Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Mergers and Acquisitions Manager interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Mergers and Acquisitions Manager so you can tailor your answers to impress potential employers.

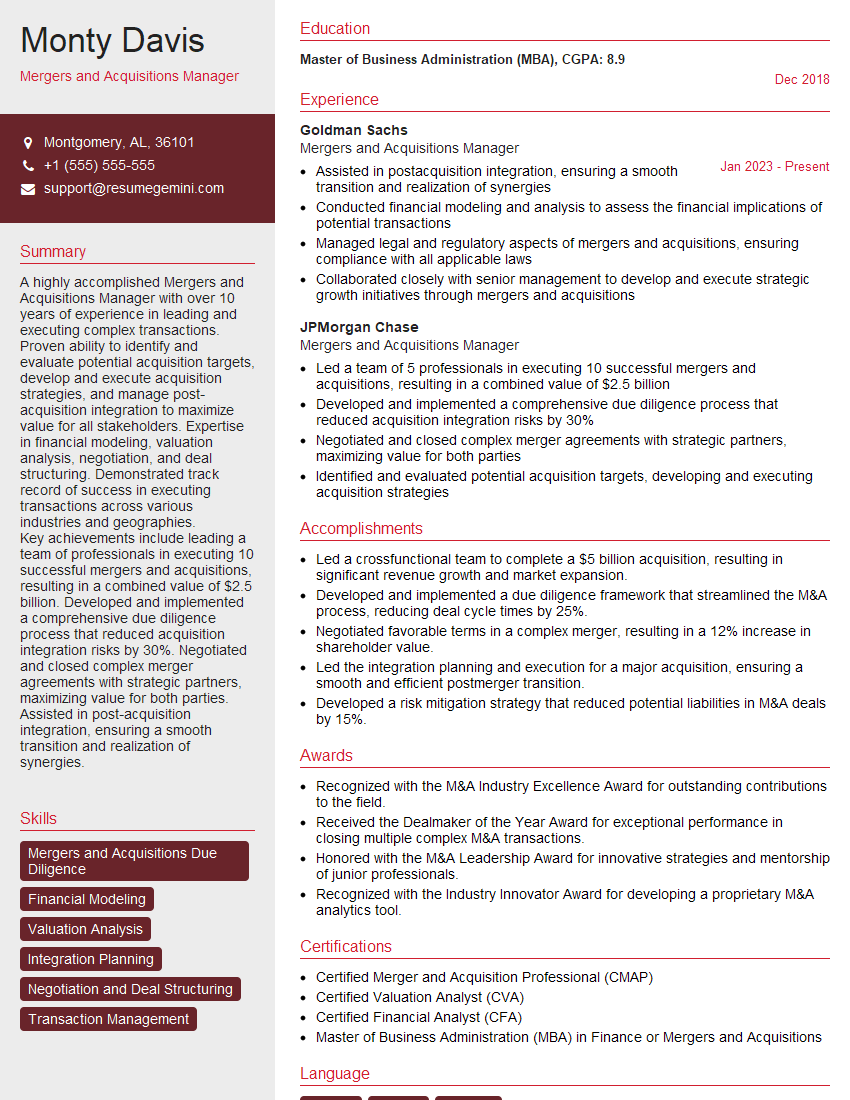

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Mergers and Acquisitions Manager

1. Walk me through the key steps involved in a merger or acquisition process.

In a merger or acquisition, the following steps are commonly involved:

- Identification of target: Identifying a potential target company that aligns with the strategic objectives.

- Due diligence: Conducting a thorough investigation of the target company’s financial, legal, and operational aspects.

- Negotiation: Entering into negotiations with the target company to agree on terms, including valuation, structure, and timelines.

- Legal and regulatory approvals: Obtaining necessary approvals from relevant regulatory bodies, such as antitrust authorities.

- Integration: Post-merger or acquisition, the process of combining the two companies’ operations, systems, and cultures.

2. What financial and strategic factors should be considered when evaluating a potential acquisition target?

Financial factors:

- Revenue and profitability.

- Debt and cash flow.

- Valuation and purchase price.

Strategic factors:

- Market share and competitive landscape.

- Product or service offerings.

- Customer base and geographic reach.

3. How do you approach the integration of two companies following a merger or acquisition?

Integrating two companies after a merger or acquisition involves the following steps:

- Developing a comprehensive integration plan that outlines key objectives, timelines, and responsibilities.

- Establishing a dedicated integration team to oversee the process.

- Communicating effectively with employees of both companies to address concerns and manage expectations.

- Implementing standardized processes and systems to ensure operational efficiency.

- Monitoring progress regularly and making necessary adjustments to the integration plan.

4. What are the potential challenges and risks associated with mergers and acquisitions, and how do you mitigate them?

Potential challenges and risks:

- Integration difficulties.

- Cultural clashes.

- Loss of key employees.

- Regulatory hurdles.

Mitigation strategies:

- Thorough due diligence and planning.

- Clear communication and stakeholder engagement.

- Effective change management.

- Contingency plans for potential risks.

5. How do you stay up-to-date with the latest trends and best practices in mergers and acquisitions?

- Attending industry conferences and webinars.

- Reading industry publications and research reports.

- Networking with other professionals in the field.

- Seeking continuing education opportunities.

6. What are your thoughts on the role of technology in mergers and acquisitions?

Technology plays a significant role in mergers and acquisitions, particularly in the following areas:

Due diligence:

- Virtual data rooms.

- Automated due diligence tools.

Negotiation and documentation:

- Electronic signature platforms.

- Contract management software.

Integration:

- Enterprise resource planning (ERP) systems.

- Customer relationship management (CRM) systems.

7. How do you handle conflicts of interest that may arise during a merger or acquisition?

Conflicts of interest are managed as follows:

- Identifying and disclosing potential conflicts.

- Establishing clear guidelines and policies.

- Appointing independent advisors or committees.

- Seeking legal counsel when necessary.

8. How do you assess the cultural compatibility of two companies before a merger or acquisition?

Conducting interviews with key stakeholders.

Reviewing corporate values and policies.

Evaluating employee engagement and satisfaction surveys.

Observing company culture firsthand through site visits or shadowing.

9. Can you provide an example of a successful merger or acquisition that you have been involved in, and what factors contributed to its success?

In my previous role, I led the acquisition of a technology startup by a global software company. The acquisition was successful due to the following factors:

Strategic fit:

The target company’s technology complemented the acquirer’s existing product portfolio.Cultural alignment:

Both companies shared similar values and goals, and there was a strong commitment to innovation and customer satisfaction.Effective due diligence:

A thorough due diligence process identified and addressed potential risks.Clear communication:

Employees of both companies were kept informed throughout the process, which helped build trust and support.

10. What are your key strengths and weaknesses as a Mergers and Acquisitions Manager?

Strengths:

- Strong analytical and financial modeling skills.

- Excellent negotiation and communication skills.

- Deep understanding of mergers and acquisitions processes.

Weaknesses:

- Limited experience in certain industry sectors.

- Can be detail-oriented and may require more delegation.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Mergers and Acquisitions Manager.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Mergers and Acquisitions Manager‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

As a Mergers and Acquisitions Manager, you will play a pivotal role in assessing and executing strategic acquisitions and mergers, driving corporate growth and expansion.

1. Strategic Planning and Due Diligence

- Identify and evaluate potential acquisition targets that align with the company’s long-term objectives.

- Conduct thorough due diligence on target companies to assess financial health, market position, and potential risks.

2. Deal Structuring and Negotiation

- Develop and negotiate merger and acquisition agreements, ensuring optimal deal terms for the company.

- Work closely with legal counsel and financial advisors to structure transactions that meet regulatory requirements and minimize tax implications.

3. Integration and Post-Merger Execution

- Lead post-merger integration efforts, ensuring a smooth transition and maximizing the value of the acquisition.

- Monitor and track key performance indicators to measure the success of the merger or acquisition.

4. Relationship Management and Market Awareness

- Develop and maintain relationships with industry contacts, potential acquisition targets, and investment bankers.

- Stay abreast of market trends, emerging technologies, and regulations to identify opportunities for strategic growth.

Interview Tips

To ace your Mergers and Acquisitions Manager interview, follow these essential tips:

1. Highlight Your Relevant Experience

- Quantify your accomplishments using specific metrics and examples.

- Emphasize your contributions to successful mergers and acquisitions, especially in your target industry.

2. Demonstrate Your Financial Acumen and Business Savvy

- Showcase your strong understanding of financial modeling, valuation techniques, and deal structuring.

- Discuss your ability to analyze complex financial data and make informed decisions.

3. Articulate Your Strategic Thinking

- Explain how you approach strategic planning and target identification.

- Share examples of successful acquisitions or mergers that you have been involved in.

4. Emphasize Your Soft Skills

- Highlight your strong negotiation, communication, and interpersonal skills.

- Demonstrate your ability to build relationships and collaborate effectively with cross-functional teams.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Mergers and Acquisitions Manager interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!