Are you gearing up for an interview for a Insurance Instructor position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Insurance Instructor and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

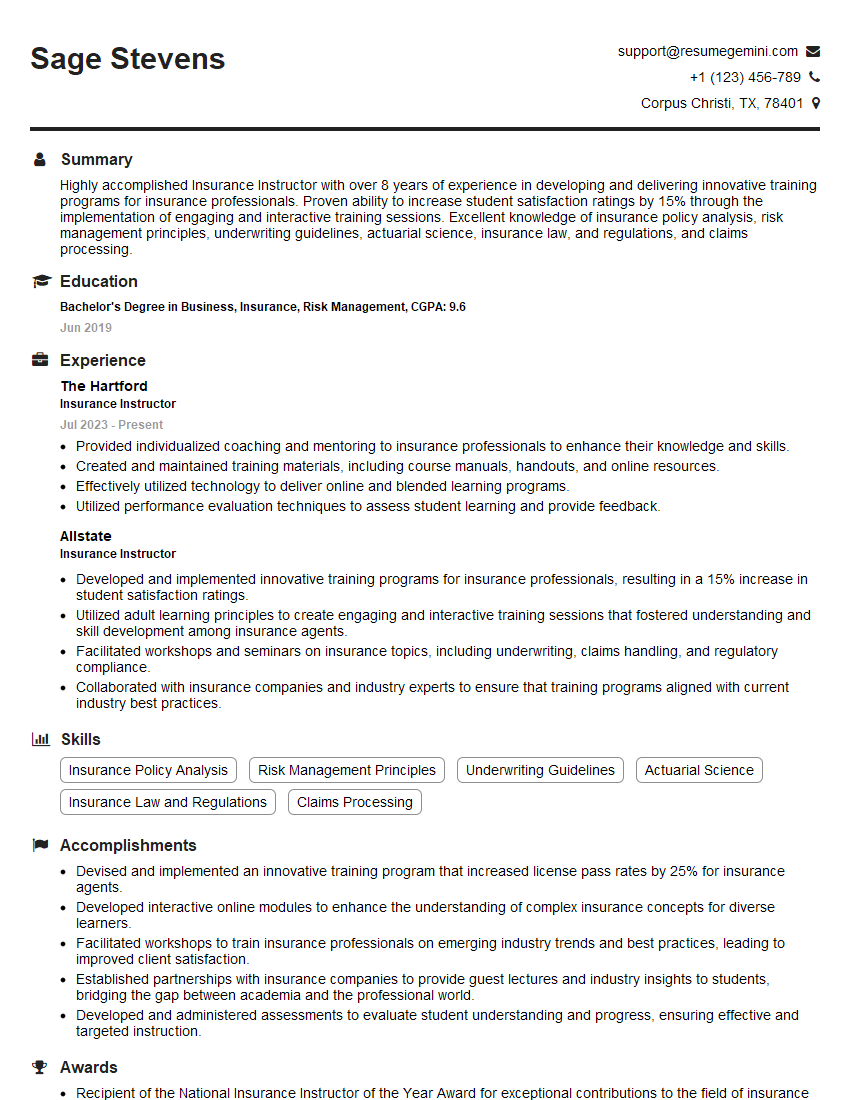

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Insurance Instructor

1. What are the key principles of insurance and how do you convey them to students?

- Explain the concepts of risk, loss, uncertainty, and indemnity.

- Discuss the different types of insurance coverage and their purposes.

- Describe the role of insurance in society and the economy.

- Use real-world examples and case studies to illustrate the importance of insurance.

- Encourage students to ask questions and participate in discussions.

2. How do you assess students’ understanding of insurance concepts?

Assessment Methods

- Written assignments, such as essays and reports

- Oral presentations

- Quizzes and exams

- Class participation and discussions

Feedback and Evaluation

- Provide timely and constructive feedback to students.

- Evaluate student performance based on their understanding of the material, analytical skills, and communication abilities.

- Use a variety of assessment methods to ensure a comprehensive evaluation.

3. How do you stay up-to-date on the latest developments in the insurance industry?

- Attend industry conferences and webinars.

- Read trade publications and journals.

- Network with professionals in the insurance field.

- Take continuing education courses.

- Stay informed about regulatory changes and new laws.

4. What are your teaching philosophies and how do you apply them to insurance instruction?

- Student-centered learning: Focus on student engagement and active learning.

- Experiential learning: Incorporate case studies, simulations, and real-world projects.

- Critical thinking and problem-solving: Encourage students to analyze insurance issues and develop solutions.

- Collaboration and teamwork: Foster student interactions and teamwork in group projects.

- Diversity and inclusion: Create an inclusive learning environment that values different perspectives.

5. Describe a challenging teaching experience and how you overcame it.

- Describe the specific challenge, such as dealing with a difficult student or teaching a complex topic.

- Explain the steps you took to address the challenge, including research, collaboration with colleagues, and adapting your teaching methods.

- Discuss the outcome of your efforts and what you learned from the experience.

6. How do you motivate students who may not be initially interested in insurance?

- Connect insurance to real-world experiences: Share stories and examples of how insurance impacts individuals, businesses, and society.

- Emphasize the importance of insurance: Discuss the financial and legal consequences of not having adequate insurance.

- Make the learning process interactive and engaging: Use games, simulations, and discussions to make insurance concepts more accessible.

- Show students how insurance can be a rewarding career: Invite guest speakers from the insurance industry to share their experiences and expertise.

7. How do you handle students with different learning styles?

- Identify different learning styles: Observe students’ behaviors and preferences to identify their learning styles.

- Adapt teaching methods: Use a variety of teaching methods, such as lectures, discussions, case studies, and simulations, to accommodate different styles.

- Provide differentiated instruction: Offer assignments and activities that cater to specific learning styles.

- Create a supportive learning environment: Encourage students to ask questions, collaborate with each other, and seek support when needed.

8. Describe your experience in developing and delivering online insurance courses.

- Explain your process for designing and developing online courses, including content creation, platform selection, and assessment strategies.

- Discuss the challenges and best practices of online learning, such as student engagement, accessibility, and technical support.

- Provide examples of successful online courses you have developed and delivered.

9. How do you promote ethical behavior and professionalism among students?

- Discuss ethical principles: Teach students about the ethical responsibilities of insurance professionals, including confidentiality, integrity, and fairness.

- Incorporate case studies and scenarios: Use real-world examples to illustrate ethical dilemmas and encourage students to analyze and discuss them.

- Set clear expectations: Establish guidelines and expectations for student behavior, including academic integrity and professional conduct.

- Encourage open communication: Create a classroom atmosphere where students feel comfortable discussing ethical issues and seeking guidance.

10. How do you incorporate technology into your insurance instruction?

- Use online learning platforms: Utilize platforms like Blackboard or Canvas for course management, communication, and assessment.

- Incorporate simulation software: Use software that allows students to practice insurance calculations and decision-making in a virtual environment.

- Leverage industry-specific apps: Introduce students to mobile apps and websites that provide real-time insurance information and tools.

- Facilitate online discussions: Use online forums or discussion boards to encourage student collaboration and engagement.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Insurance Instructor.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Insurance Instructor‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Insurance Instructors are experts in insurance who teach a wide range of insurance products and concepts to students, agents, and other individuals. They are responsible for developing and delivering engaging and informative training programs, assessing learning, and providing guidance to learners.

1. Develop and Deliver Training Programs

Insurance Instructors develop comprehensive training programs that cover a range of insurance topics, including underwriting, risk management, claims handling, and regulatory compliance. They tailor their programs to meet the specific needs of their target audience, which may include students, new agents, or experienced professionals seeking continuing education.

- Conduct needs assessments to determine the learning objectives of the target audience

- Design and develop course materials, such as presentations, handouts, and online modules

2. Provide Instruction on Insurance Concepts

Insurance Instructors impart knowledge on various insurance concepts and principles to students and agents. They explain complex technical concepts in a clear and understandable manner, utilizing a variety of teaching methods, including lectures, case studies, and role-playing exercises.

- Teach core insurance principles, such as risk management, underwriting, and claims handling

- Explain the different types of insurance policies available, such as property, casualty, and life insurance

3. Assess Learning and Provide Feedback

Insurance Instructors evaluate student understanding and progress through various assessments. They provide timely feedback to learners to help them track their progress and improve their knowledge.

- Prepare and administer tests, quizzes, and assignments

- Provide constructive feedback on student performance

4. Maintain Up-to-Date Knowledge of Insurance Industry

Insurance Instructors stay abreast of the latest developments and trends in the insurance industry. They regularly attend industry events, read industry publications, and pursue continuing education to ensure they have the most current knowledge to share with their students.

- Attend industry conferences and workshops

- Read trade publications and research materials

5. Provide Guidance and Support to Learners

Insurance Instructors are a valuable resource for students and agents, providing guidance and support throughout their learning journey. They are available to answer questions, offer advice, and help learners overcome challenges.

- Provide individual guidance and mentorship to learners

- Answer questions and provide support via email, phone, or online platforms

Interview Tips

Preparing thoroughly for your Insurance Instructor interview can significantly increase your chances of success. Here are some tips to help you ace the interview:

1. Research the Company and Position

Take the time to learn about the company you are interviewing with and the specific Insurance Instructor position. This will help you understand the company’s culture, goals, and expectations for the role. You can find this information on the company’s website, social media pages, and industry publications.

- Visit the company website and read the company’s mission, vision, and values

- Review the job description and identify the key qualifications and responsibilities

2. Practice Answering Common Interview Questions

There are many common interview questions that you are likely to encounter. It is a good idea to practice answering these questions in advance so that you can deliver clear and confident responses. Some common interview questions for Insurance Instructors include:

- Tell me about your experience in teaching insurance concepts

- How do you develop and deliver engaging training programs?

- What are the key challenges in teaching insurance?

- How do you stay up-to-date on the latest developments in the insurance industry?

To prepare for these questions, you can use the STAR method. This involves describing a situation, task, action, and result from your previous experience that demonstrates your skills and abilities.

3. Prepare Questions to Ask the Interviewer

Asking thoughtful questions at the end of the interview shows that you are engaged and interested in the position. It also gives you an opportunity to learn more about the company and the role. Some questions you could ask include:

- What are the biggest challenges facing the insurance industry today?

- What is your vision for the future of insurance education?

- What are the opportunities for professional development within the company?

4. Dress Professionally and Arrive on Time

First impressions matter. Make sure you dress professionally and arrive on time for your interview. This shows that you are respectful of the interviewer’s time and that you are serious about the position.

5. Be Confident and Enthusiastic

Confidence and enthusiasm can go a long way in an interview. Believe in yourself and your abilities, and let your passion for insurance shine through. Interviewers are more likely to be impressed by candidates who are excited about the position and the opportunity to make a contribution.

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Insurance Instructor, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Insurance Instructor positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.