Feeling lost in a sea of interview questions? Landed that dream interview for Accountant Supervisor but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Accountant Supervisor interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

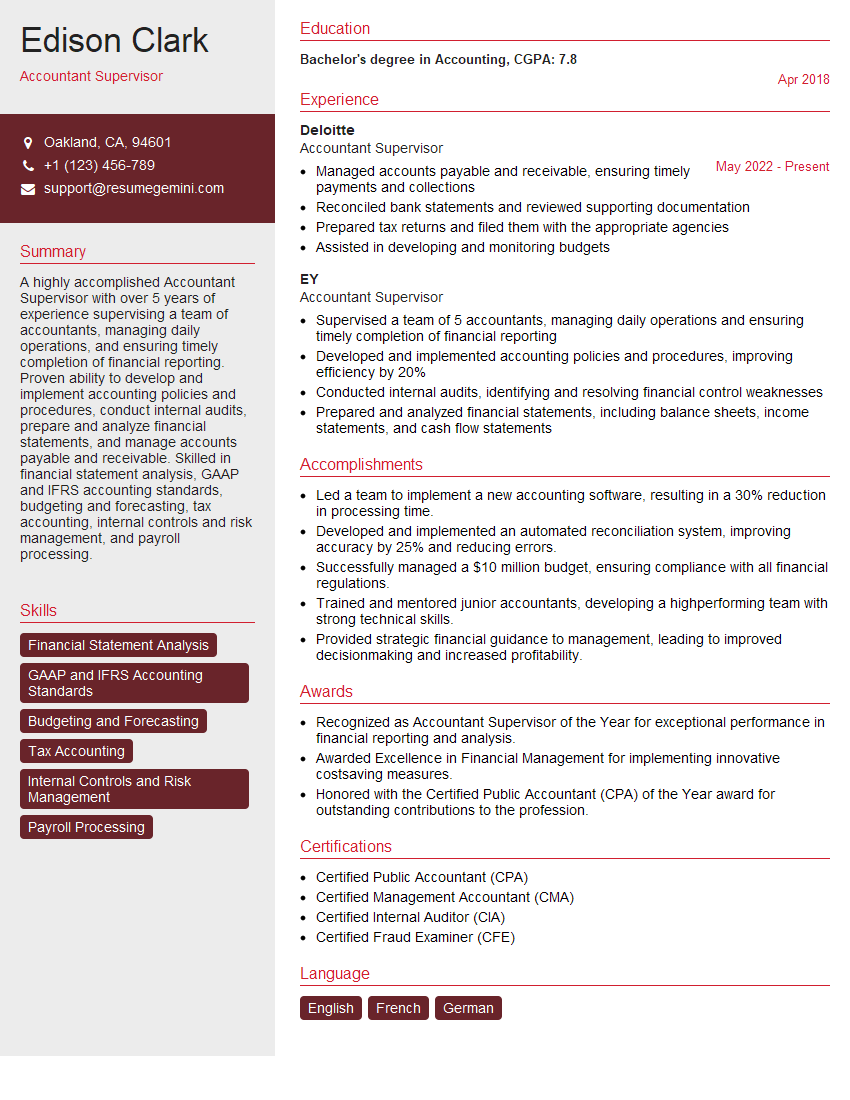

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Accountant Supervisor

1. What methods do you use to stay current with accounting principles and regulations?

As an experienced Accountant Supervisor, it’s crucial to ensure that my knowledge aligns with the latest accounting standards. To stay current, I follow these comprehensive methods:

- Regularly attend professional development seminars and workshops.

- Subscribe to industry publications and online resources.

- Participate in webinars and online courses.

- Engage in discussions and knowledge-sharing platforms with fellow accountants.

- Stay informed about regulatory updates through official websites and professional organizations.

2. Describe your approach to managing a team of accountants and ensuring the accuracy of their work.

To effectively manage a team of accountants and guarantee the precision of their work, I employ a comprehensive approach that encompasses the following key elements:

Mentoring and Training

- Provide regular training and mentorship to enhance team members’ skills and knowledge.

- Establish clear expectations and performance standards.

Quality Control Measures

- Implement robust quality control procedures to ensure accuracy and consistency.

- Conduct regular reviews and audits to identify and address any potential errors.

Communication and Collaboration

- Foster a collaborative work environment where team members can share knowledge and support each other.

- Maintain open communication channels to address concerns and provide guidance.

3. How do you prioritize and manage multiple tasks and projects simultaneously?

In a fast-paced work environment, prioritizing and managing multiple tasks and projects simultaneously is essential. I leverage the following techniques to achieve efficiency and effectiveness:

- Utilize project management tools to organize tasks and track progress.

- Identify critical tasks and allocate resources accordingly.

- Break down complex projects into smaller, manageable milestones.

- Delegate tasks to team members based on their strengths and availability.

- Effectively manage interruptions and distractions.

4. What is your experience with financial reporting and analysis?

Throughout my career, I have developed a strong foundation in financial reporting and analysis. My responsibilities have included:

- Preparing and reviewing financial statements (balance sheet, income statement, cash flow statement).

- Conducting financial analysis to identify trends, risks, and opportunities.

- Developing and presenting financial reports to stakeholders.

- Utilizing accounting software and tools for data analysis and reporting.

5. How do you handle discrepancies and errors in accounting data?

When encountering discrepancies or errors in accounting data, I follow a systematic approach to ensure accuracy and resolve issues promptly:

- Thoroughly investigate the source of the discrepancy or error.

- Review supporting documentation and verify data entries.

- Identify the root cause of the issue and implement corrective actions.

- Document the investigation process and findings.

- Communicate with stakeholders and provide updates on the resolution.

6. What is your understanding of internal control systems?

Internal control systems play a crucial role in an organization’s financial reporting and operations. My understanding of internal control systems includes the following key aspects:

- COSO framework and its components (control environment, risk assessment, control activities, information and communication, monitoring).

- Types of internal controls (preventive, detective, corrective).

- Importance of internal controls in safeguarding assets, preventing fraud, and ensuring accurate financial reporting.

- Roles and responsibilities of management and auditors in establishing and maintaining effective internal control systems.

7. How do you approach the reconciliation of accounts?

Reconciliation of accounts is a critical task in accounting to ensure data accuracy and completeness. My approach to reconciliation involves the following steps:

- Identify the accounts to be reconciled and compare their balances.

- Analyze the differences and investigate any discrepancies.

- Review supporting documentation to verify transactions and entries.

- Make necessary adjustments and post reconciling entries.

- Document the reconciliation process and findings.

8. What experience do you have with budgeting and forecasting?

Budgeting and forecasting are essential for financial planning and decision-making. My experience in this area includes:

- Developing annual operating budgets and long-term financial forecasts.

- Analyzing historical financial data and industry trends.

- Collaborating with stakeholders to gather input and ensure alignment.

- Monitoring actual performance against budget and making necessary adjustments.

- Providing insights and recommendations based on budget and forecast analysis.

9. How have you addressed ethical challenges or conflicts of interest?

Maintaining ethical standards is paramount in accounting. I have encountered ethical challenges and conflicts of interest in the following situations:

- Identifying and disclosing potential conflicts of interest to stakeholders.

- Consulting with superiors or an independent ethics committee for guidance.

- Prioritizing the interests of the organization and following ethical guidelines.

- Taking appropriate actions to avoid or mitigate conflicts of interest.

10. What is your experience with accounting software, such as QuickBooks or SAP?

Proficiency in accounting software is essential for efficient accounting operations. I have extensive experience with the following software:

- QuickBooks (all versions)

- SAP (FI/CO modules)

- Microsoft Dynamics GP

- Oracle NetSuite

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Accountant Supervisor.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Accountant Supervisor‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

The Accountant Supervisor is responsible for overseeing and managing the accounting operations of the organization. This includes supervising a team of accountants, ensuring the accuracy and timeliness of financial reporting, and implementing and maintaining accounting policies and procedures.

1. Supervise Accounting Team

The Accountant Supervisor is responsible for supervising a team of accountants. This includes providing guidance and direction, assigning tasks, and reviewing and approving their work.

- Provide guidance and direction to accounting team

- Assign tasks and set priorities

- Review and approve accounting work

- Ensure that accounting team meets deadlines

- Train and develop accounting team

2. Ensure Accuracy and Timeliness of Financial Reporting

The Accountant Supervisor is responsible for ensuring the accuracy and timeliness of financial reporting. This includes preparing financial statements, such as balance sheets, income statements, and cash flow statements, and ensuring that they are filed with the appropriate regulatory agencies.

- Prepare financial statements

- File financial statements with regulatory agencies

- Review financial statements for accuracy

- Ensure that financial statements are filed on time

- Respond to inquiries from auditors and other stakeholders

3. Implement and Maintain Accounting Policies and Procedures

The Accountant Supervisor is responsible for implementing and maintaining accounting policies and procedures. This includes developing and documenting accounting policies, and ensuring that they are followed by the accounting team.

- Develop and document accounting policies

- Ensure that accounting policies are followed

- Review accounting policies and procedures regularly

- Update accounting policies and procedures as needed

- Train accounting team on accounting policies and procedures

4. Other Responsibilities

In addition to the core responsibilities listed above, the Accountant Supervisor may also be responsible for a variety of other tasks, such as:

- Preparing budgets and forecasts

- Conducting internal audits

- Managing cash flow

- Investing surplus funds

- Preparing tax returns

Interview Tips

Here are some tips to help you ace your interview for an Accountant Supervisor position:

1. Research the Company

Before your interview, take the time to research the company. This will help you understand their business, their financial position, and their accounting practices.

- Visit the company’s website

- Read the company’s annual report

- Read news articles about the company

- Talk to people who work at the company

2. Prepare for Common Interview Questions

There are a number of common interview questions that you are likely to be asked in an interview for an Accountant Supervisor position. These questions may include:

- Tell me about your experience in accounting.

- What are your strengths and weaknesses as an accountant?

- What are your goals for your career?

- Why do you want to work for this company?

- What is your salary expectation?

3. Practice Your Answers

Once you have prepared for common interview questions, it is important to practice your answers. This will help you feel more confident and prepared during your interview.

- Practice answering questions out loud

- Record yourself answering questions and then watch it back

- Ask a friend or family member to practice interviewing you

4. Dress Professionally

It is important to dress professionally for your interview. This shows the interviewer that you are serious about the position.

- Wear a suit or business casual attire

- Make sure your clothes are clean and pressed

- Avoid wearing revealing or distracting clothing

5. Be Yourself

It is important to be yourself during your interview. The interviewer wants to get to know the real you, so don’t try to be someone you’re not.

- Be honest and authentic

- Show the interviewer your personality

- Don’t be afraid to ask questions

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Accountant Supervisor role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.