Are you gearing up for an interview for a Market Risk Analyst position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Market Risk Analyst and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

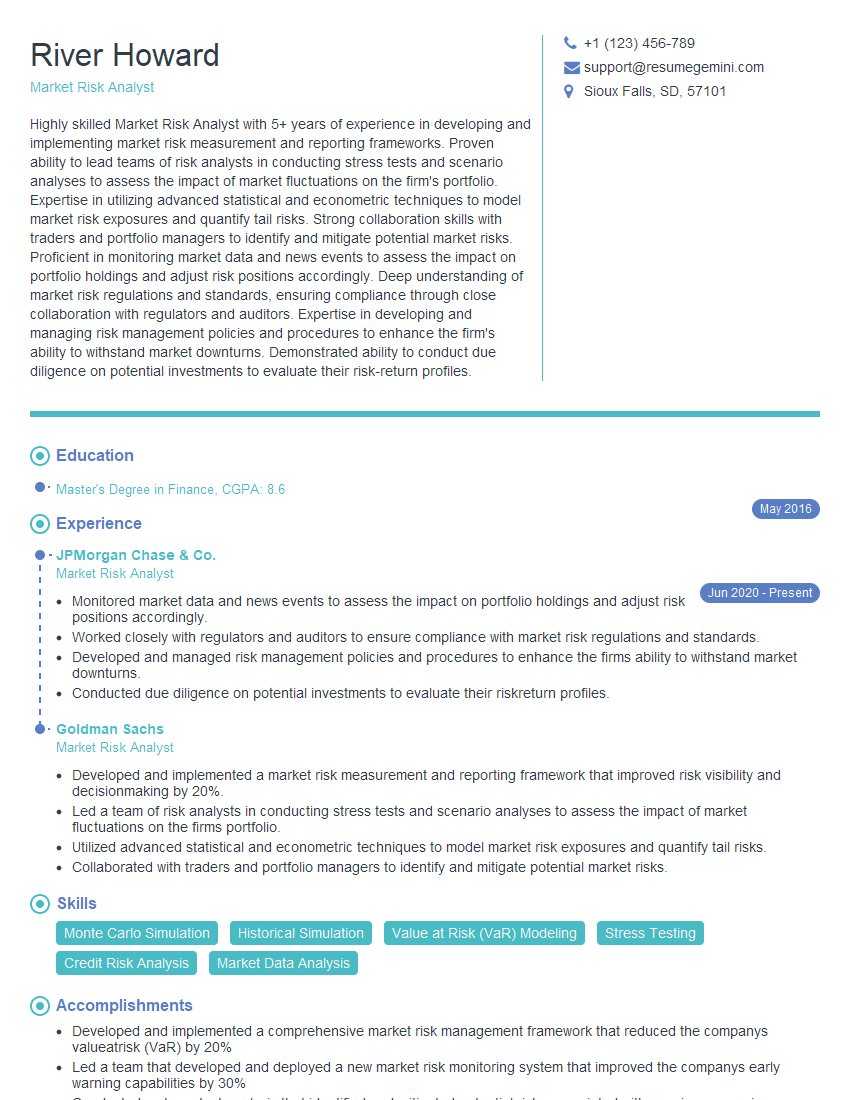

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Market Risk Analyst

1. Walk me through your understanding of Value at Risk (VaR)?

- VaR is a statistical measure that estimates the maximum possible loss of a financial portfolio over a specific time horizon and at a given confidence level.

- It helps banks and financial institutions measure and manage their risk exposure by estimating the potential financial losses that may occur.

2. How do you calculate VaR using the Variance-Covariance method?

Assumptions

- The portfolio returns are normally distributed.

- The covariance matrix of the portfolio returns remains constant over the time horizon.

Formula

- VaR = μ + Z * σ

- where: μ is the mean of the portfolio returns, Z is the Z-score corresponding to the desired confidence level, and σ is the standard deviation of the portfolio returns.

3. Explain the Monte Carlo simulation method for calculating VaR.

- Generates a large number of random scenarios based on the historical data and specified probability distributions.

- Calculates the portfolio value for each scenario and sorts the results in ascending order.

- The VaR is then determined as the loss at the desired confidence level (e.g., 95% confidence level).

4. How do you adjust VaR for fat tails and non-normality in portfolio returns?

- Use extreme value theory (EVT) to model the tails of the distribution.

- Apply Cornish-Fisher expansion to adjust the VaR estimate for non-normality.

- Use historical simulation to capture the actual distribution of portfolio returns.

5. Describe the key components of a stress testing framework for market risk analysis.

- Defining stress scenarios that represent potential extreme market conditions.

- Estimating the impact of these scenarios on portfolio value and risk metrics.

- Developing mitigation plans and strategies to address the identified risks.

6. How do you incorporate liquidity risk and operational risk into a market risk framework?

- Liquidity risk: Use liquidity measures and liquidity models to assess the ability to trade assets quickly and efficiently.

- Operational risk: Identify and manage operational risks such as data errors, process failures, and human errors.

7. Explain the role of regulatory capital in market risk analysis.

- Regulatory capital requirements are set by regulatory authorities to ensure banks have sufficient capital to cover potential losses.

- Market risk analysts play a crucial role in calculating and managing capital against market risk exposures.

8. Describe the Basel Accords and their implications for market risk management.

- The Basel Accords are international banking regulations that set capital requirements for banks.

- They aim to ensure banks have sufficient capital to cover potential financial losses, including those arising from market risk.

9. How do you communicate market risk analysis results to stakeholders?

- Use clear and concise language.

- Provide both qualitative and quantitative analysis.

- Tailor the communication to the audience’s level of understanding.

- Develop dashboards and visualizations to aid in understanding.

10. What are emerging trends in market risk analysis?

- Artificial intelligence (AI) and machine learning (ML) for risk modeling.

- Cloud computing for faster and more efficient data processing.

- Integrated risk management frameworks that combine market risk with other risk types.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Market Risk Analyst.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Market Risk Analyst‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Market Risk Analysts are responsible for identifying, assessing, and mitigating risks within financial markets. They play a crucial role in ensuring the financial stability of organizations by developing and implementing risk management strategies.

1. Risk Identification and Assessment

Market Risk Analysts are responsible for identifying and assessing potential risks that could impact an organization’s financial performance. This involves:

- Analyzing market data and trends to identify potential risk factors

- Developing and implementing risk models to quantify and evaluate risks

- Conducting stress tests to assess the impact of different market scenarios on the organization’s financial position

- Monitoring and reporting on risk exposures to senior management and stakeholders

2. Risk Mitigation and Management

Once risks have been identified and assessed, Market Risk Analysts work to develop and implement strategies to mitigate and manage those risks. This involves:

- Developing and implementing risk management policies and procedures

- Recommending and executing hedging strategies to reduce risk exposures

- Managing risk budgets and ensuring compliance with regulatory requirements

- Collaborating with other departments, such as trading and finance, to ensure risk management is integrated into decision-making processes

- Advising senior management on risk-related issues and providing recommendations for risk mitigation

3. Market Monitoring and Surveillance

Market Risk Analysts are responsible for monitoring market conditions and identifying potential risks that could impact the organization’s financial performance. This involves:

- Monitoring real-time market data to identify any significant changes or trends

- Conducting scenario analysis to assess the potential impact of different market events on the organization’s risk profile

- Identifying and reporting on emerging risks that could impact the organization’s financial performance

4. Reporting and Communication

Market Risk Analysts are responsible for reporting on risk exposures and risk management activities to senior management and stakeholders. This involves:

- Preparing and presenting risk reports to senior management and stakeholders

- Communicating risk-related information in a clear and concise manner

- Responding to inquiries and providing explanations on risk-related issues

- Participating in risk management committees and working groups

Interview Tips

Preparing for a Market Risk Analyst interview can be a daunting task. However, by following these tips, you can increase your chances of success.

1. Research the Company and the Role

Before the interview, take the time to research the company and the specific role you are applying for. This will show the interviewer that you are serious about the position and that you have a basic understanding of the company’s business and risk management practices.

- Visit the company’s website to learn about its history, mission, and values.

- Read the job description carefully and identify the key skills and experience that the company is looking for.

- Research the company’s industry and competitors to gain a better understanding of the market environment.

2. Prepare for Technical Questions

Market Risk Analysts are expected to have a strong understanding of financial markets and risk management principles. Be prepared to answer questions on topics such as:

- Types of market risks (e.g., interest rate risk, credit risk, liquidity risk)

- Risk management techniques (e.g., hedging, diversification, risk-adjusted return)

- Financial modeling and forecasting techniques

- Regulatory requirements for risk management

3. Be Able to Discuss Your Experience

In the interview, you will likely be asked about your experience in market risk management. Be prepared to discuss your role in identifying, assessing, and mitigating risks. You should also be able to provide examples of your work and how you have contributed to the success of your organization.

- Quantify your accomplishments whenever possible. For example, instead of saying “I developed a risk management model,” you could say “I developed a risk management model that reduced the organization’s risk exposure by 20%.”

- Be prepared to discuss your failures as well as your successes. This will show the interviewer that you are realistic about your abilities and that you are willing to learn from your mistakes.

4. Be Prepared to Answer Behavioral Questions

In addition to technical questions, you will also be asked behavioral questions during the interview. These questions are designed to assess your soft skills, such as teamwork, communication, and problem-solving. Be prepared to answer questions such as:

- Tell me about a time when you had to work effectively as part of a team.

- Describe a time when you had to communicate complex information to a non-technical audience.

- Give me an example of a problem you solved and how you went about solving it.

5. Ask Questions

At the end of the interview, the interviewer will likely ask if you have any questions. This is your opportunity to learn more about the company and the role. It is also a way to show the interviewer that you are engaged and interested in the position.

- Ask questions about the company’s risk management culture and practices.

- Inquire about the specific responsibilities of the role you are applying for.

- Ask about the company’s training and development programs for Market Risk Analysts.

Next Step:

Now that you’re armed with the knowledge of Market Risk Analyst interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Market Risk Analyst positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini