Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Bank Boss position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

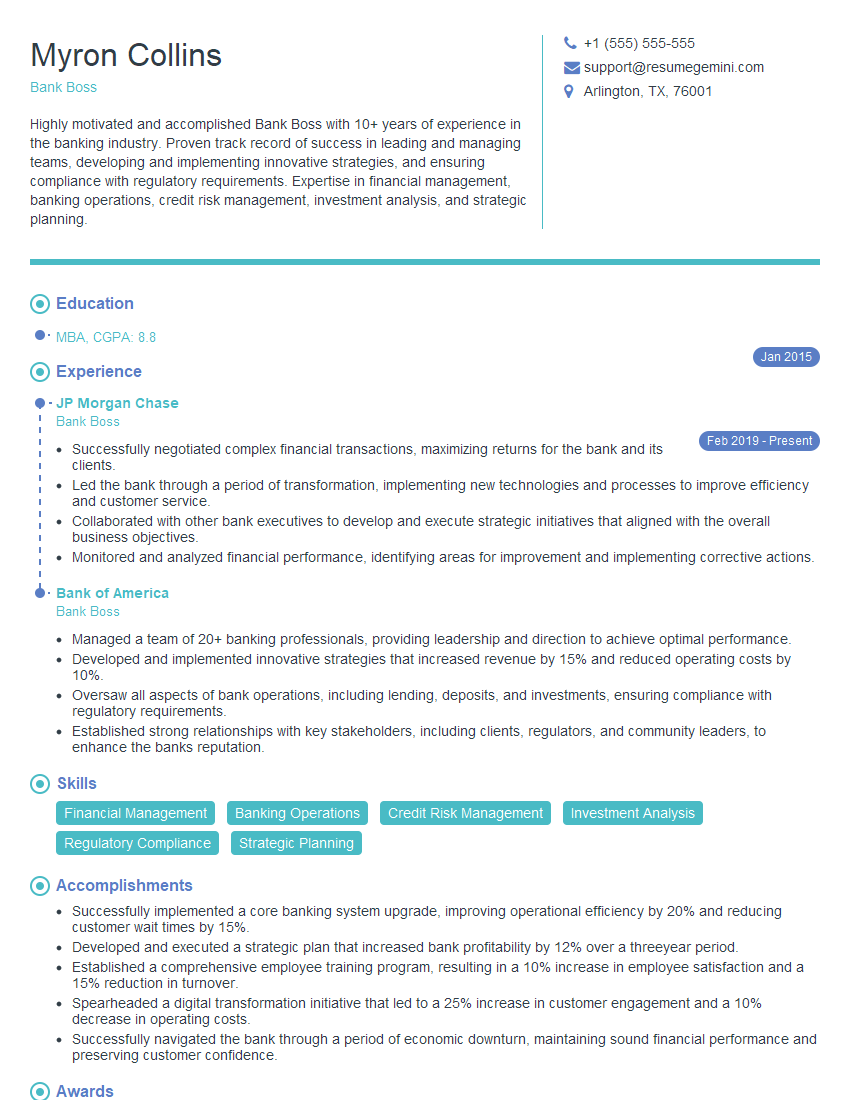

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Bank Boss

1. How would you assess the financial health of a bank?

- Review financial statements (balance sheet, income statement, cash flow statement)

- Analyze key financial ratios (liquidity, solvency, profitability, efficiency)

- Evaluate asset quality, loan portfolio, and credit risk

- Assess risk management practices and capital adequacy

- Consider macroeconomic factors and industry trends

2. What strategies would you implement to increase the bank’s profitability?

Revenue Generation

- Expand loan portfolio and offer competitive products

- Increase fee-based income through services like investment advisory and wealth management

- Explore cross-selling opportunities and provide bundled products

Cost Optimization

- Optimize operations through technology and process improvements

- Reduce overhead expenses by negotiating with vendors and streamlining processes

- Implement cost-to-income ratio targets and monitor efficiency metrics

3. How would you manage risk in a rapidly evolving regulatory environment?

- Develop a comprehensive risk management framework

- Identify, assess, and mitigate potential risks through stress testing and scenario analysis

- Establish clear risk appetite and risk limits

- Monitor regulatory changes and stay up-to-date with compliance requirements

- Foster a risk-aware culture throughout the organization

4. What is your vision for the future of banking?

- Digital transformation and the rise of fintech

- Increased focus on sustainability and social impact

- Growth of personalized and data-driven banking services

- Importance of customer experience and building strong relationships

- Collaboration and partnerships with non-traditional players

5. How would you lead and motivate a large and diverse workforce?

- Foster a positive and inclusive work environment

- Set clear goals and expectations

- Provide regular feedback and recognition

- Encourage professional development and growth opportunities

- Empower employees and delegate responsibilities

6. What are the key challenges facing the banking industry today?

- Increased competition from fintech and non-traditional players

- Regulatory pressures and compliance costs

- Low interest rates and margin compression

- Technological advancements and the need for digital transformation

- Cybersecurity threats and data protection challenges

7. How would you evaluate the performance of a bank?

- Financial metrics: profitability, growth, ROE, ROA

- Operational metrics: efficiency ratio, customer satisfaction

- Risk management metrics: non-performing loans, loss provisions

- Compliance metrics: regulatory compliance, consumer protection

- Industry benchmarks and peer comparisons

8. What is your experience in managing large-scale projects?

Example 1: Core Banking System Implementation

- Led a team to implement a new core banking system

- Managed project planning, execution, and stakeholder management

- Ensured seamless migration of customer data and minimized disruption

- Delivered the project on time and within budget

Example 2: Branch Expansion Program

- Developed and executed a strategy to expand the bank’s branch network

- Identified potential locations, conducted market research, and secured necessary approvals

- Managed construction, staffing, and operations for new branches

- Successfully increased the bank’s market reach and customer base

9. How would you approach a situation where the bank faces a reputational crisis?

- Communicate transparently and honestly

- Identify the root cause of the crisis and take corrective actions

- Engage with stakeholders, including customers, regulators, and the media

- Develop a comprehensive communication plan and monitor its effectiveness

- Implement measures to prevent similar incidents in the future

10. What are your strengths and weaknesses as a bank leader?

Strengths

- Strong strategic vision and execution capabilities

- Proven track record of driving profitability and growth

- Exceptional risk management skills and compliance expertise

- Excellent communication and interpersonal skills

- Ability to lead and motivate diverse teams

Weaknesses

- Limited experience in international banking

- Tendency to be detail-oriented and micro-manage at times

- Need to improve delegation skills and trust others with more responsibilities

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Bank Boss.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Bank Boss‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Bank Boss is the highest-ranking executive in a bank. They are responsible for the overall leadership, management, and direction of the bank. Bank Bosses must have a deep understanding of the banking industry and a proven track record of success.

1. Strategic Planning

The Bank Boss is responsible for developing and implementing the bank’s overall business strategy. This includes setting financial targets, determining the bank’s risk appetite, and allocating resources.

- Develop and implement the bank’s overall business strategy.

- Set financial targets and determine the bank’s risk appetite.

- Allocate resources and ensure that the bank has the necessary capital and liquidity to meet its obligations.

2. Risk Management

The Bank Boss is also responsible for managing the bank’s risk exposure. This means identifying and mitigating risks that could threaten the bank’s financial stability or reputation.

- Identify and mitigate risks that could threaten the bank’s financial stability or reputation.

- Implement and maintain sound risk management policies and procedures.

- Monitor the bank’s risk profile and make adjustments to the bank’s risk management strategy as needed.

3. Capital Management

The Bank Boss is responsible for ensuring that the bank has adequate capital to meet regulatory requirements and support its business operations. This means raising capital from investors and managing the bank’s capital structure.

- Ensure that the bank has adequate capital to meet regulatory requirements and support its business operations.

- Raise capital from investors and manage the bank’s capital structure.

- Monitor the bank’s capital ratios and take action to improve them if necessary.

4. Customer Service

The Bank Boss is ultimately responsible for ensuring that the bank provides excellent customer service. This means setting customer service standards, resolving customer complaints, and building relationships with customers.

- Set customer service standards and ensure that they are met.

- Resolve customer complaints and build relationships with customers.

- Monitor customer satisfaction levels and take action to improve them if necessary.

Interview Tips

To ace your interview, you need to prepare thoroughly. Here are some tips:

1. Research the bank

Before you go to your interview, you should research the bank you are applying to. This will help you to understand the bank’s business, culture, and values. You can find information about the bank on its website, in the news, and from industry analysts.

- Visit the bank’s website and read about its history, mission, and values.

- Read news articles about the bank to learn about its recent performance and industry standing.

- Talk to people in your network who work for the bank or who have knowledge of the industry.

2. Practice answering common interview questions

There are certain questions that interviewers ask all candidates. You can prepare for these questions by practicing your answers beforehand. Some common interview questions include:

- Tell me about yourself.

- Why are you interested in this position?

- What are your strengths and weaknesses?

- What are your career goals?

3. Be yourself

The most important thing is to be yourself. Don’t try to be someone you’re not. The interviewer will be able to tell if you’re being fake.

4. Dress appropriately

First impressions matter. Dress professionally for your interview. This means wearing a suit or other business attire.

5. Be on time

Punctuality is important. Be on time for your interview. If you’re running late, call the interviewer to let them know.

- Plan your route in advance and give yourself plenty of time to get to the interview location.

- If you’re running late, call the interviewer as soon as possible to let them know.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Bank Boss interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!