Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Accountant Clerk position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

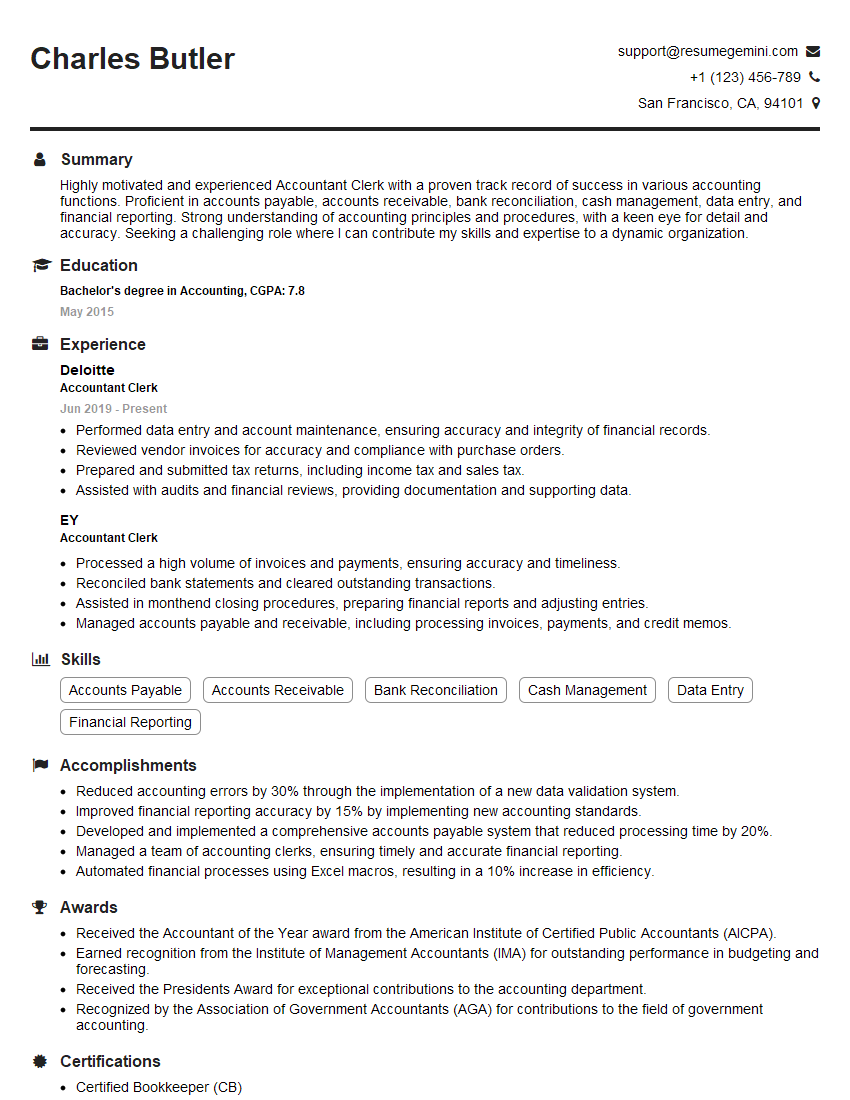

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Accountant Clerk

1. What are the two main types of accounting balances? What are the differences between them?

The two main types of accounting balances are assets and liabilities. Assets are resources owned by the company, while liabilities are debts owed by the company. The main difference between assets and liabilities is that assets are typically expected to increase in value over time, while liabilities are expected to decrease in value over time.

- Assets are typically listed on the left side of the balance sheet, while liabilities are listed on the right side.

- Assets are typically classified as current assets or long-term assets, while liabilities are typically classified as current liabilities or long-term liabilities.

2. What are the three main types of financial statements? What are the differences between them?

- Balance Sheet: Provides a snapshot of the company’s financial health at a specific point in time.

- Income Statement: Reports the company’s financial performance over a period of time.

- Statement of Cash Flows: Shows how the company’s cash was used over a period of time.

3. What are the five main steps in the accounting cycle?

- Recording transactions: Entering financial transactions into the accounting system.

- Posting to the general ledger: Transferring transactions from the journal to the general ledger.

- Preparing the trial balance: Verifying that the debits and credits in the general ledger are equal.

- Adjusting the accounts: Recording transactions that have not yet been recorded in the accounting system.

- Preparing the financial statements: Creating the balance sheet, income statement, and statement of cash flows.

4. What are the two main methods of depreciation?

- Straight-line depreciation: Allocates the cost of an asset over its useful life in equal amounts.

- Accelerated depreciation: Allocates more of the cost of an asset to the early years of its useful life.

5. What are the three main types of inventory?

- Raw materials: Materials that are used to produce finished goods.

- Work in process: Goods that are in the process of being produced.

- Finished goods: Goods that are ready to be sold.

6. What are the three main types of business organizations?

- Sole proprietorship: Owned and operated by one person.

- Partnership: Owned and operated by two or more people.

- Corporation: A legal entity that is separate from its owners.

7. What are the three main types of accounting software?

- On-premise accounting software: Installed on a computer or server that is located on the company’s premises.

- Cloud accounting software: Hosted on a server that is located in the cloud.

- Desktop accounting software: Installed on a personal computer.

8. What are the three main types of accounting errors?

- Errors of omission: Failing to record a transaction.

- Errors of commission: Recording a transaction incorrectly.

- Errors of principle: Using an incorrect accounting principle.

9. What are the three main types of internal controls?

- Preventive controls: Designed to prevent errors from occurring.

- Detective controls: Designed to detect errors that have occurred.

- Corrective controls: Designed to correct errors that have occurred.

10. What are the three main types of financial ratios?

- Liquidity ratios: Measure a company’s ability to meet its short-term obligations.

- Solvency ratios: Measure a company’s ability to meet its long-term obligations.

- Profitability ratios: Measure a company’s ability to generate profits.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Accountant Clerk.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Accountant Clerk‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

An accountant clerk is an individual responsible for performing various accounting tasks and providing support within an organization. Their key responsibilities include but are not limited to the following:

1. Recording Financial Transactions

Accurately record and maintain financial transactions, including purchases, sales, and cash flow, in a timely manner.

2. Preparing Financial Reports

Prepare and generate financial reports such as balance sheets, income statements, and cash flow statements, ensuring accuracy and compliance with accounting standards.

3. Reconciling Bank Statements

Reconcile bank statements, identify discrepancies, and ensure that transactions are recorded correctly in the accounting system.

4. Processing Accounts Payable and Receivable

Process accounts payable invoices, review and approve vendor payments, and manage accounts receivable by invoicing customers and tracking payments.

5. Maintaining Accounting System

Maintain and update the accounting system to ensure its accuracy and efficiency. Perform system backups and security measures to safeguard financial data.

6. Assisting with Financial Audits

Assist with financial audits by providing necessary documentation and explanations.

7. Other Duties

Perform other accounting-related duties as assigned, such as payroll processing, tax filing, and budgeting.

Interview Tips

Preparing adequately for an interview is essential to increase your chances of success. Here are some tips to help you ace your accountant clerk interview:

1. Research the Company

Take time to thoroughly research the company you are applying for, including their industry, financial performance, and culture. This will demonstrate your interest in the role and the organization.

2. Practice Your Answers

Prepare for common accounting clerk interview questions and practice your responses. Consider using the STAR method (Situation, Task, Action, Result) to highlight your relevant skills and experience.

3. Be Punctual and Dress Professionally

Arrive for the interview on time, or even a few minutes early. Dress professionally to make a good first impression.

4. Be Enthusiastic and Engaged

Convey enthusiasm for the role and the company. Show that you are genuinely interested and excited about the opportunity.

5. Emphasize Your Skills and Experience

Highlight your accounting knowledge, technical skills, and experience relevant to the job. Quantify your accomplishments whenever possible to demonstrate the impact of your work.

6. Ask Questions

Prepare thoughtful questions to ask the interviewer about the role, the team, and the company’s financial performance. This shows that you are engaged and interested in the position.

7. Follow Up

After the interview, send a thank-you note or email to the interviewer, reiterating your interest in the role and expressing your appreciation for their time.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Accountant Clerk interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!