Are you gearing up for a career in Equity Structurer? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Equity Structurer and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

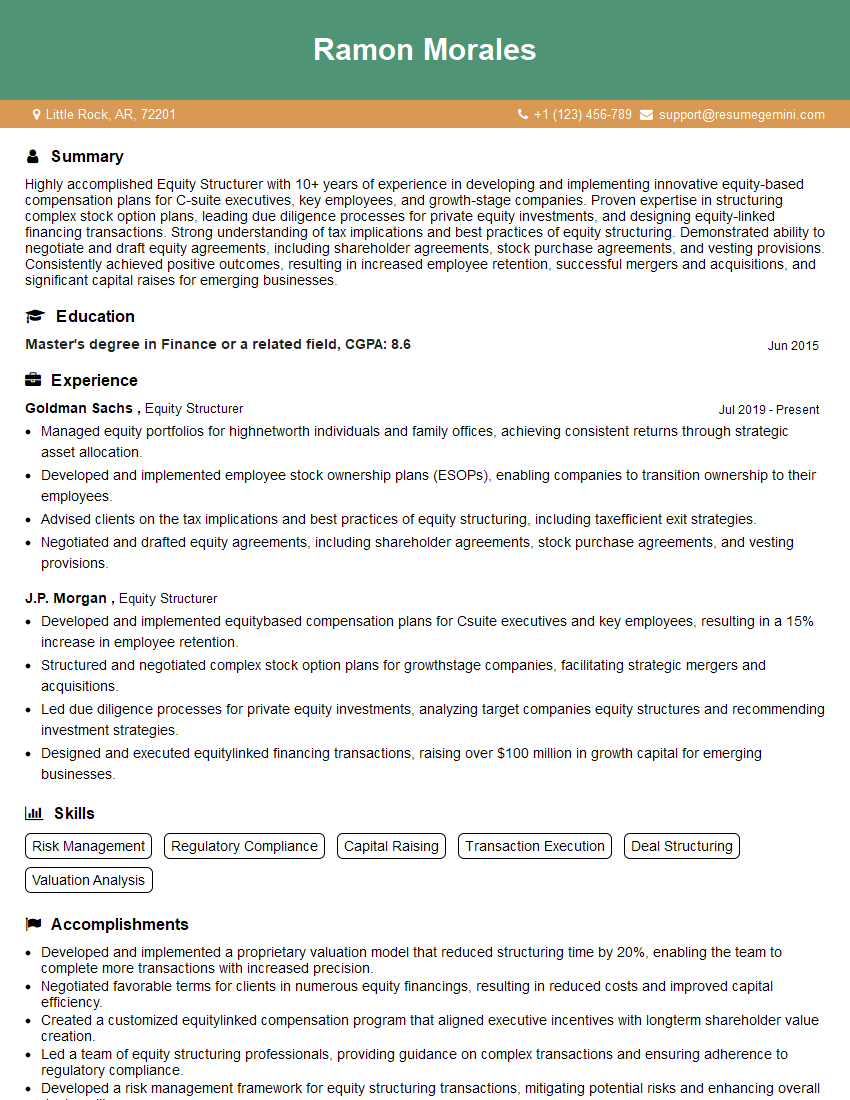

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Equity Structurer

1. Explain the concept of equity structuring and discuss its key components.

- Equity structuring involves designing and implementing financial structures that allocate ownership interests and capital in a company.

- Key components include equity ownership, voting rights, dividends, and liquidation preferences.

2. Describe the different types of equity instruments used in complex capital structures and explain their features.

Common Stock

- Represents residual ownership interest in the company.

- Entitles holders to voting rights and potential dividends.

Preferred Stock

- Hybrid security with both equity and debt characteristics.

- Typically has priority over common stock for dividends and liquidation proceeds.

- May have convertible or redeemable features.

Warrants

- Options to purchase additional shares at a set price.

- Often used to incentivize employees or raise capital.

Convertible Bonds

- Debt instruments that can be converted into equity shares at a specified ratio.

- Provide flexibility for investors and companies.

3. Discuss the factors to consider when structuring equity for a private company seeking growth capital.

- Company’s financial performance and growth potential.

- Investor risk tolerance and return expectations.

- Tax implications and regulatory considerations.

- Exit strategies and future funding requirements.

4. Explain how you evaluate the financial impact of different equity structures on a company’s financial statements.

- Analyze changes in key financial ratios, such as debt-to-equity and return on equity.

- Consider the effects on earnings per share, dividends, and cash flow.

- Use financial modeling to project future financial performance under various scenarios.

5. Describe the role of an equity structurer in a merger and acquisition transaction.

- Design equity structures that meet the objectives of both the acquiring and target companies.

- Negotiate terms related to equity ownership, voting rights, and economic interests.

- Ensure compliance with regulatory requirements and best practices.

6. Explain the concept of dilutive and anti-dilutive equity instruments and how they are used in equity structuring.

- Dilutive instruments decrease the ownership interest of existing shareholders.

- Anti-dilutive instruments increase the ownership interest of existing shareholders.

- These instruments are used to balance the interests of different stakeholders and maintain control of the company.

7. Discuss the ethical considerations and fiduciary responsibilities of an equity structurer.

- Act in the best interests of the client.

- Maintain confidentiality and avoid conflicts of interest.

- Comply with applicable laws and regulations.

- Provide unbiased and objective advice.

8. Describe your experience in using financial modeling tools to analyze and compare different equity structures.

- Proficient in using Excel, PowerPoint, and specialized financial modeling software.

- Experienced in building complex models to evaluate financial performance, sensitivity analysis, and scenario planning.

- Utilized financial models to support decision-making and provide insights to clients.

9. How do you stay up-to-date with the latest developments in equity structuring and related regulations?

- Attend industry conferences and workshops.

- Read professional journals and publications.

- Network with other equity professionals.

- Pursue continuing education and certifications.

10. What are your strengths and weaknesses as an equity structurer?

- Strong analytical and problem-solving skills.

- Deep understanding of equity markets and valuation techniques.

- Excellent communication and presentation abilities.

- Limited experience in certain specialized areas of equity structuring.

- Working under tight deadlines can be challenging at times.

Strengths

Weaknesses

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Equity Structurer.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Equity Structurer‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

An Equity Structurer is a highly specialized financial professional responsible for designing and implementing equity-based compensation plans for employees, executives, and shareholders. Their key job responsibilities include:

1. Equity Plan Design and Implementation

Develop and implement equity compensation plans tailored to the specific needs of the company, considering factors such as employee retention, performance incentives, and tax implications.

- Design equity plans that align with the company’s overall compensation strategy and business objectives.

- Structure equity plans to meet the regulatory requirements and legal compliance.

2. Equity Valuation and Modeling

Perform valuations of equity instruments, such as stock options and restricted stock units, using appropriate valuation models and methodologies.

- Utilize financial modeling tools to forecast the potential value of equity instruments.

- Provide guidance to management and employees on the valuation and potential returns of equity compensation.

3. Equity Administration and Compliance

Manage the day-to-day administration of equity compensation plans, including grant issuance, vesting schedules, and tax reporting.

- Ensure compliance with all applicable securities laws and regulations.

- Maintain accurate records and documentation related to equity compensation plans.

4. Equity Market Analysis and Reporting

Monitor equity markets and industry trends to assess the impact on equity compensation plans.

- Provide regular reports and updates on the performance of equity compensation plans.

- Conduct market research and analysis to identify best practices and emerging trends in equity structuring.

Interview Tips

To ace an interview for an Equity Structurer position, it is crucial to demonstrate a strong understanding of the job responsibilities, technical skills, and industry knowledge. Here are some tips and hacks to help you prepare effectively:

1. Research the Company and Position

Familiarize yourself with the company’s business, industry, and specific equity compensation practices. Research the role and its responsibilities thoroughly to ensure a clear understanding of what the interviewer is seeking.

- Visit the company’s website, read industry publications, and connect with current or former employees to gather information.

- Tailor your resume and cover letter to highlight your relevant experience and skills that align with the specific requirements of the position.

2. Brush Up on Technical Skills

Equity Structuring requires a strong foundation in financial modeling, valuation techniques, and regulatory compliance. Review and refresh your knowledge in these areas before the interview.

- Practice using financial modeling tools such as Excel or specialized equity valuation software.

- Study industry-standard valuation methodologies, such as the Black-Scholes model or discounted cash flow analysis.

3. Prepare for Behavioral Questions

Behavioral questions aim to assess your problem-solving, communication, and teamwork skills. Prepare examples from your past experiences that demonstrate your ability to:

- Handle complex financial modeling and analysis.

- Collaborate effectively with cross-functional teams.

- Communicate technical concepts clearly and concisely.

4. Practice Case Studies

Interviewers may present you with case studies or hypothetical scenarios to evaluate your problem-solving and decision-making abilities.

- Prepare by practicing sample case studies that involve equity compensation plan design or valuation.

- Develop a structured approach to analyzing the case, identifying key issues, and presenting your recommendations.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Equity Structurer interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!