Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Financial Economist position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

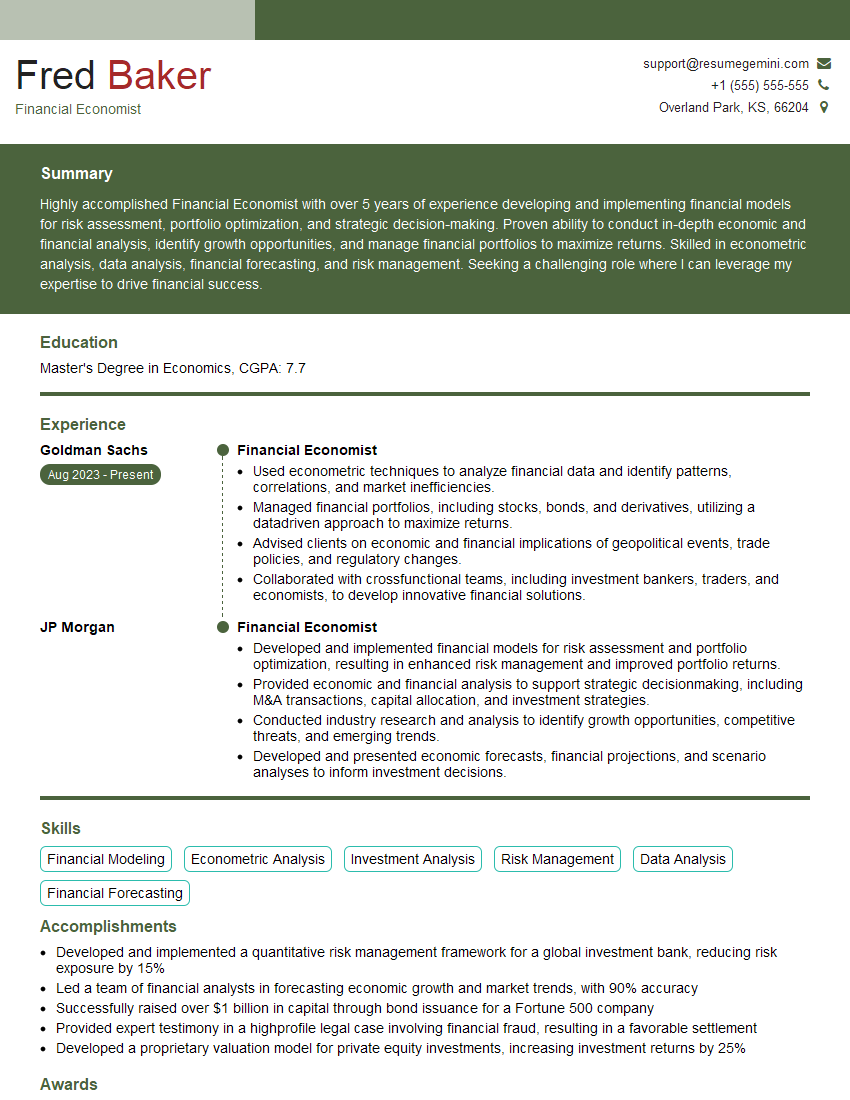

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Financial Economist

1. Explain the concept of portfolio optimization using Modern Portfolio Theory (MPT).

- Define portfolio optimization as the process of selecting the most efficient portfolio from a set of possible portfolios.

- Describe the efficient frontier as the set of portfolios that offer the highest possible return for a given level of risk.

- Explain how MPT uses diversification to reduce risk without sacrificing return.

- Discuss the assumptions of MPT, such as normally distributed returns and rational investors.

2. Discuss the different types of financial instruments and how they are used in portfolio management.

- Stocks: Equity securities that represent ownership in a company. Used for capital appreciation and dividends.

- Bonds: Fixed-income securities that pay regular interest payments. Used for income and stability.

- Mutual funds: Baskets of stocks or bonds managed by a professional. Offer diversification and convenience.

- Exchange-traded funds (ETFs): Baskets of assets that trade on stock exchanges. Offer low costs and real-time trading.

- Derivatives: Financial instruments that derive their value from an underlying asset. Used for hedging and speculation.

3. Describe the process of conducting financial forecasting and its importance in decision-making.

- Data collection: Gathering historical data, market trends, and economic indicators.

- Model selection: Choosing a forecasting model that aligns with the data and forecasting objectives.

- Parameter estimation: Determining the parameters of the model using statistical techniques.

- Forecasting: Generating predictions about future financial outcomes.

- Validation and interpretation: Evaluating the accuracy of the forecasts and interpreting the results for decision-making.

4. How do you evaluate the risk and return of a portfolio?

- Risk assessment: Quantifying the volatility and potential losses of a portfolio using measures like standard deviation, VaR, and stress testing.

- Return evaluation: Calculating the expected return of a portfolio based on historical data and market conditions.

- Risk-return trade-off: Analyzing the relationship between risk and return to determine the optimal portfolio allocation for specific investment goals.

5. Explain the concept of behavioral finance and its implications for investment decision-making.

- Definition: Behavioral finance explores the psychological and cognitive biases that influence investor behavior.

- Implications: Biases like herd mentality, overconfidence, and anchoring can lead to irrational investment decisions.

- Impact on decision-making: Understanding behavioral finance helps investors mitigate biases, make more informed choices, and improve portfolio performance.

6. How do you use economic principles to inform your investment strategies?

- Macroeconomic analysis: Monitoring economic growth, inflation, interest rates, and monetary policy to assess market conditions and investment opportunities.

- Sector and industry analysis: Identifying promising sectors and industries based on economic fundamentals and growth potential.

- Company analysis: Evaluating individual companies’ financial performance, competitive advantages, and management strategies to make informed investment decisions.

7. Explain the role of financial technology (FinTech) in the financial industry and how it impacts your work as a financial economist.

- Data analytics: FinTech tools enable the analysis of large datasets to identify trends, risks, and investment opportunities.

- Automated trading: Algorithms and platforms facilitate high-frequency trading and execute complex strategies.

- Digital platforms: FinTech apps and platforms provide investors with access to financial information, trading capabilities, and personalized advice.

- Impact on financial economists: FinTech enhances data availability, improves forecasting accuracy, and promotes innovation in investment strategies.

8. Describe your experience in using econometric models to analyze financial data.

- Model selection and estimation: Proficiency in selecting and estimating econometric models appropriate for financial data analysis.

- Data analysis: Expertise in cleaning, transforming, and visualizing financial data for modeling purposes.

- Interpretation and validation: Ability to interpret and validate econometric model results to derive meaningful insights.

- Applications: Examples of successful applications of econometric models in financial analysis, such as risk assessment, forecasting, and investment decision-making.

9. How do you stay up-to-date with the latest developments in the financial industry?

- Industry publications and journals: Reading financial news, research reports, and academic papers to stay informed about market trends, economic conditions, and investment strategies.

- Conferences and seminars: Attending industry events to connect with experts, learn about new developments, and engage in professional discussions.

- Online resources and platforms: Utilizing online tools, databases, and social media to access financial data, analysis, and insights.

10. How do you communicate your findings and recommendations to clients and stakeholders?

- Clear and concise reports: Preparing written reports that effectively convey financial analysis results, insights, and recommendations.

- Verbal presentations: Delivering oral presentations to clients and stakeholders, presenting findings, and answering questions.

- Client engagement: Interacting with clients to understand their needs, answer queries, and provide ongoing support.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Financial Economist.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Financial Economist‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Financial Economists hold a demanding position that calls for a thorough grasp of economic theories and financial markets. Their key responsibilities encompass a wide range of tasks, including:

1. Economic Modeling and Forecasting

Constructing sophisticated economic models to analyze and forecast financial market trends, economic indicators, and macroeconomic variables.

2. Risk Assessment and Management

Evaluating and quantifying financial risks, developing risk mitigation strategies, and implementing risk management frameworks to safeguard investments and ensure financial stability.

3. Investment Analysis and Portfolio Management

Conducting in-depth research on investment opportunities, recommending and evaluating investment strategies, and managing investment portfolios to optimize returns.

4. Policy Analysis and Consulting

Analyzing economic and financial policies, providing expert advice to policymakers and corporate leaders, and contributing to the development of informed decision-making.

Interview Tips

To excel in a Financial Economist interview, preparation is key. Here are some valuable tips to help you make a strong impression:

1. Expertise in Economic Theory and Financial Markets

Demonstrate your proficiency in economic theories, financial markets, and econometric modeling. Be prepared to discuss key economic concepts, theories, and empirical methods.

2. Analytical and Problem-Solving Skills

Highlight your ability to analyze complex financial data, identify patterns, and solve problems effectively. Showcase your critical thinking and quantitative aptitude.

3. Case Studies and Examples

Prepare concrete examples of your work in economic modeling, risk assessment, or investment analysis. Quantify your results and explain how they contributed to successful outcomes.

4. Communication and Presentation Skills

Practice presenting your findings and recommendations clearly and persuasively. Financial Economists often need to communicate complex economic concepts to non-specialists.

5. Market Knowledge and Industry Trends

Stay up-to-date on current economic and financial market trends. Discuss your insights on industry best practices and emerging challenges in the field.

6. Behavioral Interview Questions

Be ready to answer behavioral interview questions that explore your teamwork, problem-solving, and decision-making abilities. Use the STAR method to provide specific examples that demonstrate your skills.

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Financial Economist, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Financial Economist positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.