Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Automatic Teller Machine Servicer position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

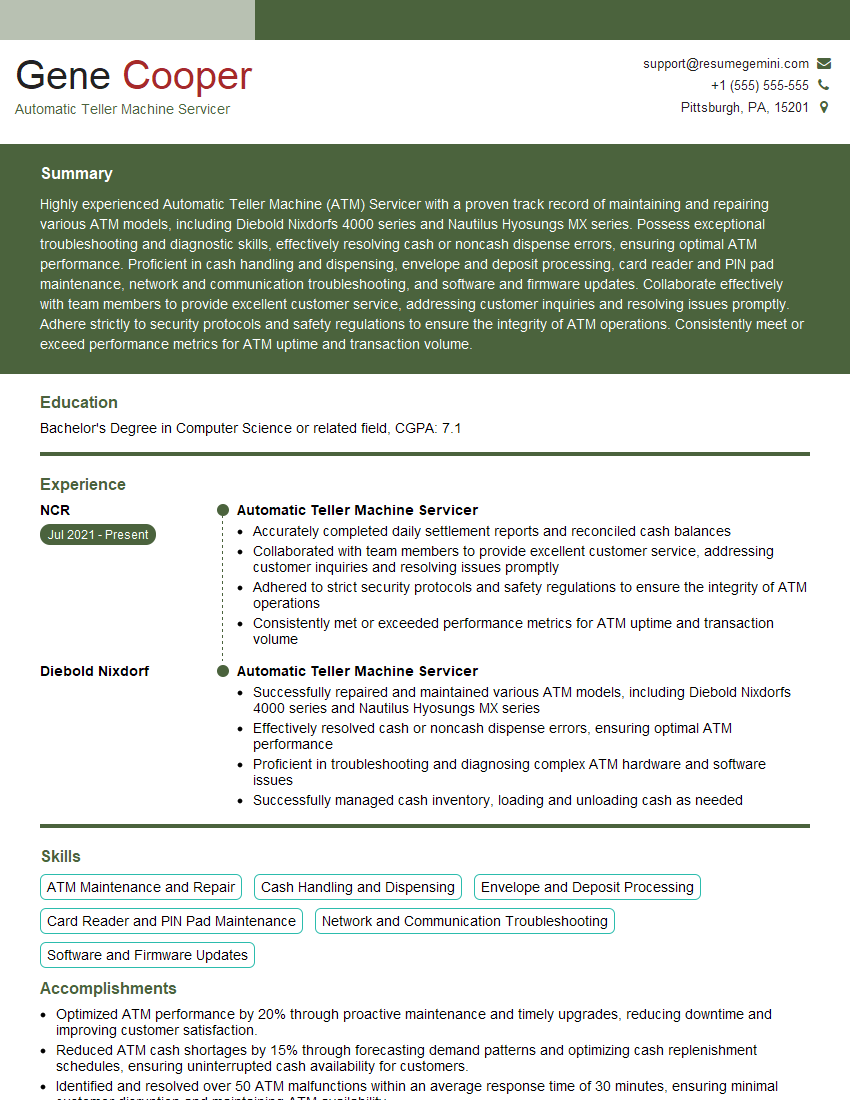

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Automatic Teller Machine Servicer

1. Describe the process of troubleshooting a malfunctioning ATM?

- Gather information about the issue from the customer or service desk.

- Examine the ATM physically for any visible damage or problems.

- Use diagnostic tools to identify the source of the malfunction.

- Repair or replace faulty components as necessary.

- Test the ATM to ensure it is functioning correctly.

2. How do you handle a situation where an ATM is dispensing incorrect amounts of money?

Calibrate the ATM

- Use calibration tools to adjust the cash dispenser.

- Test the ATM with different denominations of banknotes to ensure accuracy.

Inspect the cash cassettes

- Check for any foreign objects or damage that may be interfering with the cash flow.

- Clean and lubricate the cassettes as necessary.

Update the ATM software

- Ensure that the ATM is running on the latest software version.

- Install any necessary updates or patches.

3. Describe the steps involved in replenishing an ATM with cash?

- Prepare the cash by sorting and counting it.

- Secure the cash in the designated compartments within the ATM.

- Use a key or code to lock the cash compartments.

- Record the amount of cash dispensed into the ATM.

- Balance the cash in the ATM against the records.

4. What are the common security measures implemented in ATMs to prevent fraud?

- Physical security features: Cameras, anti-skimming devices, and reinforced casing.

- Encryption and tokenization: Encrypting sensitive data during transactions.

- Transaction limits: Setting limits on the amount of cash that can be withdrawn per transaction.

- Card verification: Checking the authenticity of a user’s card using EMV chips or magnetic stripes.

- PIN protection: Requiring users to enter a unique PIN to access their accounts.

5. How do you maintain the cleanliness and hygiene of ATMs?

- Regularly clean the exterior and interior of the ATM using approved cleaning agents.

- Disinfect areas that are frequently touched, such as the keypad and screen.

- Replace worn or damaged parts that may harbor bacteria.

- Adhere to established cleaning and hygiene protocols.

- Educate customers on proper ATM usage to minimize the spread of germs.

6. Explain the importance of preventative maintenance for ATMs and how it can extend their lifespan?

- Regularly inspecting and cleaning components reduces wear and tear.

- Updating software and firmware addresses security vulnerabilities and optimizes performance.

- Testing and calibrating ATMs ensures accurate cash dispensing and transaction processing.

- Proactive maintenance reduces the likelihood of unexpected breakdowns and costly repairs.

- Extending ATM lifespan saves on replacement costs and minimizes disruptions to customer service.

7. What are the key components of an ATM and their functions?

- Cash dispenser: Dispenses cash in various denominations.

- Card reader: Reads magnetic stripe or EMV chip on a customer’s card.

- PIN pad: Allows users to enter their PIN securely.

- Screen: Displays instructions, account information, and transaction details.

- Controller: Manages the overall operation of the ATM, including communication with the host system.

8. Describe the different types of transactions that can be performed at an ATM?

- Cash withdrawal

- Balance inquiry

- Deposit (in some machines)

- Bill payment

- Transfer funds between accounts

- Purchase airtime or other services

9. How do you stay up-to-date with the latest advancements in ATM technology?

- Attend industry conferences and workshops.

- Read trade publications and online resources.

- Participate in training programs offered by ATM manufacturers.

- Network with other ATM professionals.

- Stay informed about software updates and security patches.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Automatic Teller Machine Servicer.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Automatic Teller Machine Servicer‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

An Automatic Teller Machine (ATM) Servicer is a highly skilled individual who plays a critical role in ensuring the smooth and efficient functioning of ATMs. Key job responsibilities include:

1. Maintenance and Repair

Performing preventive maintenance tasks such as cleaning, testing, and calibrating ATMs to maintain optimal performance.

- Diagnosing and troubleshooting ATM malfunctions, identifying root causes, and implementing repairs.

- Replacing defective components, such as cash cassettes, printers, and card readers, to ensure uninterrupted service.

2. Cash Management

Loading and balancing cash in ATMs, ensuring accuracy and availability to customers.

- Monitoring cash levels and replenishing ATMs as needed to meet customer demand.

- Reconciling cash transactions and submitting reports to banks or financial institutions.

3. Customer Service

Providing assistance to customers experiencing ATM issues, resolving problems promptly and effectively.

- Responding to customer inquiries and complaints in a professional and courteous manner.

- Educating customers on ATM usage and security measures.

4. Security

Ensuring the physical and cybersecurity of ATMs, safeguarding customer information and financial assets.

- Conducting regular security inspections, monitoring surveillance cameras, and reporting suspicious activities.

- Adhering to established security protocols and guidelines to prevent fraud and unauthorized access.

Interview Tips

To ace an interview for an ATM Servicer position, it is essential to prepare thoroughly and showcase your skills and qualifications.

1. Research the Organization and Role

Gather information about the financial institution or company offering the job, as well as the specific responsibilities of the ATM Servicer role.

- Visit the company website, read industry news, and connect with current or former employees.

- Identify specific areas where your skills and experience align with the job requirements.

2. Highlight Relevant Skills and Experience

Emphasize your technical skills in ATM maintenance, troubleshooting, and cash management.

- Quantify your accomplishments and provide specific examples of how you have resolved ATM issues.

- Highlight any certifications or training programs that demonstrate your expertise in ATM servicing.

3. Demonstrate Customer Service Orientation

Convey your ability to provide excellent customer service and resolve customer issues effectively.

- Share examples of how you have handled difficult customer interactions and resolved problems to their satisfaction.

- Emphasize your patience, empathy, and communication skills.

4. Prepare for Technical Questions

Expect technical questions about ATM hardware, software, and security protocols.

- Review common ATM troubleshooting scenarios and prepare your responses.

- Be familiar with basic electrical and mechanical concepts.

5. Practice Common Interview Questions

Prepare for common interview questions, including those related to your motivations, strengths, and career goals.

- Consider why you are interested in the ATM Servicer role and how it aligns with your career aspirations.

- Identify your strengths and weaknesses, and be honest about areas where you may need additional training or support.

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Automatic Teller Machine Servicer, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Automatic Teller Machine Servicer positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.