Feeling lost in a sea of interview questions? Landed that dream interview for Account Resolution Analyst but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Account Resolution Analyst interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

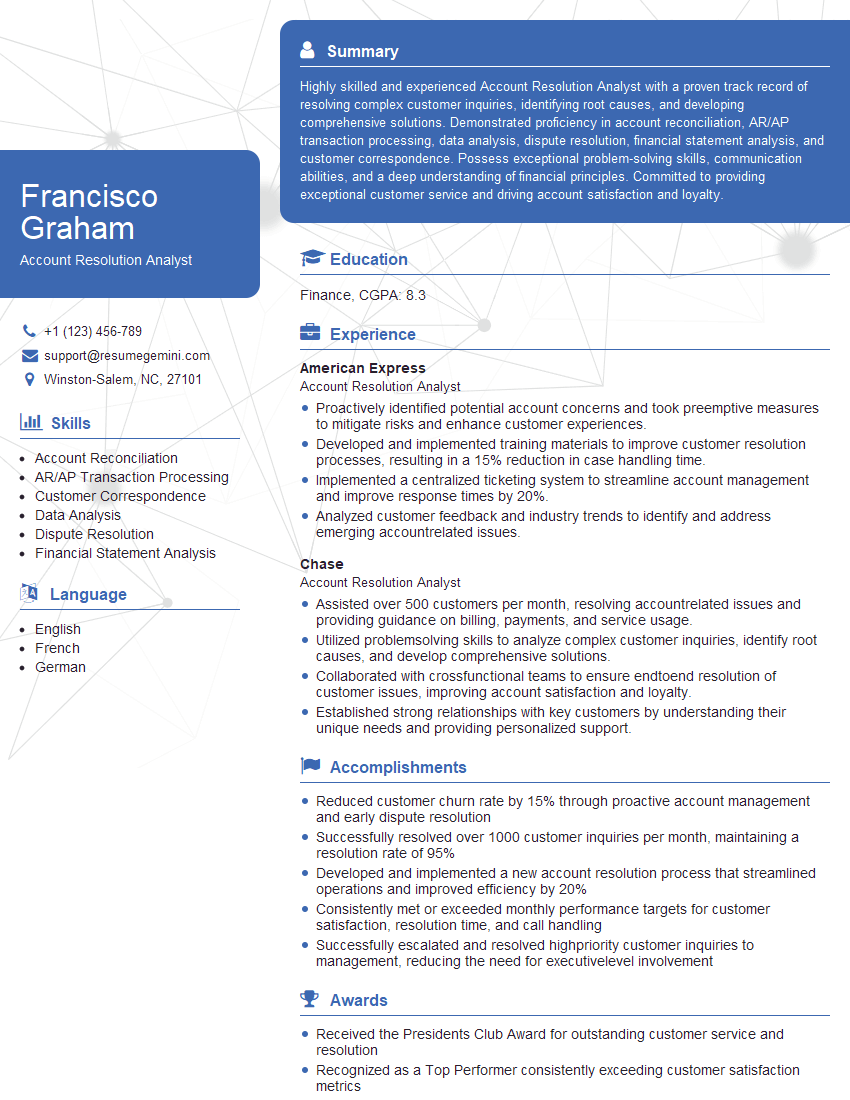

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Account Resolution Analyst

1. Walk me through the process of investigating and resolving a complex billing issue?

In investigating and resolving a complex billing issue, I follow a methodical approach:

- Contact the customer: I establish contact with the customer to gather details of the issue and document their concerns.

- Review account history: I thoroughly examine the customer’s account history, including invoices, payments, and any applicable contracts, to identify any discrepancies or errors.

- Identify potential causes: Based on the account history and customer input, I investigate potential causes of the issue, such as incorrect billing codes, misapplied taxes, or system errors.

- Analyze data: I analyze relevant data, such as usage reports or transaction logs, to pinpoint the source of the discrepancy and determine the appropriate resolution.

- Develop and implement solution: I formulate a solution that addresses the issue and prevents recurrence. This could involve correcting billing codes, adjusting charges, or providing account credits.

- Communicate resolution: I clearly communicate the resolution to the customer, explaining the cause of the issue and the steps taken to rectify it.

2. How do you handle situations where a customer is dissatisfied with the solution provided?

Managing Difficult Customers

- Acknowledge concerns: I actively listen to the customer’s concerns and acknowledge their dissatisfaction.

- Empathize and apologize: I express empathy for their frustration and apologize for any inconvenience caused.

- Explain the solution: I thoroughly explain the solution, highlighting the reasons behind the decision and how it addresses their concerns.

Negotiating a Resolution

- Be open to feedback: I encourage the customer to provide feedback on the proposed solution and am willing to consider alternative options.

- Explore compromise: I explore mutually acceptable compromises that satisfy both the customer’s needs and company policies.

- Document the agreement: I clearly document the agreed-upon solution and timelines for implementation.

3. What is your approach to prioritizing multiple customer inquiries and resolving them efficiently?

- Triage inquiries: I categorize inquiries based on urgency and impact, prioritizing those that require immediate attention.

- Establish clear timelines: I communicate estimated resolution times to customers and set realistic expectations.

- Utilize technology: I leverage technology tools, such as customer relationship management (CRM) systems, to track inquiries and manage workflow.

- Delegate tasks: When necessary, I delegate tasks to colleagues to ensure prompt resolution while maintaining quality.

- Optimize processes: I continually evaluate and improve processes to enhance efficiency and reduce response times.

4. How do you stay up-to-date on industry best practices and regulatory changes in billing and account management?

- Attend industry conferences and webinars: I actively participate in industry events to learn about emerging trends and best practices.

- Subscribe to industry publications: I subscribe to relevant trade journals and online resources to stay informed about regulatory updates.

- Network with colleagues: I engage with colleagues in the industry to share insights and stay abreast of developments.

- Utilize online learning platforms: I leverage online courses and certifications to enhance my knowledge and skillset.

5. What is your experience with using data analytics to identify customer trends and provide personalized solutions?

- Data analysis: I utilize data analytics tools to analyze customer usage patterns, billing history, and other relevant data.

- Trend identification: I identify trends and patterns in customer behavior to anticipate future needs and develop proactive solutions.

- Customized solutions: Based on data insights, I develop personalized solutions that address specific customer requirements and improve their experience.

- Reporting and communication: I generate reports and dashboards to communicate data-driven insights to stakeholders and inform decision-making.

6. Tell me about a time when you successfully resolved a customer complaint and exceeded their expectations.

Recently, I resolved a complex billing dispute for a large corporate client. The client had multiple accounts and suspected billing inaccuracies. I thoroughly investigated their account history and transaction logs, identifying misapplied charges and inconsistencies. I worked closely with the client’s accounting team to reconcile the discrepancies and develop a solution that addressed their concerns. To prevent recurrence, I implemented automated validation checks and improved communication channels between our teams. The client was highly satisfied with the outcome and expressed appreciation for my professionalism and attention to detail.

7. How do you handle escalated customer cases and ensure a positive customer experience?

- Assessment and prioritization: I assess the situation and prioritize the case based on urgency and potential impact.

- Communication: I promptly communicate with the customer, acknowledging the escalation and providing updates on the case status.

- Root cause analysis: I conduct a thorough investigation to identify the root cause of the issue, involving relevant stakeholders as necessary.

- Resolution development: I work with the team to develop and implement a comprehensive solution that addresses the customer’s concerns.

- Follow-up and evaluation: I follow up with the customer after resolution to ensure satisfaction and monitor the impact of the solution.

8. Describe your understanding of PCI DSS compliance and its importance in account resolution.

- Data security: I recognize the importance of PCI DSS compliance in protecting customer data, including credit card information.

- Compliance measures: I stay informed about the latest PCI DSS requirements and ensure that all processes and systems comply with the standards.

- Risk management: I understand the potential risks associated with non-compliance and implement measures to mitigate these risks.

- Customer trust: I believe that PCI DSS compliance enhances customer trust and confidence in the organization’s ability to protect their sensitive data.

9. How do you build and maintain strong relationships with customers and stakeholders?

- Communication: I prioritize clear and effective communication, keeping customers informed and engaged throughout the resolution process.

- Empathy: I demonstrate empathy and understanding of the customer’s perspective, building rapport and fostering trust.

- Collaboration: I collaborate with internal and external stakeholders to gather insights and develop holistic solutions that meet the needs of all parties.

- Feedback: I value customer feedback and actively seek opportunities to improve service delivery and enhance relationships.

10. What are your strengths and weaknesses as an Account Resolution Analyst?

Strengths

- Analytical problem-solving: I excel at analyzing complex issues, identifying root causes, and developing effective solutions.

- Customer focus: I am passionate about delivering exceptional customer experiences and building strong relationships.

- Communication skills: I am proficient in both written and verbal communication, effectively explaining technical concepts to customers and stakeholders.

Weaknesses

- Time management: While I am efficient in my work, I sometimes struggle to prioritize tasks during high-volume periods.

- Stress management: I am committed to delivering high-quality resolutions, but I need to further develop my stress management techniques in demanding situations.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Account Resolution Analyst.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Account Resolution Analyst‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Account Resolution Analysts are the customer-facing representatives responsible for resolving billing and account issues promptly and efficiently. Their primary objective is to maintain customer satisfaction and build strong relationships with clients.

1. Issue Resolution

Investigate and analyze customer account issues, such as billing errors, service outages, and payment disputes.

- Review account records, customer interactions, and system logs to identify the root cause of problems.

- Communicate with customers to gather information, explain resolutions, and follow up on issue resolution.

2. Customer Relationship Management

Build and maintain positive customer relationships by providing exceptional support and resolving issues effectively.

- Empathize with customers’ concerns and demonstrate a genuine desire to solve their problems.

- Maintain a professional and courteous demeanor throughout customer interactions, both in person and over the phone or email.

3. Process Improvement

Identify areas for process improvement within the account resolution function.

- Analyze customer feedback and identify common issues or pain points.

- Propose and implement process enhancements to streamline issue resolution and enhance customer experience.

4. Compliance and Training

Stay up-to-date with industry regulations and company policies.

- Ensure that account resolution practices adhere to legal and ethical standards.

- Train new employees on account resolution processes and standards.

Interview Tips

Preparing thoroughly for an Account Resolution Analyst interview is crucial to making a strong impression. Here are some tips to help you excel:

1. Research the Company and Role

Take the time to research the company’s mission, values, and products or services. Review the job description carefully and identify the key responsibilities and qualifications required.

- Example: Highlight your experience in troubleshooting and resolving customer issues in a previous role.

2. Practice Active Listening

Demonstrate your active listening skills throughout the interview. Pay attention to the interviewer’s questions and respond thoughtfully. Ask clarifying questions if necessary.

- Example: “Can you provide more details about the typical account issues that your resolution analysts handle?”

3. Emphasize Customer-Centricity

Highlight your passion for customer service and your ability to prioritize customer satisfaction. Explain how you go above and beyond to meet customer needs and build strong relationships.

- Example: Describe a situation where you successfully resolved a complex customer issue and exceeded their expectations.

4. Prepare for Process-Improvement Questions

Many interviewers will ask about your experience with process improvement. Be prepared to discuss specific examples of how you have analyzed process inefficiencies and implemented solutions to enhance customer experience.

- Example: Explain how you streamlined a resolution process using data analysis and customer feedback.

Next Step:

Now that you’re armed with the knowledge of Account Resolution Analyst interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Account Resolution Analyst positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini