Are you gearing up for a career in Prime Broker? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Prime Broker and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

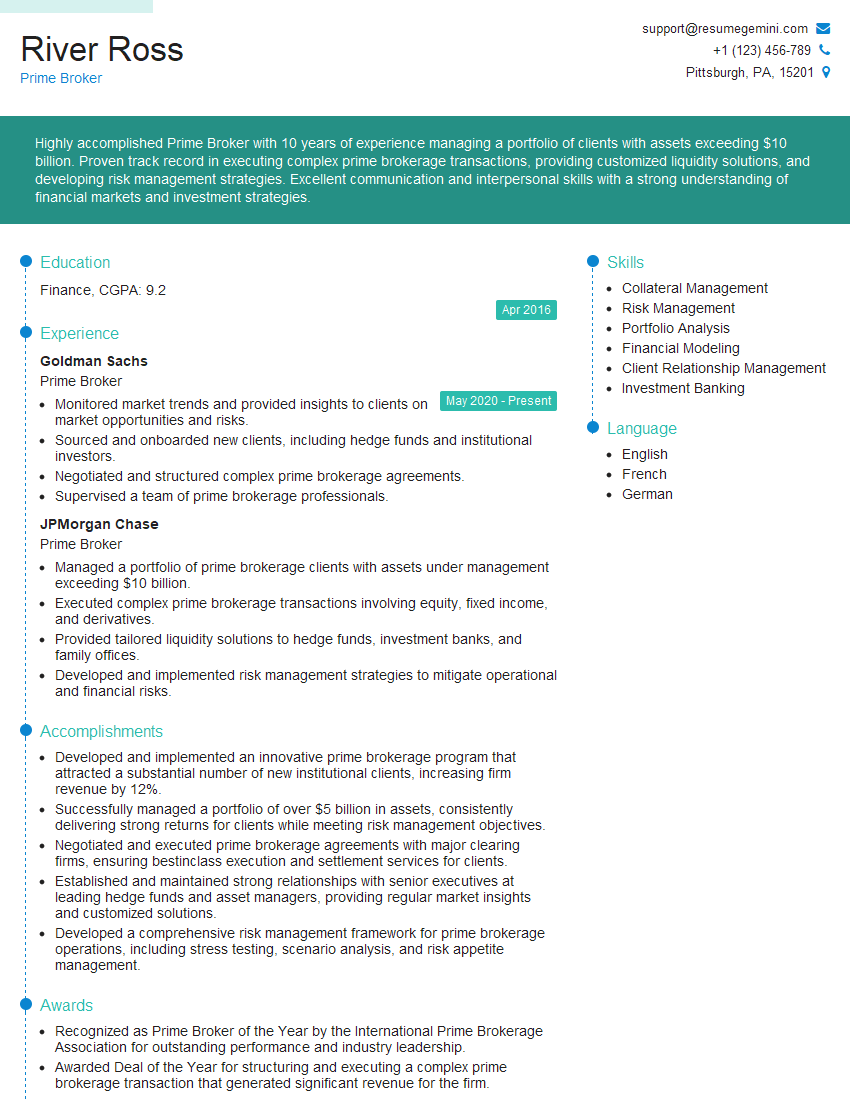

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Prime Broker

1. What are the key elements of a prime brokerage relationship?

The key elements of a prime brokerage relationship include:

- Financing – Providing credit facilities to clients for margin trading.

- Trade execution – Executing trades on behalf of clients.

- Clearing and settlement – Clearing and settling trades for clients.

- Custody – Safeguarding client assets.

- Collateral management – Managing client collateral to meet margin requirements.

- Portfolio analytics – Providing clients with performance and risk analysis.

2. What are the different types of prime brokerage services?

Financing Services

- Margin lending

- Repo financing

- Securities lending

Execution Services

- Agency execution

- Principal trading

- Algorithmic trading

Clearing and Settlement Services

- Clearing

- Settlement

- Custody

3. What are the risks involved in prime brokerage?

The risks involved in prime brokerage include:

- Credit risk – The risk that a client defaults on its obligations.

- Market risk – The risk that the value of a client’s portfolio declines.

- Operational risk – The risk that there is an error in the execution or settlement of a trade.

- Liquidity risk – The risk that a client is unable to meet its margin requirements.

4. How do you mitigate the risks involved in prime brokerage?

The risks involved in prime brokerage can be mitigated through the following measures:

- Risk management framework – Implementing a robust risk management framework that includes risk limits, stress testing, and collateral monitoring.

- Diversification – Diversifying the client base and the types of assets held in client portfolios.

- Stressed scenario analysis – Regularly conducting stressed scenario analysis to assess the impact of potential market events.

- Strong relationships with clearinghouses and custodians – Establishing strong relationships with clearinghouses and custodians to ensure the smooth execution and settlement of trades and the safekeeping of client assets.

5. What are the regulatory requirements for prime brokers?

Prime brokers are subject to a number of regulatory requirements, including:

- The Securities Exchange Act of 1934

- The Dodd-Frank Wall Street Reform and Consumer Protection Act

- The Commodity Exchange Act

- The regulations of the Securities and Exchange Commission (SEC)

- The regulations of the Commodity Futures Trading Commission (CFTC)

6. What are the key trends in the prime brokerage industry?

The key trends in the prime brokerage industry include:

- The growth of electronic trading

- The increasing use of data and analytics

- The convergence of prime brokerage and asset management

- The increasing demand for customized solutions

7. What are the challenges facing prime brokers?

The challenges facing prime brokers include:

- The increasing regulatory burden

- The need to invest in new technology

- The need to compete with other providers of prime brokerage services

- The need to manage risk in a complex and volatile market environment

8. What are the opportunities for prime brokers?

The opportunities for prime brokers include:

- The growth of the prime brokerage market

- The increasing demand for customized solutions

- The opportunity to leverage new technology to improve efficiency and risk management

- The opportunity to partner with asset managers to provide integrated solutions

9. Why are you interested in working as a prime broker?

I am interested in working as a prime broker because I am passionate about the financial markets and I believe that I have the skills and experience necessary to be successful in this role. I have a strong understanding of the Prime brokerage industry, the products and services offered by prime brokers, and the regulatory environment in which they operate. I am also confident in my ability to manage risk and build strong relationships with clients.

10. What are your strengths and weaknesses as a prime broker?

Strengths

- Strong understanding of the prime brokerage industry

- Proven ability to manage risk

- Excellent relationship-building skills

- Expertise in financial modeling and analysis

Weaknesses

- Limited experience in electronic trading

- Need to further develop my knowledge of regulatory requirements

11. What are your career goals?

My career goal is to become a senior prime broker at a leading financial institution. I believe that my skills and experience make me well-suited for this role, and I am confident that I can make a significant contribution to any team.

12. What are your salary expectations?

My salary expectations are in line with the market rate for prime brokers with my experience and qualifications.

13. Why should we hire you?

I believe that I am the ideal candidate for this role because I have the skills, experience, and dedication to be successful as a prime broker. I am confident that I can make a significant contribution to your team and I am eager to learn and grow in this role.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Prime Broker.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Prime Broker‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Prime Broker performs the following key functions:Underwriting credit lines for clients with the objective of increasing revenues and client retention.

1. Providing credit facilities

Prime brokers extend credit facilities to hedge funds and other institutional clients, allowing them to leverage their positions and enhance returns.

- Evaluate clients’ financial strength, risk tolerance, and investment strategies.

- Negotiate and structure credit agreements, including margin requirements, interest rates, and collateral.

2. Executing trades on behalf of clients

Prime brokers act as intermediaries, executing trades for clients in various financial markets.

- Efficiently route orders to exchanges and liquidity providers.

- Monitor market conditions and execute trades at optimal prices.

3. Providing custody and clearing services

Prime brokers safeguard clients’ assets and facilitate the settlement of trades.

- Hold and manage clients’ securities, cash, and other assets.

- Clear trades through central counterparties or clearinghouses.

4. Offering portfolio management and advisory services

Some prime brokers provide portfolio management and advisory services to clients, assisting them with investment decisions.

- Develop investment strategies aligned with clients’ objectives.

- Monitor portfolio performance and make recommendations for adjustments.

Interview Tips

To ace an interview for a Prime Broker position, consider the following tips:

1. Research the industry and company

Familiarize yourself with the latest trends in the investment banking and prime brokerage industries. Research the specific company you’re applying to, including their business model, target clients, and recent news.

- Read industry publications, attend conferences, and network with professionals in the field.

- Visit the company’s website, read their annual reports, and follow their social media channels.

2. Prepare for technical questions

Prime Broker interviews involve technical questions related to topics such as credit analysis, trading strategies, and risk management. Brush up on your knowledge of these areas and be prepared to provide specific examples.

- Review financial modeling techniques, valuation methodologies, and risk assessment frameworks.

- Practice solving case studies that involve underwriting credit lines, executing trades, and managing portfolios.

3. Highlight your relevant skills and experience

Emphasize your analytical, problem-solving, and communication skills. Demonstrate your understanding of the prime brokerage business and how your prior experience has prepared you for this role.

- Quantify your accomplishments whenever possible, using metrics such as revenue generated, risk reduced, or clients acquired.

- Be prepared to discuss your knowledge of specific financial products and markets.

4. Dress professionally and arrive on time

First impressions matter, so dress professionally for your interview and arrive on time. This shows that you respect the interviewer’s time and that you’re serious about the position.

- Wear a suit or business attire that fits well and is clean and pressed.

- Arrive at the interview location at least 15 minutes early to allow for any unexpected delays.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Prime Broker role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.