Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Securities Underwriter position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

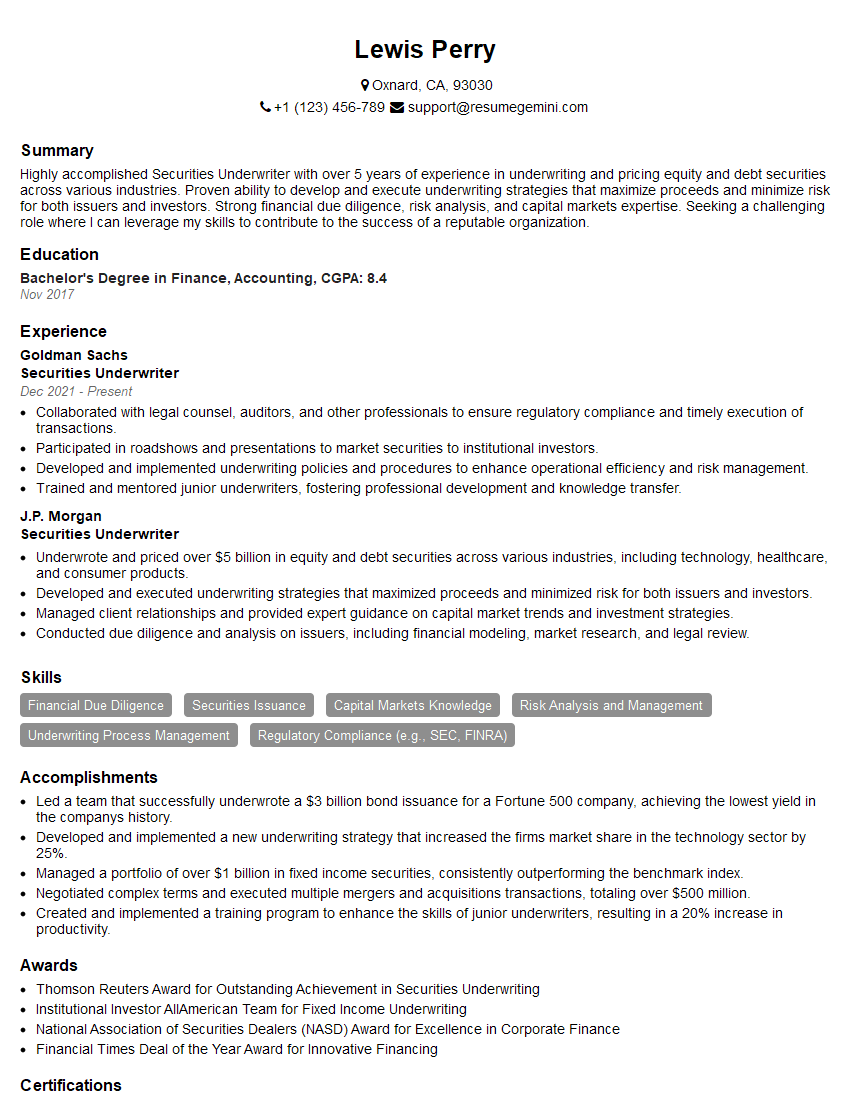

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Securities Underwriter

1. What are the different types of securities that can be underwritten?

As a Securities Underwriter, I am familiar with a wide range of securities that can be underwritten. These include stocks, bonds, mutual funds, exchange-traded funds (ETFs), and structured products.

2. What are the key steps involved in the underwriting process?

Due diligence

- Conducting thorough research and analysis of the issuer.

- Assessing the issuer’s financial health, management team, and business prospects.

Structuring the offering

- Determining the type, size, and terms of the securities offering.

- Pricing the securities to attract investors.

Marketing and distribution

- Developing a marketing plan to reach potential investors.

- Distributing the securities to investors through a network of brokers and dealers.

3. What are the different methods of underwriting?

- Firm commitment underwriting: The underwriter purchases the entire offering from the issuer and then sells the securities to investors.

- Best efforts underwriting: The underwriter acts as an agent for the issuer and sells the securities on a best efforts basis, with no guarantee of selling the entire offering.

- Syndicate underwriting: A group of underwriters jointly underwrite an offering, sharing the risk and reward.

4. What are the key factors that determine the success of an underwriting?

- The quality of the issuer and the offering.

- The market conditions at the time of the offering.

- The skill and experience of the underwriter.

- The marketing and distribution strategy.

5. What are the ethical and regulatory considerations that underwriters must be aware of?

- Adhering to all applicable securities laws and regulations.

- Avoiding conflicts of interest.

- Maintaining confidentiality of client information.

- Acting in the best interests of investors.

6. What are the career opportunities for Securities Underwriters?

- Analysts within investment banks

- Portfolio managers

- Financial advisors

- Compliance officers

- Risk managers

7. What are the challenges facing the underwriting industry?

- Increasing regulatory scrutiny.

- Competition from new technologies and fintech companies.

- Volatile market conditions.

- The need to adapt to the changing needs of investors.

8. What are the key skills and qualifications for a successful Securities Underwriter?

- Strong analytical and financial modeling skills.

- Excellent communication and interpersonal skills.

- A deep understanding of the securities markets.

- Experience in underwriting or a related field.

- A strong work ethic and dedication to client service.

9. What are the key trends that are shaping the underwriting industry?

- The use of technology to automate and streamline the underwriting process.

- The growth of alternative investments.

- The increasing importance of environmental, social, and governance (ESG) factors in investment decisions.

- The globalization of the securities markets.

10. What is the outlook for the underwriting industry?

The outlook for the underwriting industry is positive. The increasing demand for capital from issuers, coupled with the low interest rate environment, is expected to drive growth in the industry. Additionally, the development of new technologies and the globalization of the securities markets are expected to create new opportunities for underwriters.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Securities Underwriter.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Securities Underwriter‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Securities Underwriters are responsible for coordinating the sale of new securities to investors. They connect companies that need to raise capital with investors who are looking for investment opportunities.

1. Prospectus Preparation

Creating and managing prospectuses, which provide detailed information about the securities being offered and the company issuing them.

2. Due Diligence

Conducting thorough due diligence on the issuing company, including its financial statements, operations, and legal compliance.

3. Marketing and Roadshows

Developing and executing marketing campaigns to promote the securities offering, including organizing roadshows where the company meets with potential investors.

4. Pricing and Allocation

Determining the appropriate price for the securities and allocating them to investors based on their interest and risk appetite.

Interview Tips

Preparing for an interview as a Securities Underwriter requires thorough research and a strong understanding of the industry and your own qualifications.

1. Research the Company

Learn as much as you can about the company you are interviewing with, their recent deals, and their reputation in the market.

- Example: Visit the company’s website, read recent news articles, and review their financial statements.

2. Practice Your Pitch

Prepare a concise and compelling pitch that highlights your relevant skills and experience, and why you are a suitable candidate for the role.

- Example: Quantify your accomplishments, using specific metrics and examples to demonstrate your impact.

3. Ask Insightful Questions

Demonstrate your genuine interest in the role and the company by asking thoughtful questions about the underwriting process, current market trends, and the company’s growth plans.

- Example: Ask about the company’s approach to due diligence, or their strategies for navigating volatile market conditions.

4. Dress Professionally

First impressions matter, so dress professionally and arrive on time for your interview. A sharp appearance conveys confidence and attention to detail.

- Example: Consider wearing a suit, polished shoes, and a tie or scarf.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Securities Underwriter role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.