Are you gearing up for a career in Accounting Bookkeeper? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Accounting Bookkeeper and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

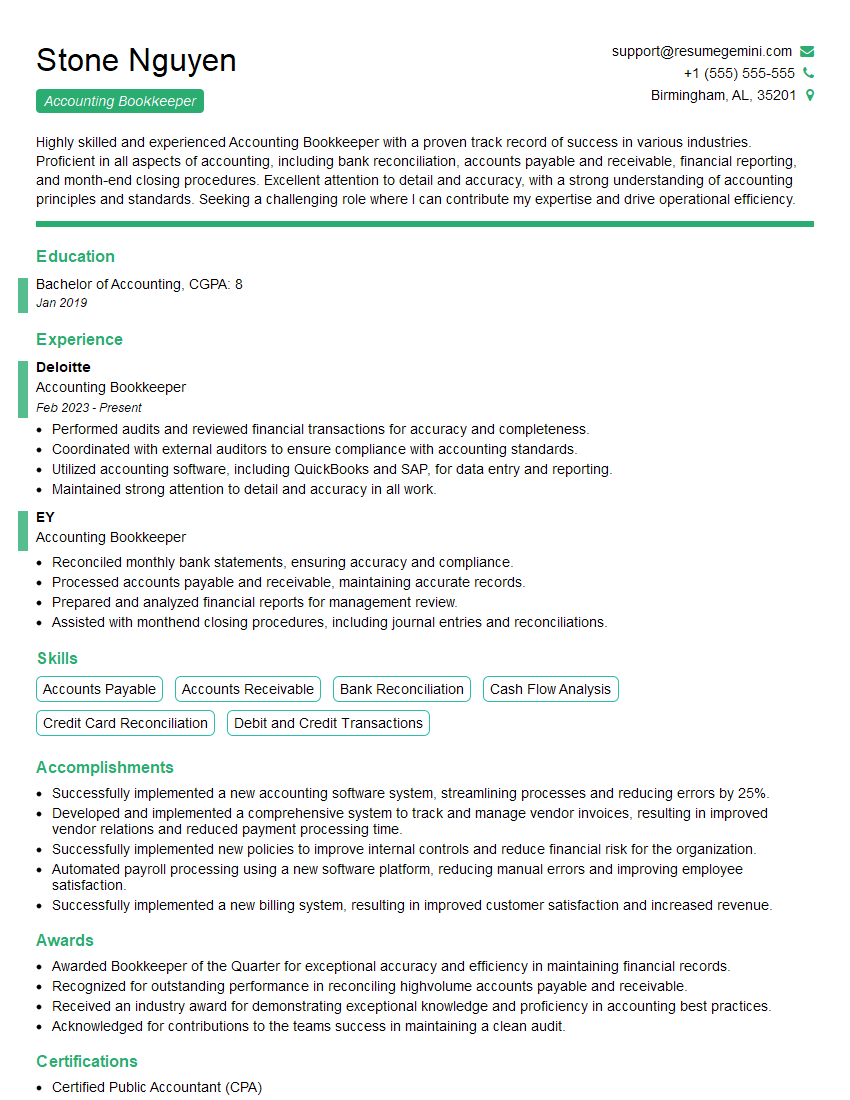

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Accounting Bookkeeper

1. What are the key responsibilities of an Accounting Bookkeeper?

As an Accounting Bookkeeper, my primary responsibilities include:

- Recording financial transactions accurately and timely.

- Maintaining and reconciling accounting records, including general ledgers, sub-ledgers, and subsidiary ledgers.

2. Explain the concept of double-entry accounting and its significance in bookkeeping.

Importance of Double-Entry Accounting

- Ensures the accuracy and integrity of financial records.

- Provides a complete and auditable trail of all transactions.

- Facilitates the preparation of financial statements and tax returns.

Process of Double-Entry Accounting

- Each transaction affects at least two accounts.

- The total debits must always equal the total credits.

- Transactions are recorded in both the debit and credit columns of the general ledger.

3. Describe the different types of accounting software you have experience with.

I am proficient in various accounting software applications, including:

- QuickBooks Online and Desktop

- Xero

- NetSuite ERP

- Sage Intacct

4. How do you handle month-end closing procedures, including reconciling bank accounts?

- Review and finalize all transactions for the month.

- Reconcile bank accounts and identify any outstanding items.

- Accrue and defer expenses and revenues.

- Prepare a trial balance to ensure the accuracy of the financial records.

- Close the accounting period and prepare financial statements.

5. What are your strengths and weaknesses as an Accounting Bookkeeper?

My strengths include:

- Strong understanding of accounting principles and practices.

- Excellent attention to detail and accuracy.

- Ability to work independently and as part of a team.

- Proficiency in accounting software and technology.

My areas for improvement include:

- Expanding my knowledge of financial reporting and analysis.

- Developing stronger communication and interpersonal skills.

6. How do you stay up-to-date with changes in accounting rules and regulations?

- Attend industry conferences and webinars.

- Subscribe to accounting publications and online forums.

- Participate in continuing education courses.

- Regularly review professional standards and updates.

7. What is your experience with payroll processing and tax filings?

I have experience with the following aspects of payroll processing and tax filings:

- Calculating and withholding payroll taxes.

- Preparing and submitting payroll reports.

- Filing federal and state payroll tax returns.

- Issuing employee paychecks and benefits.

8. How do you handle discrepancies or errors in financial records?

- Review the transaction in question and identify the source of the error.

- Make necessary corrections to the accounting records.

- Document the error and correction in a log.

- Communicate any significant errors to management.

9. What are your thoughts on the future of bookkeeping and how it will be impacted by technology?

I believe that technology will continue to play an increasingly important role in bookkeeping. Artificial intelligence (AI) and machine learning (ML) will automate many routine tasks, allowing bookkeepers to focus on more complex and value-added activities. Cloud-based accounting software will also become more prevalent, providing businesses with real-time access to their financial data.

10. What is your desired salary range?

My salary expectations are in line with industry benchmarks and my experience. I am open to discussing a competitive salary package that includes benefits and growth opportunities.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Accounting Bookkeeper.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Accounting Bookkeeper‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

An Accounting Bookkeeper is a crucial role responsible for managing a company’s financial records. Here are the key job responsibilities:

1. Maintaining Financial Records

Accurately and efficiently record all financial transactions, including accounts payable and receivable, cash flow, and bank reconciliations.

2. Preparing Financial Reports

Prepare various financial reports, such as income statements, balance sheets, and cash flow statements, for management, auditors, and other stakeholders.

3. Bank Reconciliation

Reconcile bank statements to ensure accuracy and identify any discrepancies or errors, protecting the company’s financial integrity.

4. Accounts Payable and Receivable Management

Process and track accounts payable and receivable, ensuring timely payments and collections, maintaining good relationships with vendors and customers.

5. Payroll Processing

Calculate and process employee payroll, including salaries, taxes, and benefits, ensuring compliance with regulations and accuracy.

6. Tax Preparation and Filing

Assist with tax preparation and filing, ensuring compliance with tax laws and regulations, and reducing potential liabilities.

7. Collaboration and Reporting

Work closely with other departments, such as accounting, management, and external auditors, to provide financial information and support decision-making.

Interview Tips

To ace the interview for an Accounting Bookkeeper position, it’s crucial to:

1. Practice and Proficiency

Demonstrate a deep understanding of accounting principles, bookkeeping software, and industry best practices. Be ready to discuss your proficiency in various accounting tasks.

2. Highlight Attention to Detail

Emphasize your meticulousness, attention to accuracy, and ability to handle large volumes of financial data with precision.

3. Discuss Technology Skills

Showcase your proficiency in accounting software such as QuickBooks, Xero, or NetSuite. Mention any additional certifications or experience with specialized tools.

4. Strong Communication and Interpersonal Skills

Highlight your ability to communicate effectively with colleagues and clients, both verbally and in writing.

5. Examples and Quantified Results

Use the STAR method (Situation, Task, Action, Results) to provide specific examples of your accounting skills and achievements. Quantify your results to demonstrate the impact of your work.

6. Be Prepared for Technical Questions

Prepare answers to common accounting questions, such as accounting principles, transaction processing, and financial analysis.

7. Research the Company

Show that you’ve researched the company and understand its industry and financial practices. This demonstrates your interest and enthusiasm for the role.

8. Dress Professionally

First impressions matter. Dress appropriately for the interview, reflecting the professionalism expected for the position.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Accounting Bookkeeper interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.