Feeling lost in a sea of interview questions? Landed that dream interview for Accounting Associate but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Accounting Associate interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

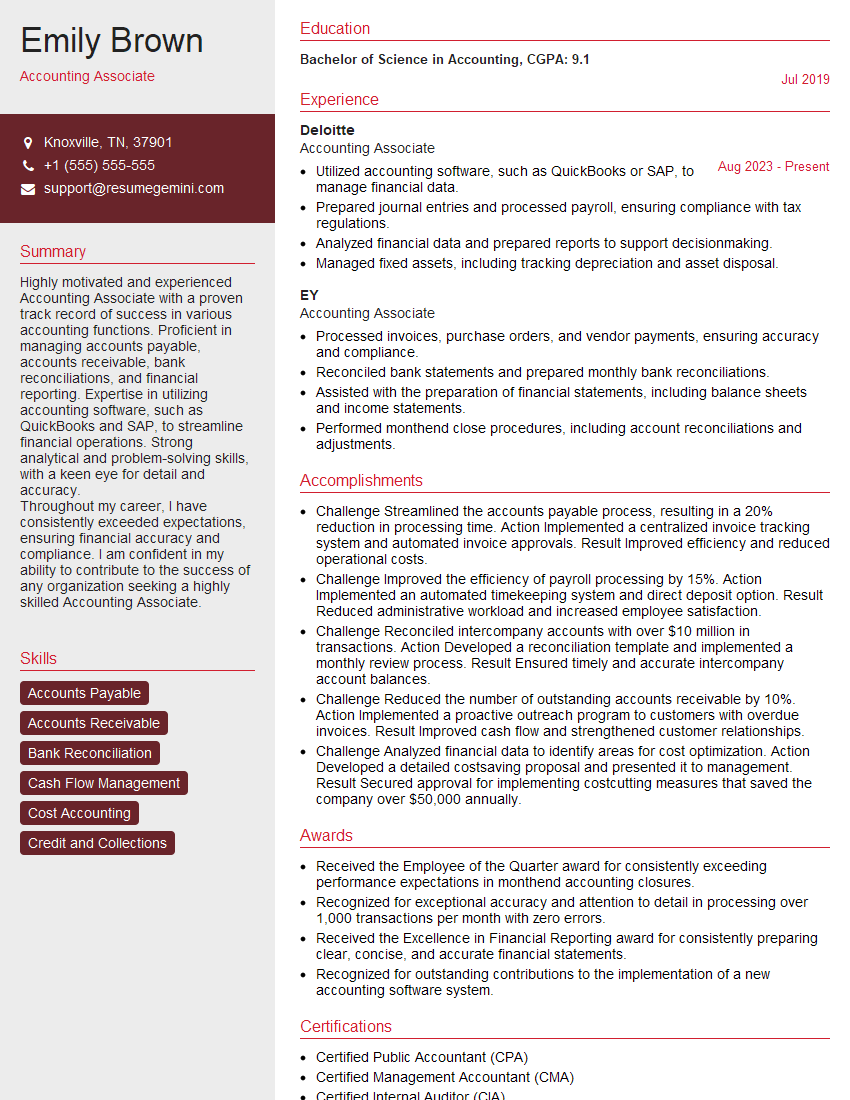

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Accounting Associate

1. Explain the accounting cycle?

The accounting cycle is a series of steps that are performed in order to record, process, and report financial information. The cycle begins with the recording of transactions in a journal, and ends with the preparation of financial statements.

- Journalizing transactions

- Posting to the ledger

- Preparing a trial balance

- Adjusting the accounts

- Preparing an adjusted trial balance

- Preparing financial statements

- Closing the accounts

2. What are the differences between debits and credits?

Assets

- Debits increase assets.

- Credits decrease assets.

Liabilities

- Credits increase liabilities.

- Debits decrease liabilities.

Equity

- Credits increase equity.

- Debits decrease equity.

Revenue

- Credits increase revenue.

- Debits decrease revenue.

Expense

- Debits increase expenses.

- Credits decrease expenses.

3. What is the purpose of a balance sheet?

A balance sheet is a financial statement that provides a snapshot of a company’s financial health at a specific point in time. It shows the company’s assets, liabilities, and equity.

- Assets are what the company owns.

- Liabilities are what the company owes.

- Equity is the difference between assets and liabilities.

4. What is the difference between an income statement and a statement of cash flows?

An income statement reports on a company’s revenues and expenses over a period of time. A statement of cash flows shows how a company’s cash has changed over a period of time.

- The income statement shows how much money a company has made or lost.

- The statement of cash flows shows how much cash a company has generated and used.

5. What are the three main types of financial ratios?

- Liquidity ratios

- Solvency ratios

- Profitability ratios

6. What are the steps involved in preparing a bank reconciliation?

- Compare the bank statement to the company’s cash records.

- Identify any differences between the two.

- Investigate the differences and make any necessary adjustments.

- Prepare a bank reconciliation statement.

7. What are the different types of internal controls?

- Preventive controls

- Detective controls

- Corrective controls

8. What are the different types of accounting software?

- Enterprise resource planning (ERP) systems

- Accounting software

- Spreadsheet software

9. What are the different career paths for accounting associates?

- Staff accountant

- Senior accountant

- Manager

- Controller

- Chief financial officer (CFO)

10. What are the qualities of a successful accounting associate?

- Strong analytical skills

- Attention to detail

- Communication skills

- Teamwork skills

- Ethics

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Accounting Associate.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Accounting Associate‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Accounting Associates play a pivotal role in the financial operations of a company. Their responsibilities encompass a wide range of tasks, including:

1. Accounts Receivable and Payable Management

Process invoices and payments, manage customer accounts, and ensure timely reconciliation.

- Receive and process customer invoices.

- Issue vendor payments and maintain accurate vendor records.

2. General Ledger Maintenance

Record and classify financial transactions, maintain accounting records, and prepare financial statements.

- Post transactions to the general ledger.

- Prepare trial balances and assist in month-end closing.

3. Payroll Processing

Calculate and process employee salaries, manage payroll deductions, and comply with payroll regulations.

- Gross up employee earnings and calculate taxes.

- Process payroll for employees, contractors, and vendors.

4. Month-End Reporting

Compile and analyze financial data, prepare financial reports, and assist in the preparation of tax returns.

- Review and analyze general ledger accounts for accuracy.

- Prepare income statements, balance sheets, and cash flow statements.

Interview Tips

To ace an interview for an Accounting Associate position, candidates should:

1. Research the Company and Position

Familiarize yourself with the company’s industry, business model, and specific accounting practices.

- Visit the company’s website and LinkedIn page.

- Review the job description thoroughly.

2. Practice Common Interview Questions

Prepare for questions related to your accounting skills, experience, and understanding of accounting principles.

- Review basic accounting principles, such as GAAP and IFRS.

- Practice answering questions about your work experience and qualifications.

3. Prepare for Technical Questions

Expect questions that test your knowledge of specific accounting software, such as QuickBooks or SAP.

- If possible, become familiar with the company’s accounting system.

- Brush up on your accounting terminology and concepts.

4. Emphasize Your Communication and Interpersonal Skills

Accounting Associates often interact with clients, vendors, and colleagues. Highlight your ability to communicate clearly and work effectively in a team environment.

- Provide examples of how you have effectively communicated with clients or colleagues.

- Emphasize your ability to work independently and as part of a team.

5. Dress Professionally and Arrive on Time

Make a good impression by dressing professionally and arriving on time for your interview.

- Choose appropriate business attire, such as a suit or dress pants and a button-down shirt.

- Plan your route and allow ample time to arrive at the interview location.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Accounting Associate interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!