Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Accounting Consultant interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Accounting Consultant so you can tailor your answers to impress potential employers.

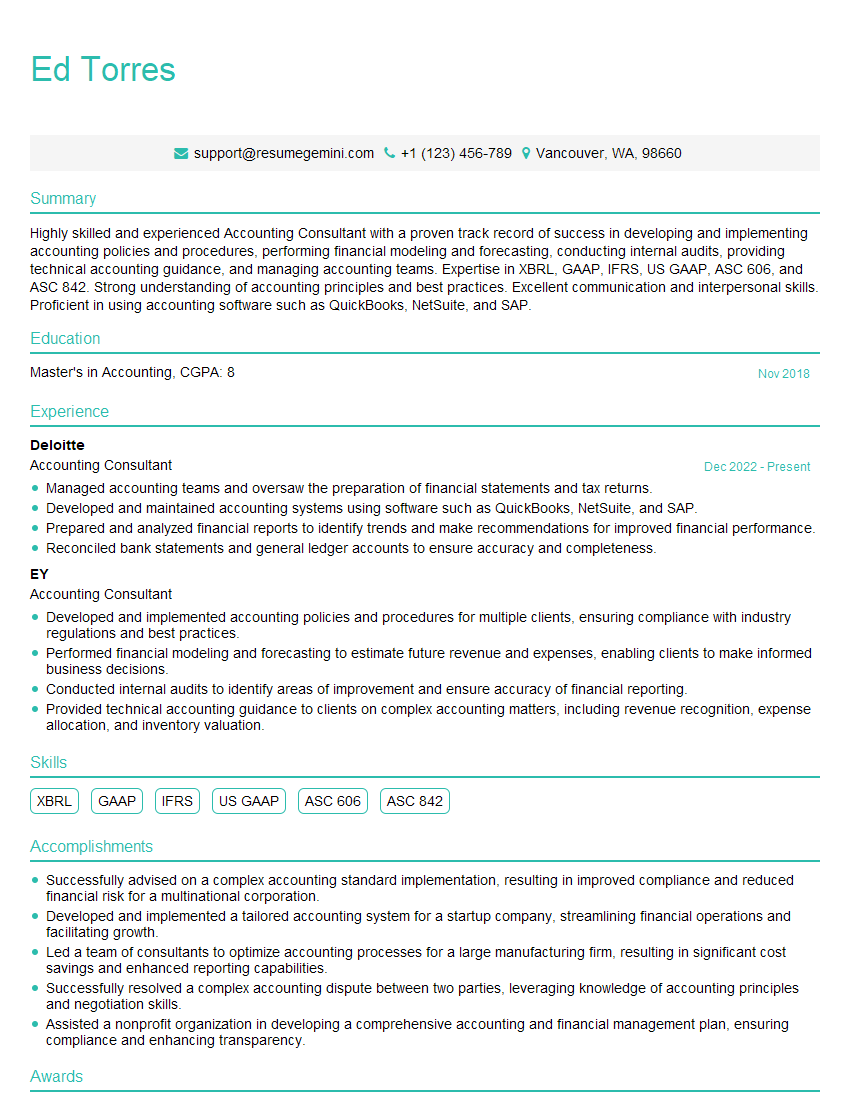

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Accounting Consultant

1. Explain the role of an Accounting Consultant in guiding clients through complex accounting and financial reporting matters?

As an Accounting Consultant, I play a crucial role in assisting clients with complex accounting and financial reporting issues. My responsibilities involve:

- Providing expert advice on financial reporting standards, including US GAAP, IFRS, and other relevant frameworks

- Guiding clients through the implementation of new accounting and reporting requirements, such as revenue recognition or lease accounting

- Analyzing financial statements, identifying areas of improvement, and recommending strategies to enhance financial performance

- Assisting clients with mergers and acquisitions, due diligence, and other special projects

- Educating clients on technical accounting and financial reporting topics, empowering them to make informed decisions

2. Describe your experience in developing and implementing accounting policies and procedures for clients?

Understanding Client Needs

- Assess client’s specific business operations and financial reporting requirements

- Identify areas where policies and procedures need to be established or improved

Developing Policies and Procedures

- Draft clear and concise policies that align with industry best practices and regulatory guidelines

- Create step-by-step procedures to guide employees in executing accounting transactions

Implementation and Training

- Roll out policies and procedures to relevant departments and personnel

- Provide training to ensure proper understanding and adherence

Monitoring and Evaluation

- Monitor compliance with established policies and procedures

- Evaluate effectiveness and make adjustments as needed

3. How do you approach internal control assessments and what are the key areas you focus on?

Internal control assessments are critical to ensure the accuracy and reliability of financial reporting. My approach involves:

- Understanding the client’s business and industry

- Evaluating the design and effectiveness of internal controls over financial reporting

- Focusing on key areas such as revenue recognition, inventory management, and cash handling

- Identifying internal control weaknesses and recommending improvements

- Providing guidance to management on strengthening internal controls

4. What are the key considerations when advising clients on mergers and acquisitions?

When advising clients on mergers and acquisitions, I consider the following key aspects:

- Due diligence assessment: Evaluating the financial health, regulatory compliance, and potential risks of the target company

- Accounting for the transaction: Determining the appropriate accounting treatment for the transaction, including purchase price allocation and goodwill recognition

- Integration planning: Assisting clients with the integration of financial systems, policies, and procedures

- Post-merger reporting: Ensuring accurate and timely financial reporting after the transaction

- Tax implications: Advising on the tax consequences of the transaction and optimizing tax strategies

5. How do you stay up-to-date on the latest accounting and financial reporting standards?

Staying up-to-date on accounting and financial reporting standards is essential for providing accurate and reliable guidance to clients. I employ the following strategies:

- Attending industry conferences and webinars

- Subscribing to professional journals and publications

- Participating in continuing professional education courses

- Engaging with professional organizations and regulatory bodies

- Leveraging online resources and research platforms

6. Describe your experience in using accounting software and technology tools?

I am proficient in various accounting software and technology tools, including:

- Enterprise resource planning (ERP) systems, such as SAP and Oracle

- Accounting and financial reporting software, such as QuickBooks and NetSuite

- Data analytics and visualization tools, such as Power BI and Tableau

- Cloud-based accounting platforms, such as Xero and Wave

- I leverage these tools to automate accounting processes, improve efficiency, and extract valuable insights from financial data

7. How do you handle conflicts of interest and maintain confidentiality when working with clients?

Maintaining ethical standards and avoiding conflicts of interest are paramount. I adhere to the following principles:

- Disclosing any potential conflicts of interest to clients

- Avoiding situations where personal or financial interests could impair professional judgment

- Safeguarding client information and maintaining confidentiality

- Following professional codes of conduct and ethical guidelines

- Seeking guidance from senior colleagues or external experts when necessary

8. Tell me about a time you successfully resolved a complex accounting issue for a client?

Recently, I assisted a client with a complex revenue recognition issue. The client was a software company that had recently adopted a new revenue recognition standard. I analyzed the company’s revenue streams, identified the applicable requirements, and developed a tailored implementation plan. Through collaboration with the client’s team, we successfully implemented the new standard, ensuring compliance and improving the accuracy of financial reporting.

9. How do you measure the success of your consulting engagements?

I evaluate the success of my consulting engagements based on the following metrics:

- Client satisfaction: Positive feedback and expressions of value from clients

- Achievement of project objectives: Delivering on the agreed-upon scope and deliverables

- Measurable improvements: Quantifying the impact of my recommendations on the client’s financial performance or operations

- Long-term relationships: Establishing ongoing partnerships with clients

- Professional recognition: Receiving industry awards or recognition for my work

10. What are your professional development goals for the next few years?

My professional development goals for the next few years include:

- Expanding my knowledge of emerging accounting and financial reporting trends

- Obtaining specialized certifications, such as the Certified Public Accountant (CPA) or Chartered Global Management Accountant (CGMA)

- Developing expertise in a niche area of accounting, such as forensic accounting or international financial reporting

- Mentoring junior accounting professionals and sharing my knowledge with others

- Contributing to the accounting profession through research or publications

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Accounting Consultant.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Accounting Consultant‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Accounting Consultants are experts in the field of accounting who provide guidance and assistance to businesses in various aspects of their financial operations. They play a crucial role in helping companies improve their financial performance, optimize their accounting systems, and achieve their business goals.

1. Financial Statement Analysis and Reporting

Analyze financial statements, including balance sheets, income statements, and cash flow statements, to assess a company’s financial health and performance.

- Identify trends, patterns, and areas of concern in financial data.

- Develop and implement strategies to improve financial reporting accuracy and transparency.

2. Accounting System Design and Implementation

Design and implement accounting systems that meet the specific needs of businesses, including chart of accounts, accounting policies, and internal controls.

- Evaluate existing accounting systems and recommend improvements or replacements.

- Work with IT departments to integrate accounting systems with other business applications.

3. Accounting Policy Development and Compliance

Develop and implement accounting policies that comply with Generally Accepted Accounting Principles (GAAP) or other relevant accounting standards.

- Stay updated on changes in accounting regulations and standards.

- Ensure that accounting practices are aligned with industry best practices.

4. Internal Control Assessment and Improvement

Assess and improve internal controls to mitigate financial risks and ensure the accuracy and reliability of financial reporting.

- Conduct internal audits to identify weaknesses in internal controls.

- Develop and implement recommendations to strengthen internal controls.

Interview Tips

Preparing thoroughly for an Accounting Consultant interview is crucial to showcasing your expertise and enthusiasm for the role. Here are some tips to help you ace the interview:

1. Research the Company and the Role

Familiarize yourself with the company’s industry, business model, and financial performance. Review the job description carefully to understand the specific responsibilities and requirements.

- Visit the company’s website and social media pages to gather information.

- Read industry news and articles to stay informed about the latest accounting trends.

2. Practice Common Interview Questions

Anticipate common interview questions and prepare your answers in advance. Focus on highlighting your skills, experience, and why you are a suitable fit for the role.

- Prepare examples of your accounting expertise, problem-solving abilities, and communication skills.

- Consider using the STAR method (Situation, Task, Action, Result) to structure your answers.

3. Showcase Your Technical Skills

Demonstrate your proficiency in accounting principles, financial analysis, and accounting software. Emphasize your understanding of GAAP or other relevant accounting standards.

- Highlight your experience with specific accounting software, such as QuickBooks, SAP, or Oracle NetSuite.

- Quantify your accomplishments with specific metrics, such as reducing accounting errors or improving financial reporting accuracy.

4. Highlight Your Communication and Interpersonal Skills

Accounting Consultants often interact with clients, colleagues, and management. Emphasize your strong communication, presentation, and interpersonal skills.

- Provide examples of your ability to effectively communicate complex financial information to non-financial audiences.

- Discuss your experience working in a team environment and collaborating with others.

5. Prepare Questions for the Interviewer

Asking thoughtful questions at the end of the interview demonstrates your interest and engagement. Prepare questions related to the company’s accounting practices, industry challenges, or opportunities for professional development.

- Ask about the company’s accounting software and how you can contribute to its effective use.

- Inquire about the company’s plans for future growth and how you can align your skills with those goals.

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Accounting Consultant, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Accounting Consultant positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.