Are you gearing up for a career in Accounting Auditor? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Accounting Auditor and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

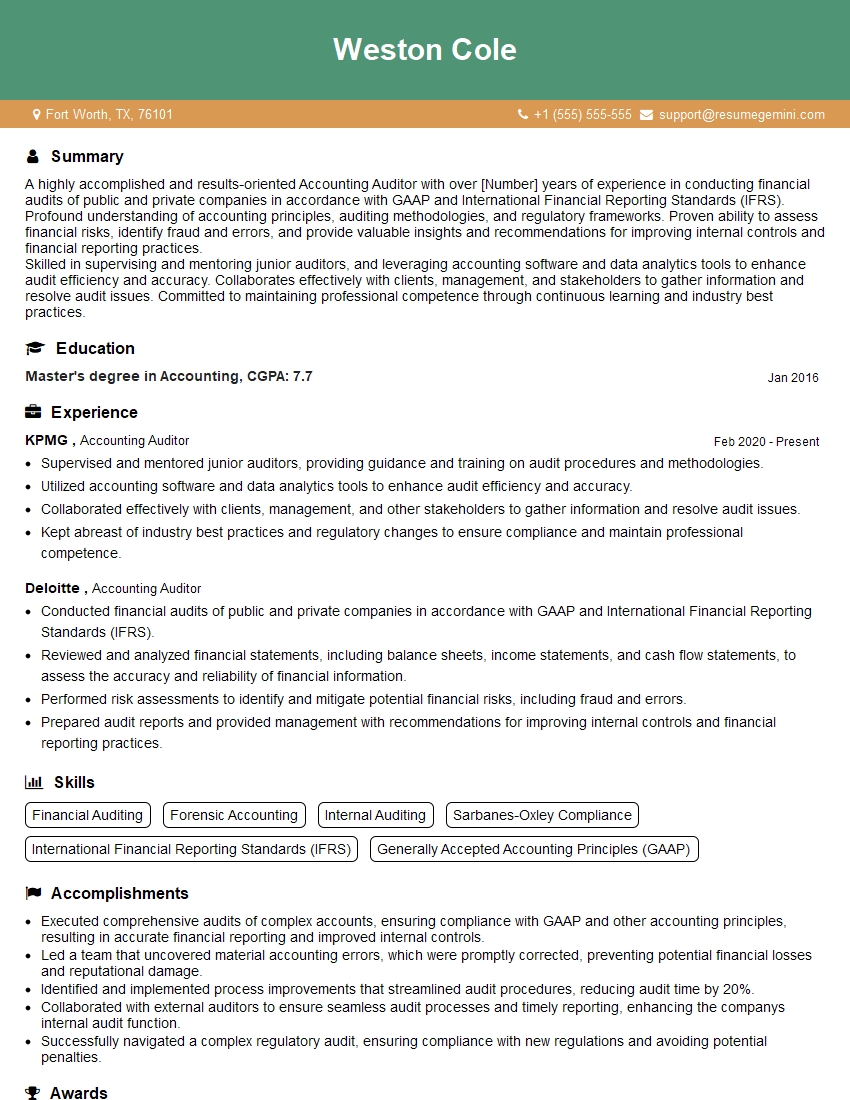

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Accounting Auditor

1. Describe the procedures you would follow to audit a company’s accounts payable?

- Obtain a list of all accounts payable invoices and review them for accuracy.

- Trace a sample of invoices to the underlying supporting documentation.

- Review the company’s purchase orders and receiving reports to ensure that all goods and services received have been properly recorded.

2. What are the key differences between an audit and a review?

Audit

- Involves a more thorough examination of the financial statements.

- Provides a higher level of assurance that the financial statements are accurate.

Review

- Involves a less extensive examination of the financial statements.

- Provides a lower level of assurance that the financial statements are accurate.

3. What is the purpose of internal control?

- To provide reasonable assurance that the financial statements are accurate.

- To prevent or detect fraud.

- To promote efficiency and effectiveness in the organization’s operations.

4. What are the five components of internal control?

- Control environment

- Risk assessment

- Control activities

- Information and communication

- Monitoring

5. What are the four types of audit opinions?

- Unqualified opinion

- Qualified opinion

- Adverse opinion

- Disclaimer of opinion

6. What are the key responsibilities of an auditor?

- To express an opinion on the fairness of the financial statements.

- To report on the results of the audit.

- To communicate any material weaknesses in internal control to management.

7. What are the different types of accounting fraud?

- Financial statement fraud

- Asset misappropriation

- Corruption

8. What are the red flags of fraud?

- Unusual or unexplained transactions.

- Lack of documentation or supporting evidence.

- Management override of controls.

9. What are the steps involved in investigating fraud?

- Gather evidence.

- Interview witnesses.

- Analyze the evidence.

10. What are the consequences of fraud?

- Financial loss

- Reputational damage

- Legal liability

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Accounting Auditor.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Accounting Auditor‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Accounting Auditors are responsible for ensuring the accuracy and reliability of financial records and statements. They work closely with accounting and finance teams to ensure that all financial transactions are properly recorded and documented.

1. Review and analyze financial records

Auditors are responsible for reviewing and analyzing a variety of financial records, including balance sheets, income statements, and cash flow statements.

- Verify that all financial transactions are properly recorded and documented

- Ensure that all financial statements are accurate and reliable

2. Conduct internal audits

Auditors may conduct internal audits to assess the effectiveness of a company’s internal controls. This involves reviewing the company’s accounting processes and procedures to identify any areas of risk.

- Review the company’s accounting processes and procedures

- Identify any areas of risk

- Recommend improvements to the company’s internal controls

3. Prepare audit reports

Auditors are responsible for preparing audit reports that summarize their findings and recommendations. These reports are used by management to improve the company’s accounting processes and internal controls.

- Summarize their findings and recommendations

- Communicate their findings to management

- Help management improve the company’s accounting processes and internal controls

4. Stay up-to-date on accounting standards

Auditors must stay up-to-date on accounting standards to ensure that their work is in accordance with the latest requirements.

- Read accounting publications

- Attend accounting conferences

- Participate in continuing education courses

Interview Tips

Preparing for an accounting auditor interview can be daunting, but there are few tips that can help you ace the interview.

1. Research the company and the position

Before your interview, take some time to research the company and the specific position you are applying for. This will give you a better understanding of the company’s culture and the skills and experience that they are looking for in a candidate.

- Visit the company’s website

- Read the job description carefully

- Talk to your network to see if anyone knows about the company or the position

2. Practice answering common interview questions

There are a number of common interview questions that you are likely to be asked, such as “Tell me about yourself” and “Why are you interested in this position?”. It is helpful to practice answering these questions in advance so that you can deliver your answers confidently and concisely.

- Use the STAR method to answer interview questions

- Be specific and provide examples

- Practice your answers with a friend or family member

3. Be prepared to talk about your experience and skills

The interviewer will want to know about your experience and skills as an accounting auditor. Be prepared to discuss your experience with reviewing financial records, conducting internal audits, and preparing audit reports. You should also be able to demonstrate your knowledge of accounting standards.

- Highlight your experience and skills in your resume and cover letter

- Be prepared to answer questions about your experience in detail

- Quantify your accomplishments whenever possible

4. Be professional and enthusiastic

First impressions matter, so it is important to be professional and enthusiastic during your interview. Dress appropriately, arrive on time, and be polite to everyone you meet. Show the interviewer that you are excited about the opportunity to work for the company and that you are confident in your abilities.

- Dress appropriately

- Arrive on time

- Be polite and respectful

- Show enthusiasm for the position

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Accounting Auditor interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!