Are you gearing up for an interview for a Risk Management Analyst position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Risk Management Analyst and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

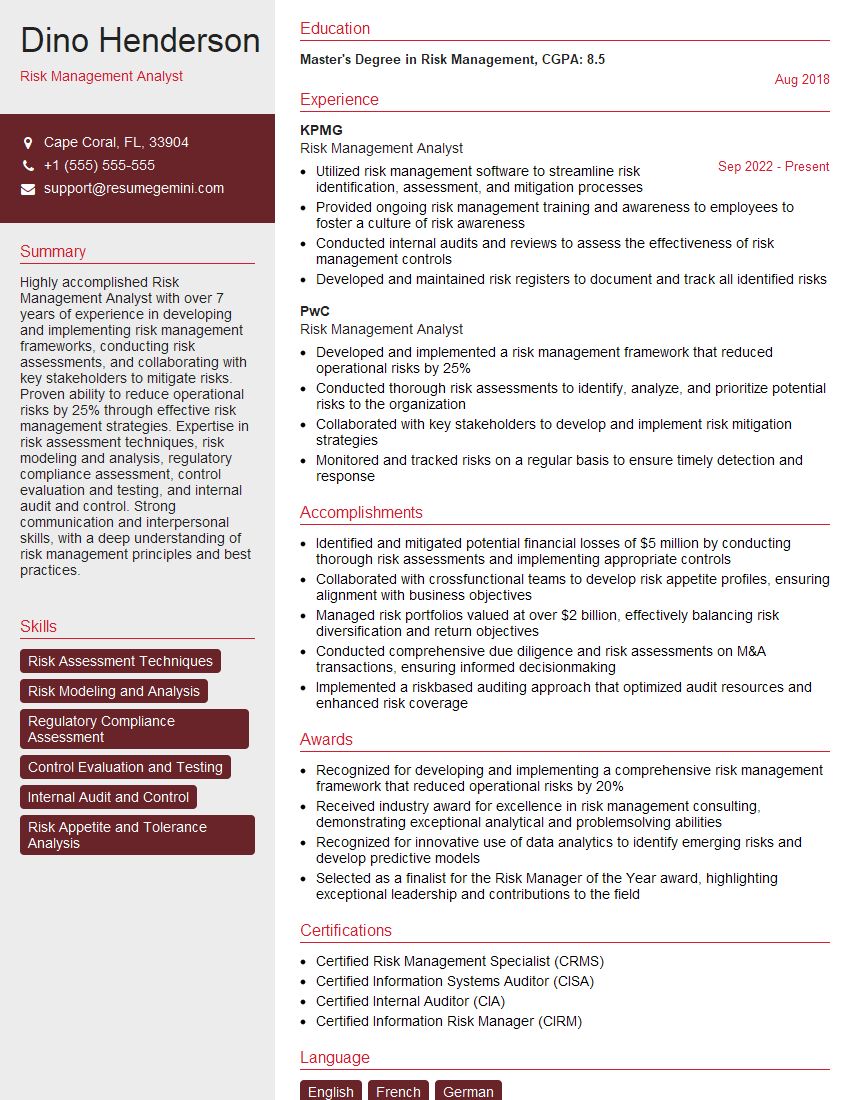

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Risk Management Analyst

1. What are the key steps involved in conducting a risk assessment?

- Identify potential hazards

- Analyze and assess risks

- Develop and implement risk mitigation strategies

- Monitor and evaluate risk management effectiveness

2. How do you prioritize risks in order of importance and urgency?

Risk Assessment Criteria

- Likelihood of occurrence

- Severity of impact

Risk Prioritization

- High likelihood and high severity risks

- High likelihood and medium severity risks

- Medium likelihood and high severity risks

- Medium likelihood and medium severity risks

3. Describe different methods for quantifying and communicating risk?

- Qualitative methods: Expert judgment, risk matrices

- Quantitative methods: Statistical analysis, scenario modeling

- Communication methods: Reports, presentations, risk dashboards

4. What are common challenges faced in risk management, and how do you overcome them?

- Challenge: Data limitations

- Solution: Use qualitative methods or expert judgment to supplement data

- Challenge: Stakeholder disagreement

- Solution: Facilitate open communication and consensus-building workshops

5. How do you stay up-to-date on emerging risk management practices and methodologies?

- Attend industry conferences and workshops

- Read professional journals and publications

- Participate in professional organizations

6. Can you explain the concept of “risk appetite” and how it guides risk management decisions?

Risk appetite is the level of risk an organization is willing to accept in pursuit of its objectives. It influences risk management decisions by:

- Setting limits on risk exposure

- Prioritizing risk mitigation efforts

- Communicating risk tolerance to stakeholders

7. How do you integrate risk management into the decision-making process within an organization?

- Provide timely risk assessments to decision-makers

- Participate in strategic planning and project review meetings

- Develop risk management policies and procedures that guide decision-making

8. What are the key principles of effective risk management?

- Proactive and forward-looking

- Aligned with organizational objectives

- Integrated into decision-making

- Continuously monitored and improved

9. Describe a challenging risk management situation you have encountered and how you resolved it.

- Situation: Emerging regulatory changes posed significant risk to operations

- Actions:

- Conducted a thorough impact assessment

- Developed mitigation strategies in collaboration with legal and compliance teams

- Communicated risks and mitigation plans to stakeholders

- Outcome: Proactive management of risks ensured minimal disruption to operations

10. What are the latest trends and innovations in risk management?

- Artificial Intelligence (AI) for risk identification and prediction

- Blockchain technology for secure data sharing and risk management

- Enterprise Risk Management (ERM) platforms for integrated risk assessment and management

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Risk Management Analyst.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Risk Management Analyst‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Risk Management Analyst is responsible for identifying, assessing, and mitigating risks within an organization. Their key job responsibilities include:

1. Risk Identification and Assessment

Identifying potential risks that may affect the organization’s operations, finances, or reputation.

- Performing risk assessments to determine the likelihood and impact of potential risks.

- Developing risk mitigation plans to address identified risks.

2. Risk Monitoring and Reporting

Monitoring risks on a regular basis and updating risk assessments as needed.

- Reporting risk management activities to senior management and stakeholders.

- Conducting risk audits to ensure compliance with risk management policies and procedures.

3. Risk Management Policy and Procedure Development

Developing and implementing risk management policies and procedures.

- Providing training and support to employees on risk management practices.

- Coordinating with other departments to ensure a comprehensive approach to risk management.

4. Risk Management Technology

Utilizing risk management technology to support risk management activities.

- Staying up-to-date on best practices in risk management.

- Understanding the legal and regulatory requirements related to risk management.

Interview Tips

To ace an interview for a Risk Management Analyst position, candidates should consider the following tips:

1. Research the Organization and Industry

Familiarize yourself with the organization’s risk management practices, industry trends, and regulatory environment.

- Visit the organization’s website and read their annual reports.

- Identify the key risks and challenges facing the industry.

2. Showcase Your Skills and Experience

Highlight your skills in risk identification, assessment, and mitigation. Provide specific examples of projects you have worked on.

- Discuss your experience in developing and implementing risk management policies and procedures.

- Describe how you have used risk management technology to improve risk management processes.

3. Be Prepared to Discuss Your Risk Management Philosophy

Explain your understanding of risk management and your approach to managing risks. Discuss how you balance the need for risk mitigation with the need for innovation and growth.

- Provide examples of how you have successfully managed risks in the past.

- Explain how you would approach a specific risk scenario.

4. Demonstrate Your Communication and Interpersonal Skills

Risk Management Analysts need to be able to communicate effectively with a variety of stakeholders, including senior management, employees, and external partners.

- Provide examples of how you have effectively communicated risk information to different audiences.

- Discuss your experience in building relationships and working with others.

Next Step:

Now that you’re armed with the knowledge of Risk Management Analyst interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Risk Management Analyst positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini