Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Consulting Actuary interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Consulting Actuary so you can tailor your answers to impress potential employers.

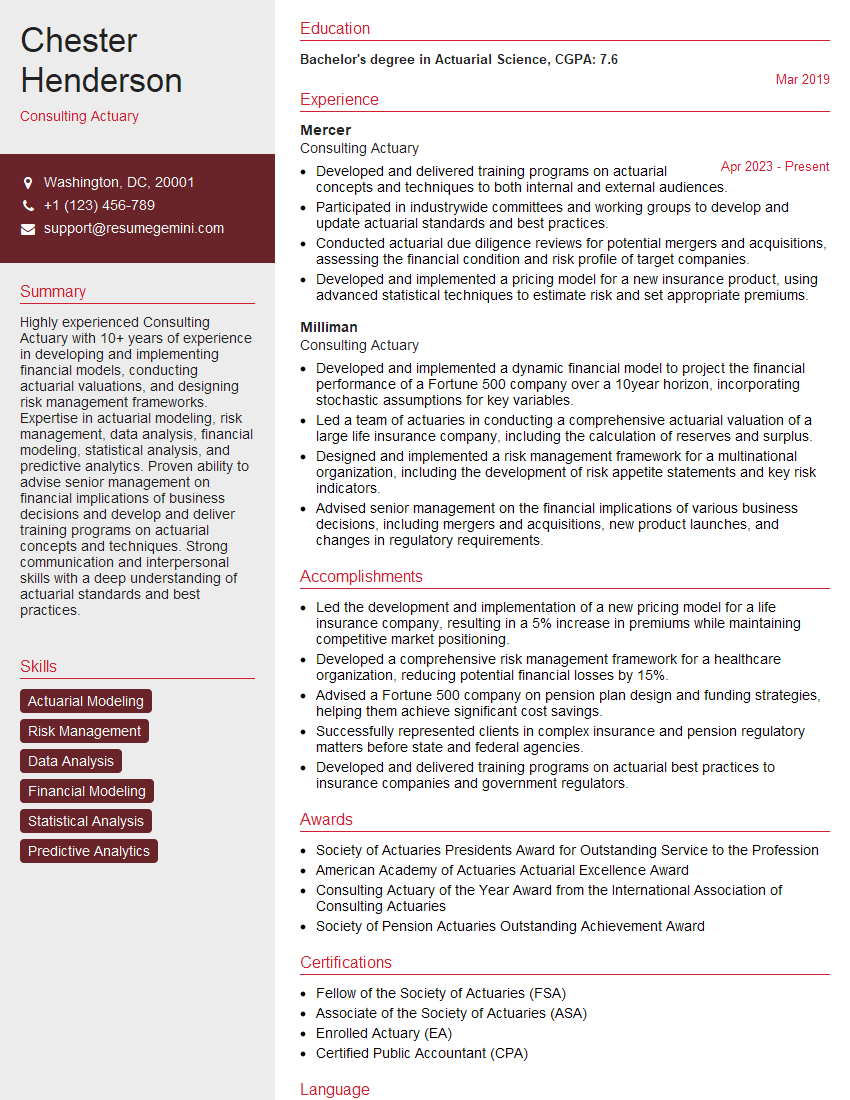

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Consulting Actuary

1. Describe your process for developing and presenting actuarial recommendations to clients.

- Gather and analyze data relevant to the client’s situation

- Develop actuarial models and calculations to assess risks and project outcomes

- Interpret and communicate findings clearly and effectively to clients

- Work with clients to develop and implement solutions that meet their needs

2. How do you stay up-to-date on the latest actuarial techniques and regulations?

Continuing Education

- Attend actuarial conferences and workshops

- Enroll in online courses and webinars

- Read actuarial journals and publications

Professional Organizations

- Maintain membership in professional organizations like the Society of Actuaries

- Participate in committee work and networking events

- Access resources and publications provided by these organizations

3. Discuss a recent actuarial project you worked on that involved complex financial modeling.

Describe the project in detail, including the challenges you faced and the solutions you implemented. Explain how your work contributed to the success of the project.

- Provide a brief overview of the project

- Identify the specific actuarial techniques and financial models used

- Describe the challenges encountered and how they were overcome

- Explain the impact and outcomes of your work

4. How do you assess and manage risk in your actuarial work?

- Identify and analyze potential risks

- Develop mitigation strategies to address risks

- Monitor and evaluate risks on an ongoing basis

- Communicate risks clearly to clients

5. Describe your experience with communicating actuarial results to clients and stakeholders.

Provide examples of how you have effectively communicated complex actuarial concepts to non-technical audiences.

- Describe your process for preparing and delivering presentations

- Provide examples of successful presentations you have given

- Explain how you tailor your communication to the specific audience

6. How do you handle situations where you disagree with a client’s request or decision?

- Professionally express your concerns and provide supporting data

- Explore alternative solutions that meet the client’s needs while addressing the concerns

- Document your recommendations and the rationale behind them

- Maintain a respectful and collaborative relationship with the client

7. What are some emerging trends in the actuarial field?

How do you expect these trends to impact the profession and your work?

- Discuss recent advancements in actuarial science and technology

- Analyze how these trends are shaping the industry and client needs

- Explain how you plan to adapt to these changes

8. How do you prioritize and manage your workload as a consulting actuary?

- Use project management tools and techniques

- Delegate tasks effectively

- Set realistic deadlines and communicate them clearly

- Track progress and make adjustments as needed

9. What is your understanding of the role of an actuary in corporate governance?

- Provide actuarial advice on risk management and financial planning

- Evaluate and report on the financial health of the organization

- Ensure compliance with regulatory requirements

- Contribute to strategic decision-making

10. How do you stay informed about industry best practices and emerging actuarial standards?

- Attend industry conferences and webinars

- Read actuarial journals and publications

- Participate in professional organizations and committees

- Collaborate with colleagues and mentors

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Consulting Actuary.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Consulting Actuary‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Consulting Actuaries provide actuarial services to a wide range of clients, including insurance companies, pension plans, and other financial institutions. They use their knowledge of mathematics, statistics, and finance to assess and manage risk.

1. Develop and communicate actuarial analyses and recommendations

Consulting Actuaries develop and communicate actuarial analyses and recommendations to clients. This may include:

- Conducting actuarial studies to assess the financial condition of an insurance company or pension plan.

- Developing and pricing insurance products.

- Managing investment portfolios.

- Providing advice on mergers and acquisitions.

2. Design and implement actuarial models

Consulting Actuaries design and implement actuarial models to assess and manage risk. These models may be used to:

- Predict future financial performance.

- Measure the impact of different investment strategies.

- Assess the risk of a new insurance product.

- Determine the appropriate level of reserves for an insurance company.

3. Provide consulting services to clients

Consulting Actuaries provide consulting services to clients to help them make informed decisions about their financial future. These services may include:

- Providing advice on investment strategies.

- Helping clients to develop and implement risk management plans.

- Conducting due diligence for mergers and acquisitions.

- Providing expert testimony in legal proceedings.

4. Stay up-to-date on actuarial and financial trends

Consulting Actuaries must stay up-to-date on actuarial and financial trends to provide the best possible advice to their clients. This involves:

- Reading actuarial and financial publications.

- Attending actuarial and financial conferences.

- Taking continuing education courses.

Interview Preparation Tips

In order to ace a Consulting Actuarial interview, preparing is key. Here are 6 tips to help you succeed:

1. Know the basics of actuarial science

Consulting actuaries need to have a strong understanding of mathematics, statistics, and finance. Make sure you are familiar with these concepts before your interview.

2. Practice your communication skills

Consulting actuaries need to be able to communicate their findings clearly and concisely to clients. Practice presenting your work to a friend, family member, or colleague.

3. Be prepared to answer technical questions

Interviewers will likely ask you technical questions about actuarial science. Be prepared to discuss your coursework, experience, and knowledge of actuarial concepts.

4. Be prepared to talk about your consulting experience

If you have any consulting experience, be sure to highlight it in your interview. Discuss the projects you worked on, the clients you worked with, and the results you achieved.

5. Be prepared to discuss your career goals

Interviewers will want to know what your career goals are and how a consulting actuarial role fits into your plans. Be prepared to discuss your long-term goals and how you plan to achieve them.

6. Be prepared to ask questions

Asking questions at the end of an interview shows that you’re engaged and interested in the role. Prepare a few questions to ask the interviewer about the company, the role, and the team.

Next Step:

Now that you’re armed with the knowledge of Consulting Actuary interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Consulting Actuary positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini