Are you gearing up for a career in Tax Attorney? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Tax Attorney and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

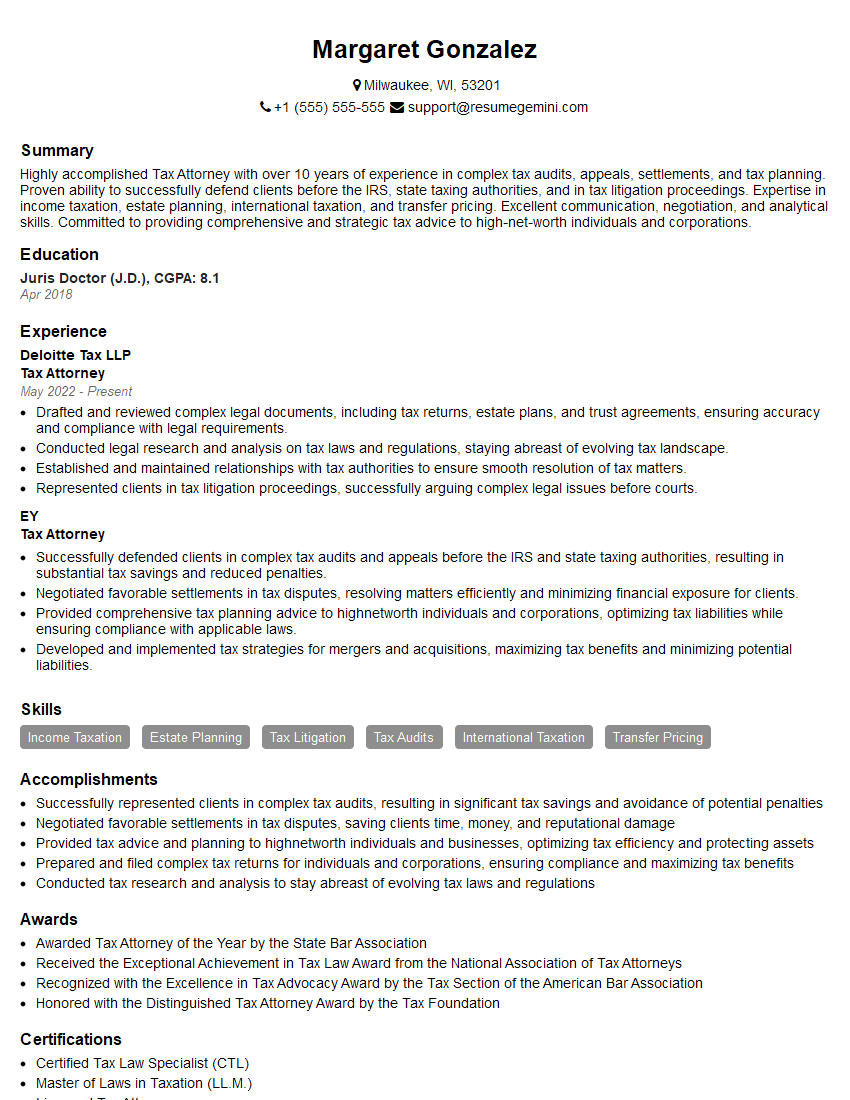

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Tax Attorney

1. What are the key provisions of the Tax Cuts and Jobs Act (TCJA) that impact individual taxpayers?

The TCJA made significant changes to the individual income tax code, including:

- Lowering the individual income tax rates.

- Increasing the standard deduction and child tax credit.

- Eliminating the personal exemption.

- Capping the state and local tax deduction.

- Limiting the mortgage interest deduction.

2. How has the TCJA impacted the taxation of pass-through entities?

- The TCJA created a new 20% deduction for qualified business income (QBI) from pass-through entities.

- The QBI deduction is phased out for taxpayers with high incomes.

- The TCJA also made changes to the rules for the net investment income tax (NIIT).

3. What are the different types of tax audits conducted by the IRS?

The IRS conducts different types of tax audits, including:

- Correspondence audits: These are conducted through the mail and typically involve relatively minor issues.

- Field audits: These are conducted at the taxpayer’s place of business or residence and typically involve more complex issues.

- Office audits: These are conducted at an IRS office and typically involve even more complex issues.

4. What are the key steps involved in the tax audit process?

- The IRS will send the taxpayer a notice of audit.

- The taxpayer will have the opportunity to provide the IRS with documentation and evidence.

- The IRS will review the taxpayer’s documentation and evidence.

- The IRS will issue a report of its findings.

- The taxpayer will have the opportunity to appeal the IRS’s findings.

5. What are the different types of tax relief available to taxpayers?

There are a variety of tax relief options available to taxpayers, including:

- Extensions:

- Installment agreements:

- Offers in compromise:

- Innocent spouse relief:

- Penalty abatement:

6. What are the different types of tax-exempt organizations?

- Section 501(c)(3) organizations: These are charitable organizations that are exempt from federal income tax.

- Section 501(c)(4) organizations: These are social welfare organizations that are exempt from federal income tax.

- Section 501(c)(6) organizations: These are business leagues that are exempt from federal income tax.

7. What are the key provisions of the Foreign Account Tax Compliance Act (FATCA)?

- FATCA requires foreign financial institutions to report information about U.S. citizens and residents who have accounts with them.

- FATCA also imposes a withholding tax on certain payments made to U.S. citizens and residents who do not comply with FATCA reporting requirements.

8. What are the different types of international tax treaties?

There are different types of international tax treaties, including:

- Income tax treaties:

- Estate tax treaties:

- Gift tax treaties:

9. What are the key provisions of the Taxpayer First Act (TFA)?

- The TFA made a number of changes to the tax code, including:

- Increasing the threshold for the estate tax.

- Simplifying the rules for the child tax credit.

- Expanding the use of electronic filing.

10. What are the different types of tax fraud?

- Filing a false tax return.

- Failing to report all income.

- Claiming false deductions or credits.

- Using a fake Social Security number.

- Hiding assets from the IRS.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Tax Attorney.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Tax Attorney‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Tax Attorney is an indispensable asset to any organization, providing expert guidance on tax laws and regulations. Their responsibilities encompass various aspects of tax advising, including:1. Tax Planning and Compliance

– Advising clients on tax optimization strategies to minimize tax liability – Preparing and filing complex tax returns for individuals and businesses – Staying abreast of constantly evolving tax codes and regulations – Assisting with tax audits and representing clients before tax authorities

2. Litigation and Dispute Resolution

– Representing clients in tax litigation cases before courts and administrative tribunals – Developing legal strategies to defend clients against tax disputes – Negotiating settlements and acuerdos with tax authorities – Advising on tax implications of business transactions

3. Tax Research and Analysis

– Conducting in-depth research on complex tax issues and providing legal opinions – Analyzing tax laws and regulations to identify potential loopholes and opportunities – Preparing legal briefs and memoranda on tax-related matters – Advising on tax implications of proposed legislation and regulations

4. Business Transactions and Advisory

– Providing tax due diligence services during mergers, acquisitions, and other business transactions – Structuring transactions to minimize tax liability and maximize tax benefits – Advising on the tax implications of investments and business operations – Assisting with estate and trust planning

Interview Preparation Tips

Aceing a Tax Attorney interview requires meticulous preparation and a comprehensive understanding of the role. Here are some invaluable tips to enhance your chances:1. Research the Firm and the Role

– Thoroughly research the law firm, its practice areas, and its clientele – Study the specific responsibilities and requirements of the Tax Attorney position – Familiarize yourself with the firm’s culture and values

2. Highlight Your Technical Expertise

– Showcase your in-depth knowledge of tax laws, regulations, and legal precedents – Provide specific examples of your experience in tax planning, compliance, litigation, and research – Quantify your accomplishments and demonstrate your impact on client outcomes

3. Demonstrate Your Analytical Skills

– Emphasize your ability to analyze complex tax issues and develop creative solutions – Highlight your experience in interpreting tax codes, researching legal precedents, and preparing legal briefs – Showcase your ability to think critically and provide well-reasoned legal advice

4. Communicate Effectively

– Practice articulating your thoughts clearly and concisely – Prepare for questions that require you to explain complex tax concepts in a non-technical manner – Demonstrate your ability to communicate effectively with clients, colleagues, and tax authorities

5. Be Enthusiastic and Confident

– Convey your passion for tax law and your desire to contribute to the firm’s success – Express your confidence in your abilities and your eagerness to take on challenging assignments – Maintain a positive and professional demeanor throughout the interview

By following these preparation tips, you will significantly enhance your chances of impressing the interviewers and securing your dream job as a Tax Attorney.Next Step:

Now that you’re armed with the knowledge of Tax Attorney interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Tax Attorney positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini