Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Fraud Examiner interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Fraud Examiner so you can tailor your answers to impress potential employers.

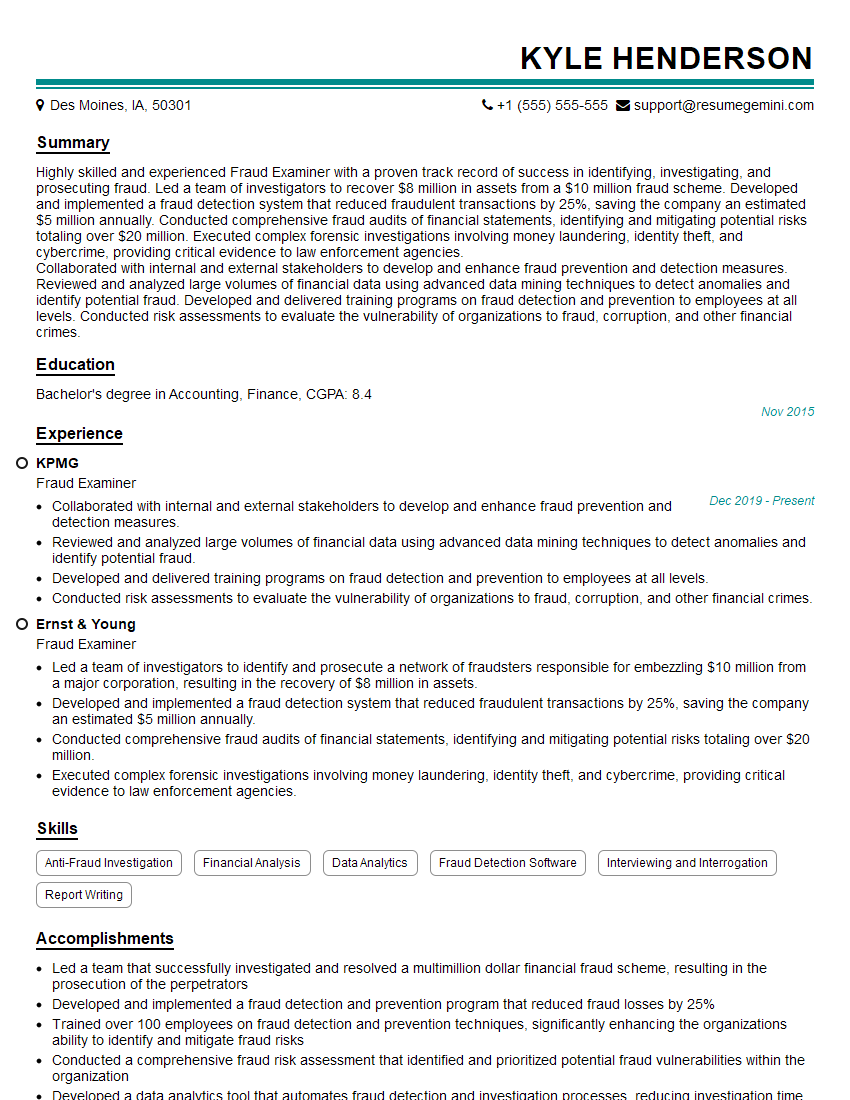

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Fraud Examiner

1. What are the common red flags that may indicate potential fraud?

As a Fraud Examiner, I have encountered various red flags that may suggest potential fraud. Here are some of the key indicators:

- Unusual or unexplained transactions, especially those involving large sums or unconventional patterns.

- Inconsistencies in documentation or records, such as mismatched signatures, altered invoices, or missing supporting documents.

- Employees or vendors displaying excessive personal financial difficulties or lavish lifestyles that are not consistent with their reported income.

- Attempts to conceal or obscure financial information, such as through the use of complex or opaque accounting practices.

- Unusually high rates of returns, refunds, or chargebacks.

2. Describe the different types of fraud schemes and how you would approach investigating each one.

Asset misappropriation

- Involves the unauthorized use or theft of company assets.

- Investigative approach: Examine financial records, conduct interviews, and review physical assets.

Financial statement fraud

- Intentional misrepresentation of financial statements to deceive stakeholders.

- Investigative approach: Analyze accounting records, identify discrepancies, and assess the underlying rationale for adjustments.

Corruption

- Involves bribery, extortion, or other illegal practices for personal gain.

- Investigative approach: Examine communication records, review vendor transactions, and conduct interviews.

3. How do you prioritize which cases to investigate?

Prioritizing fraud cases is crucial. I consider the following factors:

- Potential financial impact and reputational damage to the organization.

- Likelihood of recovering stolen assets or preventing further losses.

- Severity of the fraud scheme and its potential impact on stakeholders.

- Availability of evidence and witnesses.

- Legal and regulatory implications of the fraud.

4. What tools and techniques do you use to conduct fraud investigations?

- Data analytics software to identify anomalies and trends in financial data.

- Interviewing techniques to gather information from suspects, witnesses, and subject matter experts.

- Document examination to analyze financial records, emails, and other documents for evidence of fraud.

- Forensic accounting techniques to trace financial transactions and reconstruct events.

- Collaboration with external experts, such as forensic auditors and law enforcement.

5. How do you maintain confidentiality and integrity during a fraud investigation?

Maintaining confidentiality and integrity is paramount in fraud investigations. I adhere to the following principles:

- Limiting access to sensitive information only to authorized individuals.

- Securely storing and handling all evidence and documents.

- Respecting the privacy and rights of individuals involved in the investigation.

- Communicating only what is necessary and appropriate to relevant parties.

- Documenting all investigative steps and findings thoroughly.

6. What are the legal and ethical considerations involved in fraud investigations?

Fraud investigations must comply with both legal and ethical standards. I am aware of the following considerations:

- Protecting the rights of the accused and ensuring fair treatment.

- Complying with privacy laws and data protection regulations.

- Maintaining objectivity and impartiality throughout the investigation.

- Avoiding conflicts of interest and potential biases.

- Cooperating with law enforcement and regulatory authorities as necessary.

7. How do you report and communicate your findings effectively?

Effective communication of findings is essential for successful fraud investigations. I approach this by:

- Preparing clear and concise reports that summarize the key findings, conclusions, and recommendations.

- Presenting findings to management and stakeholders in a manner that is clear, compelling, and actionable.

- Answering questions and providing additional context as needed.

- Documenting and recording all communications related to the investigation.

8. How do you stay up-to-date on emerging fraud trends and best practices?

Staying abreast of the latest fraud trends and best practices is crucial. I engage in continuous learning through:

- Attending industry conferences and webinars.

- Reading professional journals and publications.

- Participating in training and development programs.

- Networking with other fraud examiners and law enforcement professionals.

9. How do you handle situations where you are met with resistance or obstruction during an investigation?

Resistance and obstruction during fraud investigations are not uncommon. I approach these situations by:

- Maintaining a professional and ethical demeanor.

- Communicating the purpose and scope of the investigation clearly.

- Seeking support from management and legal counsel as needed.

- Documenting all instances of resistance or obstruction.

- Exploring alternative sources of information and evidence.

10. Describe a time when you successfully investigated a fraud case and the impact it had on the organization.

In a previous role, I investigated a case of financial statement fraud involving the overstatement of sales revenue. Through data analytics and forensic accounting techniques, I uncovered a pattern of fictitious transactions and falsified invoices. This led to the identification and prosecution of the responsible individuals, resulting in the recovery of stolen funds and a significant reduction in financial losses for the organization.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Fraud Examiner.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Fraud Examiner‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

1. Detect and Investigate Fraud

Investigate suspicious activities, review financial records, conduct interviews, and provide evidence in support of fraud claims.

2. Analyze Financial Data

Analyze financial data to identify anomalies, trends, and patterns that may indicate fraudulent activity.

3. Develop and Implement Fraud Prevention Measures

Collaborate with other departments to establish policies, procedures, and systems to prevent and mitigate fraud risks.

4. Provide Expert Testimony

Present findings and provide expert testimony in legal proceedings related to fraud investigations.

Interview Preparation Tips

1. Research the Company and Industry

Understand the company’s business model, operations, and industry landscape. This will help you align your answers to the interviewer’s expectations.

2. Highlight Relevant Skills and Experience

Emphasize your strong analytical, investigative, and communication skills. Provide specific examples of how you have successfully detected and investigated fraud.

3. Practice Answering Common Questions

Prepare for questions related to your experience, fraud investigation techniques, and knowledge of financial regulations. Consider using the STAR method (Situation, Task, Action, Result) to structure your answers.

4. Seek Feedback

Ask friends, family, or colleagues to provide feedback on your answers. This can help you identify areas for improvement and refine your responses.

5. Dress Professionally and Arrive on Time

First impressions matter. Dress appropriately and arrive for your interview on time to demonstrate your professionalism and respect for the interviewer.

6. Be Prepared to Ask Questions

Asking thoughtful questions at the end of the interview shows your interest in the role and the company. Prepare questions about the company’s fraud prevention program, the specific challenges of the position, and any opportunities for professional development.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Fraud Examiner role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.