Are you gearing up for a career in Accounting Technician? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Accounting Technician and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

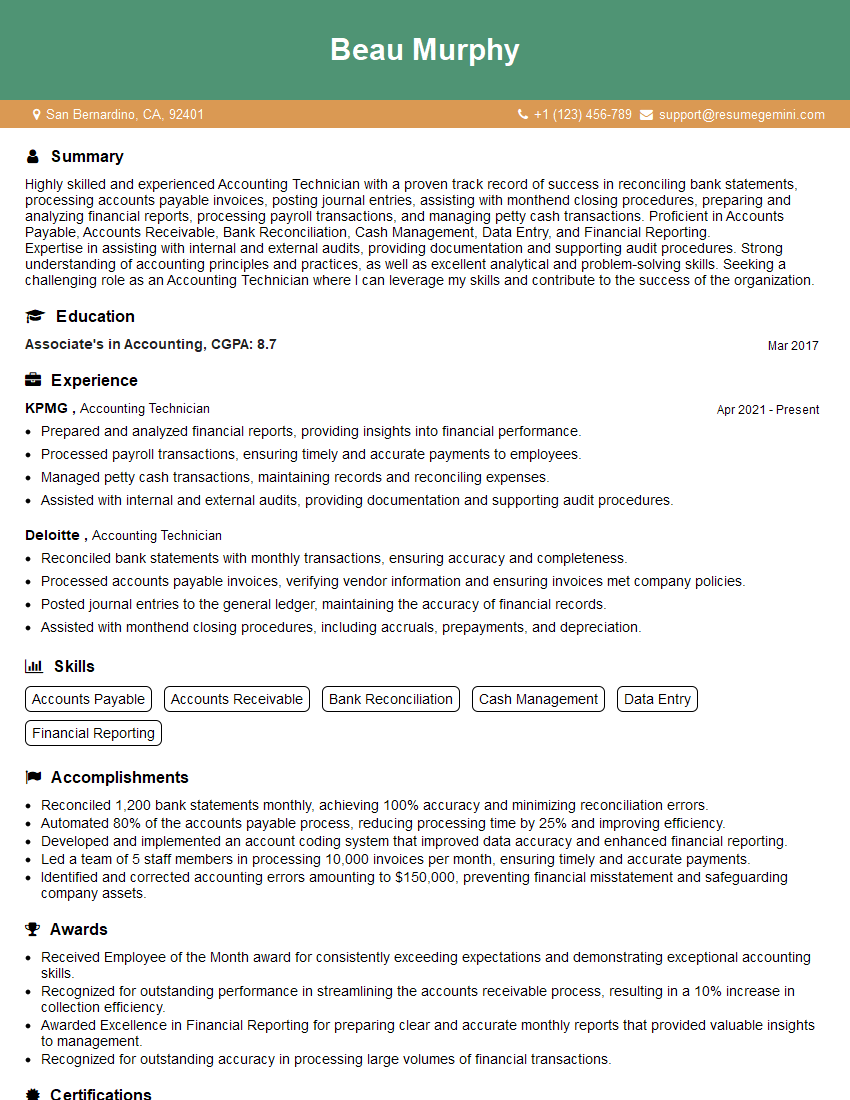

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Accounting Technician

1. Walk me through the accounting cycle from start to finish.

Answer:

- Transaction Recording: Recording financial transactions in the journal.

- Posting to the Ledger: Transferring journal entries to the appropriate ledger accounts.

- Trial Balance: Summarizing account balances to ensure they balance.

- Adjusting Entries: Recording end-of-period adjustments to update account balances.

- Adjusted Trial Balance: Summarizing adjusted account balances.

- Financial Statements: Preparing financial statements (income statement, balance sheet, cash flow statement).

- Closing Entries: Transferring temporary account balances to retained earnings.

- Post-Closing Trial Balance: Ensuring account balances are zero after closing entries.

2. How do you handle month-end closing procedures?

Answer:

- Reconcile Bank Accounts: Match bank statements with internal records.

- Accrue and Defer Expenses/Revenues: Record expenses or revenues incurred but not yet paid or received.

- Record Depreciation and Amortization: Allocate the cost of fixed assets and intangible assets over their useful lives.

- Prepare Adjusting Journal Entries: Update account balances to reflect current financial status.

- Prepare Financial Statements: Create income statement, balance sheet, and cash flow statement.

3. Explain the difference between GAAP and IFRS.

Answer:

- Purpose: GAAP is used in the US, while IFRS is used internationally.

- Principles-Based vs. Rule-Based: GAAP is more principles-based, allowing for more interpretation, while IFRS is more rule-based.

- Disclosures: IFRS requires more extensive disclosures than GAAP.

- Adoption: GAAP is required in the US, while IFRS is adopted voluntarily in some countries.

4. How do you ensure the accuracy and reliability of financial data?

Answer:

- Internal Controls: Implement internal controls to prevent and detect errors.

- Data Validation: Check the accuracy and completeness of data entry.

- Reconciliations: Reconcile different sets of records to identify discrepancies.

- Analytical Reviews: Compare financial data to previous periods and industry benchmarks.

5. Explain how you handle errors in accounting records.

Answer:

- Identify the Error: Determine the type and source of the error.

- Quantify the Error: Determine the financial impact of the error.

- Record the Correction: Make an adjusting entry to correct the error.

- Document the Error: Prepare supporting documentation to explain the error and the correction.

6. How do you allocate overhead costs?

Answer:

- Identify Overhead Costs: Determine the costs that will be allocated.

- Select an Allocation Base: Choose a basis that fairly distributes costs to departments or cost centers.

- Calculate Allocation Rates: Divide overhead costs by the allocation base to determine rates.

- Apply Allocation Rates: Multiply rates by usage to allocate costs.

7. What types of inventory valuation methods are there?

Answer:

- FIFO: First-in, first-out assumes that the oldest inventory is sold first.

- LIFO: Last-in, first-out assumes that the newest inventory is sold first.

- Weighted Average: Calculates an average cost per unit based on all inventory on hand.

- Specific Identification: Identifies the specific cost of each unit of inventory.

8. Explain the concept of depreciation and its different methods.

Answer:

- Purpose: Allocates the cost of fixed assets over their useful lives.

- Methods:

- Straight-Line: Uniform depreciation expense over the asset’s life.

- Declining Balance: Higher depreciation expense in the early years.

- Units-of-Production: Depreciation based on the asset’s usage.

9. How do you prepare a cash flow statement?

Answer:

- Indirect Method: Adjusts net income to account for non-cash transactions.

- Direct Method: Shows the actual cash inflows and outflows from operating, investing, and financing activities.

- Components:

- Operating Activities: Cash from core business operations.

- Investing Activities: Cash from investments and asset purchases.

- Financing Activities: Cash from debt and equity transactions.

10. What are some common accounting software programs?

Answer:

- QuickBooks

- Sage Intacct

- NetSuite

- Oracle NetSuite

- Xero

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Accounting Technician.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Accounting Technician‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

An Accounting Technician plays a crucial role in the Accounting department, assisting senior accountants with various tasks related to financial data processing and accounting procedures. Their key responsibilities include:

1. Data Entry and Processing

Accurately entering and processing financial data from various sources, including invoices, bank statements, and receipts.

2. Accounts Payable/Receivable Maintenance

Maintaining accounts payable and receivable records, including processing invoices, reconciling payments, and following up on outstanding payments.

3. Bank Reconciliation

Reconciling bank statements with internal records, identifying and resolving any discrepancies.

4. General Ledger Maintenance

Posting transactions to the general ledger, ensuring accuracy and completeness of financial records.

5. Financial Reporting

Assisting in the preparation of financial reports, such as balance sheets, income statements, and cash flow statements.

Interview Tips

To ace an interview for an Accounting Technician position, it’s important to prepare thoroughly. Here are some tips to help you:

1. Research the Company and Position

Familiarize yourself with the company’s background, industry, and financial performance. Research the specific role you’re applying for to understand its responsibilities and requirements.

2. Highlight Relevant Skills and Experience

Emphasize your proficiency in accounting software, data entry, and financial analysis. Provide specific examples from your previous work experience that demonstrate your abilities in these areas.

3. Practice Behavioral Interview Questions

Behavioral questions ask you to describe how you handled specific situations in the past. Prepare for these questions by using the STAR method (Situation, Task, Action, Result) to structure your answers.

4. Ask Thoughtful Questions

Asking thoughtful questions during the interview shows that you’re engaged and interested. Prepare questions about the company’s culture, growth opportunities, and the specific responsibilities of the role.

5. Dress Professionally and Arrive on Time

First impressions matter! Dress appropriately for the interview and arrive on time to demonstrate respect for the interviewer’s time.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Accounting Technician interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.