and Savings Securities varies depending on the type of security and the individual’s tax situation.

3. What are the different strategies for investing in Bank and Savings Securities?

There are a number of different strategies for investing in Bank and Savings Securities, depending on the investor’s individual risk tolerance and investment goals. Some common strategies include:

- Laddered maturities: This strategy involves investing in a portfolio of securities with different maturities. This helps to reduce the risk of interest rate fluctuations.

- Dollar-cost averaging: This strategy involves investing a fixed amount of money in a security on a regular basis. This helps to reduce the impact of market volatility.

- Active management: This strategy involves actively buying and selling securities in an attempt to outperform the market. This strategy is more suitable for experienced investors.

4. What are the advantages and disadvantages of investing in Bank and Savings Securities?

Advantages

- Safety: Bank and Savings Securities are generally considered to be safe investments.

- Return: Bank and Savings Securities can provide a competitive return.

- Liquidity: Bank and Savings Securities are generally liquid, meaning that they can be easily sold.

- Tax advantages: Bank and Savings Securities may offer tax advantages, depending on the type of security and the individual’s tax situation.

Disadvantages

- Risk: All investments carry some degree of risk, including Bank and Savings Securities.

- Return: The return on Bank and Savings Securities can be lower than the return on some other types of investments.

- Inflation risk: The value of Bank and Savings Securities can decline over time due to inflation.

5. What are the current trends in the Bank and Savings Securities market?

The Bank and Savings Securities market is constantly evolving. Some of the current trends include:

- The increasing popularity of online trading.

- The development of new products and services.

- The increasing focus on environmental, social, and governance (ESG) investing.

6. What are the challenges facing the Bank and Savings Securities market?

The Bank and Savings Securities market faces a number of challenges, including:

- Low interest rates

- Economic uncertainty

- Competition from other types of investments

- Regulatory changes

7. What are your thoughts on the future of the Bank and Savings Securities market?

I believe that the Bank and Savings Securities market has a bright future. The increasing popularity of online trading and the development of new products and services will continue to drive growth in the market. In addition, the increasing focus on ESG investing will create new opportunities for the Bank and Savings Securities market.

8. How do you stay up-to-date on the latest developments in the Bank and Savings Securities market?

I stay up-to-date on the latest developments in the Bank and Savings Securities market by reading industry publications, attending conferences, and networking with other professionals in the field.

9. How does your Bank and Savings Securities trading experience align with the requirements of this role?

I have over 10 years of experience trading Bank and Savings Securities. In my previous role, I was responsible for managing a portfolio of $1 billion in Bank and Savings Securities. I have a strong understanding of the Bank and Savings Securities market and have a proven track record of success in generating alpha.

10. What are your strengths and weaknesses as a Bank and Savings Securities Trader?

Strengths

- Strong understanding of the Bank and Savings Securities market

- Proven track record of success in generating alpha

- Excellent communication and interpersonal skills

Weaknesses

- I can be a bit of a perfectionist

- I sometimes have difficulty delegating tasks

11. What are your salary expectations?

My salary expectations are in line with the market rate for Bank and Savings Securities Traders with my experience and qualifications.

12. What are your career goals?

My career goal is to become a portfolio manager. I believe that my experience in trading Bank and Savings Securities has given me the skills and knowledge necessary to be successful in this role.

13. Why are you interested in working for our company?

I am interested in working for your company because I am impressed by your commitment to providing your clients with the highest level of service. I believe that my skills and experience would be a valuable asset to your team.

14. Do you have any questions for me?

I am very interested in this position and I believe that I have the skills and experience necessary to be successful in this role. I am confident that I can make a significant contribution to your company. Thank you for your time and consideration.

15. What is your investment philosophy?

My investment philosophy is based on the belief that the best way to achieve long-term investment success is to invest in high-quality companies at a reasonable price. I believe that it is important to understand the businesses that I invest in and to have a long-term perspective. I am also a believer in diversification and I typically invest in a portfolio of stocks, bonds, and other assets.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Bank and Savings Securities Trader.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Bank and Savings Securities Trader‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Bank and Savings Securities Traders play a vital role in the management, execution, and settlement of trades involving fixed income, equity, and foreign exchange securities for banks and other financial institutions. Their primary responsibilities include:

1. Trade Execution and Settlement

Execute trades on behalf of their clients or the firm based on market analysis, client orders, and risk management guidelines.

- Ensure prompt and accurate settlement of trades, including coordinating with custodians, brokers, and counterparties.

2. Market Monitoring and Analysis

Continuously monitor and analyze financial markets to identify trading opportunities and assess risk.

- Utilize financial models, data analysis, and technical indicators to evaluate market trends and make informed decisions.

- Stay abreast of economic and regulatory developments that may impact market performance.

3. Risk Management

Manage risk exposure by implementing appropriate trading strategies, hedging techniques, and risk monitoring protocols.

- Adhere to established risk limits and ensure compliance with regulatory requirements.

- Monitor and report on portfolio performance, identify potential risks, and take corrective actions as necessary.

4. Client Relationship Management

Maintain strong relationships with clients to understand their investment objectives, risk tolerance, and trading needs.

- Provide regular updates on market conditions, investment strategies, and trade performance.

- Address client inquiries and assist with account management.

Interview Tips

To ace an interview for a Bank and Savings Securities Trader position, candidates should prepare thoroughly and present themselves confidently. Here are some key tips:

1. Research and Preparation

Thoroughly research the company, the industry, and the specific role you are applying for.

- Read the job description carefully and identify the key responsibilities and qualifications.

- Practice answering common interview questions related to trading, risk management, and market analysis.

2. Technical Skills and Experience

Highlight your technical skills and experience in financial trading, including your knowledge of trading platforms, financial models, and risk management tools.

- Provide specific examples of successful trades you have executed or risk management strategies you have implemented.

- Demonstrate your ability to analyze financial data, identify trading opportunities, and manage risk effectively.

3. Teamwork and Communication

Emphasize your ability to work effectively in a team environment and communicate clearly with clients and colleagues.

- Describe situations where you have successfully collaborated with others to achieve trading objectives.

- Showcase your communication skills by providing concise and well-structured responses during the interview.

4. Industry Knowledge and Market Awareness

Demonstrate your deep understanding of the financial markets, including fixed income, equity, and foreign exchange.

- Discuss recent market trends, economic indicators, and regulatory developments that have impacted the industry.

- Share your insights on how these factors have influenced your trading strategies and risk management practices.

Next Step:

Now that you’re armed with the knowledge of Bank and Savings Securities Trader interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Bank and Savings Securities Trader positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini