Feeling lost in a sea of interview questions? Landed that dream interview for Bankruptcy Assistant but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Bankruptcy Assistant interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

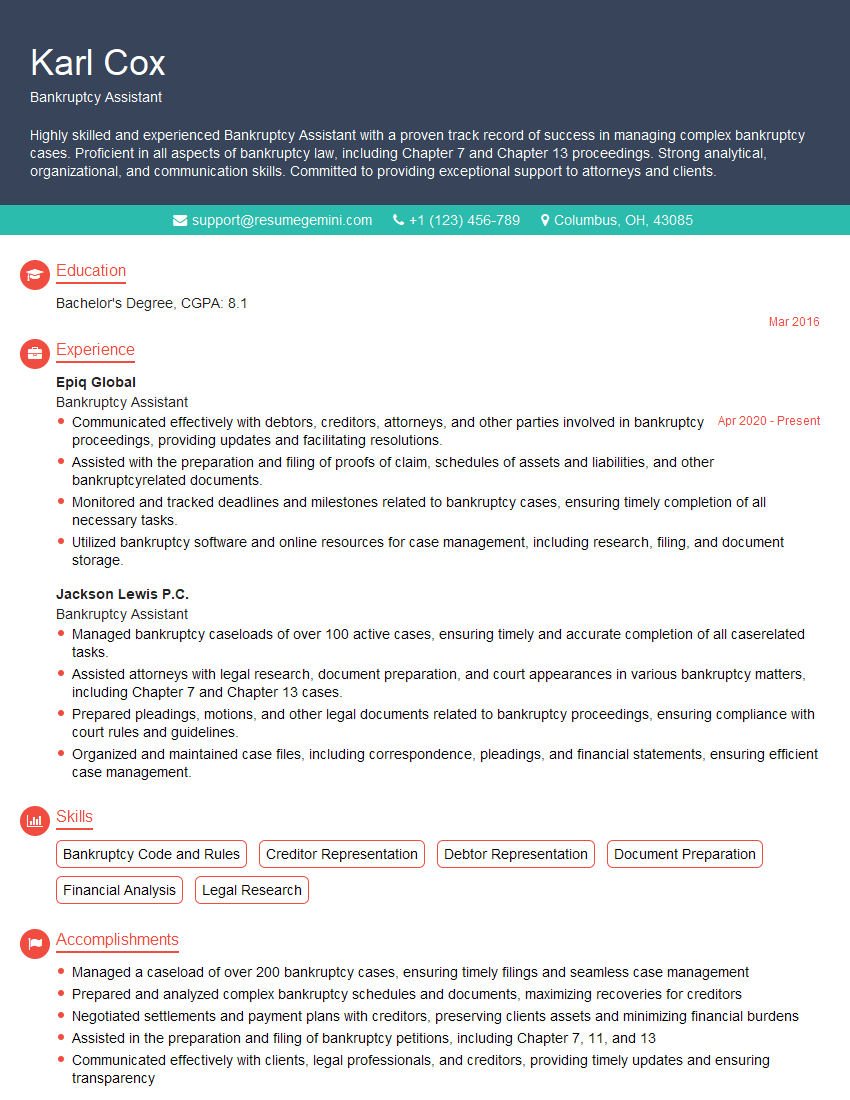

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Bankruptcy Assistant

1. How do you determine if a debtor is eligible to file for bankruptcy?

To determine eligibility for bankruptcy, I would assess various factors, including:

- Income: I would examine the debtor’s income sources and amounts to determine if they meet the income eligibility criteria.

- Assets: I would review the debtor’s assets to ensure they do not exceed the allowable exemption limits.

- Debts: I would analyze the debtor’s debts to determine if they are primarily consumer debts and if they meet the minimum debt amount.

- Prior bankruptcies: I would check the debtor’s bankruptcy history to verify if they have previously filed for bankruptcy within the eligibility period.

2. What are the different types of bankruptcy chapters and their key differences?

Chapter 7

- Liquidation of non-exempt assets to pay creditors.

- Eligibility based on income and asset limits.

- Complete discharge of most debts.

Chapter 13

- Reorganization of debts into a repayment plan.

- No income or asset limits.

- Partial or complete discharge of debts after successful plan completion.

3. How do you assist debtors in preparing and filing their bankruptcy petition?

I would guide debtors through the following steps:

- Assessment: Gather information and assess financial situation.

- Petition preparation: Help debtors complete and assemble required documentation.

- Filing: Electronically or manually file the petition with the bankruptcy court.

- Post-filing assistance: Provide ongoing support and guidance throughout the bankruptcy process.

4. What are the common challenges faced by debtors during the bankruptcy process, and how would you address them?

Potential challenges and my approach:

- Emotional distress: Provide emotional support and connect debtors with resources for counseling.

- Legal issues: Consult with the bankruptcy attorney and assist with legal matters as needed.

- Financial management: Develop strategies for managing finances during and after bankruptcy, such as budgeting and debt consolidation.

5. How do you handle objections to discharge and other contested matters in bankruptcy cases?

I would approach contested matters as follows:

- Review objection: Examine the objections raised and gather evidence to support the debtor’s position.

- Negotiation: Attempt to resolve the matter amicably through negotiations with opposing counsel.

- Hearing preparation: Prepare the debtor for any hearings and present evidence to support their case.

6. What are the ethical considerations you adhere to in your role as a Bankruptcy Assistant?

Ethical principles I uphold:

- Confidentiality: Maintain the privacy of debtor information.

- Objectivity: Provide impartial assistance and avoid conflicts of interest.

- Competence: Continuously update my knowledge and skills to provide accurate guidance.

7. How do you stay updated on changes in bankruptcy laws and regulations?

To stay abreast of legal developments, I would employ the following strategies:

- Professional development: Attend conferences and workshops on bankruptcy law.

- Legal research: Utilize online legal databases and consult with bankruptcy attorneys for guidance.

- Industry publications: Subscribe to industry journals and newsletters.

8. What tools or software do you commonly use in your role as a Bankruptcy Assistant?

I am proficient in using the following tools:

- Bankruptcy software: Manage case information and prepare bankruptcy petitions.

- Case management systems: Track case progress and client communications.

- Legal research databases: Access legal precedents and stay informed about changes in bankruptcy law.

9. How do you prioritize and manage multiple bankruptcy cases simultaneously?

To effectively manage multiple cases, I would:

- Create a case schedule: Establish deadlines and milestones for each case.

- Delegate tasks: Assign administrative tasks to support staff when possible.

- Utilize technology: Leverage case management software to streamline workflows and track progress.

10. What strategies do you employ to ensure accurate and timely preparation of bankruptcy petitions?

To ensure accuracy and timeliness, I would:

- Thorough review: Carefully examine all supporting documentation before preparing petitions.

- Attention to detail: Pay meticulous attention to completeness and adherence to legal requirements.

- Quality control: Implement a review process to verify accuracy before final submission.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Bankruptcy Assistant.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Bankruptcy Assistant‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

The Bankruptcy Assistant assists attorneys with all aspects of bankruptcy cases, including preparing petitions, schedules, and other documents, as well as communicating with clients and creditors.

1. Prepare bankruptcy petitions and schedules

Prepares and files bankruptcy petitions and schedules for individuals and businesses.

- Gather and review financial documents, including income statements, balance sheets, and tax returns.

- Interview clients to obtain necessary information for the petition and schedules.

2. Communicate with clients and creditors

Communicates with clients and creditors to obtain information and explain the bankruptcy process.

- Answer client questions about the bankruptcy process and their rights.

- Negotiate with creditors on behalf of clients.

3. Assist with bankruptcy hearings

Assists attorneys with bankruptcy hearings, including preparing witnesses and documents.

- Attend bankruptcy hearings and assist attorneys with the presentation of evidence.

- Prepare witnesses for testimony.

4. Maintain bankruptcy case files

Maintains bankruptcy case files and ensures that all documents are filed timely.

- Organize and maintain bankruptcy case files.

- File documents with the bankruptcy court and creditors.

Interview Tips

Preparing for a bankruptcy assistant interview can be daunting, but with the right preparation, you can increase your chances of success. Here are some tips to help you ace the interview:

1. Research the firm and the position

Before the interview, take some time to research the bankruptcy firm and the specific position you are applying for. This will help you understand the firm’s culture and the responsibilities of the role.

- Visit the firm’s website to learn about their practice areas and attorneys.

- Read articles and blog posts written by the firm’s attorneys.

2. Practice your answers to common interview questions

There are a number of common interview questions that you are likely to be asked, such as “Why are you interested in this position?” and “What are your strengths and weaknesses?”. Practice your answers to these questions ahead of time so that you can deliver them confidently and concisely.

- Use the STAR method to answer interview questions.

- Prepare specific examples of your skills and experience that are relevant to the position.

3. Dress professionally and arrive on time

First impressions matter, so it is important to dress professionally for your interview. You should also arrive on time to show that you are respectful of the interviewer’s time.

- Choose a conservative outfit that is appropriate for a business setting.

- Arrive at the interview location at least 15 minutes early.

4. Be prepared to ask questions

Asking questions at the end of the interview shows that you are engaged and interested in the position. It also gives you an opportunity to learn more about the firm and the role.

- Prepare a list of questions to ask the interviewer.

- Ask questions about the firm’s culture, the position, and the training provided to new employees.

5. Follow up after the interview

After the interview, send a thank-you note to the interviewer. This is a simple way to show your appreciation for their time and to reiterate your interest in the position.

- Send a thank-you note within 24 hours of the interview.

- Reiterate your interest in the position and thank the interviewer for their time.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Bankruptcy Assistant interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!