Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Accounting Methods Analyst position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

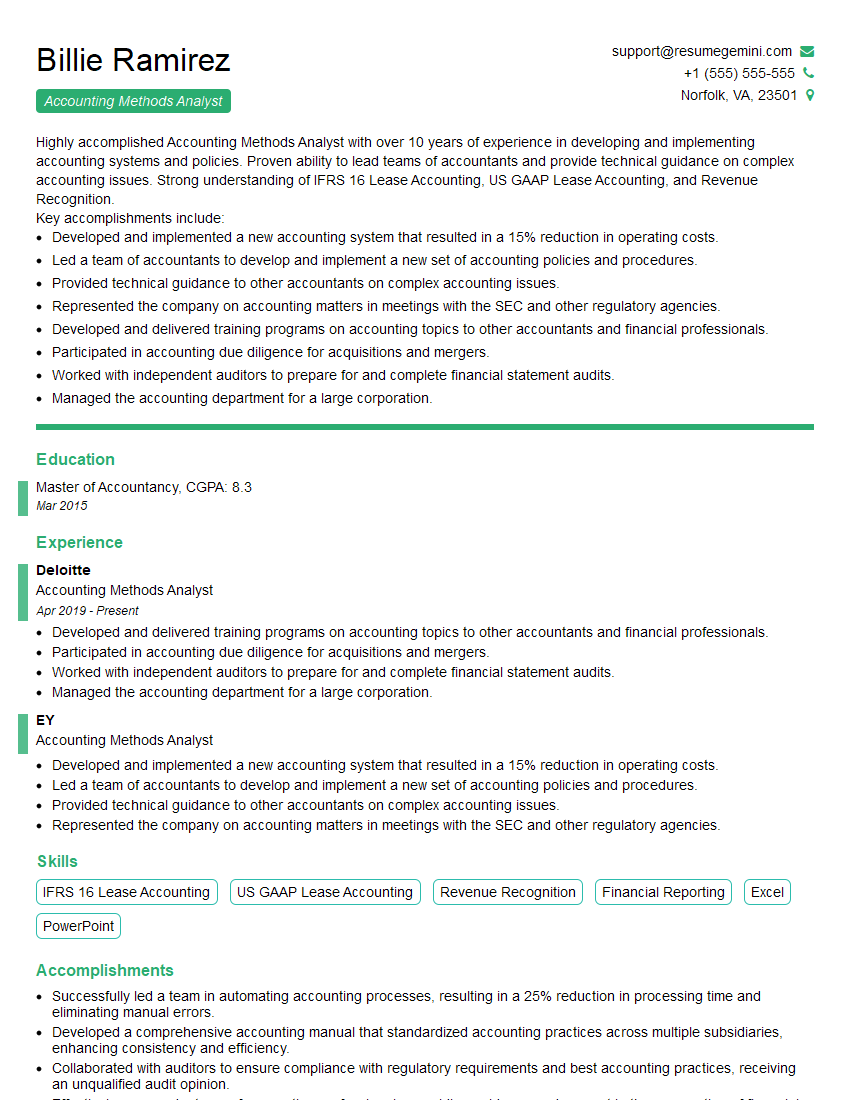

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Accounting Methods Analyst

1. Describe the key differences between IFRS and US GAAP?

Key Differences between IFRS and US GAAP

- Scope of Consolidation: IFRS has a broader scope of consolidation than US GAAP, requiring the consolidation of all controlled entities regardless of their legal form, while US GAAP allows for the exclusion of certain controlled entities under certain conditions.

- Asset Recognition: IFRS allows for the recognition of intangible assets that do not meet the recognition criteria under US GAAP, such as internally generated goodwill.

- Revenue Recognition: Under IFRS, revenue is recognized when control over the goods or services is transferred to the customer, while under US GAAP, revenue is recognized when persuasive evidence of an arrangement exists and delivery has occurred or services have been performed.

- Impairment: IFRS requires the annual testing of goodwill for impairment, while US GAAP only requires impairment testing when there is evidence of impairment.

- Business Combinations: IFRS uses the acquisition method for all business combinations, while US GAAP allows for the use of the pooling-of-interests method in certain limited circumstances.

2. Explain the concept of materiality as it applies to accounting?

Definition of Materiality

- Materiality is a qualitative concept that refers to the significance of an accounting misstatement or omission to the financial statements as a whole.

- A misstatement or omission is considered material if it could influence the economic decisions of users of the financial statements.

Factors Affecting Materiality

- Size and nature of the misstatement or omission

- Financial position and results of operations of the entity

- Nature of the industry and environment in which the entity operates

- Expectations of users of the financial statements

3. What are the different types of accounting estimates?

Types of Accounting Estimates

- Point Estimates: Estimates of a single amount, such as the estimated useful life of an asset or the estimated amount of a liability.

- Range Estimates: Estimates of a range of possible amounts, such as the estimated range of future sales or the estimated range of future expenses.

- Probability Distributions: Estimates that assign probabilities to different possible outcomes, such as the estimated probability distribution of future cash flows.

4. Describe the process of developing and implementing an accounting policy?

Development of Accounting Policy

- Identify the accounting issue to be addressed.

- Research the relevant accounting standards and guidance.

- Consider the specific circumstances of the entity.

- Develop a proposed accounting policy.

- Obtain approval from management.

Implementation of Accounting Policy

- Communicate the accounting policy to relevant personnel.

- Train personnel on the application of the accounting policy.

- Monitor the application of the accounting policy on an ongoing basis.

5. What are the responsibilities of an Accounting Methods Analyst?

Responsibilities of an Accounting Methods Analyst

- Develop and implement accounting policies and procedures.

- Analyze and interpret accounting standards and guidance.

- Provide technical accounting support to management and other departments.

- Prepare accounting manuals and other accounting documentation.

- Stay abreast of developments in accounting principles and practices.

6. Describe the role of the Accounting Methods Analyst in the financial reporting process?

Role of the Accounting Methods Analyst in Financial Reporting

- Participate in the preparation of the financial statements.

- Review the financial statements for compliance with accounting standards and regulations.

- Provide guidance and support to other accounting personnel involved in the financial reporting process.

- Assist in the preparation of management’s discussion and analysis of financial condition and results of operations.

7. What are the challenges facing the accounting profession today?

Challenges Facing the Accounting Profession Today

- The increasing complexity of accounting standards and regulations.

- The need for greater transparency and accountability in financial reporting.

- The rise of new technologies and their impact on accounting practices.

- The globalization of the economy and its impact on accounting reporting.

- The shortage of qualified accounting professionals.

8. How do you stay up-to-date on the latest developments in accounting?

Methods for Staying Up-to-Date on Accounting Developments

- Attend conferences and seminars.

- Read accounting journals and publications.

- Take continuing education courses.

- Participate in professional organizations.

- Follow accounting news and updates online.

9. What is your experience with accounting software?

Experience with Accounting Software

- Name of accounting software used and level of proficiency.

- Specific modules or functionalities used, such as general ledger, accounts payable, accounts receivable, and financial reporting.

- Experience with data entry, report generation, and other accounting tasks.

- Knowledge of accounting software best practices and security measures.

10. How would you approach a project to develop a new accounting policy for a complex issue?

Project Approach for Developing a New Accounting Policy

- Planning: Identify the issue, research relevant standards, and define project scope and objectives.

- Analysis: Evaluate the issue, consider alternative accounting treatments, and analyze potential impacts.

- Development: Draft a proposed accounting policy, including rationale and supporting documentation.

- Approval: Obtain approval from management and relevant stakeholders.

- Implementation: Communicate the policy, train personnel, and monitor its application.

- Evaluation: Regularly review the policy’s effectiveness and make adjustments as necessary.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Accounting Methods Analyst.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Accounting Methods Analyst‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Accounting Methods Analysts are responsible for various tasks that support the principles which companies use for financial reporting. These responsibilities include:1. Analyzing and Reviewing Accounting Principles

Analyzing current accounting methods and policies to ensure compliance with applicable financial reporting frameworks, such as GAAP or IFRS.

Reviewing proposed changes to accounting principles and evaluating their impact on financial statements.

2. Developing and Implementing Accounting Policies

Developing and documenting accounting policies that align with industry best practices and regulatory requirements.

Implementing new accounting policies and ensuring their consistent application throughout the organization.

3. Providing Guidance and Training

Providing guidance and training to accounting staff on the interpretation and application of accounting principles.

Developing and conducting training programs to ensure a thorough understanding of accounting methods and policies.

4. Monitoring and Evaluating Accounting Practices

Monitoring accounting practices to identify areas for improvement and ensure compliance with established policies.

Evaluating the effectiveness of accounting methods and making recommendations for enhancements.

5. Working with External Auditors

Working closely with external auditors to provide explanations and support during the audit process.

Responding to auditor inquiries and providing documentation to support accounting practices.

Interview Tips

Preparing for an Accounting Methods Analyst interview requires a comprehensive approach that includes researching the role, practicing answering common questions, and showcasing your technical expertise. Here are some tips to help you ace the interview:1. Research the Company and Role

Thoroughly research the company, its industry, and its financial reporting practices.

Understand the specific responsibilities of the Accounting Methods Analyst role and how it aligns with the company’s needs.

2. Practice Answering Common Questions

Prepare for common interview questions related to accounting principles, financial reporting, and your experience in analyzing and developing accounting policies.

Use the STAR method (Situation, Task, Action, Result) to structure your answers and provide specific examples of your work.

3. Showcase Your Technical Expertise

Demonstrate your deep understanding of accounting principles, GAAP or IFRS, and various accounting methods.

Highlight your experience in developing and implementing accounting policies, as well as your ability to analyze and evaluate accounting practices.

4. Emphasize Communication and Interpersonal Skills

Accounting Methods Analysts work closely with various stakeholders, including accounting staff, external auditors, and management.

Emphasize your strong communication and interpersonal skills, and provide examples of how you effectively collaborate with others.

5. Be Prepared to Discuss Industry Trends

Keep up-to-date with industry trends and emerging accounting issues.

Be prepared to discuss your thoughts on these trends and how they may impact accounting practices.

Next Step:

Now that you’re armed with the knowledge of Accounting Methods Analyst interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Accounting Methods Analyst positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini