Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Insurance Attorney interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Insurance Attorney so you can tailor your answers to impress potential employers.

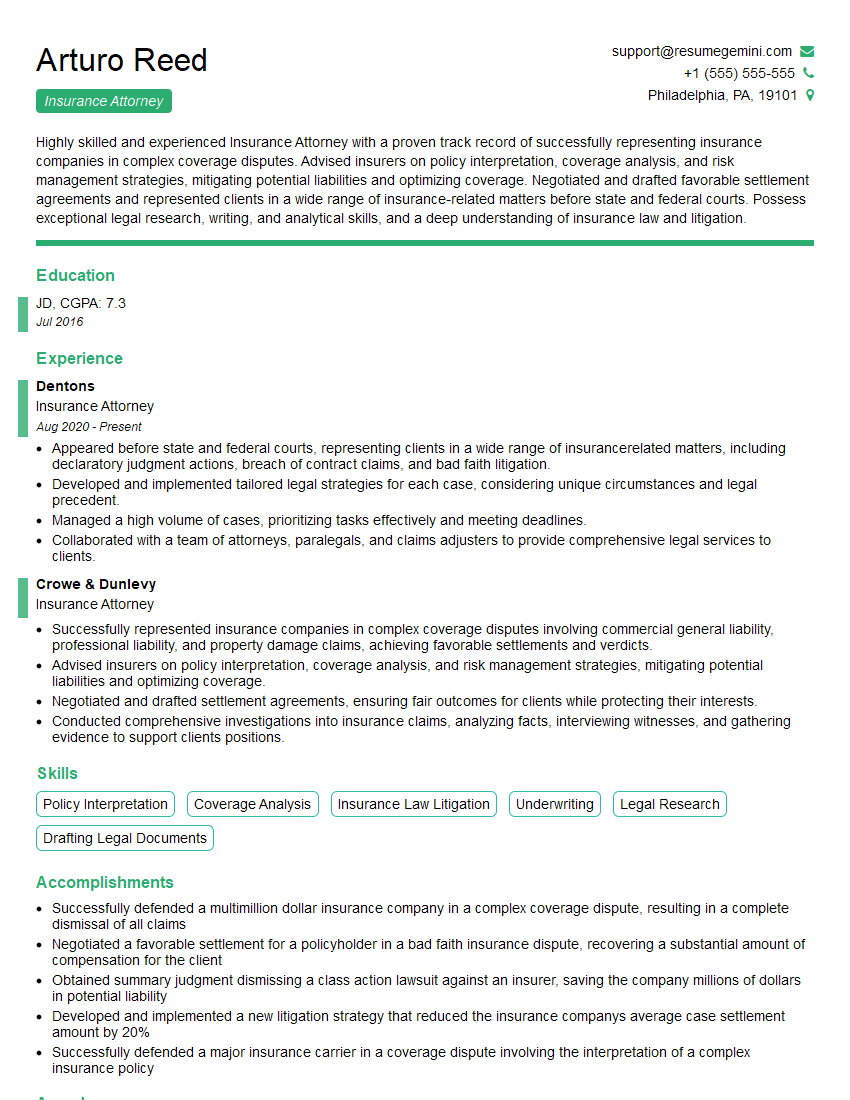

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Insurance Attorney

1. How do you go about evaluating an insurance policy to determine coverage for a claim?

- Identify the applicable policy language.

- Review the facts of the claim and determine whether they fall within the policy’s coverage.

- Analyze any exclusions or limitations that may apply.

- Consider any relevant case law or regulatory guidance.

- Make a determination as to whether coverage exists.

2. What are the different types of insurance litigation?

Coverage Disputes

- Disagreements over whether a particular claim is covered under an insurance policy.

- Examples: Disputes over property damage, bodily injury, or business interruption coverage.

Bad Faith Litigation

- Claims that an insurer has acted in bad faith in handling a claim.

- Examples: Unreasonable delays, denials of coverage without a valid basis, or failure to investigate claims properly.

Subrogation

- Claims by an insurer to recover payments it has made to its insured from a third party responsible for the loss.

- Examples: Claims against tortfeasors or other insurance companies.

Extra-Contractual Liability

- Claims against insurers for damages beyond the terms of the insurance policy.

- Examples: Negligence, fraud, or intentional infliction of emotional distress.

3. What are the key elements of a successful insurance litigation strategy?

- Thorough investigation and preparation.

- Strong legal research and analysis.

- Effective communication and negotiation skills.

- Ability to manage complex litigation matters.

- Understanding of the insurance industry and its practices.

4. What are some of the challenges you have faced in your previous insurance litigation work?

- Handling complex coverage disputes.

- Proving bad faith by an insurer.

- Negotiating favorable settlements.

- Managing large-scale litigation matters.

- Keeping up with changes in insurance law and regulations.

5. How do you stay up-to-date on the latest developments in insurance law?

- Attending industry conferences and seminars.

- Reading legal publications and journals.

- Participating in professional organizations.

- Networking with other insurance attorneys.

- Taking continuing legal education courses.

6. What are your thoughts on the future of insurance litigation?

- Increased use of technology, such as electronic discovery and data analytics.

- More complex coverage disputes as new risks emerge.

- Greater focus on bad faith litigation.

- Increased regulatory scrutiny of the insurance industry.

- Potential for new legal theories and precedents.

7. How do you manage your time and resources effectively when handling multiple insurance litigation matters?

- Prioritize tasks and set realistic deadlines.

- Delegate tasks to paralegals and other staff members.

- Use technology to streamline tasks and improve efficiency.

- Take advantage of outsourcing opportunities.

- Seek support from colleagues and mentors.

8. What are your thoughts on alternative dispute resolution methods, such as mediation and arbitration, in insurance litigation?

- Can be effective in resolving disputes quickly and cost-effectively.

- May not be appropriate in all cases, such as those involving complex legal issues or high stakes.

- Important to weigh the pros and cons carefully before agreeing to alternative dispute resolution.

9. How do you deal with opposing counsel who are difficult to work with?

- Maintain a professional and respectful demeanor.

- Focus on the issues and avoid personal attacks.

- Communicate clearly and concisely.

- Be willing to compromise when appropriate.

- Seek assistance from the court or mediation if necessary.

10. What are your salary expectations for this position?

- Research industry benchmarks and consider your experience and qualifications.

- Be prepared to negotiate and justify your request.

- Consider the total compensation package, including benefits and perks.

- Be confident and professional in your response.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Insurance Attorney.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Insurance Attorney‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Insurance Attorneys specialize in the intricate legal landscape of insurance law, representing clients in a range of insurance-related matters. Their responsibilities encompass:

1. Case Evaluation and Investigation

Thoroughly analyzing insurance policies, reviewing claim documentation, and conducting investigations to determine coverage, liability, and potential defenses.

- Assessing policy language and coverage disputes

- Investigating claims, interviewing witnesses, and gathering evidence

2. Litigation and Dispute Resolution

Representing clients in various legal proceedings, including trials, mediations, and arbitrations, to resolve insurance disputes.

- Negotiating settlements with insurance companies and opposing parties

- Preparing and arguing cases before courts and tribunals

3. Legal Advice and Counseling

Providing legal counsel to clients on insurance-related issues, reviewing policies, and advising on risk management strategies.

- Analyzing insurance contracts and providing coverage opinions

- Advising clients on compliance and regulatory matters

4. Regulatory Compliance

Staying abreast of insurance regulations and industry best practices to ensure compliance and ethical conduct.

- Monitoring changes in insurance laws and regulations

- Ensuring compliance with ethical guidelines and professional standards

Interview Tips

To ace an interview for an Insurance Attorney position, candidates should:

1. Research the Firm and Industry

Thoroughly research the law firm, its clients, and the insurance industry to demonstrate a genuine interest and understanding of the field.

- Review the firm’s website and recent casework

- Stay informed about current trends and legal developments in insurance law

2. Highlight Relevant Experience and Skills

Emphasize experience in insurance law, litigation, and dispute resolution, showcasing specific examples of successful outcomes.

- Quantify accomplishments, such as the number of cases handled or settlements negotiated

- Highlight analytical, research, and writing abilities essential for insurance attorneys

3. Demonstrate Communication and Interpersonal Skills

Insurance Attorneys must possess excellent communication and interpersonal skills to interact effectively with clients, opposing counsel, and insurance professionals.

- Share examples of how they built rapport with clients and negotiated favorable outcomes

- Convey a professional and confident demeanor throughout the interview

4. Prepare Questions for the Interviewers

Asking thoughtful questions demonstrates interest and engagement in the position. Questions should focus on the firm’s culture, growth opportunities, and the specific role.

- Inquire about the firm’s mentorship and training programs

- Ask about the types of cases the firm typically handles

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Insurance Attorney, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Insurance Attorney positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.