Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Bank Teller Machine Mechanic position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

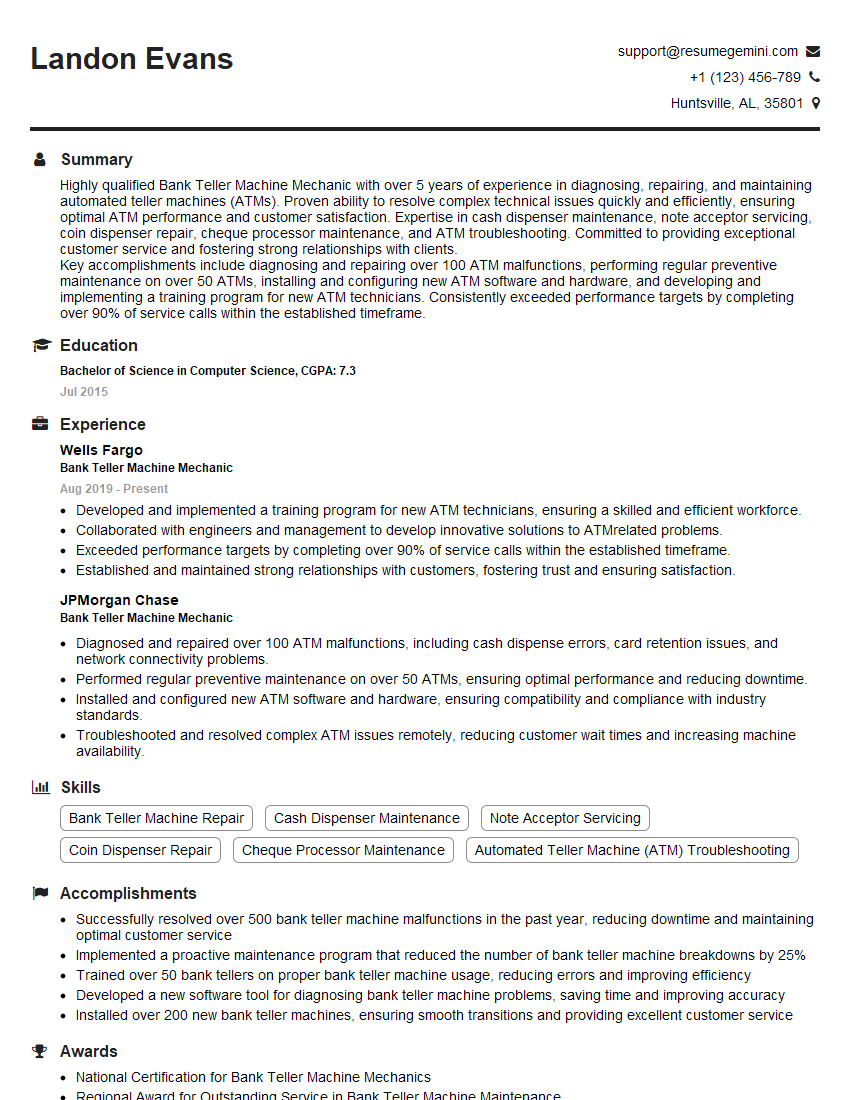

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Bank Teller Machine Mechanic

1. Explain the different types of bank teller machines and their functions?

- Cash Dispensers (ATMs): Allow customers to withdraw cash, check balances, and make deposits.

- Cash Acceptors: Enable customers to deposit cash and checks.

- Coin Dispensers: Dispense coins in various denominations.

- Multi-Function Machines: Combine multiple functions, such as cash withdrawals, deposits, coin dispensing, and account inquiries.

2. Describe the common issues faced by bank teller machines and how you troubleshoot them?

Hardware Issues:

- Cassette jams

- Card reader malfunctions

- Printer problems

Software Issues:

- Connectivity issues

- Transaction errors

- Firmware updates

3. What are the safety procedures you follow when servicing bank teller machines?

- Wear appropriate safety gear (gloves, mask, safety glasses).

- Power down the machine and unplug it.

- Use anti-static precautions to prevent electrical shocks.

- Follow lockout/tagout procedures.

- Report any safety hazards or concerns.

4. What steps do you take to maintain and prolong the lifespan of bank teller machines?

- Regular cleaning and inspection

- Firmware updates and software patches

- Preventive maintenance checks

- Calibration and adjustments

- Monitoring usage and performance data

5. How do you stay up-to-date with the latest technology and industry trends in bank teller machine maintenance?

- Attend industry conferences and webinars

- Read trade publications and technical manuals

- Participate in training programs

- Follow industry associations and forums

6. Describe your experience in diagnosing and repairing complex issues with bank teller machines.

Example Response: “I once encountered a situation where an ATM was dispensing duplicate bills due to a sensor malfunction. I used diagnostic tools to identify the faulty sensor, replaced it, and re-calibrated the machine, resolving the issue.”

7. How do you prioritize and manage multiple service calls while maintaining customer satisfaction?

Example Response: “I prioritize calls based on urgency and potential impact on customer service. I communicate with customers transparently about estimated repair times and keep them updated on progress. I also seek assistance from colleagues when necessary to ensure prompt and efficient service.”

8. Describe your understanding of the different anti-counterfeiting measures implemented in bank teller machines.

- Magnetic Ink Character Recognition (MICR)

- Ultraviolet (UV) ink detection

- Holograms and watermarks

- Paper texture and density analysis

9. What are the ethical considerations and security measures you take when handling sensitive customer data during repairs?

- Maintain confidentiality of customer information.

- Follow data security protocols and encryption standards.

- Report any suspected fraudulent activity.

- Dispose of sensitive data securely.

10. How would you handle a situation where a customer is unhappy with the service provided?

Example Response: “I would apologize for the inconvenience and actively listen to their concerns. I would explain the steps taken to resolve the issue and provide a clear explanation of the repair process. I would offer alternative solutions or escalate the issue if necessary to ensure customer satisfaction.”

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Bank Teller Machine Mechanic.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Bank Teller Machine Mechanic‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Bank Teller Machine Mechanics are responsible for installing, maintaining, and repairing automated teller machines (ATMs) and related equipment. Their key job responsibilities include:

1. Installation and Maintenance

Installing, configuring, and testing new ATMs and related equipment to ensure proper functionality.

- Performing regular preventive maintenance on ATMs to ensure optimal performance and identify potential issues.

- Repairing and replacing faulty components of ATMs, including cash dispensers, check readers, and card readers.

2. Troubleshooting and Problem Solving

Diagnosing and resolving malfunctions and technical issues with ATMs, including software and hardware problems.

- Using specialized diagnostic tools and software to identify the root cause of errors and system failures.

- Developing and implementing solutions to restore ATM functionality and minimize downtime.

3. Security and Compliance

Ensuring ATMs are secure and compliant with industry standards and regulations.

- Performing security audits and assessments to identify potential vulnerabilities and risks.

- Implementing and maintaining security measures to prevent unauthorized access, fraud, and data breaches.

4. Communication and Teamwork

Collaborating with other bank personnel, including tellers, managers, and customers, to resolve issues and provide support.

- Communicating effectively with customers to understand their needs and assist with ATM operations.

- Working as part of a team to ensure smooth and efficient ATM maintenance and support.

Interview Tips

To ace an interview for a Bank Teller Machine Mechanic position, it’s essential to prepare effectively and demonstrate your skills and qualifications.

1. Research the Company and Industry

Research the bank and its specific ATM services. Learn about their market position, customer base, and any recent news or developments related to their ATMs.

2. Highlight Your Technical Skills

Emphasize your expertise in installing, maintaining, and repairing ATMs. Provide specific examples of projects you’ve worked on and challenges you’ve overcome.

3. Demonstrate Problem-Solving Ability

Describe situations where you successfully diagnosed and resolved technical issues with ATMs. Explain your troubleshooting process and the solutions you implemented.

4. Showcase Your Security Awareness

Discuss your knowledge of ATM security best practices and your experience implementing and maintaining security measures. Highlight any industry certifications or training you have in this area.

5. Emphasize Your Communication and Customer Service Skills

Share examples of how you have effectively communicated with customers and resolved their ATM-related issues. Demonstrate your ability to work as part of a team and provide excellent customer service.

6. Prepare for Common Interview Questions

Anticipate questions about your experience, qualifications, and why you’re interested in the position. Be prepared to provide concise and informative answers that showcase your strengths.

7. Ask Thoughtful Questions

Ask insightful questions during the interview that demonstrate your interest in the company and the position. This can help you stand out and show your enthusiasm.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Bank Teller Machine Mechanic interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.