Feeling lost in a sea of interview questions? Landed that dream interview for Electronic Transaction Implementer but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Electronic Transaction Implementer interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

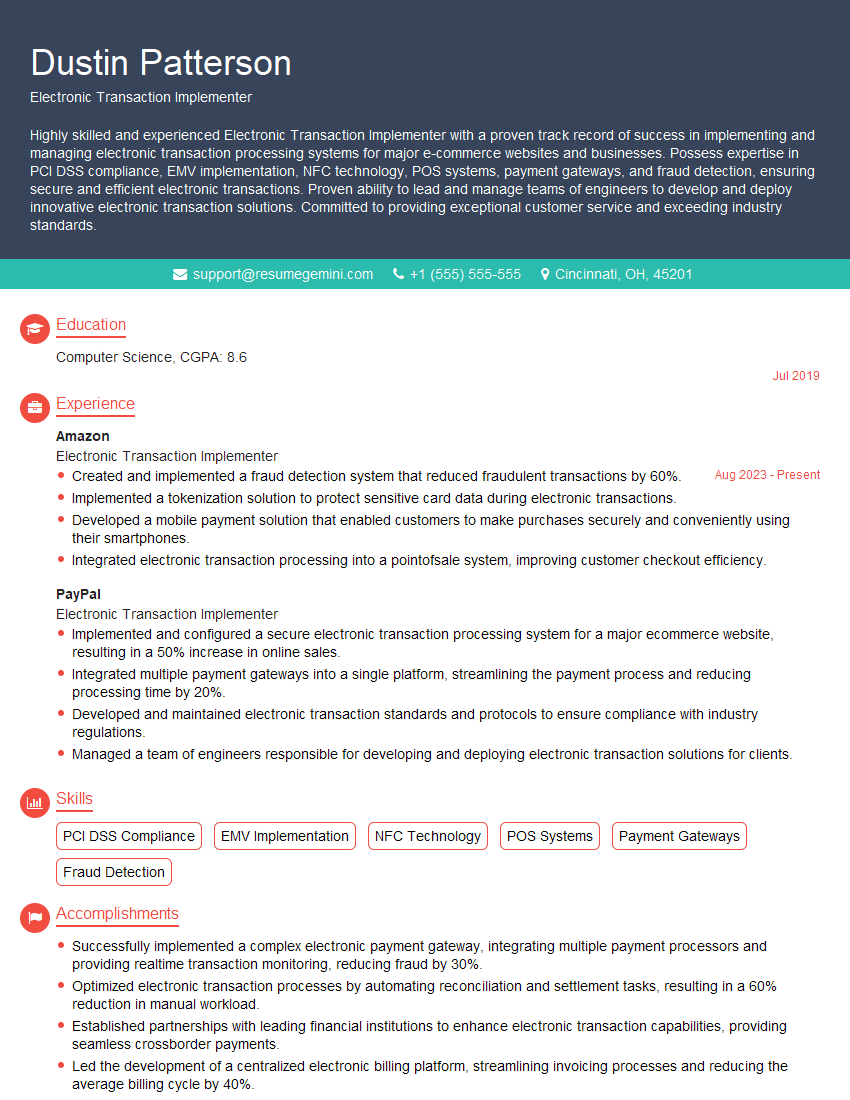

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Electronic Transaction Implementer

1. Describe the key components of an electronic transaction processing system?

- Point of Sale (POS) Terminals or Payment Gateways:

- Electronic Funds Transfer (EFT) Networks:

- Payment Processors:

- Issuing and Acquiring Banks:

- Clearing and Settlement Systems:

2. Explain the role of payment gateways in electronic transaction processing?

Security:

- Encrypt sensitive data

- Prevent fraud and data breaches

Routing:

- Direct transactions to the appropriate payment processor

- Handle multiple payment methods

Authorization:

- Verify the validity of payment information

- Authorize or decline transactions

3. What are the different types of electronic transaction processing networks?

- Public Switched Telephone Networks (PSTN):

- Dedicated Leased Lines:

- Virtual Private Networks (VPNs):

- Wireless Networks:

4. Describe the process of cardholder authentication in electronic transactions?

- Strong Customer Authentication (SCA):

- Two-Factor Authentication (2FA):

- EMV Chip and PIN Technology:

- Biometric Authentication:

5. What are the key challenges in implementing and managing electronic transaction processing systems?

- Security and Fraud Prevention:

- Compliance with Regulations:

- Interoperability and Integration:

- Scalability and Performance:

- Cost and Resource Management:

6. Explain the role of clearing and settlement systems in electronic transaction processing?

- Reconcile transactions between issuing and acquiring banks:

- Ensure the final settlement of funds:

- Manage risk and liquidity:

7. Describe the emerging trends in electronic transaction processing?

- Mobile Payments:

- Digital Wallets:

- Blockchain and Cryptocurrencies:

- Artificial Intelligence (AI) and Machine Learning (ML):

8. What are your experiences with implementing and maintaining electronic transaction processing systems?

- Project Management and Implementation:

- Technical Expertise and Troubleshooting:

- Team Collaboration and Communication:

9. How do you stay up-to-date on the latest technologies and trends in electronic transaction processing?

- Industry Events and Conferences:

- Technical Publications and Webinars:

- Vendor Certifications and Training:

- Networking and Collaboration:

10. Provide an example of a successful electronic transaction processing implementation you have been involved in?

- Project Background and Objectives:

- Technical Solution and Implementation Process:

- Results and Impact:

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Electronic Transaction Implementer.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Electronic Transaction Implementer‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

The Electronic Transaction Implementer (ETI) is responsible for the implementation and maintenance of electronic transaction systems. This includes working with various stakeholders, such as financial institutions, merchants, and customers, to ensure the smooth and efficient flow of electronic transactions.

1. Implementation and Maintenance of Electronic Transaction Systems

The ETI is responsible for the implementation and maintenance of electronic transaction systems. This includes working with various stakeholders, such as financial institutions, merchants, and customers, to ensure the smooth and efficient flow of electronic transactions.

- Implement and maintain electronic transaction systems, such as point-of-sale (POS) systems, automated teller machines (ATMs), and online banking systems.

- Work with stakeholders to identify and resolve issues with electronic transaction systems.

- Monitor electronic transaction systems for performance and security issues.

2. Customer Support

The ETI is responsible for providing customer support to users of electronic transaction systems. This includes answering questions, resolving issues, and providing training.

- Provide customer support to users of electronic transaction systems.

- Answer questions about electronic transaction systems.

- Resolve issues with electronic transaction systems.

- Provide training on electronic transaction systems.

3. Risk Management

The ETI is responsible for identifying and mitigating risks associated with electronic transaction systems. This includes working with stakeholders to develop and implement security measures.

- Identify and mitigate risks associated with electronic transaction systems.

- Work with stakeholders to develop and implement security measures.

- Monitor electronic transaction systems for security breaches.

4. Regulatory Compliance

The ETI is responsible for ensuring that electronic transaction systems comply with all applicable laws and regulations. This includes working with stakeholders to develop and implement compliance measures.

- Ensure that electronic transaction systems comply with all applicable laws and regulations.

- Work with stakeholders to develop and implement compliance measures.

- Monitor electronic transaction systems for compliance issues.

Interview Tips

Preparing for an interview for an Electronic Transaction Implementer position can be daunting, but with the right preparation, you can increase your chances of success. Here are some tips to help you prepare:

1. Research the Company and the Role

Take some time to research the company you’re applying to. This will help you understand the company’s culture, values, and goals. You should also research the specific role you’re applying for. This will help you understand the key responsibilities of the role and the skills and experience required.

- Visit the company’s website to learn about their history, mission, and values.

- Read job descriptions for similar roles to get a better understanding of the responsibilities and requirements.

- Network with people who work at the company to get insights into the company culture and the role.

2. Practice Your Answers to Common Interview Questions

There are a number of common interview questions that you’re likely to be asked, such as “Tell me about yourself” and “Why are you interested in this role?” It’s important to practice your answers to these questions so that you can deliver them confidently and concisely.

- Write down your answers to common interview questions and practice saying them out loud.

- Ask a friend or family member to practice interviewing you.

- Use online resources to find sample interview questions and answers.

3. Be Prepared to Talk About Your Experience

The interviewer will want to know about your experience in the field of electronic transaction implementation. Be prepared to talk about your specific skills and experience, and how they would benefit the company.

- Highlight your experience in implementing and maintaining electronic transaction systems.

- Describe your experience in working with stakeholders to resolve issues and improve performance.

- Discuss your experience in risk management and regulatory compliance.

4. Be Enthusiastic and Confident

The interviewer will be looking for someone who is enthusiastic and confident about the role. Be sure to convey your passion for electronic transaction implementation and your commitment to providing excellent customer service.

- Smile and be friendly during the interview.

- Make eye contact with the interviewer.

- Speak clearly and confidently.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Electronic Transaction Implementer role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.