Feeling lost in a sea of interview questions? Landed that dream interview for Account Analyst but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Account Analyst interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

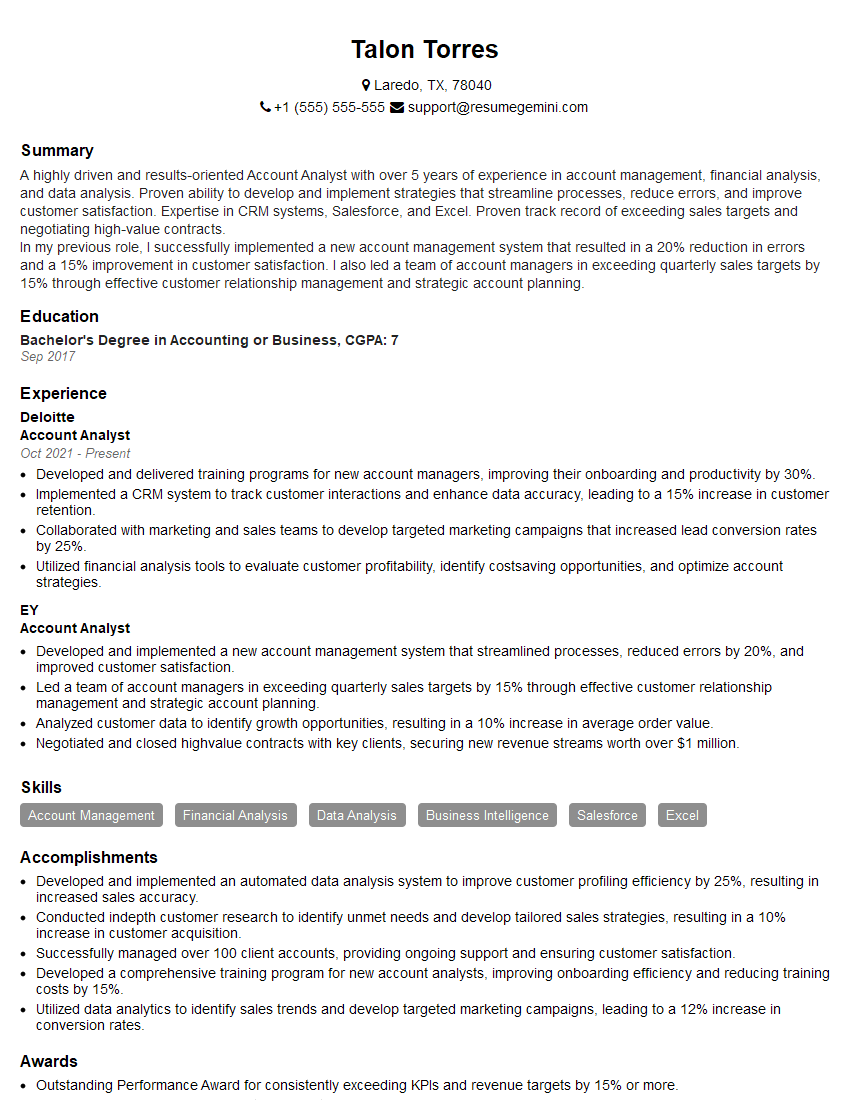

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Account Analyst

1. Describe your experience with financial analysis and reporting.

In my previous role as an Account Analyst, I was responsible for a comprehensive suite of financial analysis and reporting activities. I regularly conducted variance analysis, prepared monthly financial statements, and provided insights to management on key financial metrics. My strong analytical skills and attention to detail allowed me to identify trends, risks, and opportunities within the company’s financial performance.

2. How do you ensure the accuracy and integrity of financial data?

Data Validation and Reconciliation

- Implement automated data validation checks to minimize errors.

- Perform regular reconciliations between multiple data sources to ensure consistency.

- Review and analyze financial data for completeness and accuracy before finalizing reports.

Internal Controls

- Adhere to established accounting principles and internal control procedures.

- Implement segregation of duties to prevent fraud and errors.

- Maintain a system of documentation and audit trails for all financial transactions.

3. What are your key responsibilities as an Account Analyst?

- Prepare and analyze financial statements, including balance sheets, income statements, and cash flow statements.

- Conduct variance analysis to identify and explain deviations from budget.

- Prepare financial reports and presentations for management and external stakeholders.

- Monitor key financial metrics and provide insights on business performance.

- Collaborate with other departments, such as sales, operations, and treasury, to ensure financial data accuracy.

4. How do you stay current with accounting standards and regulations?

- Attend industry conferences and webinars to stay informed about new developments.

- Subscribe to accounting publications and newsletters to receive updates on relevant topics.

- Engage in continuing professional education courses to maintain my knowledge and skills.

- Utilize online resources and databases to research specific accounting issues.

5. Can you explain the concept of accrual accounting?

Accrual accounting is a method of recording transactions and events based on when they occur, regardless of when cash is received or paid. This approach ensures that revenues and expenses are recognized in the periods in which they are earned or incurred, providing a more accurate representation of financial performance. Accrual accounting principles include recognizing revenue when services are performed, regardless of when cash is received, and recording expenses when goods or services are received, regardless of when cash is paid.

6. How would you approach analyzing the financial performance of a company?

- Review financial statements to assess overall financial health and performance.

- Conduct vertical and horizontal analysis to identify trends and changes over time.

- Calculate and analyze key financial ratios to evaluate profitability, liquidity, and solvency.

- Identify areas of strength and weakness in the company’s financial performance.

- Provide recommendations for improvement based on the analysis.

7. What is the importance of internal controls in financial reporting?

Internal controls are crucial in financial reporting as they provide reasonable assurance regarding the reliability of financial information. They help in preventing fraud, errors, and misstatements in financial records and reports. Effective internal controls ensure that transactions are authorized, recorded, and processed appropriately, and that assets are safeguarded. They also promote transparency and accountability within the organization and enhance the credibility of financial reporting to stakeholders.

8. How do you handle discrepancies and errors in financial data?

- Identify the source and nature of the discrepancy or error.

- Investigate the underlying cause to prevent recurrence.

- Make necessary adjustments or corrections to the financial records.

- Document the process and communicate the findings to relevant stakeholders.

- Implement additional controls or procedures to minimize the risk of similar errors in the future.

9. Can you describe your experience with budgeting and forecasting?

In my previous role, I was involved in developing and monitoring the company’s budget. I collaborated with various departments to gather input and assumptions, and utilized historical data and industry trends to create realistic and achievable financial projections. I also conducted regular variance analysis to track actual results against the budget, and provided insights to management on areas for improvement and cost control.

10. What is your understanding of GAAP and IFRS?

GAAP (Generally Accepted Accounting Principles) and IFRS (International Financial Reporting Standards) are accounting frameworks that establish a set of rules and standards for preparing financial statements. GAAP is primarily used in the United States, while IFRS is widely adopted internationally. Both frameworks aim to provide transparency and consistency in financial reporting, but they have some differences in their specific requirements. As an Account Analyst, I am familiar with both GAAP and IFRS, and I am able to apply the appropriate standards based on the reporting requirements of the organization.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Account Analyst.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Account Analyst‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

An Account Analyst is responsible for managing and analyzing financial data to assess the financial health of an organization. The key job responsibilities include:

1. Financial Analysis

Analyze financial statements, including balance sheets, income statements, and cash flow statements, to assess the financial performance of the organization.

- Identify trends and patterns in financial data.

- Make recommendations for improving financial performance.

2. Budgeting and Forecasting

Develop and manage budgets to ensure that the organization meets its financial goals.

- Forecast future financial performance based on historical data and industry trends.

- Monitor actual financial performance against the budget and make necessary adjustments.

3. Reporting and Communication

Prepare and present financial reports to management and stakeholders to communicate the organization’s financial performance.

- Explain financial data and its implications to non-financial audiences.

- Develop and maintain financial models and tools to facilitate analysis.

4. Risk Management

Identify and assess financial risks that may impact the organization.

- Develop and implement strategies to mitigate financial risks.

- Monitor financial risks and report on their potential impact.

Interview Tips

To ace the interview for an Account Analyst position, the candidate should follow these tips:

1. Research the organization

Familiarize yourself with the organization’s financial performance, industry, and competitive landscape. This will help you understand the context of the job and ask informed questions during the interview.

- Review the organization’s website, annual reports, and financial statements.

- Research the industry and identify key trends and challenges.

2. Practice your technical skills

Be prepared to demonstrate your proficiency in financial analysis, budgeting, and forecasting. You may be asked to solve a case study or present a financial model during the interview.

- Review your knowledge of financial ratios, accounting principles, and forecasting methods.

- Practice presenting financial data and making recommendations.

3. Highlight your experience

Emphasize your experience in financial analysis, budgeting, and forecasting. Use specific examples to demonstrate your skills and the value you can bring to the organization.

- Describe your role in developing and implementing financial plans.

- Quantify the results of your financial analysis and recommendations.

4. Prepare for behavioral questions

Be prepared to answer questions about your work ethic, teamwork skills, and ability to work under pressure.

- Use the STAR method (Situation, Task, Action, Result) to answer behavioral questions.

- Practice your answers in advance.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Account Analyst interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!