Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Actuarial Assistant interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Actuarial Assistant so you can tailor your answers to impress potential employers.

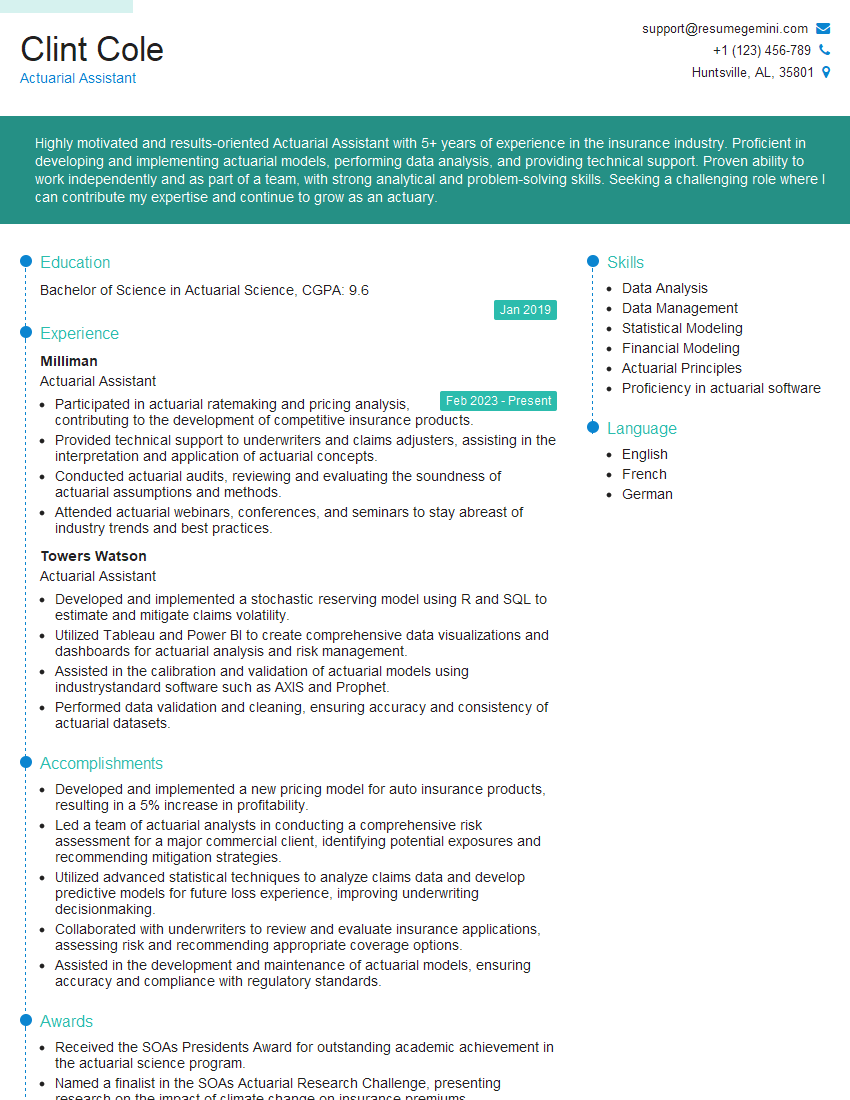

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Actuarial Assistant

1. Explain the role of an Actuary in the insurance industry?

Actuaries play a vital role in the insurance industry by assessing and managing financial risks. Their responsibilities include:

- Developing and pricing insurance products

- Assessing the risk of insurance claims

- Managing insurance reserves

- Providing advice to insurance companies on risk management

2. Describe the different types of actuarial models?

Deterministic Models

- Assume known and fixed inputs

- Provide a single, specific outcome

Stochastic Models

- Account for uncertainty in inputs

- Generate a range of possible outcomes

Hybrid Models

- Combine elements of both deterministic and stochastic models

- Provide a more comprehensive and realistic assessment of risk

3. What are the key assumptions used in actuarial models?

The key assumptions used in actuarial models include:

- Stationarity: Future events will resemble past events

- Independence: Events are not correlated with each other

- Homogeneity: The population being studied is homogeneous

- Parameter Stability: Model parameters will remain constant over time

4. How do you validate the accuracy of actuarial models?

To validate the accuracy of actuarial models, actuaries use a variety of techniques, such as:

- Historical data analysis

- Sensitivity analysis

- Stress testing

- Backtesting

5. What are the ethical considerations for actuaries?

Actuaries are bound by a code of ethics that requires them to:

- Act with integrity and objectivity

- Maintain confidentiality

- Avoid conflicts of interest

- Provide sound and impartial advice

6. What are the challenges facing the actuarial profession?

The actuarial profession is facing a number of challenges, including:

- Increased regulation

- Changing demographics

- Technological advances

- Climate change

7. What are your strengths and weaknesses as an actuarial assistant?

In my current role as an actuarial assistant, I have gained valuable experience in:

- Data analysis and modeling

- Insurance product development

- Risk assessment and management

I am also proficient in using actuarial software and Excel. While I am still developing my skills, I am confident that I can make a significant contribution to your team.

8. Why are you interested in working for our company?

I am very interested in working for your company because I am impressed by your commitment to providing innovative and customer-centric insurance solutions. I believe that my skills and experience would be a valuable asset to your team, and I am eager to contribute to your continued success.

9. What are your salary expectations?

My salary expectations are in line with the market average for actuarial assistants with my level of experience and qualifications. I am open to discussing a salary package that includes benefits such as health insurance, paid time off, and professional development opportunities.

10. Do you have any questions for me?

I do have a few questions for you:

- What is the company culture like?

- What are the opportunities for professional development within the company?

- What are the company’s goals for the future?

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Actuarial Assistant.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Actuarial Assistant‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Actuarial Assistants play a crucial role in supporting actuaries in the insurance and risk management industries. Their key responsibilities include:

1. Data Management and Analysis

Assist in collecting, cleaning, and analyzing data related to insurance policies, claims, and financial transactions.

- Develop and maintain databases and spreadsheets to store and organize data efficiently.

- Perform statistical analysis and modeling techniques to identify trends and patterns in data.

2. Model Building and Validation

Assist in developing and validating actuarial models used to assess risks and determine premiums.

- Create and modify complex spreadsheets and software programs to implement actuarial models.

- Perform simulations and sensitivity analyses to test the accuracy and reliability of models.

3. Regulatory Compliance and Reporting

Assist in ensuring compliance with regulatory requirements related to insurance and risk management.

- Prepare and submit actuarial reports to regulatory authorities and clients.

- Monitor changes in regulations and stay updated on industry best practices.

4. Communication and Presentation

Effectively communicate findings and technical information to actuaries, underwriters, and other stakeholders.

- Prepare written reports, presentations, and visualizations to convey complex data and analysis.

- Collaborate with actuaries and other professionals to provide insights and solutions.

Interview Tips

To ace the interview for an Actuarial Assistant position, candidates should follow these interview tips:

1. Research the Company and Role

Thoroughly research the insurance or risk management company and the specific role to demonstrate your interest.

- Visit the company’s website and read about their business, services, and values.

- Review the job description carefully and identify the key responsibilities and requirements.

2. Highlight Your Skills and Experience

Emphasize your technical skills, data analysis capabilities, and knowledge of actuarial principles.

- Quantify your accomplishments using specific metrics whenever possible.

- Provide examples of projects or assignments where you have successfully applied actuarial techniques.

3. Demonstrate Your Passion for the Industry

Convey your enthusiasm for the insurance and risk management industry and your desire to contribute.

- Share your understanding of current industry trends and challenges.

- Discuss your interest in pursuing further education or certifications in the field.

4. Prepare for Technical Questions

Expect to answer technical questions related to probability, statistics, and actuarial modeling.

- Review basic actuarial concepts and formulas.

- Practice solving case studies or problems involving data analysis and modeling techniques.

5. Ask Thoughtful Questions

Asking thoughtful questions at the end of the interview shows your engagement and interest.

- Inquire about the company’s actuarial department, its goals, and its challenges.

- Ask about the mentorship and training opportunities available to new Actuarial Assistants.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Actuarial Assistant interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!