Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Financial Quantitative Analyst position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

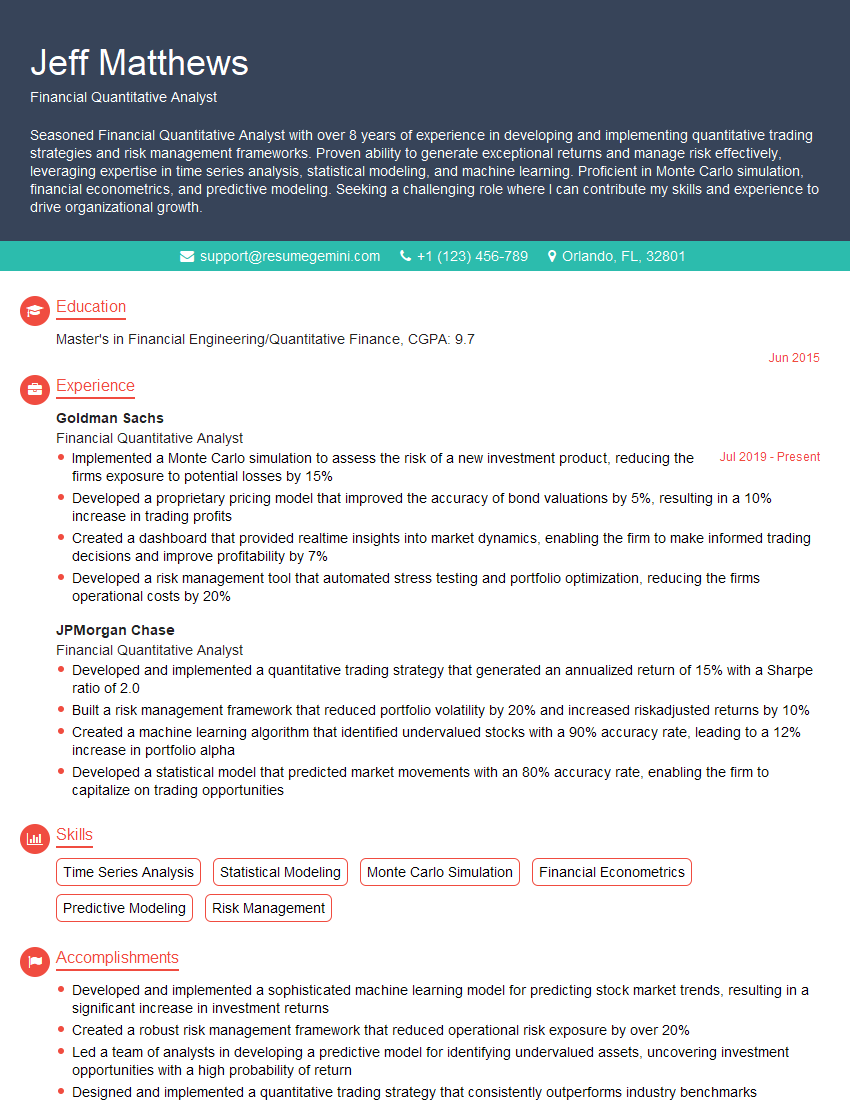

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Financial Quantitative Analyst

1. Describe the process of building a time series model for forecasting financial data.

- Start by collecting and cleaning the data.

- Explore the data to identify trends, seasonality, and other patterns.

- Select an appropriate time series model, such as an ARIMA or GARCH model.

- Estimate the model parameters using the data.

- Validate the model by evaluating its performance on out-of-sample data.

2. Discuss the different types of risk measures used in financial analysis and how they are calculated.

Value at Risk (VaR)

- Measures the maximum potential loss over a given time horizon and confidence level.

- Calculated using historical simulations, Monte Carlo simulations, or parametric methods.

Expected Shortfall (ES)

- Measures the average loss in the worst cases within the tail of the loss distribution.

- Calculated as the expected value of the loss distribution beyond a given quantile.

3. Describe the Black-Scholes model and its assumptions.

- Assumptions: no arbitrage, constant volatility, continuous trading, European options.

- Formula: C = S * N(d1) – K * e^(-rT) * N(d2), where C is the option price, S is the underlying asset price, K is the strike price, r is the risk-free rate, T is the time to expiration, and N(.) is the cumulative distribution function of the standard normal distribution.

4. Explain the concept of portfolio optimization and describe the different methods used to optimize portfolios.

- Portfolio optimization aims to select the optimal combination of assets to achieve a desired level of risk and return.

- Methods: mean-variance optimization, risk-parity optimization, maximum diversification optimization.

5. Describe the role of machine learning in financial analysis.

- Predictive analytics: forecasting financial data, credit scoring, fraud detection.

- Natural language processing: sentiment analysis of financial news, automated financial reporting.

- Risk management: identifying and quantifying risks in financial portfolios.

6. Discuss the ethical considerations involved in financial quantitative analysis.

- Conflicts of interest: ensuring that personal or professional relationships do not influence analysis.

- Data integrity: verifying the accuracy and reliability of data used in analysis.

- Transparency: clearly communicating assumptions, methods, and limitations of analysis.

7. Explain how you would approach a problem where you need to estimate the expected return of a stock.

- Use historical data and statistical techniques to analyze the stock’s price movements.

- Consider factors such as earnings, dividends, industry trends, and economic conditions.

- Apply valuation models such as discounted cash flow analysis or comparable company analysis.

- Incorporate risk factors and adjust expected returns accordingly.

8. Describe the different techniques used to analyze high-frequency financial data.

- Time series analysis: identifying patterns and trends in data over time.

- Event study analysis: examining the impact of specific events on financial markets.

- Clustering and classification algorithms: grouping similar data points and identifying outliers.

9. Discuss the challenges and limitations of quantitative analysis in financial markets.

- Data limitations: incomplete or inaccurate data can bias analysis.

- Model uncertainty: assumptions and simplifications in models can affect accuracy.

- Non-stationarity: financial data often exhibits time-varying characteristics.

10. Describe your experience in using programming languages and software packages for financial analysis.

- Proficient in Python, R, and SQL for data analysis and visualization.

- Experience using financial data analysis libraries such as NumPy, Pandas, and scikit-learn.

- Familiar with Bloomberg, Eikon, and other financial data platforms.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Financial Quantitative Analyst.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Financial Quantitative Analyst‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

As a Financial Quantitative Analyst, you will be responsible for developing and implementing mathematical and statistical models to analyze financial data and make investment recommendations. Your key responsibilities will include:

1. Data Analysis and Modeling

Collect and analyze large datasets to identify patterns and trends.

- Develop and implement statistical and econometric models to forecast financial performance.

- Create simulations to assess risk and return profiles of investment portfolios.

2. Investment Analysis and Recommendation

Use models and data analysis to evaluate potential investment opportunities.

- Recommend investment strategies and asset allocation based on quantitative analysis.

- Monitor and track investment performance to ensure alignment with objectives.

3. Risk Management

Assess and manage financial risk using quantitative techniques.

- Develop risk models to estimate potential losses and market volatility.

- Implement risk mitigation strategies and monitoring systems.

4. Communication and Reporting

Communicate findings and recommendations to stakeholders.

- Prepare reports, presentations, and visualizations to convey complex financial information.

- Collaborate with portfolio managers and investment professionals to refine investment strategies.

Interview Tips

To ace your interview for a Financial Quantitative Analyst position, follow these tips:

1. Technical Skills

Thoroughly review your knowledge of mathematics, statistics, econometrics, and programming languages used in quantitative finance.

- Practice solving quantitative and analytical problems that may be asked during the interview.

- Be prepared to discuss your experience with statistical software such as R, Python, or SAS.

2. Behavioral Skills

Highlight your critical thinking, problem-solving, and analytical skills.

- Emphasize your ability to communicate complex technical information clearly and effectively.

- Demonstrate your attention to detail and ability to work accurately with large datasets.

3. Industry Knowledge

Stay up-to-date with financial markets and industry trends.

- Read financial news, journals, and research papers to expand your understanding of the industry.

- Follow industry experts and thought leaders on social media.

4. Practice and Mock Interviews

Prepare for the interview by practicing your answers to common questions.

- Conduct mock interviews with a friend, family member, or career counselor to get feedback on your performance.

- Time yourself to ensure your answers are concise and within the expected time limit.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Financial Quantitative Analyst interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!