Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Account Receivable Clerk position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

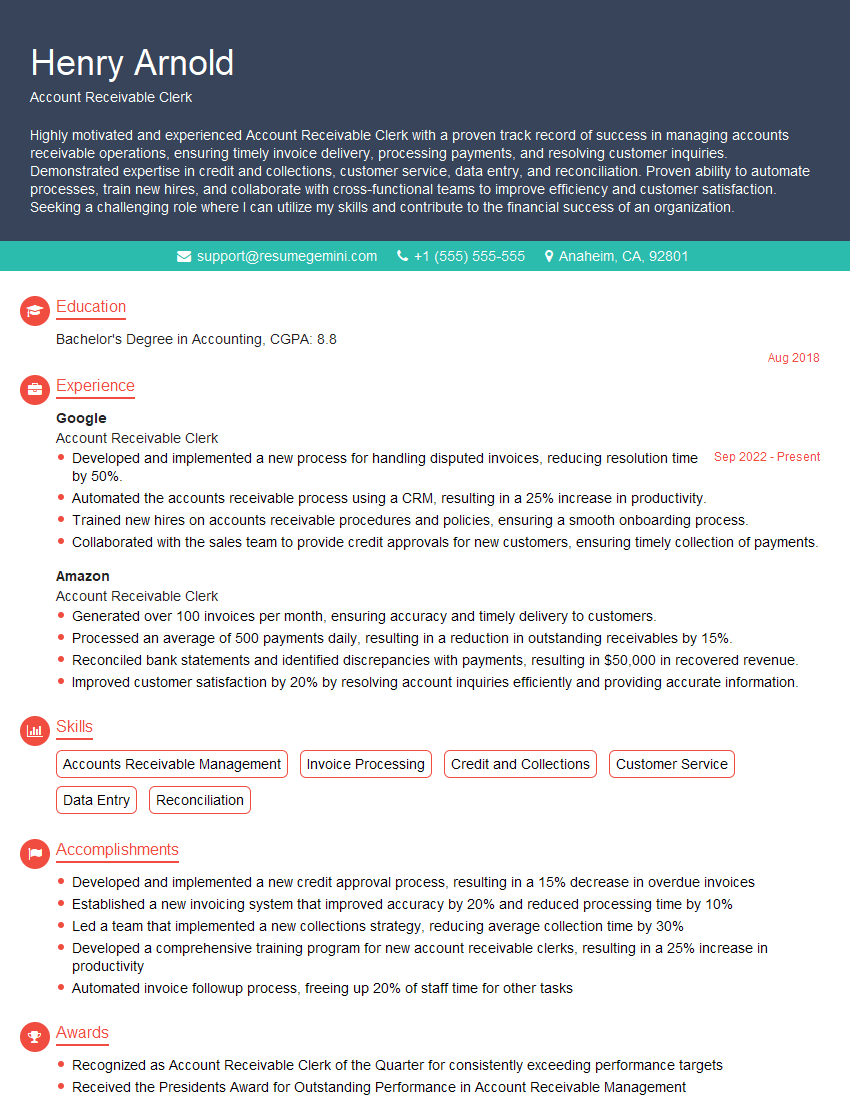

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Account Receivable Clerk

1. What are your responsibilities as an Account Receivable Clerk?

As an Account Receivable Clerk, my responsibilities include:

- Preparing and mailing invoices

- Posting customer payments

- Maintaining customer accounts

- Resolving customer inquiries

- Preparing and reconciling bank deposits

- Assisting with month-end closing procedures

2. What is your experience with using accounting software?

I have experience using a variety of accounting software, including QuickBooks, NetSuite, and SAP. I am proficient in using these software to perform the following tasks:

- Creating and managing customer accounts

- Invoicing customers

- Posting payments

- Reconciling bank statements

- Generating financial reports

3. How do you handle a customer dispute?

When handling a customer dispute, I first try to understand the customer’s concerns. I then review the relevant documentation to determine if there is any validity to the dispute. If there is, I work with the customer to resolve the issue. If there is not, I explain the company’s policy to the customer and provide them with documentation to support it.

4. What are the most common mistakes you see customers make when paying their invoices?

The most common mistakes I see customers make when paying their invoices are:

- Sending payment to the wrong address

- Paying the incorrect amount

- Not including the invoice number

- Paying late

5. How do you ensure that customer payments are processed quickly and accurately?

To ensure that customer payments are processed quickly and accurately, I:

- Enter payments into the accounting system as soon as they are received

- Check for errors in the payment information

- Update customer accounts with the payment information

- Send receipts to customers for their records

6. What are your strengths as an Account Receivable Clerk?

My strengths as an Account Receivable Clerk include:

- Strong attention to detail

- Excellent communication skills

- Ability to work independently and as part of a team

- Proficiency in using accounting software

- Experience with resolving customer disputes

7. What are your weaknesses as an Account Receivable Clerk?

One of my weaknesses is that I can be a bit slow at times. However, I am always willing to learn and improve, and I am confident that I can overcome this weakness with time and experience.

8. Why are you interested in this position?

I am interested in this position because I am looking for a challenging and rewarding career in accounting. I believe that my skills and experience make me a good fit for this role, and I am confident that I can make a significant contribution to your company.

9. What are your salary expectations?

My salary expectations are in line with the market average for this position. I am confident that I can provide value to your company that is commensurate with my salary expectations.

10. What questions do you have for me?

I am very interested in this position and I have a few questions for you:

- What is the company culture like?

- What are the opportunities for advancement?

- What are the company’s goals for the future?

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Account Receivable Clerk.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Account Receivable Clerk‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

An Account Receivable Clerk, commonly known as an A/R clerk, performs crucial tasks within an organization’s accounting department. They handle various responsibilities related to tracking and collecting payments from customers, ensuring the smooth flow of revenue. Key job duties include:

1. Maintaining Customer Accounts

A/R clerks establish and maintain customer accounts within the company’s accounting system. They record all sales transactions, invoice customers, and update account balances regularly.

2. Processing and Posting Payments

When customers make payments, A/R clerks receive and process those payments promptly. They record the payments in the accounting system, update customer balances, and prepare receipts or deposit slips.

3. Managing Collections and Follow-Ups

A/R clerks keep track of accounts receivable and monitor payment due dates. For overdue payments, they follow up with customers via phone, email, or mail to resolve any issues and initiate collection procedures if necessary.

4. Reconciling Bank Statements

Regularly reconciling bank statements with the accounts receivable records is essential. A/R clerks compare deposits and payments to identify any discrepancies, ensuring accurate financial reporting.

Interview Tips

Preparing thoroughly for an interview is essential to increase your chances of success. Here are some tips to help you ace your upcoming Account Receivable Clerk interview:

1. Research the Company and Position

Take the time to research the company’s website, LinkedIn profile, and industry news to gain a deep understanding of their business operations and the specific responsibilities of the A/R clerk role.

2. Practice Answering Common Interview Questions

Prepare for common interview questions related to your experience, skills, and qualifications. Anticipate questions about your knowledge of accounts receivable processes, payment collection strategies, and experience with accounting software.

3. Use Keywords from the Job Description

Carefully review the job description and identify the key skills and experience required. Incorporate those keywords into your answers to demonstrate how your qualifications align with the position.

4. Showcase Your Organizational and Communication Skills

Emphasize your ability to manage multiple accounts, prioritize tasks, and communicate effectively with both internal staff and external customers. Highlight experiences that demonstrate your written and verbal communication proficiency.

5. Be Enthusiastic and Professional

During the interview, maintain a positive and professional demeanor. Express your enthusiasm for the position and the opportunity to contribute to the company’s financial operations. Remember to dress appropriately and arrive on time for the interview.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Account Receivable Clerk interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!