Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Investment Banker interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Investment Banker so you can tailor your answers to impress potential employers.

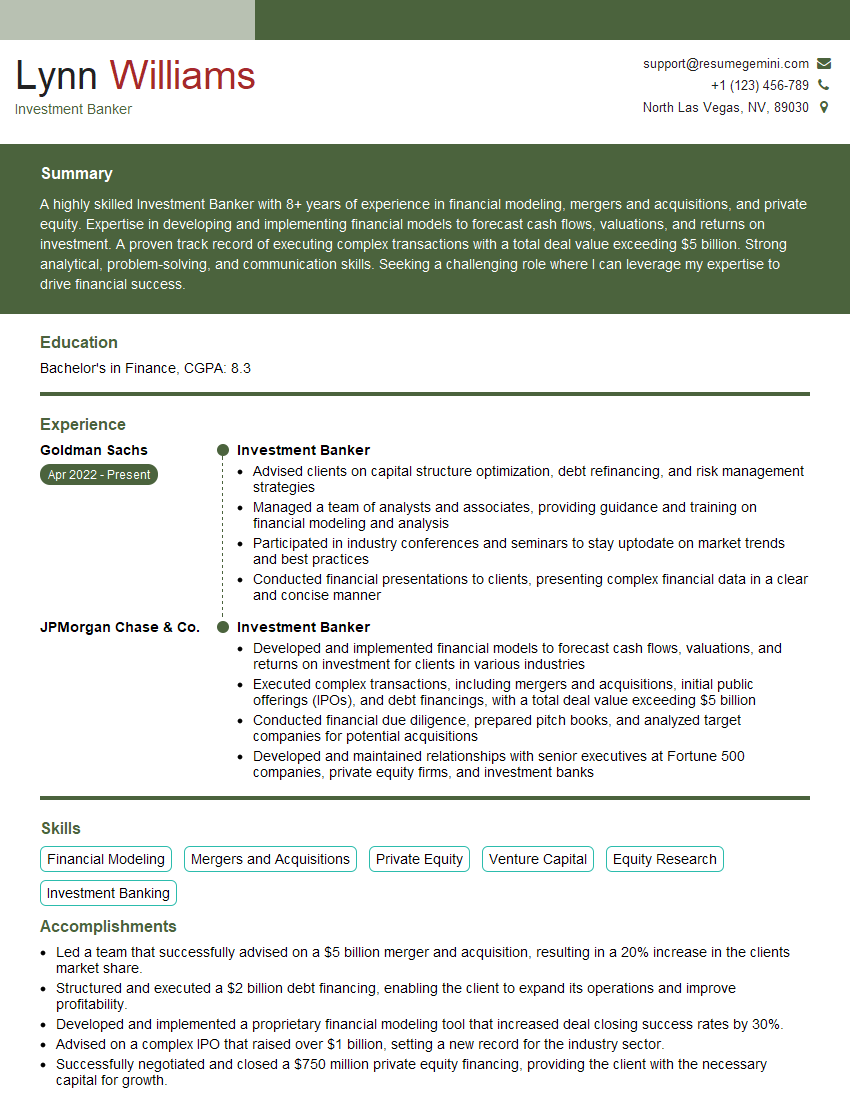

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Investment Banker

1. Walk me through your understanding of a leveraged buyout?

A leveraged buyout (LBO) is a transaction in which a company is acquired using a significant amount of debt financing. The debt is used to finance the purchase price of the company and other related costs. LBOs are often used to take a company private or to change its ownership structure.

- LBOs are typically structured as follows:

- A private equity firm or other investor group forms a new holding company.

- The holding company then borrows money to finance the purchase of the target company.

- The target company’s assets are used as collateral for the loan.

- The holding company then acquires the target company.

- The holding company then repays the loan with the cash flow generated by the target company.

2. How would you evaluate a potential target for a private equity investment?

Due Diligence

- Conduct financial due diligence to assess the company’s financial health and performance.

- Conduct operational due diligence to assess the company’s operations and management team.

- Conduct legal due diligence to review the company’s legal documents and contracts.

Investment Criteria

- Industry and market analysis to assess the company’s competitive landscape and growth potential.

- Management team assessment to evaluate the quality and experience of the management team.

- Financial analysis to assess the company’s financial performance and projections.

3. What are the key factors to consider when structuring a private equity transaction?

- Deal structure: This includes the type of transaction (e.g., leveraged buyout, minority investment), the ownership structure of the target company, and the financing arrangements.

- Valuation: This involves determining the fair value of the target company and negotiating an appropriate purchase price.

- Due diligence: This is the process of investigating the target company’s financial, operational, and legal condition.

- Negotiation: This involves negotiating the terms of the transaction, including the purchase price, the terms of the financing, and the representations and warranties.

- Closing: This is the final step of the transaction, where the purchase price is paid and the ownership of the target company is transferred to the acquirer.

4. Describe your experience with financial modeling and valuation?

I have extensive experience with financial modeling and valuation. I have used a variety of financial modeling techniques to value companies, including discounted cash flow analysis, precedent transactions analysis, and market multiple analysis. I have also used financial models to forecast a company’s financial performance and to assess the impact of different strategic decisions.

- In my previous role, I was responsible for developing and maintaining the company’s financial model.

- I used this model to forecast the company’s financial performance and to assess the impact of different strategic decisions.

- I also used the model to value the company and to prepare for various financing transactions.

5. What are the key trends that you are seeing in the investment banking industry?

- The increasing use of technology in investment banking.

- The growing importance of ESG (environmental, social, and governance) factors in investment decisions.

- The increasing globalization of the investment banking industry.

- The rise of fintech (financial technology).

- The increasing regulatory scrutiny of the investment banking industry.

6. How do you stay up-to-date on the latest developments in the investment banking industry?

- I read industry publications and research reports.

- I attend industry conferences and events.

- I network with other professionals in the industry.

- I take continuing education courses.

7. What are your strengths and weaknesses as an investment banker?

Strengths

- Strong analytical skills

- Excellent communication and presentation skills

- Deep understanding of financial markets and products

- Proven track record of success in investment banking

Weaknesses

- Can be too detail-oriented at times

- Can be impatient with people who do not understand financial markets

8. Why are you interested in working at our firm?

I am interested in working at your firm because of its reputation as a leading investment bank. I am particularly impressed by your firm’s commitment to providing its clients with the highest level of service and its focus on innovation.

- I believe that my skills and experience would be a valuable asset to your firm.

- I am confident that I can make a significant contribution to your firm’s success.

9. What are your salary expectations?

My salary expectations are in line with the market for investment bankers with my experience and qualifications.

- I am confident that I can negotiate a salary that is fair and equitable for both parties.

10. When can you start?

I am available to start work immediately.

- I am eager to get started and contribute to your firm’s success.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Investment Banker.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Investment Banker‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

1. Financial Analysis

Investment bankers analyze the financial health of companies and industries to assess their risk and return profiles. They use this information to develop investment recommendations and structure financial transactions.

- Conduct financial due diligence on companies and their operations.

- Develop financial models to forecast a company’s future performance.

2. Capital Raising

Investment bankers help companies raise capital by underwriting and selling securities. This can involve issuing new stocks or bonds, or arranging for private placements of debt or equity.

- Structure and execute debt and equity offerings for companies.

- Manage the underwriting process and ensure that securities are sold to investors.

3. Mergers and Acquisitions

Investment bankers advise companies on mergers, acquisitions, and other corporate transactions. They help clients assess the potential benefits and risks of a transaction, and negotiate terms that are favorable to their clients.

- Advise clients on merger and acquisition strategies.

- Negotiate and structure merger and acquisition transactions.

4. Financial Advisory

Investment bankers provide advisory services to companies on a variety of financial matters, including capital raising, financial restructuring, and risk management.

- Develop and implement financial strategies for clients.

- Advise clients on risk management and mitigation.

Interview Tips

Preparing for an investment banking interview can be a daunting task, but by following these tips, you can increase your chances of success.

1. Research the Firm and the Industry

Take the time to learn about the investment bank you are interviewing with. This includes their history, their culture, and their business model. You should also familiarize yourself with the investment banking industry as a whole.

- Visit the company website and review their annual reports.

- Read articles about the investment banking industry.

2. Practice Your Technical Skills

Investment bankers are expected to have strong technical skills in finance. This includes a deep understanding of financial modeling, valuation, and accounting. You should practice these skills before your interview so that you can answer questions confidently.

- Take practice tests on financial modeling and valuation.

- Review your accounting knowledge.

3. Prepare for Behavioral Questions

In addition to technical questions, you will also be asked behavioral questions during your interview. These questions are designed to assess your soft skills, such as teamwork, problem-solving, and communication. You should prepare for these questions by thinking about your experiences and how they demonstrate your skills.

- Use the STAR method to answer behavioral questions.

- Practice your answers with a friend or family member.

4. Be Yourself

It is important to be yourself during your interview. The interviewer wants to get to know the real you, so don’t try to be someone you’re not. Just be confident and articulate your thoughts clearly.

- Dress professionally and arrive on time for your interview.

- Make eye contact with the interviewer and speak clearly.

5. Ask Questions

At the end of your interview, the interviewer will likely ask if you have any questions. This is your chance to learn more about the position and the company. It is also a good opportunity to show the interviewer that you are engaged and interested in the job.

- Prepare a few questions about the position and the company.

- Ask questions that show your enthusiasm for the job.

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Investment Banker, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Investment Banker positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.