Are you gearing up for a career in Accounting Supervisor? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Accounting Supervisor and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

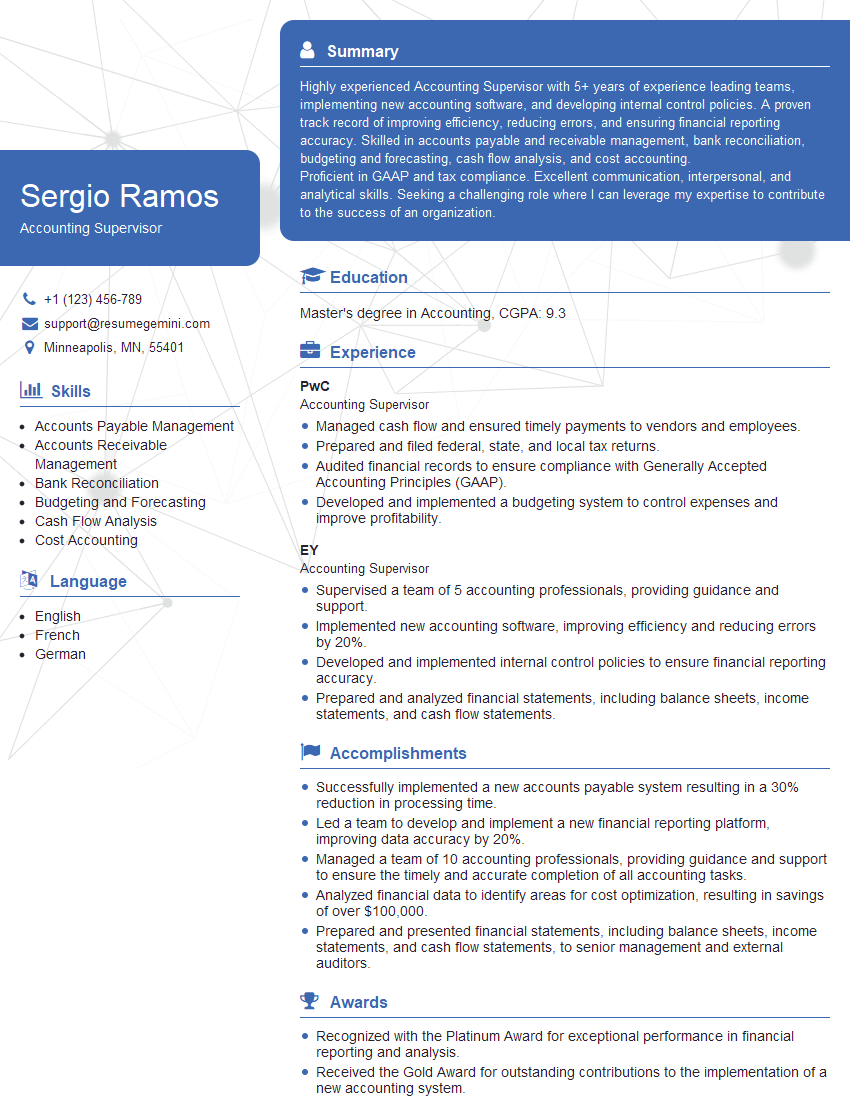

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Accounting Supervisor

1. What are the key accounting principles that guide the preparation of financial statements?

Answer: – Accrual accounting – Matching principle – Going concern – Materiality – Consistency

2. Describe the process for recording and reconciling intercompany transactions.

: Recording the Transactions

- Identify the intercompany transaction and its amount.

- Record the transaction in the books of both the issuing and receiving company.

Subheading: Reconciling the Transactions

- Compare the intercompany transactions recorded in the books of both companies.

- Investigate and resolve any differences between the two companies’ records.

3. How do you ensure the accuracy and completeness of the financial reporting process?

Answer: – Establish clear accounting policies and procedures. – Implement internal controls to prevent errors and fraud. – Perform regular reconciliations and audits. – Review financial statements for reasonableness and accuracy.

4. Explain the difference between the direct and indirect methods of preparing the statement of cash flows.

Answer: – Direct Method: Reports cash flows from operating, investing, and financing activities directly. – Indirect Method: Reconciles net income to cash flow from operating activities using adjustments for non-cash items.

5. How do you account for deferred income taxes?

Answer: – Determine the temporary differences between book and taxable income. – Calculate the deferred tax liability or asset based on applicable tax rates. – Record the deferred tax adjustment and related expense or income.

6. Explain the IASB’s Conceptual Framework for Financial Reporting.

Answer: – Defines the qualitative and quantitative characteristics of useful financial information. – Provides guidance on the recognition, measurement, presentation, and disclosure of financial information. – Enhances the consistency and comparability of financial statements.

7. What are the key responsibilities of an Accounting Supervisor?

Answer: – Supervise accounting staff and ensure the accuracy and efficiency of accounting processes. – Review and approve financial statements and reports. – Ensure compliance with accounting standards and regulatory requirements. – Manage accounting systems and develop accounting policies and procedures. – Provide technical accounting guidance and support to staff.

8. Describe your experience with internal and external audits.

Answer: – Internal Audits: Participated in audits of accounting processes, financial controls, and compliance with regulations. – External Audits: Assisted external auditors with the review of financial statements and related supporting documents.

9. What are the key challenges facing the accounting profession today?

Answer: – Technological advancements and the need for digital accounting skills. – Increasing regulatory complexity and the need for compliance. – The global nature of business and the need for cross-border accounting expertise.

10. How do you stay up-to-date on the latest accounting standards and best practices?

Answer: – Attend conferences and workshops. – Read professional journals and publications. – Participate in online forums and discussions. – Seek continuing education opportunities.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Accounting Supervisor.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Accounting Supervisor‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

As an Accounting Supervisor, you will have a critical role in overseeing and managing various accounting functions within the organization.

1. Financial Reporting and Analysis

You will be responsible for ensuring the accuracy and timely submission of financial statements, including balance sheets, income statements, and cash flow statements.

- Analyze financial data to identify trends, patterns, and potential areas for improvement.

- Prepare management reports and presentations to communicate financial performance and insights.

2. Accounting Operations

You will oversee the day-to-day accounting operations, including accounts payable, accounts receivable, and payroll.

- Manage and train accounting staff to ensure adherence to accounting principles and standards.

- Implement and maintain accounting systems and controls to safeguard the integrity of financial data.

3. Budgeting and Forecasting

You will develop and monitor budgets and forecasts to support organizational planning and decision-making.

- Collaborate with department heads and stakeholders to establish realistic and achievable financial targets.

- Monitor actual performance against budget and forecast, and make necessary adjustments as needed.

4. Internal Audit and Compliance

You will assist with internal audit functions and ensure compliance with applicable laws, regulations, and accounting standards.

- Conduct periodic reviews and analysis of accounting records to identify and mitigate risks.

- Stay updated on industry best practices and accounting updates to maintain a high level of compliance.

Interview Tips

To ace your interview for an Accounting Supervisor role, consider these preparation tips:

1. Research the company and the role

Familiarize yourself with the organization’s industry, financial performance, and specific requirements for the role.

- Visit the company’s website, LinkedIn page, and other online resources to gather information.

- Review the job description thoroughly to understand the key responsibilities and qualifications.

2. Highlight your technical skills

Demonstrate your proficiency in accounting principles, financial reporting, and auditing techniques.

- Quantify your accomplishments whenever possible to showcase your impact.

- Provide specific examples of projects or initiatives where you successfully implemented accounting solutions.

3. Emphasize your leadership abilities

An Accounting Supervisor is expected to lead and motivate a team.

- Describe your experience in managing and mentoring accounting staff.

- Explain how you effectively delegate tasks and provide constructive feedback to your team.

4. Demonstrate your communication skills

Effective communication is crucial for success in this role.

- Share examples of how you clearly and concisely communicated complex financial information to stakeholders.

- Emphasize your ability to present and defend your analysis and recommendations in a persuasive manner.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Accounting Supervisor role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.