Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Market Risk Specialist position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

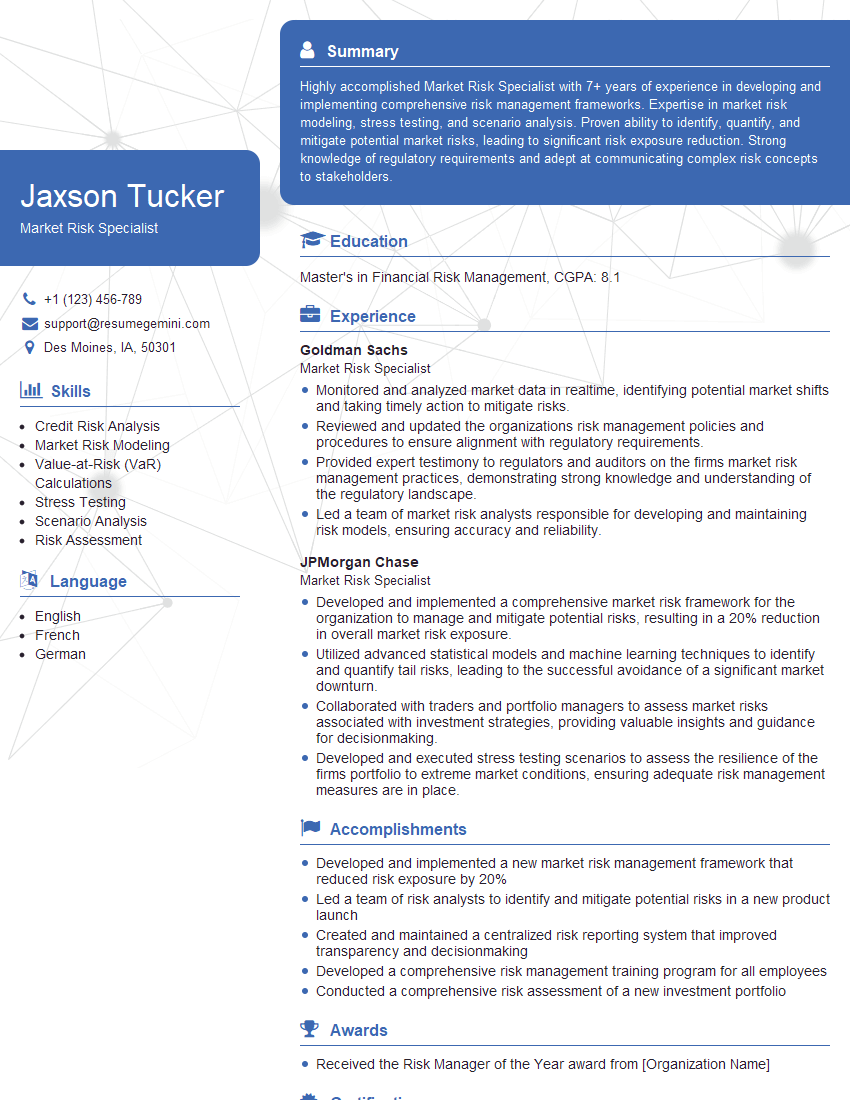

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Market Risk Specialist

1. How would you calculate the expected shortfall of a given portfolio?

To calculate the expected shortfall of a given portfolio, I would use the following steps:

- Calculate the portfolio’s value at risk (VaR).

- Calculate the portfolio’s expected loss given that the loss exceeds the VaR.

- The expected shortfall is the sum of the VaR and the expected loss.

2. What are the different types of market risk?

The different types of market risk include:

Interest rate risk

- This is the risk that the value of a portfolio will change due to changes in interest rates.

- Interest rate risk can be measured using duration and convexity.

Currency risk

- This is the risk that the value of a portfolio will change due to changes in exchange rates.

- Currency risk can be measured using a variety of techniques, such as correlation analysis and scenario analysis.

Equity risk

- This is the risk that the value of a portfolio will change due to changes in the stock market.

- Equity risk can be measured using a variety of techniques, such as volatility analysis and scenario analysis.

Commodity risk

- This is the risk that the value of a portfolio will change due to changes in commodity prices.

- Commodity risk can be measured using a variety of techniques, such as correlation analysis and scenario analysis.

3. How do you measure the correlation between two portfolios?

There are a number of different ways to measure the correlation between two portfolios. Some of the most common methods include:

- Pearson correlation coefficient

- Spearman rank correlation coefficient

- Kendall tau correlation coefficient

The choice of which method to use depends on the nature of the data and the assumptions that are being made.

4. What are the different types of stress tests?

The different types of stress tests include:

Historical stress tests

- These tests use historical data to simulate market conditions that are more extreme than those that have been observed in the past.

- Historical stress tests can be used to identify potential vulnerabilities in a portfolio.

Scenario stress tests

- These tests use hypothetical scenarios to simulate market conditions that are more extreme than those that have been observed in the past.

- Scenario stress tests can be used to assess the impact of specific events on a portfolio.

Monte Carlo stress tests

- These tests use random simulations to generate market conditions that are more extreme than those that have been observed in the past.

- Monte Carlo stress tests can be used to assess the probability of different outcomes.

5. What are the different types of market risk models?

The different types of market risk models include:

Factor models

- These models use a small number of factors to explain the movements of a large number of assets.

- Factor models are often used to estimate the risk of a portfolio.

Monte Carlo models

- These models use random simulations to generate market conditions that are more extreme than those that have been observed in the past.

- Monte Carlo models can be used to assess the probability of different outcomes.

Historical simulation models

- These models use historical data to simulate market conditions that are more extreme than those that have been observed in the past.

- Historical simulation models can be used to identify potential vulnerabilities in a portfolio.

6. How do you validate a market risk model?

To validate a market risk model, I would use the following steps:

- Compare the model’s output to historical data.

- Perform stress tests to assess the model’s performance under extreme conditions.

- Review the model’s assumptions and ensure that they are reasonable.

7. What is the difference between market risk and credit risk?

Market risk is the risk that the value of a portfolio will change due to changes in market conditions. Credit risk is the risk that a counterparty will default on its obligations.

8. What are the different types of market risk management techniques?

The different types of market risk management techniques include:

- Diversification

- Hedging

- Stress testing

- Risk limits

9. What are the challenges of market risk management?

Some of the challenges of market risk management include:

- The complexity of market risk

- The uncertainty of future market conditions

- The need to balance risk and return

10. What are the latest trends in market risk management?

Some of the latest trends in market risk management include:

- The use of big data

- The development of new risk models

- The increasing use of stress testing

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Market Risk Specialist.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Market Risk Specialist‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Market Risk Specialists play a crucial role in identifying, measuring, and managing financial risks within an organization’s trading and investment activities.

1. Risk Identification and Assessment

Assess potential risks associated with trading and investment portfolios, including market fluctuations, credit risks, and operational risks.

- Develop and implement risk management strategies to mitigate these risks.

- Monitor market conditions and identify emerging risks.

2. Risk Measurement and Modeling

Develop and use quantitative models to assess the potential impact of risks on the organization’s financial performance.

- Estimate the probability and severity of potential losses.

- Conduct stress testing to gauge the resilience of the portfolio under various scenarios.

3. Risk Reporting and Communication

Communicate risk findings and recommendations to senior management and stakeholders.

- Develop reports and presentations that clearly articulate risk exposures.

- Provide guidance on risk management practices and best practices.

4. Regulatory Compliance

Ensure compliance with regulatory requirements and industry best practices related to risk management.

- Stay abreast of evolving regulatory landscapes.

- Implement and maintain risk management frameworks that meet regulatory expectations.

Interview Tips

Preparing thoroughly for a Market Risk Specialist interview is essential to showcase your skills and knowledge.

1. Research the Industry and Company

Gain a deep understanding of the financial industry, market risk management principles, and the specific company you are applying to.

- Read industry publications, news articles, and company reports.

- Identify the company’s risk management strategies and any recent risk-related events.

2. Highlight Your Technical Skills

Emphasize your proficiency in quantitative risk modeling techniques, such as Value at Risk (VaR) and stress testing.

- Quantify your experience in developing and implementing risk models.

- Showcase your knowledge of statistical analysis and data management.

3. Demonstrate Your Communication Skills

Interviewers will assess your ability to communicate complex risk concepts clearly and effectively.

- Practice explaining risk assessment results to both technical and non-technical audiences.

- Prepare examples of presentations or written reports you have delivered on risk management topics.

4. Emphasize Your Risk Management Experience

Highlight your practical experience in identifying, assessing, and mitigating financial risks.

- Describe specific risk management projects you have led or contributed to.

- Quantify the impact of your work on the organization’s risk profile.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Market Risk Specialist interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.