Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Product Development Actuary position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

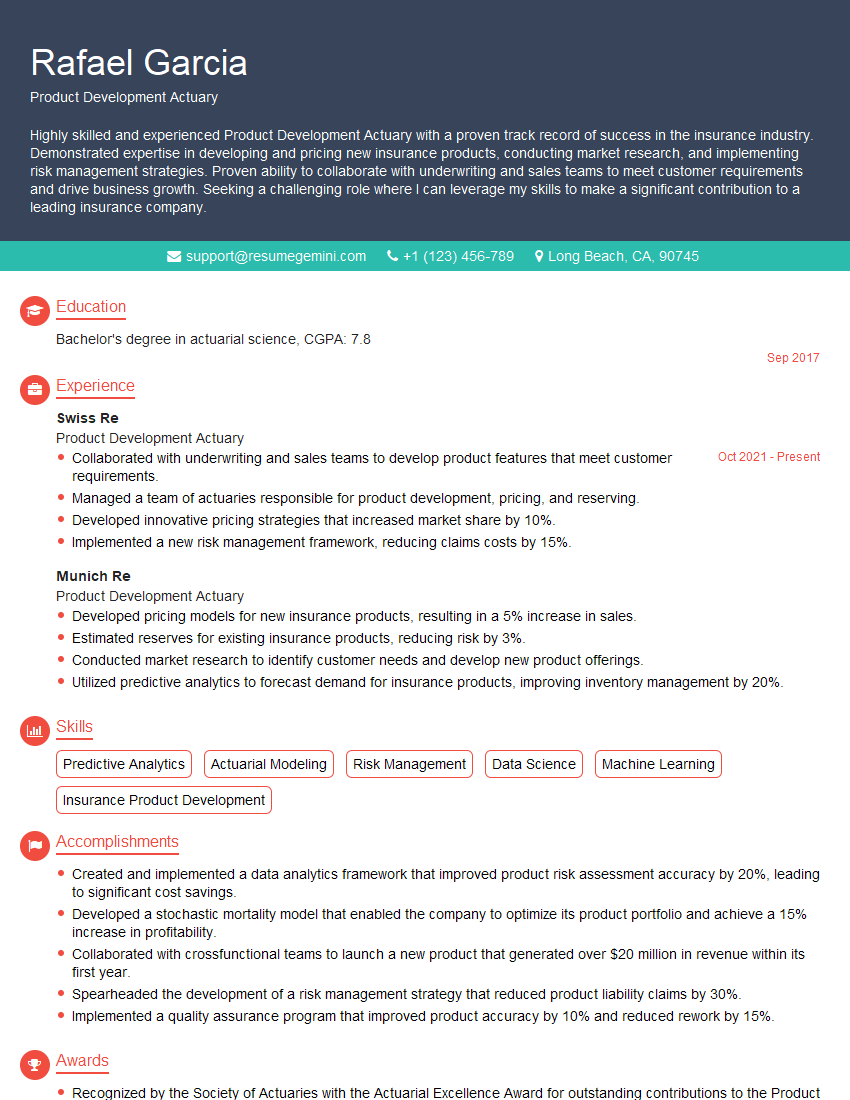

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Product Development Actuary

1. How do you approach the development of a new insurance product?

- Identify market needs and gaps by conducting thorough market research.

- Develop a clear understanding of the target customer base and their risk profile.

- Analyze competitive products and market trends to gain insights and differentiate the new product.

- Define product specifications, including coverage, benefits, terms, and pricing.

- Conduct actuarial analysis to determine appropriate premiums and reserve levels.

2. Explain the role of actuarial assumptions in product development.

Assumptions impact product pricing

- Assumptions about mortality rates, morbidity rates, and other factors impact premium calculations.

- Inaccurate assumptions can lead to underpricing or overpricing of the product, affecting profitability and financial stability.

Assumptions impact product design

- Assumptions about consumer preferences and behaviors influence product features, such as coverage limits and benefit structures.

- Understanding customer assumptions helps tailor products that meet their needs and demands.

3. How do you incorporate regulatory considerations into the product development process?

- Stay up-to-date with relevant regulations and compliance requirements.

- Review product designs to ensure compliance with underwriting guidelines and policy forms.

- Collaborate with legal counsel and regulatory professionals to address regulatory concerns and obtain approvals.

- Monitor regulatory changes and adapt product offerings as needed to maintain compliance.

4. Describe your experience in using actuarial modeling software for product development.

- Proficient in using actuarial software, such as Prophet Actuarial Suite, MoSes, or R.

- Expertise in developing actuarial models to forecast cash flows, project expenses, and simulate different scenarios.

- Ability to use models to analyze market data, evaluate product performance, and inform decision-making.

5. How do you communicate technical actuarial concepts to non-actuarial stakeholders?

- Simplify complex actuarial concepts using clear and concise language.

- Use analogies, examples, and visuals to illustrate technical aspects.

- Adapt communication style to the audience’s level of understanding.

- Seek feedback to ensure comprehension and clarity.

6. How do you evaluate the financial performance of an insurance product?

- Analyze premium income, claims expenses, and investment earnings.

- Calculate profitability metrics, such as return on investment and loss ratios.

- Assess the adequacy of reserves and identify potential financial risks.

- Recommend strategies to improve financial performance and ensure long-term viability.

7. Describe your experience in working on cross-functional teams.

- Collaborated effectively with underwriters, marketers, and other stakeholders.

- Participated in brainstorming sessions and contributed actuarial insights.

- Provided technical guidance and support to other team members.

- Leveraged cross-functional perspectives to develop innovative solutions.

8. How do you stay abreast of industry trends and developments in product development?

- Attend industry conferences and webinars.

- Read actuarial journals and publications.

- Network with other professionals in the field.

- Participate in continuing education programs.

9. Describe your approach to managing risk in product development.

- Identify potential risks and assess their likelihood and impact.

- Develop mitigation strategies to reduce or eliminate risks.

- Monitor risks throughout the product lifecycle and adjust mitigation measures as needed.

- Collaborate with risk management professionals to ensure a comprehensive approach.

10. How do you measure and evaluate the success of a new insurance product?

- Establish key performance indicators (KPIs) aligned with product objectives.

- Monitor sales and market share data to track market penetration.

- Analyze profitability metrics to assess financial performance.

- Conduct customer satisfaction surveys to gather feedback and identify areas for improvement.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Product Development Actuary.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Product Development Actuary‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Product Development Actuaries assume an important role in the insurance industry, leveraging actuarial science to create and evaluate new insurance and financial products. Let us deep dive into their essential responsibilities:

1. Product Design and Development

In collaboration with other departments like underwriting, marketing, and legal, these actuaries delve into market research, analyze customer needs, and develop innovative products. They determine the product’s features, benefits, and pricing, ensuring alignment with the company’s strategic goals.

2. Risk Assessment and Pricing

By employing actuarial models and statistical techniques, they evaluate the potential risks associated with new products. This involves calculating premiums that are adequate to cover potential claims while maintaining the product’s competitiveness in the market.

3. Financial Modeling and Projections

To assess the financial viability of new products, they develop sophisticated financial models. These models predict cash flows, profitability, and reserves, enabling the company to make informed decisions about product launch and pricing strategies.

4. Regulatory Compliance

Product Development Actuaries ensure that new products comply with regulatory requirements. They thoroughly review product design, pricing, and marketing materials to adhere to applicable laws and regulations.

Interview Tips

To ace your interview for a Product Development Actuary position, consider these valuable tips:

1. Research the Company and Position

Familiarize yourself with the company’s products, services, and market position. Understanding the specific role and its responsibilities within the organization will demonstrate your genuine interest and preparation.

2. Showcase Your Technical Skills

Highlight your proficiency in actuarial modeling, risk assessment, and financial analysis. Provide specific examples of projects where you applied these skills to solve business problems.

3. Emphasize Your Analytical and Problem-Solving Abilities

Product Development Actuaries must be able to analyze complex data, identify trends, and develop innovative solutions. Share examples from your experience that showcase your analytical thinking and problem-solving capabilities.

4. Communicate Your Understanding of the Insurance Industry

Demonstrate your grasp of the insurance market, regulatory landscape, and current industry trends. This understanding will underscore your ability to contribute effectively to the company’s product development process.

5. Be Prepared to Discuss Your Career Goals

Articulate your career aspirations and explain how this role aligns with your long-term goals. Show your enthusiasm for product development and your drive to make a meaningful contribution to the company’s success.

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Product Development Actuary, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Product Development Actuary positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.