Are you gearing up for a career in Title Examiner? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Title Examiner and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

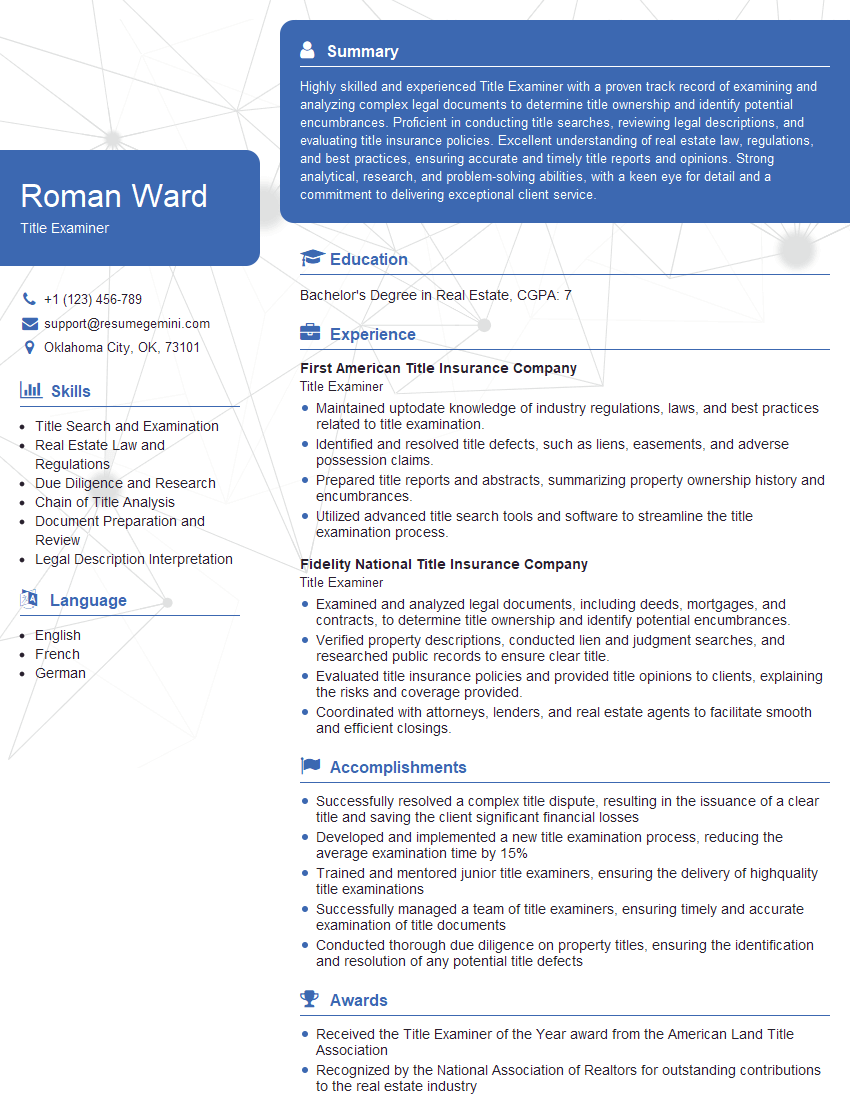

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Title Examiner

1. Explain the process of title examination?

Title examination is a thorough process of reviewing all relevant documents and records to determine the ownership of a property. The process involves the following steps:

- Gathering Documents: Collect all necessary documents such as deeds, mortgages, title insurance policies, and tax records.

- Examining Ownership: Analyze the chain of title to ensure that the current owner has a legal right to possess the property.

- Identifying Encumbrances: Determine if there are any liens, easements, or other claims that may affect the title to the property.

- Assessing Defects: Evaluate any potential issues or flaws in the title that could impact the marketability or value of the property.

- Issuing Title Report: Prepare a comprehensive report that outlines the findings of the examination and identifies any risks or concerns.

2. What are the common title defects?

Types of Title Defects:

- Liens: Legal claims against the property, such as unpaid taxes or mortgages.

- Easements: Rights granted to others to use or access the property.

- Encroachments: Physical structures that extend onto the property from neighboring properties.

- Boundary Disputes: Unresolved conflicts over the property’s boundaries.

- Forged or Invalid Documents: Fraudulent or improperly executed deeds or other title documents.

Consequences of Title Defects:

- Impaired Marketability: Defects can make the property less attractive to potential buyers.

- Reduced Property Value: Defects can lower the value of the property.

- Legal Disputes: Defects can lead to costly and time-consuming legal battles.

3. How do you prioritize title defects?

Defects are prioritized based on their potential impact on the property:

- Severity: Evaluate the seriousness of the defect and its potential consequences.

- Priority: Consider the order in which the defects appear in the chain of title.

- Legal Standing: Determine the validity and enforceability of the defect.

- Marketability: Assess how the defect affects the ability to sell or finance the property.

4. What are the different types of title insurance policies?

- Owner’s Policy: Protects the homeowner from financial loss due to covered title defects.

- Lender’s Policy: Protects the lender from financial loss if the title to the property is defective.

- Extended Coverage Policy: Provides additional protection beyond the standard owner’s policy, covering issues such as forgery or undisclosed easements.

5. How do you determine the amount of title insurance coverage?

The amount of coverage is determined by:

- Purchase Price: The value of the property when purchased.

- Loan Amount: The amount borrowed from a lender.

- Risks: The potential title risks associated with the property.

6. What are the key elements of a real estate abstract?

- Ownership History: Summary of all previous owners and transactions involving the property.

- Legal Descriptions: Precise descriptions of the property’s boundaries and location.

- Encumbrances: List of any liens, easements, or other claims against the property.

- Liens and Judgments: Details of any recorded liens or legal judgments against the property.

- Title Insurance: Information about any title insurance policies issued for the property.

7. How do you handle title discrepancies?

When title discrepancies are identified, the following steps are taken:

- Research: Conduct in-depth research to gather additional information and evidence.

- Communication: Involve all relevant parties, such as the seller, buyer, and lender, to discuss the issue.

- Resolution: Negotiate and implement solutions to resolve the discrepancies, such as obtaining corrective documents or removing encumbrances.

8. Describe the importance of ethics in title examination.

- Protecting Clients: Ensures that clients receive accurate and unbiased information about the title to their property.

- Maintaining Credibility: Upholds the reputation of the title industry and inspires confidence in title reports.

- Preventing Fraud: Reduces the risk of fraudulent or unethical practices that could harm clients.

- Adhering to Legal Obligations: Complies with all applicable laws and regulations governing title examination.

9. What technology tools do you use to assist with title examination?

- Title Search Software: Automated systems that search public records for title-related documents.

- Property Data Platforms: Databases that provide information on property ownership, liens, and taxes.

- GIS Mapping Tools: Help visualize property boundaries and identify potential encroachments.

- Document Management Systems: Organize and store title-related documents digitally.

10. How do you stay up-to-date on changes in real estate laws and regulations?

- Continuing Education: Attend seminars, workshops, and online courses.

- Professional Organizations: Join industry associations that provide updates and resources.

- Legal Research: Regularly review legal statutes and case law changes.

- Industry Publications: Subscribe to trade magazines and publications.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Title Examiner.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Title Examiner‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Title examiners are primarily responsible for conducting thorough examinations of property titles to ascertain their validity and marketability. Their primary objective is to ensure that the property is clear of any encumbrances or claims that may affect its ownership.

1. Title Examination

The core responsibility of a title examiner is to examine and interpret legal documents related to a property to determine its ownership history.

- Reviewing deeds, mortgages, liens, and other legal instruments

- Verifying the accuracy and completeness of property descriptions

- Identifying any potential defects, encumbrances, or disputes that may affect the title

2. Title Reports and Risk Assessment

Based on their examination, title examiners prepare detailed reports that outline their findings.

- Issuing clear or clouding title reports that assess the risk associated with the property

- Providing recommendations to clients on how to mitigate any identified risks

3. Legal Knowledge and Research

Title examiners must possess a deep understanding of real estate law and legal principles.

- Staying abreast of changes in laws and regulations related to property ownership

- Conducting legal research to resolve complex title issues or disputes

4. Communication and Customer Service

Title examiners work closely with clients, attorneys, and other professionals throughout the title examination process.

- Explaining title reports and answering questions in a clear and concise manner

- Building and maintaining strong relationships with clients and industry partners

Interview Tips

To help you ace your interview for a title examiner position, here are some valuable tips:

1. Research the Company and Industry

Familiarize yourself with the company you’re applying to and the real estate industry in your area. Understand their business model, key services, and reputation.

2. Practice Your Technical Skills

Review fundamental principles of real estate law, title examination procedures, and legal research skills. Practice interpreting title documents and drafting title reports.

3. Highlight Your Attention to Detail

Emphasize your meticulous nature and ability to focus on intricate details. Title examination requires extreme precision and the ability to identify potential issues that others may overlook.

4. Demonstrate Your Legal Knowledge

Showcase your understanding of relevant laws and regulations. Discuss your experience in conducting legal research and resolving complex title issues.

5. Prepare Examples of Your Work

If possible, prepare samples of your title reports or other work products that demonstrate your technical abilities and attention to detail.

6. Be Enthuastic and Confident

Convey your enthusiasm for the industry and your confidence in your abilities. Employers seek individuals who are passionate about title examination and committed to providing high-quality services.

7. Ask Thoughtful Questions

Prepare thoughtful questions about the company, the role, and the industry. Asking informed questions demonstrates your interest and eagerness to learn.

8. Dress Professionally and Be Punctual

First impressions matter. Dress professionally and arrive on time for your interview. Your appearance and demeanor convey a sense of respect and professionalism.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Title Examiner interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!