Feeling lost in a sea of interview questions? Landed that dream interview for Account Information Clerk but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Account Information Clerk interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

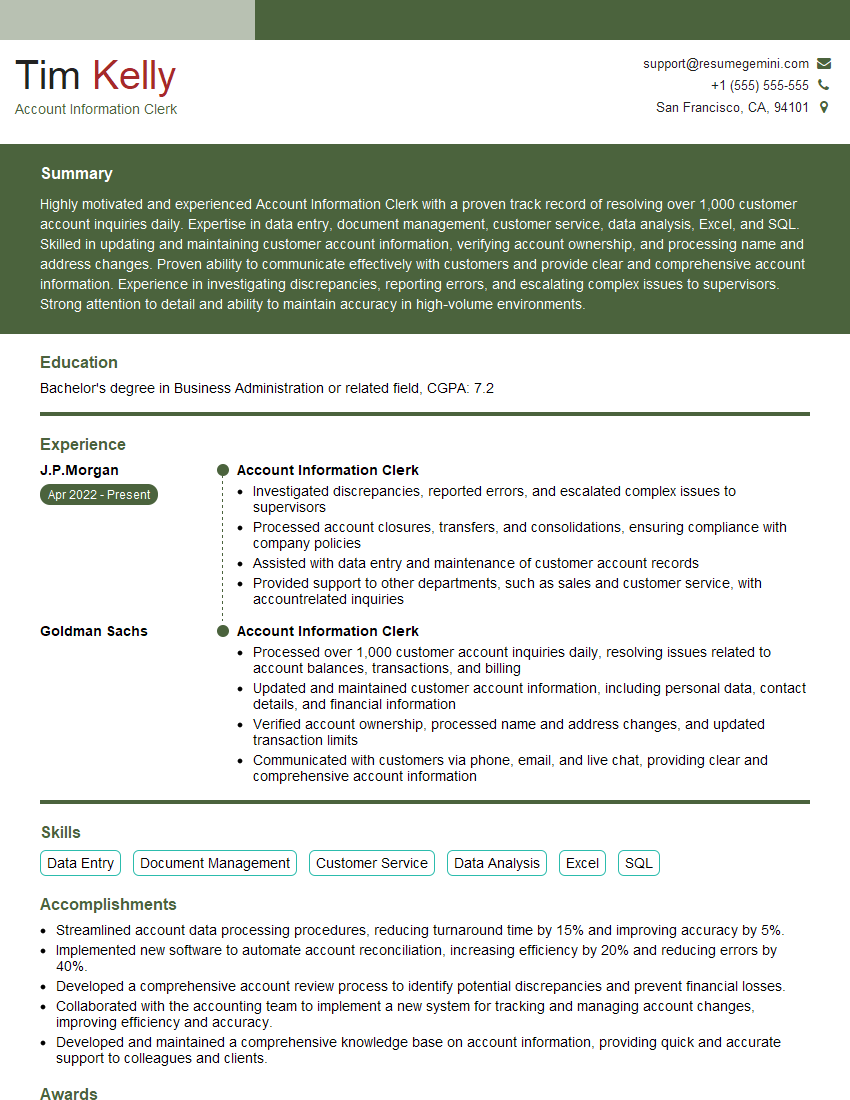

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Account Information Clerk

1. What are the key responsibilities of an Account Information Clerk?

- Providing account information to customers.

- Processing account transactions, such as deposits, withdrawals, and transfers.

- Maintaining account records.

- Answering customer questions and resolving issues.

- Following bank regulations and procedures.

2. How would you handle a customer who is upset about an error on their account?

Communicate effectively

- Listen to the customer’s concerns and empathize with their situation.

- Explain the error and how it occurred in a clear and concise manner.

- Apologize for the error and take ownership of the mistake.

Resolve the issue efficiently

- Work with the customer to find a solution that is satisfactory to both parties.

- Document the error and the steps taken to resolve it.

- Follow up with the customer to ensure that the issue has been resolved to their satisfaction.

3. What is your experience with handling sensitive customer information?

- Trained in data protection and information security best practices.

- Experience in handling confidential customer data, such as account numbers and personal information.

- Committed to maintaining the privacy and confidentiality of customer information.

4. How would you prioritize multiple tasks and meet deadlines?

- Prioritize tasks based on importance and urgency.

- Use time management techniques, such as to-do lists and calendars.

- Delegate tasks when appropriate.

- Communicate with colleagues and supervisors to ensure that deadlines are met.

- Stay organized and efficient in my work.

5. What software and systems are you familiar with for account management?

Proficient in using various account management software and systems, including:

- Core banking systems.

- Customer relationship management (CRM) software.

- Spreadsheet and database software.

- Microsoft Office Suite.

- Online banking platforms.

6. How would you deal with a difficult or demanding customer?

- Stay calm and professional, even under pressure.

- Listen attentively to the customer’s concerns.

- Emphasize with the customer’s situation.

- Offer solutions that are in line with bank policies and procedures.

- Document the interaction and follow up as necessary.

7. What is your understanding of bank regulations and compliance?

- Familiar with key banking regulations, such as KYC, AML, and BSA.

- Understand the importance of compliance and the consequences of non-compliance.

- Committed to adhering to all applicable laws and regulations in my work.

8. How do you handle discrepancies in customer accounts?

- Investigate the discrepancy thoroughly.

- Contact the customer to gather additional information.

- Analyze the data and identify the root cause of the discrepancy.

- Work with the customer to resolve the discrepancy and prevent future occurrences.

- Document the discrepancy and the steps taken to resolve it.

9. What is your experience in working in a team environment?

- Excellent communication and interpersonal skills.

- Ability to work independently and as part of a team.

- Experience in collaborating with colleagues to achieve common goals.

- Willingness to support team members and contribute to a positive work environment.

10. Why are you interested in working as an Account Information Clerk?

- Passion for helping customers manage their finances.

- Strong attention to detail and accuracy.

- Excellent communication and interpersonal skills.

- Belief that I can make a positive contribution to your team.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Account Information Clerk.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Account Information Clerk‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Account Information Clerks are responsible for handling account-related inquiries, providing customer service, and maintaining accurate financial records.

1. Process Account Inquiries and Transactions

This involves answering phone calls, emails, or in-person inquiries from customers about their accounts, balances, and transactions.

- Verify customer information and account details.

- Research and resolve account discrepancies or issues.

- Process account transactions, such as deposits, withdrawals, and transfers.

2. Maintain Account Records

Account Information Clerks are responsible for maintaining accurate and up-to-date account records.

- Update customer account information, such as address, phone number, and email address.

- Maintain records of all account transactions and activities.

- Generate and send account statements and other financial reports.

3. Provide Customer Service

Account Information Clerks provide excellent customer service to ensure customer satisfaction and build strong relationships.

- Resolve customer complaints and issues in a timely and professional manner.

- Provide clear and concise information about account products and services.

- Build rapport with customers and foster long-term relationships.

4. Comply with Regulations

Account Information Clerks must adhere to all applicable laws and regulations related to financial transactions and customer data privacy.

- Follow established procedures and policies.

- Protect customer confidentiality and prevent fraud.

- Comply with anti-money laundering and other regulatory requirements.

Interview Tips

Preparing for an Account Information Clerk interview requires understanding the key responsibilities and developing effective strategies to showcase your skills and experience.

1. Highlight Your Attention to Detail

Emphasize your ability to handle financial transactions accurately and maintain meticulous records.

- Quantify your experience by providing specific examples of how you managed large volumes of account inquiries or processed complex transactions efficiently.

- Discuss your knowledge of financial regulations and industry best practices.

2. Showcase Your Customer Service Skills

Demonstrate your ability to provide exceptional customer service and build positive relationships.

- Share examples of how you resolved customer issues effectively and maintained a positive attitude even under pressure.

- Highlight your communication skills, including active listening, empathy, and clear verbal and written expression.

3. Emphasize Your Knowledge of Financial Accounts

Display your understanding of account types, transactions, and record-keeping principles.

- Review common banking products and services, such as checking, savings, and investment accounts.

- Familiarize yourself with different types of account transactions, including deposits, withdrawals, transfers, and loan payments.

4. Practice Your Interview Answers

Prepare thoughtful responses to common interview questions and consider how your skills and experience align with the employer’s needs.

- Anticipate questions about your customer service experience, data entry accuracy, and ability to work independently.

- Rehearse your answers to highlight your strengths and how you can contribute to the organization.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Account Information Clerk interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!