Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Accounting Manager position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

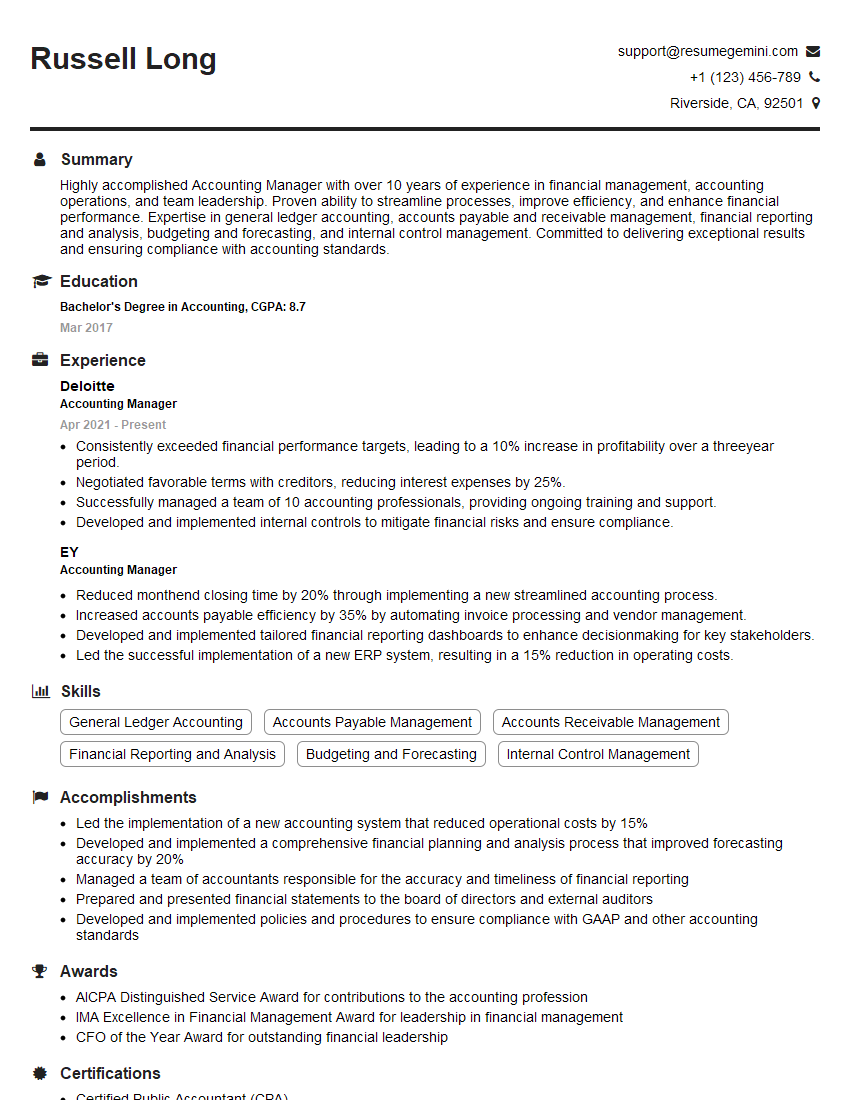

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Accounting Manager

1. Describe the key responsibilities of an Accounting Manager.

- Lead and manage accounting staff, ensuring accuracy and efficiency in financial reporting.

- Prepare and analyze financial statements, including balance sheets, income statements, and cash flow statements.

- Monitor and analyze financial performance, identify trends, and recommend improvements to management.

- Develop and implement accounting policies and procedures to ensure compliance with regulatory requirements.

- Supervise the audit process, including planning, preparation, and response to auditor queries.

2. Explain the Generally Accepted Accounting Principles (GAAP) and how they impact financial reporting.

- Principle-Based Approach: GAAP provides principles that guide accounting practices, rather than specific rules.

- Materiality: Only material financial information is disclosed in financial statements.

- Consistency: The same accounting methods are used consistently from period to period.

- Good Faith: Financial statements are prepared with integrity and without bias.

- Going Concern: The business is assumed to continue operating in the foreseeable future.

3. What is the difference between accrual accounting and cash basis accounting?

- Accrual Accounting: Transactions are recorded when they occur, regardless of when cash is received or paid.

- Cash Basis Accounting: Transactions are recorded only when cash is received or paid.

4. Explain the process of preparing a balance sheet.

- Gather account balances from the general ledger.

- Classify assets, liabilities, and equity accounts into current and non-current categories.

- Calculate totals for assets, liabilities, and equity.

- Ensure that the balance sheet balances (Assets = Liabilities + Equity).

5. Describe the key differences between debits and credits.

- Debits: Increase asset and expense accounts, decrease liability, revenue, and equity accounts.

- Credits: Increase liability, revenue, and equity accounts, decrease asset and expense accounts.

6. What is the role of an internal control system in ensuring the accuracy and reliability of financial information?

- Establish a system of checks and balances to prevent and detect errors and fraud.

- Segregate duties among employees to prevent any one person from having too much control over financial transactions.

- Implement physical controls to safeguard assets and financial records.

- Establish a system of authorization and approval for financial transactions.

- Regularly review and monitor the internal control system to ensure its effectiveness.

7. How do you stay up-to-date on accounting changes and regulations?

- Attend conferences and seminars.

- Read industry publications and accounting journals.

- Network with other accounting professionals.

- Participate in professional development programs.

8. What are the different types of financial audits, and what are their purposes?

- External Audit: Conducted by an independent auditor to provide an opinion on the fairness of financial statements.

- Internal Audit: Conducted by an internal team to assess the effectiveness of internal controls and identify opportunities for improvement.

- Operational Audit: Focuses on the efficiency and effectiveness of business operations, including non-financial areas.

9. What are the key elements of a strong financial forecast?

- Based on historical data and reasonable assumptions.

- Supported by a clear understanding of the business and industry.

- Regularly reviewed and updated.

- Used to make informed decisions and set realistic goals.

10. What is your experience with financial planning and analysis?

- Develop financial models to forecast revenue, expenses, and cash flow.

- Analyze financial data to identify trends and opportunities.

- Prepare financial reports to support decision-making.

- Identify and mitigate financial risks.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Accounting Manager.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Accounting Manager‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

The Accounting Manager is responsible for overseeing all accounting operations within the company, including financial reporting, budgeting, and auditing. They also work closely with other departments, such as finance and operations, to ensure that the company’s financial goals are met.

1. Financial Reporting

The Accounting Manager is responsible for ensuring that the company’s financial statements are accurate and compliant with all applicable laws and regulations. They also work with external auditors to prepare for and complete the company’s annual audit.

- Prepare and analyze financial statements, such as balance sheets, income statements, and cash flow statements

- File financial reports with regulatory agencies

- Meet with external auditors to discuss audit findings

2. Budgeting

The Accounting Manager is responsible for developing and monitoring the company’s budget. They also work with other departments to ensure that the budget is aligned with the company’s strategic goals.

- Develop and implement the company’s annual budget

- Monitor actual results against budget

- Work with other departments to develop cost-saving initiatives

3. Auditing

The Accounting Manager is responsible for conducting internal audits to ensure that the company’s internal controls are working properly. They also work with external auditors to prepare for and complete the company’s annual audit.

- Conduct internal audits to assess the effectiveness of internal controls

- Work with external auditors to prepare for and complete the company’s annual audit

- Review and evaluate audit findings

4. Other Responsibilities

In addition to the above responsibilities, the Accounting Manager may also be responsible for the following:

- Managing the accounting department

- Developing and implementing accounting policies and procedures

- Training and supervising accounting staff

- Providing guidance and support to other departments on accounting matters

Interview Tips

Interviews for Accounting Manager positions can be highly competitive. By following these tips, you can increase your chances of success.

1. Research the company and the position

The first step is to research the company and the position you’re applying for. This will help you understand the company’s culture, its financial goals, and the specific responsibilities of the Accounting Manager.

- Visit the company’s website

- Read news articles about the company

- Talk to people who work at the company

2. Practice your answers to common interview questions

There are a number of common interview questions that you’re likely to be asked for an Accounting Manager position. By practicing your answers to these questions, you can improve your delivery and make a better impression on the interviewer.

- Tell me about your experience in financial reporting.

- How do you develop and monitor a budget?

- What are your strengths and weaknesses as an Accounting Manager?

3. Be prepared to talk about your experience in financial management

The interviewer will want to know about your experience in financial management. This includes your experience in budgeting, forecasting, and financial analysis.

- Highlight your experience in developing and implementing financial strategies.

- Explain how you’ve used financial data to make informed decisions.

- Discuss your experience in managing risk and forecasting financial outcomes.

4. Be prepared to talk about your leadership skills

The Accounting Manager is a leadership position. The interviewer will want to know about your leadership skills and your ability to motivate and manage a team.

- Highlight your experience in leading and motivating teams.

- Explain how you’ve developed and mentored team members.

- Discuss your experience in resolving conflict and building consensus.

5. Be confident and enthusiastic

Finally, be confident and enthusiastic during your interview. This will show the interviewer that you’re passionate about the position and that you’re confident in your abilities.

- Make eye contact with the interviewer.

- Smile and be polite.

- Speak clearly and confidently.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Accounting Manager interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!