Are you gearing up for a career in Accountant Manager? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Accountant Manager and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

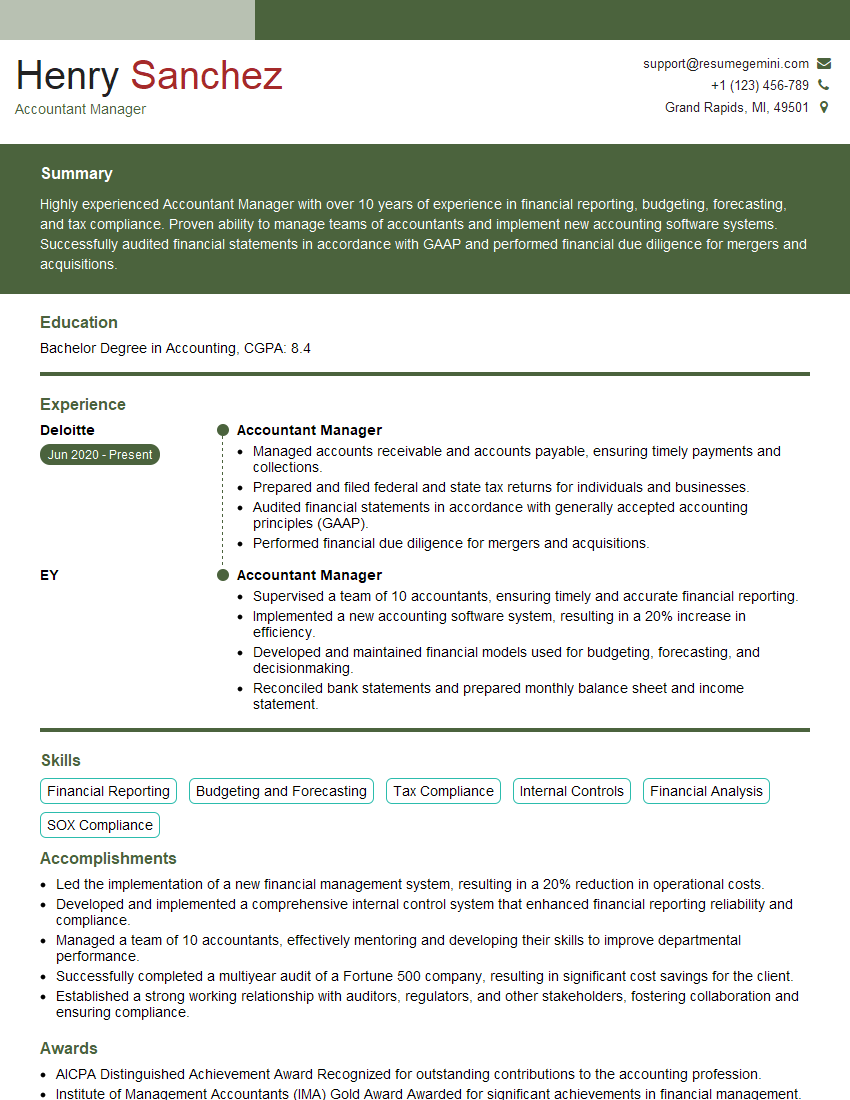

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Accountant Manager

1. What are your key responsibilities as an Accountant Manager?

As an Accountant Manager, my primary responsibilities include:

- Overseeing all accounting operations and financial reporting

- Managing a team of accountants and financial analysts

- Developing and implementing accounting policies and procedures

- Preparing and analyzing financial statements

- Monitoring financial performance and identifying areas for improvement

- Ensuring compliance with all applicable accounting standards and regulations

2. How do you stay up-to-date on the latest accounting standards and regulations?

Continuing Education

- Attend industry conferences and webinars

- Obtain professional certifications (e.g., CPA, CMA)

- Read industry publications and online resources

Internal Training

- Participate in company-sponsored training programs

- Share knowledge and best practices with colleagues

- Review relevant accounting manuals and guidance

3. What experience do you have with budgeting and forecasting?

In my previous role, I was responsible for developing and monitoring the company’s annual budget. I worked closely with department heads to set realistic targets and track progress throughout the year. I also developed financial forecasts that were used to inform decision-making and plan for the future.

4. How do you manage risk in the accounting function?

I have implemented a robust risk management framework that includes the following elements:

- Identifying and assessing potential risks

- Developing and implementing controls to mitigate risks

- Monitoring controls and making adjustments as needed

- Regularly reviewing and updating the risk management framework

5. What are your strengths and weaknesses as an Accountant Manager?

My strengths include my:

- Strong technical accounting skills

- Ability to manage a team effectively

- Communication and interpersonal skills

- Attention to detail and accuracy

My main weakness is that I sometimes have difficulty delegating tasks. I am always willing to take on new challenges, but I recognize that it is important to empower my team to take on more responsibility.

6. What are your salary expectations for this role?

My salary expectations are commensurate with my experience and qualifications. I am confident that I can make a significant contribution to your organization and I am eager to discuss my compensation package in more detail.

7. Why are you interested in this role?

I am interested in this role because it offers me the opportunity to use my skills and experience to make a positive impact on your organization. I am passionate about accounting and finance, and I am always looking for ways to improve my knowledge and skills. I am also a highly motivated and results-oriented individual, and I am confident that I can exceed your expectations in this role.

8. What is your experience with internal and external audits?

I have extensive experience with both internal and external audits. I have worked with internal audit teams to develop and implement audit plans, conduct risk assessments, and review financial controls. I have also worked with external auditors to prepare for and respond to audits, and to implement their recommendations.

9. What is your experience with financial reporting and analysis?

I have extensive experience with financial reporting and analysis. I am proficient in preparing financial statements in accordance with GAAP and IFRS. I am also skilled in using financial analysis techniques to identify trends and make recommendations for improving financial performance.

10. What is your experience with tax planning and compliance?

I have experience with tax planning and compliance. I am familiar with the tax laws and regulations that apply to businesses, and I can advise clients on how to minimize their tax liability. I can also prepare and file tax returns, and represent clients in tax audits.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Accountant Manager.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Accountant Manager‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Accountant Managers are responsible for a wide range of accounting and financial management tasks. They typically supervise a team of accountants and clerks, and report directly to the CFO or CEO. Key job responsibilities include:1. Financial Reporting and Analysis

Preparing and analyzing financial statements, such as balance sheets, income statements, and cash flow statements.

- Ensuring that financial reports are accurate, timely, and in accordance with GAAP.

- Identifying trends and patterns in financial data, and making recommendations for improving financial performance.

2. Budget Preparation and Execution

Developing and implementing budgets for the organization.

- Monitoring actual results against budget projections, and making adjustments as necessary.

- Identifying cost-saving opportunities, and developing strategies to reduce expenses.

3. Internal Controls

Establishing and maintaining internal controls to ensure the accuracy and reliability of financial information.

- Developing and implementing policies and procedures for accounting and financial reporting.

- Conducting internal audits to assess the effectiveness of internal controls.

4. Tax Compliance

Ensuring that the organization complies with all applicable tax laws and regulations.

- Preparing and filing tax returns.

- Representing the organization in tax audits.

5. Management Reporting

Preparing and presenting financial reports to management.

- Providing analysis and interpretation of financial data.

- Making recommendations for improving financial performance.

Interview Tips

To prepare for an interview for an Accountant Manager position, it is important to:1. Research the company

Visit the company’s website, read their financial statements, and learn about their industry.

- This will help you to understand the company’s business and its financial challenges.

- You can also use this information to prepare questions to ask the interviewer.

2. Practice your answers to common interview questions

There are a number of common interview questions that you are likely to be asked, such as:

- “Tell me about your experience in financial reporting.”

- “What are your strengths and weaknesses as an Accountant Manager?”

- “Why are you interested in this position?”

It is important to practice your answers to these questions so that you can deliver them confidently and concisely.

3. Be prepared to talk about your experience in detail

The interviewer will likely ask you to talk about your experience in detail, so it is important to be prepared to discuss your accomplishments and skills.

- Use the STAR method to answer interview questions.

- Provide specific examples of your work, and quantify your results whenever possible.

4. Be prepared to ask questions

At the end of the interview, the interviewer will likely ask if you have any questions.

- This is your opportunity to learn more about the position and the company.

- Prepare a few thoughtful questions to ask the interviewer.

5. Dress professionally and arrive on time

First impressions matter, so make sure you dress professionally and arrive on time for your interview.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Accountant Manager role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.