Are you gearing up for an interview for a Accounting Officer position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Accounting Officer and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

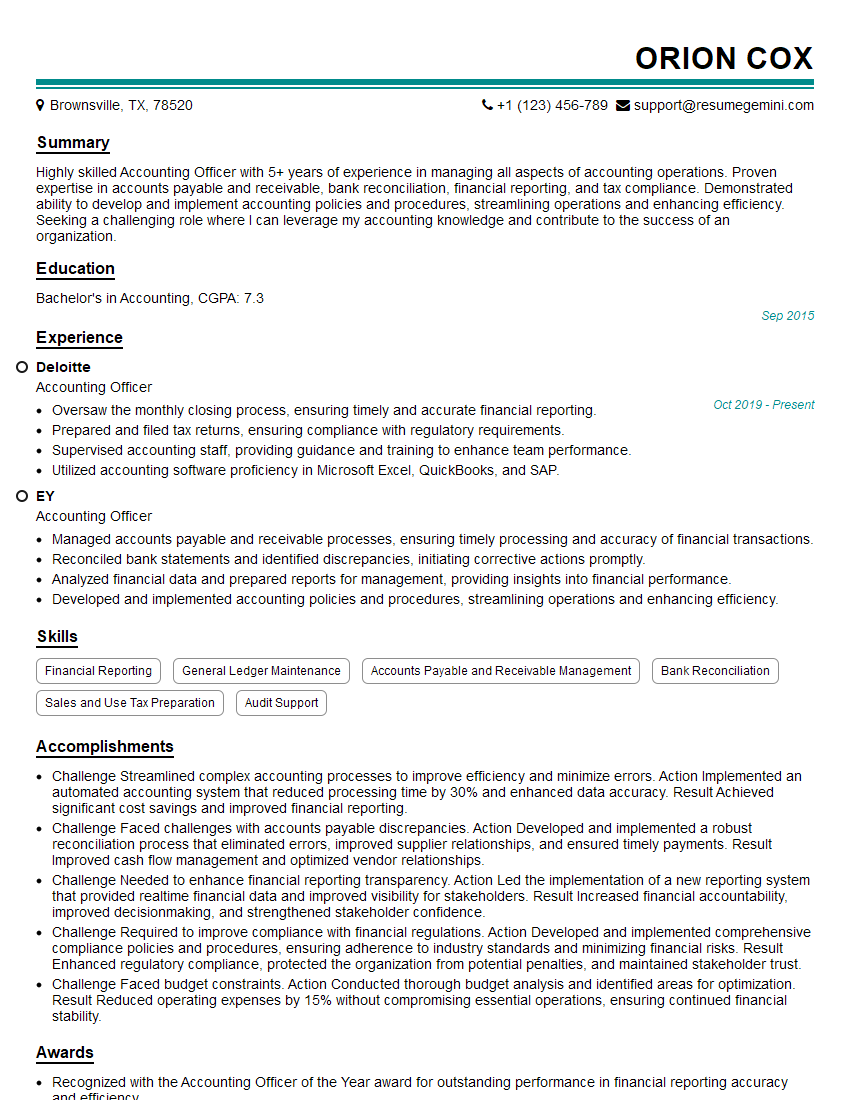

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Accounting Officer

1. Describe the primary responsibilities of an Accounting Officer.

The primary responsibilities of an Accounting Officer typically include:

- Overseeing the preparation and presentation of accurate and reliable financial statements.

- Ensuring compliance with all applicable accounting regulations and standards.

2. Explain the importance of maintaining strong internal controls in an organization.

Risk mitigation

- Internal controls help to identify and mitigate risks that could lead to financial loss or fraud.

- They provide a framework for preventing and detecting errors and irregularities.

Accurate financial reporting

- Strong internal controls ensure that financial records are accurate and reliable, which is essential for producing meaningful financial statements.

- This enhances the credibility of the organization’s financial reporting.

3. Discuss the role of an Accounting Officer in ensuring financial compliance.

The Accounting Officer plays a crucial role in ensuring financial compliance by:

- Developing and implementing policies and procedures that comply with relevant laws and regulations.

- Monitoring and reviewing financial transactions to ensure adherence to these policies and procedures.

4. Explain the concept of accrual accounting and its advantages over cash basis accounting.

Accrual accounting records transactions when they occur, regardless of when cash is received or paid. Its advantages over cash basis accounting include:

- Provides a more accurate picture of the financial performance of an organization.

- Helps to avoid distortions in financial statements due to timing differences between transactions and cash flows.

5. Describe the key elements of a balance sheet.

A balance sheet typically includes the following key elements:

- Assets: Resources owned or controlled by the organization.

- Liabilities: Obligations owed by the organization to external parties.

- Equity: The residual interest in the organization after deducting liabilities from assets.

6. Explain the concept of depreciation and its impact on financial statements.

Depreciation is the process of allocating the cost of a long-lived asset over its useful life. Its impact on financial statements includes:

- Reducing the carrying value of the asset on the balance sheet.

- Recognizing an expense on the income statement, which can affect profitability.

7. Discuss the importance of cash flow management in an organization.

Cash flow management is essential for an organization to:

- Meet its financial obligations and operating expenses.

- Invest in growth opportunities and maintain financial stability.

8. Explain the concept of internal audit and its benefits to an organization.

Internal audit is an independent evaluation activity within an organization that provides:

- Assurance on the reliability and accuracy of financial reporting.

- Assessment of the effectiveness of internal controls.

9. Discuss the ethical responsibilities of an Accounting Officer.

The ethical responsibilities of an Accounting Officer include:

- Adhering to the highest standards of integrity and professionalism.

- Maintaining confidentiality of sensitive financial information.

- Avoiding any conflicts of interest.

10. Explain the role of an Accounting Officer in the financial planning and budgeting process.

The Accounting Officer is responsible for:

- Providing financial data and analysis to support decision-making.

- Developing and implementing financial plans and budgets.

- Monitoring and evaluating financial performance against budgets.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Accounting Officer.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Accounting Officer‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

The Accounting Officer plays a crucial role in managing the organization’s financial operations. Here are their key responsibilities:

1. Financial Reporting and Compliance

Responsible for preparing accurate financial statements, including income statements, balance sheets, and cash flow statements.

- Ensures compliance with accounting standards (GAAP, IFRS, etc.) and regulatory requirements.

- Works closely with auditors to facilitate external audits and provide timely responses to audit inquiries.

2. Budgeting and Forecasting

Develops and manages the organization’s budget, ensuring alignment with strategic goals and financial resources.

- Creates financial projections, forecasts, and analyzes financial performance to support decision-making.

- Monitors actual results against budgeted amounts and recommends corrective actions as needed.

3. Accounting Operations

Oversees all accounting operations, including recording transactions, reconciling accounts, and managing accounts payable and receivable.

- Implements and maintains accounting systems and procedures to ensure data integrity and timely reporting.

- Manages a team of accounting professionals and ensures their compliance with professional standards.

4. Risk Management

Identifies, assesses, and mitigates financial risks to protect the organization’s assets and reputation.

- Develops and implements internal controls to prevent fraud and errors.

- Monitors financial markets and economic trends to anticipate potential risks and opportunities.

Interview Tips

To ace the Accounting Officer interview, consider the following tips:

1. Research the Organization

Demonstrate a genuine interest in the organization by researching its industry, financial performance, and current projects.

2. Highlight Relevant Experience

Quantify your accomplishments and highlight specific examples where you have successfully managed financial operations, implemented accounting systems, or mitigated risks.

3. Demonstrate Technical Proficiency

Be prepared to discuss your knowledge of accounting standards, auditing principles, and financial analysis techniques.

4. Practice Financial Modeling

Expect questions related to financial modeling, such as developing budgets, forecasting revenue, and analyzing financial ratios.

5. Emphasize Communication and Leadership Skills

Accounting Officers often interact with stakeholders and lead accounting teams. Showcase your ability to communicate effectively and motivate others.

6. Ask Insightful Questions

Prepare thoughtful questions that demonstrate your interest in the role and the organization’s financial strategy.

7. Be Professional and Enthusiastic

Dress professionally, arrive on time, and maintain a positive and enthusiastic attitude throughout the interview.

8. Prepare Sample Documents

Consider bringing sample financial reports, budgeting models, or other relevant documents that showcase your skills and experience.

9. Follow Up

After the interview, send a follow-up email thanking the interviewer and reiterating your interest in the position.

10. Practice Mock Interviews

Consider practicing mock interviews with a friend, colleague, or career counselor to gain confidence and refine your presentation.

Next Step:

Now that you’re armed with the knowledge of Accounting Officer interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Accounting Officer positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini