Feeling lost in a sea of interview questions? Landed that dream interview for Accounting/Finance Tutor but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Accounting/Finance Tutor interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

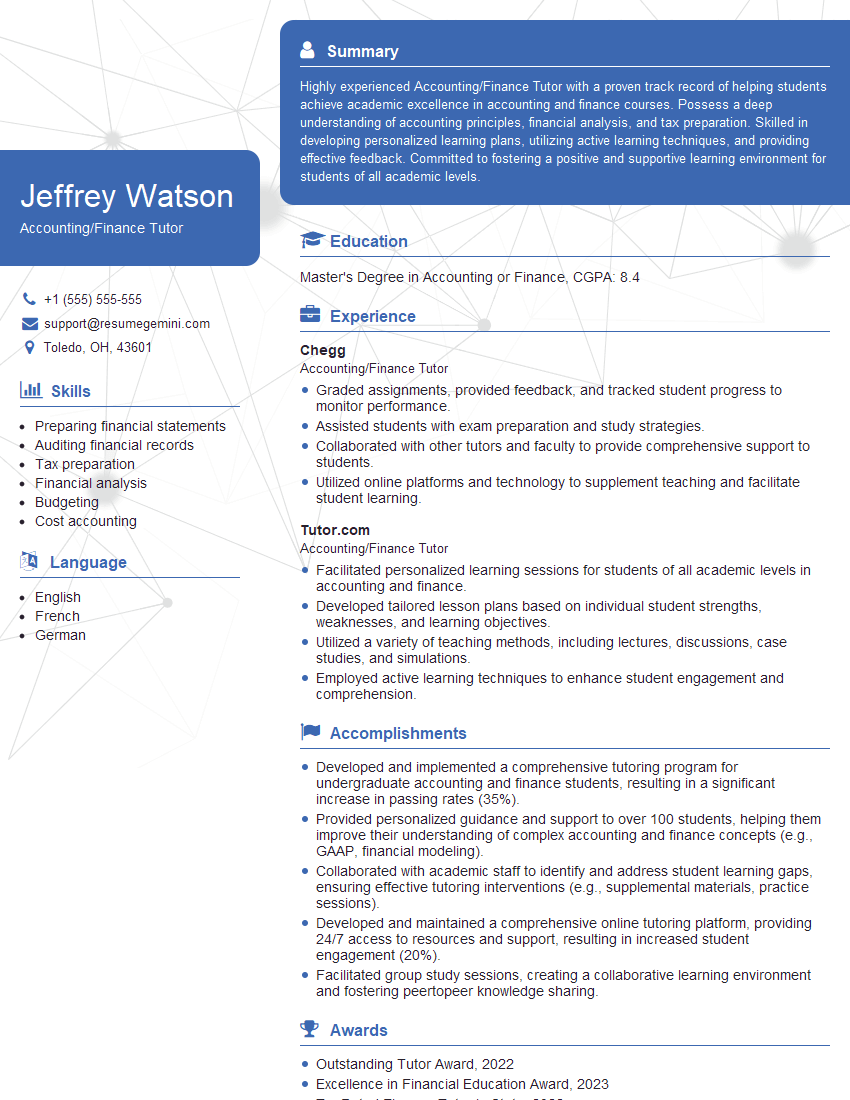

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Accounting/Finance Tutor

1. What are the different types of financial statements and what are their purposes?

- Balance sheet: provides a snapshot of a company’s financial health at a specific point in time. It shows the company’s assets, liabilities, and equity.

- Income statement: shows a company’s revenues and expenses over a period of time. It is used to calculate a company’s net income or loss.

- Statement of cash flows: shows how a company’s cash is being used. It is used to track a company’s cash inflows and outflows.

2. What are the accounting principles and standards that govern financial reporting?

- International Financial Reporting Standards (IFRS): a set of accounting standards that are used by companies in over 140 countries. IFRS are designed to make financial statements more transparent and comparable.

- Generally Accepted Accounting Principles (GAAP): a set of accounting standards that are used by companies in the United States. GAAP are designed to ensure that financial statements are accurate and reliable.

3. What are the different types of accounting transactions and how are they recorded?

- Revenues: are increases in a company’s assets resulting from the sale of goods or services.

- Expenses: are decreases in a company’s assets resulting from the purchase of goods or services.

- Assets: are resources that a company owns or controls. Assets can include cash, inventory, and equipment.

- Liabilities: are obligations that a company owes to others. Liabilities can include accounts payable, notes payable, and loans.

- Equity: is the residual interest in a company’s assets after subtracting its liabilities.

4. What are the different types of financial ratios and how are they used?

- Liquidity ratios: measure a company’s ability to meet its short-term obligations.

- Solvency ratios: measure a company’s ability to meet its long-term obligations.

- Profitability ratios: measure a company’s profitability.

- Efficiency ratios: measure a company’s efficiency.

5. What are the different types of financial instruments and how are they valued?

- Stocks: are equity securities that represent ownership in a company. Stocks are valued based on their market price.

- Bonds: are debt securities that represent a loan to a company. Bonds are valued based on their coupon rate and maturity date.

- Derivatives: are financial instruments that derive their value from an underlying asset. Derivatives can include options, futures, and swaps.

6. What are the different types of financial markets and how do they operate?

- Stock market: is a market where stocks are bought and sold.

- Bond market: is a market where bonds are bought and sold.

- Foreign exchange market: is a market where currencies are bought and sold.

- Derivatives market: is a market where derivatives are bought and sold.

7. What are the different types of financial institutions and what services do they provide?

- Banks: provide a variety of financial services, including checking and savings accounts, loans, and investment advice.

- Credit unions: are not-for-profit financial institutions that provide similar services to banks.

- Investment banks: help companies raise capital by underwriting securities and providing advisory services.

- Insurance companies: provide insurance against a variety of risks, including life, health, and property damage.

- Brokerage firms: provide services to investors, such as buying and selling stocks, bonds, and mutual funds.

8. What are the different types of financial regulations and how do they affect the financial industry?

- Securities and Exchange Commission (SEC): is the federal agency responsible for regulating the securities industry.

- Commodities Futures Trading Commission (CFTC): is the federal agency responsible for regulating the futures and options markets.

- Federal Reserve: is the central bank of the United States and is responsible for regulating the banking industry.

- Financial Industry Regulatory Authority (FINRA): is a self-regulatory organization that oversees the securities industry.

9. What are the different types of financial crimes and how are they investigated?

- Securities fraud: involves the sale of securities using false or misleading information.

- Insider trading: involves the trading of securities based on non-public information.

- Money laundering: involves the hiding of the source of money obtained through illegal activities.

- Bank fraud: involves the illegal use of a financial institution to obtain money or credit.

10. What are the different types of financial risks and how are they managed?

- Market risk: is the risk of loss due to changes in the market price of a financial instrument.

- Credit risk: is the risk of loss due to a borrower’s inability to repay a loan.

- Operational risk: is the risk of loss due to an error or failure in a financial institution’s operations.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Accounting/Finance Tutor.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Accounting/Finance Tutor‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Accounting/Finance Tutors are responsible for providing personalized instruction and guidance to students who need assistance in accounting and finance concepts.

1. Assessing Student Needs

Identifying individual weaknesses and strengths to develop tailored lesson plans

- Conducting diagnostic assessments

- Analyzing student performance

2. Developing and Implementing Lesson Plans

Creating engaging and interactive lessons that cater to diverse learning styles

- Preparing lesson plans aligned with curriculum standards

- Incorporating real-world examples and case studies

3. Providing Instruction and Guidance

Explaining accounting and finance principles in a clear and understandable manner

- Leading group discussions and facilitating small group activities

- Providing personalized feedback and support

4. Monitoring Student Progress

Tracking student performance and providing regular feedback to identify areas for improvement

- Administering quizzes and tests

- Analyzing student work

Interview Tips

Preparing thoroughly for an Accounting/Finance Tutor interview is crucial. Here are some tips to help you ace the process:

1. Research the School and Position

Familiarize yourself with the school’s mission, values, and curriculum. Understanding the specific needs of the position will demonstrate your interest and preparedness.

- Visit the school’s website

- Read the job description carefully

2. Highlight Your Skills and Experience

Emphasize your expertise in accounting and finance, as well as your teaching abilities. Provide specific examples of your experience working with students.

- Quantify your accomplishments

- Use the STAR method to structure your answers (Situation, Task, Action, Result)

3. Prepare for Common Interview Questions

Be prepared to answer questions about your teaching philosophy, methods, and experience working with students.

- Practice answering questions in front of a mirror or with a friend

- Research common interview questions for tutors

4. Dress Professionally and Arrive on Time

Make a good first impression by dressing appropriately and arriving for your interview on time. This shows respect for the interviewer and the position you are applying for.

- Choose business casual attire

- Plan your route ahead of time to avoid any delays

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Accounting/Finance Tutor role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.