Are you gearing up for a career in Title Insurance Examiner? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Title Insurance Examiner and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

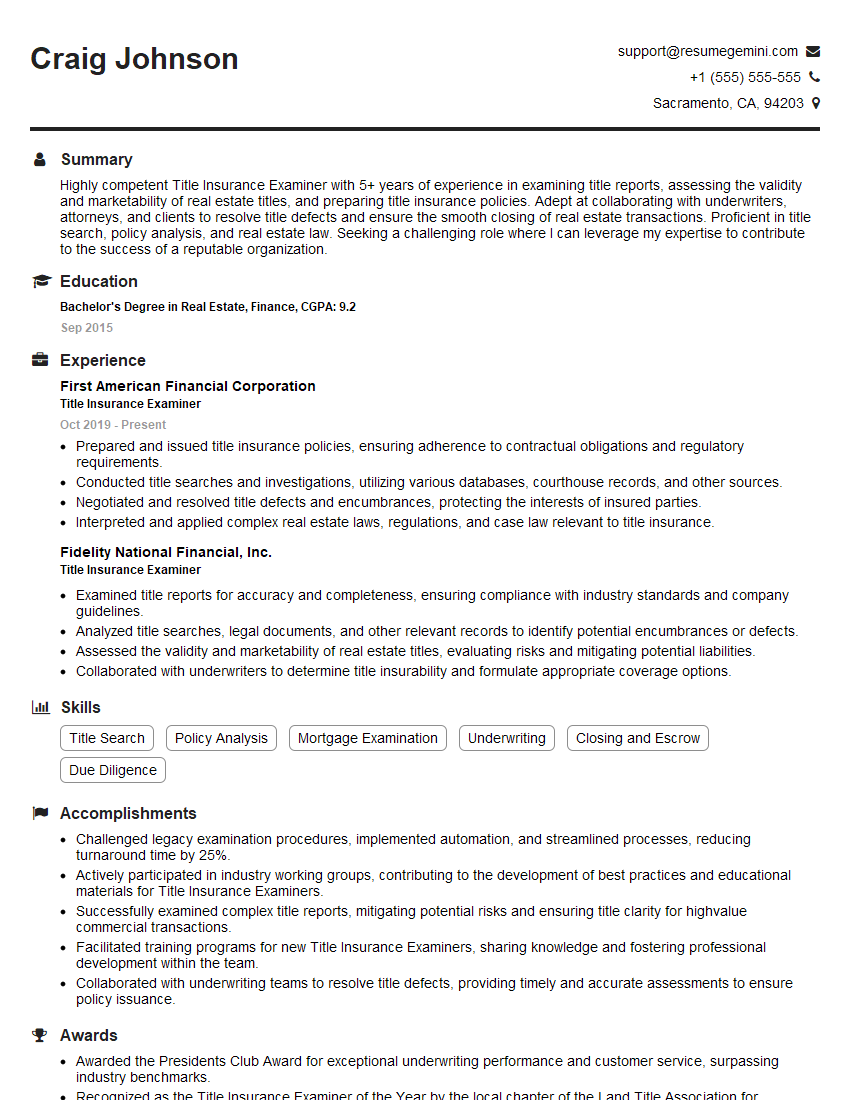

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Title Insurance Examiner

1. What are the key elements of a title search?

- Reviewing the property deed to verify ownership and any liens or encumbrances.

- Searching public records for judgments, bankruptcies, and other legal actions that may affect the title.

- Examining tax records for unpaid taxes or assessments.

- Checking for easements, restrictions, or other limitations on the property’s use.

2. Describe the process for identifying and resolving title defects.

- Researching: Identifying potential title defects by conducting a thorough title search.

- Notification: Informing the lender and borrower of any defects discovered and providing recommendations to resolve them.

- Negotiation: Engaging in negotiations with relevant parties, such as lienholders or easement holders, to resolve defects and clear the title.

- Resolution: Ensuring that all title defects are resolved, such as obtaining releases, subordinations, or judgments.

3. Explain the different types of title insurance policies and their coverage.

- Owner’s Policy: Protects the property owner against financial loss due to defects in the title.

- Lender’s Policy: Protects the lender’s interest in the property and ensures that the loan is secured.

- ALTA Policies: Comprehensive title insurance policies that meet the American Land Title Association’s (ALTA) standards and provide a range of additional coverage options.

4. Discuss the factors that can affect the insurability of a title.

- Defects in the chain of title: Missing or forged documents, undisclosed liens, or boundary disputes.

- Forgeries or fraud: Intentional misrepresentations or illegal actions that affect the title.

- Unknown heirs or claims: Unidentified or missing heirs who may have claims to the property.

- Environmental issues: Liens or restrictions due to environmental concerns, such as contamination or hazardous materials.

5. Describe the role of title insurance in real estate transactions.

- Protects against risks: Title insurance provides financial protection for both homeowners and lenders against potential losses due to title defects.

- Facilitates transactions: By ensuring clear and insurable titles, title insurance allows real estate transactions to proceed smoothly and reduces the risk of disputes.

- Provides peace of mind: Title insurance gives buyers and lenders the confidence to invest in properties, knowing that their interests are protected.

6. Explain the process of reviewing and underwriting title insurance applications.

- Reviewing the application: Examining the property’s legal description, ownership history, and any known defects.

- Conducting a title search: Conducting a comprehensive search of public records to identify potential title issues.

- Assessing the risk: Evaluating the identified title risks and determining the appropriate level of coverage.

- Issuing the policy: Drafting and issuing a title insurance policy that meets the underwriting guidelines and protects the insured party’s interests.

7. Discuss the importance of staying up-to-date on changes in real estate laws and regulations.

- Ensure compliance: Staying informed ensures compliance with the latest laws and regulations, which can change frequently.

- Protect clients: Understanding legal changes allows Title Insurance Examiners to provide accurate and up-to-date advice to clients.

- Avoid liability: Being aware of legal changes helps Examiners identify and mitigate potential risks that could lead to liability issues.

8. Describe the ethical responsibilities of a Title Insurance Examiner.

- Confidentiality: Maintaining the privacy of client information and documents.

- Impartiality: Conducting objective and unbiased title searches and evaluations.

- Accuracy: Providing accurate and reliable information to clients and stakeholders.

- Communication: Clearly and effectively communicating title risks and coverage options to clients.

9. Explain the role of technology in title insurance.

- Automated searches: Technology streamlines title searches and reduces the time required to identify potential issues.

- Electronic document storage: Digitalization allows for secure storage and easy access to title documents.

- Online communication: Technology facilitates communication between Examiners, clients, and other stakeholders.

10. Describe the career advancement opportunities for Title Insurance Examiners.

- Senior Examiner: Supervising other Examiners and handling complex or high-value title searches.

- Underwriting Manager: Assessing risks, determining coverage, and issuing title insurance policies.

- General Counsel: Providing legal counsel and guidance on title insurance matters.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Title Insurance Examiner.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Title Insurance Examiner‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Title Insurance Examiners play a critical role in the real estate industry, ensuring the accuracy and validity of property titles. Their responsibilities encompass:

1. Title Examination

Thoroughly examining title documents, including deeds, mortgages, and liens, to determine the legal ownership and any encumbrances on a property.

2. Title Search

Conducting comprehensive searches of public records, such as deeds, tax assessments, and court documents, to uncover any potential liens, judgments, or other claims against the property.

3. Title Report Preparation

Creating detailed title reports that summarize the findings of the examination and search, outlining any risks or issues that may affect the property’s ownership.

4. Risk Assessment

Evaluating the risks associated with issuing title insurance based on the findings of the examination and search, and recommending any necessary exceptions or endorsements.

5. Customer Communication

Effectively communicating with clients, lenders, and other parties involved in the real estate transaction to explain the title report and any potential risks or issues.

Interview Tips

To ace the interview for a Title Insurance Examiner position, consider the following tips:

1. Research the Company and Industry

Familiarize yourself with the company’s history, services, and industry reputation. Research current trends in title insurance and any recent changes in regulations or best practices.

2. Practice Your Communication Skills

Title Insurance Examiners need to be able to convey complex legal information clearly and effectively. Practice your communication skills by explaining legal concepts in a concise and understandable manner.

3. Showcase Your Problem-Solving Abilities

Be prepared to discuss your approach to problem-solving, particularly in the context of title examination. Highlight your ability to analyze complex data, identify potential risks, and develop solutions.

4. Study Real Estate Law and Title Insurance Principles

Review key concepts in real estate law and title insurance principles. This knowledge will demonstrate your understanding of the industry and your ability to apply it in practice.

5. Prepare for Common Interview Questions

Research common interview questions for Title Insurance Examiners. Prepare thoughtful and concise answers that highlight your skills, experience, and enthusiasm for the role.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Title Insurance Examiner interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!