Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Accountant interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Accountant so you can tailor your answers to impress potential employers.

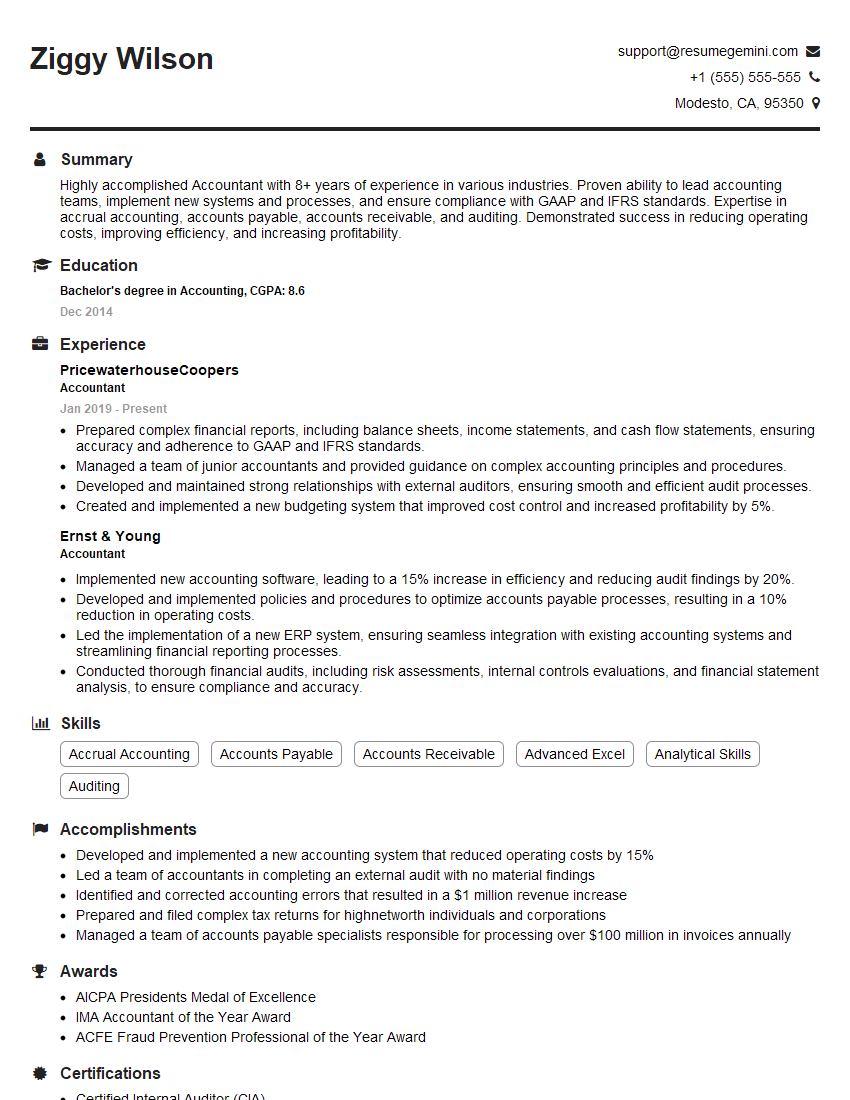

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Accountant

1. What are the different types of accounting software you are familiar with?

I am proficient in a variety of accounting software, including QuickBooks, NetSuite, SAP, and Oracle. I am also familiar with Microsoft Excel and other spreadsheet software used for accounting purposes.

2. What are the steps involved in the accounting cycle?

Recording Transactions

- Identifying and recording financial transactions

- Using source documents to support entries

Posting to Ledgers

- Transferring transactions to general ledger accounts

- Classifying and summarizing transactions

Preparing Financial Statements

- Creating the balance sheet, income statement, and cash flow statement

- Using trial balance to ensure accuracy

Closing the Books

- Transferring net income or loss to retained earnings

- Preparing post-closing trial balance

Preparing Adjusting Entries

- Recording transactions that have occurred but not yet entered

- Updating balances to reflect current financial position

3. How do you handle accounts receivable and accounts payable?

For accounts receivable, I am responsible for maintaining customer accounts, issuing invoices, and collecting payments. I also reconcile bank statements to ensure accuracy of receivables. For accounts payable, I process vendor invoices, manage payments, and maintain vendor relationships. I ensure timely payments to avoid late fees and penalties.

4. What are your experiences with payroll processing?

In my previous role, I was responsible for processing payroll for over 100 employees. I calculated gross pay, withheld taxes and deductions, and issued paychecks. I also filed payroll tax returns and maintained employee payroll records.

5. How do you stay up-to-date on changes in accounting regulations?

I regularly read industry publications, attend conferences, and participate in online forums to stay informed about changes in accounting regulations. I also maintain my professional certifications, which require continuing education to ensure my knowledge is current.

6. What is your experience with internal controls?

I am familiar with the importance of internal controls in safeguarding a company’s assets and ensuring the reliability of financial information. I have experience implementing and maintaining internal controls in previous roles, including segregation of duties, authorization of transactions, and regular reconciliation of accounts.

7. How do you handle a discrepancy between a bank statement and a company’s accounting records?

If there is a discrepancy between a bank statement and a company’s accounting records, I would first compare the two documents carefully to identify the source of the difference. I would then trace the transactions in question through the accounting system to verify their accuracy. Once the discrepancy is identified, I would make the necessary adjustments to the accounting records and communicate the findings to the appropriate parties.

8. What are your strengths and weaknesses as an accountant?

My strengths as an accountant include my strong analytical skills, attention to detail, and ability to work independently. I am also proficient in accounting software and have a deep understanding of accounting principles. My weakness is that I can sometimes be too detail-oriented, which can slow down my work progress at times.

9. Why are you interested in this position?

I am interested in this position because it aligns with my skills and experience as an accountant. I am confident that I can add value to your company with my strong work ethic and commitment to accuracy. I am also eager to learn and grow within the accounting field.

10. What are your salary expectations?

My salary expectations are commensurate with my experience and qualifications. I am open to discussing a salary range that is fair and competitive for this position.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Accountant.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Accountant‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

1. Financial Reporting and Analysis

Accountants prepare and maintain financial statements, such as balance sheets, income statements, and cash flow statements. They also analyze financial data to identify trends and patterns, and to make recommendations to management.

2. Tax Compliance

Accountants prepare and file tax returns for individuals and businesses. They also advise clients on tax laws and regulations.

3. Auditing

Accountants conduct audits to ensure that financial statements are accurate and complete. They also review internal controls and make recommendations to improve efficiency and effectiveness.

4. Budgeting and Forecasting

Accountants prepare budgets and forecasts to help businesses plan for the future. They also track actual results against budgets and forecasts, and make adjustments as needed.

5. Cost Accounting

Accountants track and analyze costs to help businesses understand where their money is going. They also develop and implement cost-control measures.

6. Financial Planning

Accountants help businesses develop and implement financial plans. They also provide guidance on investment decisions and other financial matters.

Interview Tips

1. Research the Company and the Position

Before the interview, take some time to research the company and the specific position you are applying for. This will help you understand the company’s culture and needs, and to better tailor your answers to the interviewer’s questions.

2. Practice Your Answers to Common Interview Questions

There are some common interview questions that you are likely to be asked, such as “Why are you interested in this position?” and “What are your strengths and weaknesses?” Practice answering these questions in a clear and concise way.

3. Be Prepared to Talk About Your Experience

The interviewer will want to know about your experience as an accountant. Be prepared to talk about your skills and accomplishments.

4. Dress Professionally and Arrive on Time

First impressions matter, so dress professionally and arrive on time for your interview. This will show the interviewer that you are serious about the position.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Accountant role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.