Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Accounting Specialist position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

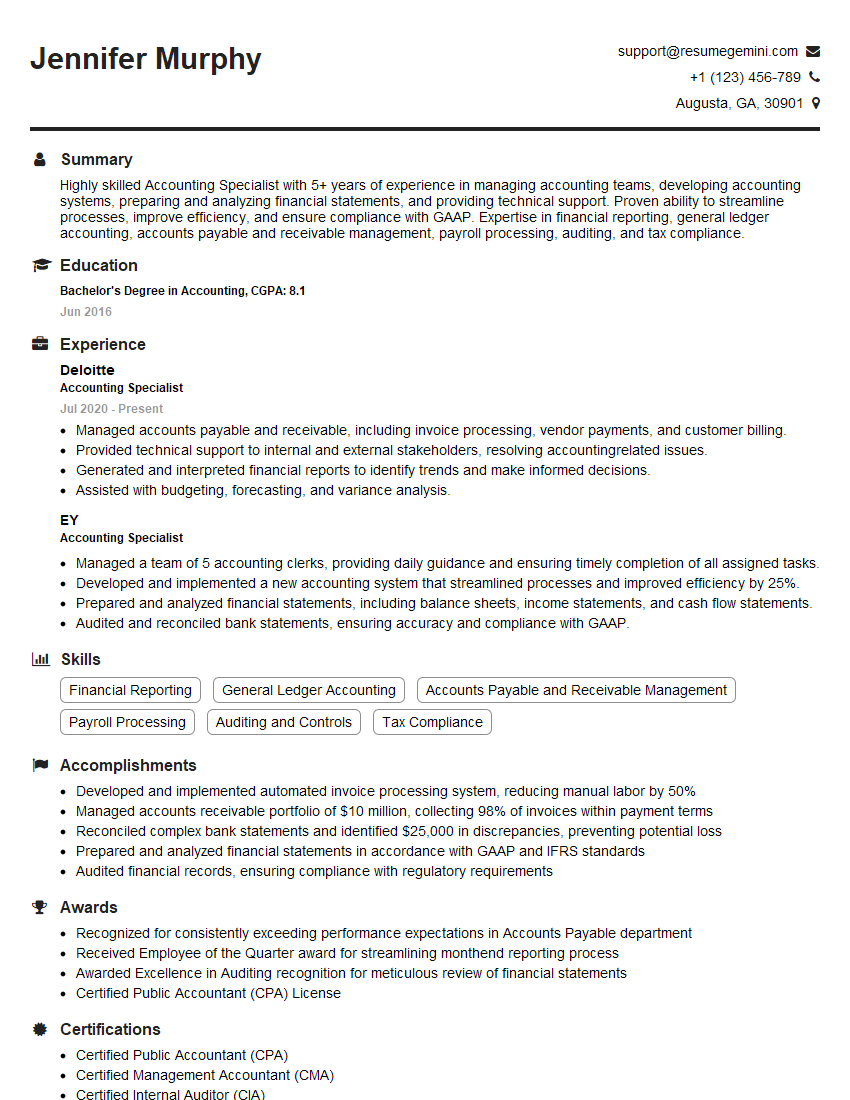

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Accounting Specialist

1. Explain the double-entry accounting system.

The double-entry accounting system is a method of recording financial transactions that involves recording every transaction in at least two accounts. This ensures that the total debits equal the total credits, which helps to maintain the accounting equation (Assets = Liabilities + Equity).

- Advantages of the double-entry accounting system include:

- Improved accuracy

- Easier to detect errors

- Provides a more complete picture of the financial position of a company

2. What are the different types of financial statements?

Balance Sheet

- A financial statement that summarizes a company’s assets, liabilities, and equity at a specific point in time.

- Provides a snapshot of the company’s financial health.

Income Statement

- A financial statement that summarizes a company’s revenues, expenses, and profits over a period of time.

- Shows how the company has performed financially over the period.

Statement of Cash Flows

- A financial statement that summarizes a company’s cash inflows and outflows over a period of time.

- Shows how the company has generated and used cash.

3. What are the accounting principles that govern the preparation of financial statements?

- The principles of accounting that govern the preparation of financial statements include:

- Accrual accounting: Transactions are recorded when they occur, regardless of when cash is received or paid.

- Going concern: The company is assumed to be a going concern, meaning that it will continue to operate in the foreseeable future.

- Matching principle: Expenses are matched to the revenues they generate.

- Materiality: Only information that is material to the financial statements is disclosed.

4. What are the different types of accounting software?

- There are many different types of accounting software available, each with its own strengths and weaknesses.

- Some of the most popular accounting software programs include QuickBooks, NetSuite, and SAP.

- When choosing an accounting software program, it is important to consider the size of your company, your industry, and your specific needs.

5. What are the key responsibilities of an Accounting Specialist?

- The key responsibilities of an Accounting Specialist include:

- Preparing financial statements

- Maintaining accounting records

- Performing audits

- Providing financial advice

6. What are the qualifications of an Accounting Specialist?

- The qualifications of an Accounting Specialist typically include:

- A bachelor’s degree in accounting

- Several years of experience in accounting

- Strong knowledge of accounting principles and practices

7. What are the challenges of being an Accounting Specialist?

- The challenges of being an Accounting Specialist include:

- Keeping up with the latest accounting standards

- Dealing with complex financial transactions

- Meeting deadlines

8. What are the rewards of being an Accounting Specialist?

- The rewards of being an Accounting Specialist include:

- Job security

- Good earning potential

- Opportunities for advancement

9. Why are you interested in this position?

I am interested in this position because I am a highly motivated and experienced Accounting Specialist with a strong understanding of accounting principles and practices. I am also proficient in the use of accounting software and have a proven track record of success in preparing financial statements, maintaining accounting records, and performing audits.

10. What are your salary expectations?

My salary expectations are $ [amount] per year.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Accounting Specialist.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Accounting Specialist‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Accounting Specialists are responsible for handling a wide range of accounting tasks. These tasks may vary depending on the size and industry of the company, but generally include:

1. Financial Reporting

Preparing and reviewing financial statements, such as balance sheets, income statements, and cash flow statements.

2. Asset Management

Tracking and managing fixed assets, such as property, plant, and equipment.

3. Payroll Processing

Calculating and processing employee payroll, including withholding taxes and deductions.

4. Accounts Payable and Receivable

Managing accounts payable and receivable, including invoice processing and payment.

5. Auditing

Conducting internal audits to ensure that accounting practices are being followed and that financial records are accurate.

6. Month-End Closing

Performing month-end closing procedures, such as reconciling accounts and preparing financial statements.

7. Financial Analysis

Analyzing financial data to identify trends and patterns, and making recommendations to management.

8. Budget Preparation and Monitoring

Preparing budgets and monitoring actual performance against budget.

Interview Tips

To ace your interview for an Accounting Specialist position, it is important to:

1. Research the Company

Learn as much as you can about the company, its industry, and its financial performance.

- This will help you to answer questions about the company’s business and its accounting practices.

- Example: You might visit the company’s website, read its annual report, and look for news articles about the company.

2. Practice Your Accounting Skills

Make sure you are comfortable with the accounting principles and practices that are relevant to the position.

- This may include refreshing your knowledge of GAAP or IFRS, or practicing your skills in using accounting software.

- Example: You might take a practice test or complete some sample accounting problems.

3. Be Prepared to Talk About Your Experience

In your interview, be sure to highlight your relevant experience and skills.

- This may include your experience in financial reporting, asset management, payroll processing, or other accounting areas.

- Example: You might talk about a time when you successfully implemented a new accounting system or streamlined a process.

4. Ask Questions

Asking questions at the end of the interview shows that you are interested in the position and the company.

- This is also an opportunity to learn more about the company and its culture.

- Example: You might ask about the company’s plans for growth, its accounting policies, or its employee benefits.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Accounting Specialist interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!