Are you gearing up for an interview for a Accounting Coordinator position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Accounting Coordinator and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

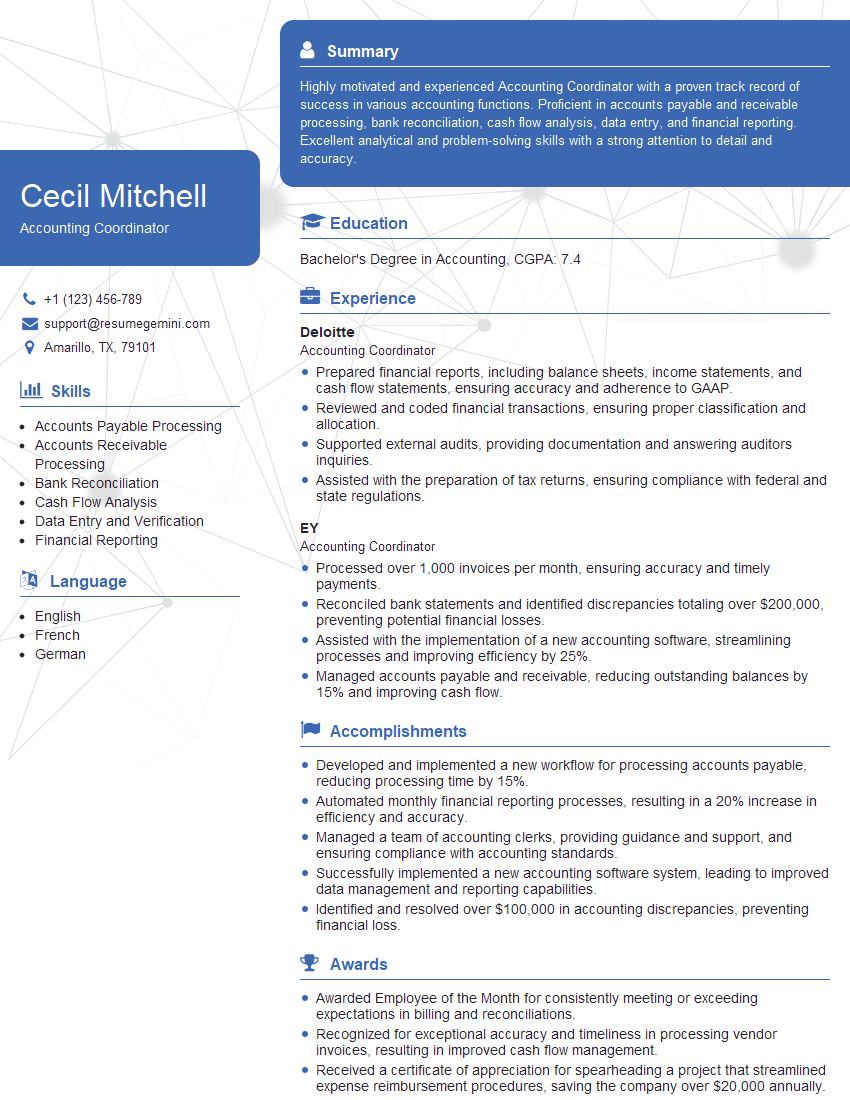

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Accounting Coordinator

1. What are the key responsibilities of an Accounting Coordinator?

In my experience, the key responsibilities of an Accounting Coordinator include:

- Processing accounts payable and receivable transactions

- Maintaining accounting records and ledgers

- Preparing financial reports and statements

- Assisting with audits and other accounting-related projects

- Providing support to accounting staff and management

2. What are the different types of accounting software that you are familiar with?

Experience with Accounting Software

- I have experience with a variety of accounting software, including QuickBooks, NetSuite, and SAP

- I am proficient in using these software programs to perform a variety of accounting tasks, such as data entry, financial reporting, and account reconciliation

Knowledge of Accounting Principles

- I have a strong understanding of accounting principles and practices

- I am familiar with GAAP and IASB standards

3. What is your experience with financial reporting?

In my previous role, I was responsible for preparing a variety of financial reports, including:

- Income statements

- Balance sheets

- Cash flow statements

I am also familiar with the SEC’s financial reporting requirements

4. What is your experience with auditing?

I have experience assisting with both internal and external audits

- My responsibilities included:

- Reviewing financial records and documents

- Performing analytical procedures

- Preparing audit reports

5. What are your strengths and weaknesses as an Accounting Coordinator?

Strengths

- I am highly organized and detail-oriented

- I have a strong work ethic and am always willing to go the extra mile

- I am a team player and am able to work independently

Weaknesses

- I can be a bit perfectionist at times

- I am still relatively new to the accounting field

6. How do you stay up-to-date on the latest accounting standards and regulations?

I stay up-to-date on the latest accounting standards and regulations by:

- Reading industry publications

- Attending conferences and webinars

- Completing continuing education courses

7. What are your salary expectations?

My salary expectations are in line with the industry average for Accounting Coordinators with my experience and qualifications

I am also willing to negotiate based on the benefits package and other factors

8. Are you available to work overtime or on weekends?

I am willing to work overtime or on weekends if necessary

I understand that there may be times when the workload is heavy and I am happy to do my part to meet the deadlines

9. What are your career goals?

My career goal is to become a Certified Public Accountant (CPA)

I believe that this certification will give me the skills and knowledge necessary to advance my career in accounting

10. Do you have any questions for me?

Yes, I do have a few questions:

- What is the company culture like?

- What are the opportunities for advancement?

- What is the training program like?

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Accounting Coordinator.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Accounting Coordinator‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

An Accounting Coordinator is a crucial member of the accounting team, responsible for managing various financial tasks and ensuring the smooth functioning of the accounting department.

1. Accounts Payable and Receivable

Process invoices, manage payments to vendors, and maintain accounts receivable records. Reconcile bank statements and investigate discrepancies.

2. Payroll Processing

Calculate and process employee salaries, including deductions and taxes. Prepare and distribute paychecks or direct deposits.

3. Journal Entries

Record financial transactions in the general ledger, ensuring accuracy and compliance with accounting standards.

4. Financial Reporting

Assist in the preparation of financial reports, such as income statements, balance sheets, and cash flow statements.

5. Data Entry and Maintenance

Enter and maintain financial data in accounting software or spreadsheets. Reconcile data and ensure its accuracy.

6. Office Administration

Provide administrative support to the accounting department, including answering phones, managing correspondence, and maintaining office supplies.

7. Customer Service

Respond to customer inquiries regarding invoices, payments, or other accounting-related issues.

Interview Tips

Preparing for an interview for an Accounting Coordinator position requires careful consideration and thorough research. Here are some tips to help you ace the interview:

1. Research the Company and Position

Familiarize yourself with the company’s industry, products/services, and recent news. Read the job description carefully and identify the key skills and qualifications required for the role.

2. Practice Common Interview Questions

Prepare answers to common interview questions, such as “Tell me about yourself,” “Why are you interested in this position?” and “What are your strengths and weaknesses?” Rehearse your answers aloud or with a friend.

3. Highlight Relevant Experience and Skills

Tailor your resume and cover letter to the specific requirements of the job. Quantify your accomplishments and use specific examples to demonstrate your accounting knowledge, skills, and experience.

4. Prepare Questions for the Interviewer

Asking thoughtful questions shows interest and engagement in the role. Prepare questions about the company’s accounting practices, company culture, or opportunities for professional development.

5. Dress Professionally and Arrive on Time

First impressions matter. Dress appropriately for an office setting and arrive on time for your interview. Be polite and respectful of everyone you encounter.

6. Follow Up After the Interview

Within 24 hours of the interview, send a thank-you note to the interviewer, expressing your gratitude and reiterating your interest in the position.

7. Practice Confidence and Enthusiasm

Confidence and enthusiasm can help you stand out from other candidates. Believe in yourself, your abilities, and your passion for accounting.

Next Step:

Now that you’re armed with the knowledge of Accounting Coordinator interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Accounting Coordinator positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini