Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Accounts Executive interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Accounts Executive so you can tailor your answers to impress potential employers.

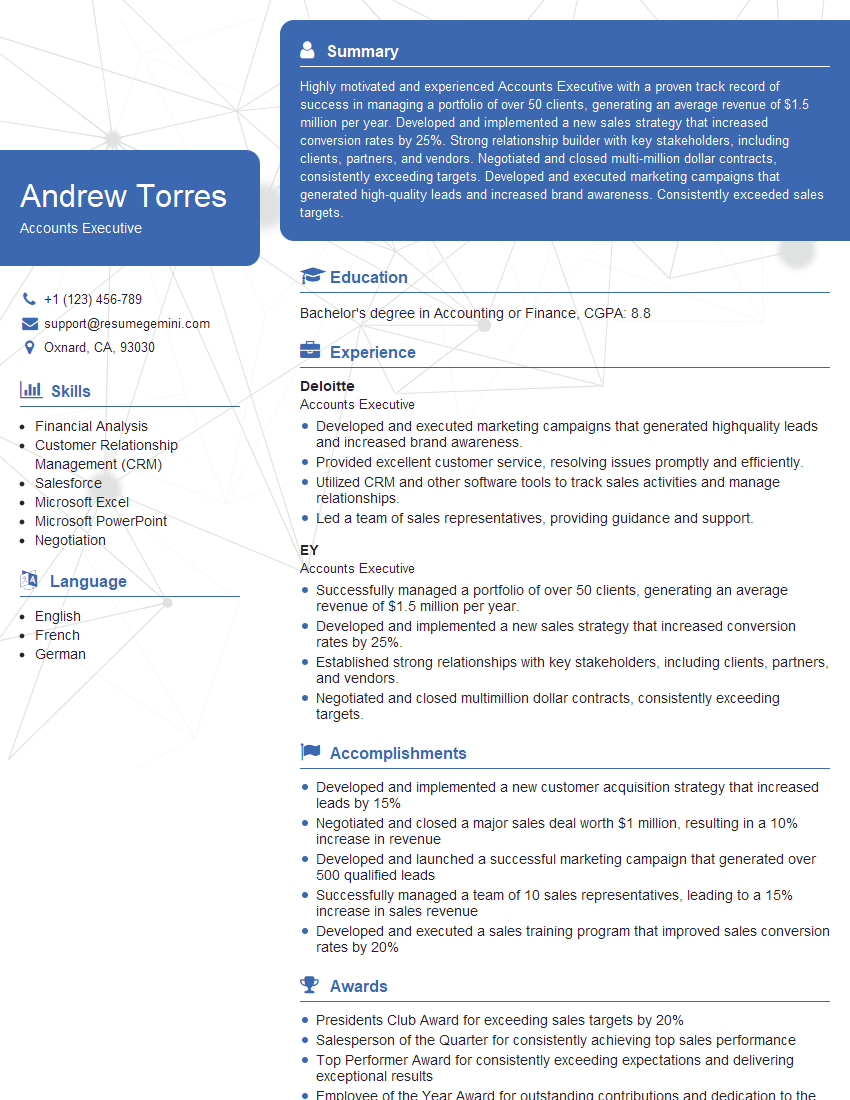

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Accounts Executive

1. Explain the process of reconciling a bank statement?

The process of reconciling a bank statement involves comparing the records of an entity’s bank account with its own internal records to ensure that both sets of records match.

- Gather necessary documents: Bank statement, check register, deposit slips, and outstanding checks.

- Compare beginning balances: Ensure that the beginning balance on the bank statement matches the ending balance on the check register.

- Review deposits: Check if all deposits recorded in the check register have been credited to the bank statement.

- Check withdrawals: Compare canceled checks against the bank statement to verify that all withdrawals have been recorded.

- Identify outstanding checks: Note any checks issued but not yet presented to the bank.

- Adjustments: Make necessary adjustments to the check register to account for outstanding checks or any other discrepancies.

- Calculate adjusted balance: Determine the adjusted balance by adding outstanding checks and subtracting deposits in transit from the bank statement balance.

- Reconcile adjusted balance: Compare the adjusted balance with the adjusted balance on the check register. If they match, the reconciliation is complete.

2. How do you handle customer inquiries related to billing errors?

Understanding the Issue

- Actively listen to the customer’s concern and gather specific details about the billing error.

- Review the customer’s account history and relevant documents to identify the root cause of the error.

Resolving the Issue

- Communicate the error to the customer in a clear and empathetic manner.

- Work with the customer to provide a prompt and accurate resolution, such as issuing a refund or credit.

- Update the customer’s account accordingly and provide them with a revised invoice or statement.

Follow-Up and Documentation

- Follow up with the customer to ensure that the issue has been resolved to their satisfaction.

- Document the inquiry, resolution, and any necessary adjustments for future reference.

3. Describe your experience with using accounting software.

I have extensive experience using a variety of accounting software packages, including:

- QuickBooks: Proficient in all aspects of QuickBooks, including setup, transaction processing, financial reporting, and tax preparation.

- NetSuite: Experienced in implementing and managing NetSuite for accounting, inventory management, and billing.

- Sage Intacct: Familiar with Sage Intacct’s features for financial management, project accounting, and expense tracking.

- Microsoft Dynamics GP: Utilized Microsoft Dynamics GP for accounting, financial reporting, and inventory control.

4. How do you ensure the accuracy and completeness of financial records?

- Established Procedures: Implement clear and concise procedures for recording transactions and maintaining financial records.

- Regular Reconciliation: Conduct regular reconciliations of bank accounts, accounts receivable, and accounts payable to ensure accuracy.

- Internal Controls: Establish internal controls to prevent errors and fraud, such as segregation of duties and authorization processes.

- Periodic Audits: Conduct internal or external audits to review the accuracy and integrity of financial records.

- Training and Development: Provide ongoing training to ensure that staff members are well-versed in accounting principles and procedures.

- Validation and Verification: Implement measures to validate and verify transactions, such as invoice matching and approval workflows.

5. Explain the concept of deferred revenue and how it is accounted for.

- Definition: Deferred revenue represents payments received for services or products that will be delivered or performed in the future.

- Recording: When deferred revenue is received, it is initially recorded as a liability.

- Recognition: As the services or products are delivered or performed, a portion of the deferred revenue is recognized as income.

- Balance Sheet Presentation: Deferred revenue is typically reported as a current liability on the balance sheet.

- Importance: Proper accounting for deferred revenue ensures accurate financial reporting and prevents overstatement of current period revenue.

6. Describe your experience with managing accounts receivable.

- Customer Invoicing: Responsible for creating, sending, and tracking customer invoices.

- Collections: Implemented strategies for timely and effective collections, including sending reminders, negotiating payment plans, and handling disputes.

- Customer Relationship Management: Maintained positive relationships with customers to facilitate smooth payment processes.

- Reporting: Provided regular reports on accounts receivable aging and collection performance.

- Process Optimization: Identified and implemented improvements to streamline accounts receivable processes and reduce outstanding balances.

7. How do you handle the preparation of financial statements?

- Gathering Data: Collect and review all necessary financial data, including trial balances, transaction reports, and supporting documentation.

- Analysis: Perform financial analysis to identify trends, patterns, and potential areas of concern.

- Statement Preparation: Prepare financial statements in accordance with relevant accounting standards and regulations, including the balance sheet, income statement, and cash flow statement.

- Review and Disclosure: Thoroughly review financial statements for accuracy and completeness, and ensure appropriate disclosures are made.

- Communication: Effectively communicate financial information to stakeholders, including management, investors, and regulatory bodies.

8. Describe your approach to managing accounts payable.

- Invoice Processing: Establish a system for efficient and accurate invoice processing, including verification and approval.

- Supplier Management: Maintain strong relationships with suppliers and negotiate favorable payment terms.

- Payment Processing: Process payments on time to avoid late fees and maintain supplier relationships.

- Process Controls: Implement internal controls to prevent duplicate payments and fraud.

- Reporting: Provide regular reports on accounts payable aging and payment performance.

9. How do you maintain compliance with relevant accounting regulations?

- Stay Informed: Keep updated on the latest accounting standards, regulations, and industry best practices.

- Internal Policies and Procedures: Develop and implement internal policies and procedures that align with regulatory requirements.

- Regular Reviews: Conduct regular reviews of accounting processes and documentation to ensure compliance.

- External Audits: Collaborate with external auditors during audits to demonstrate compliance and address any identified issues.

- Training and Development: Provide ongoing training to staff members on relevant accounting regulations to promote compliance.

10. Explain your understanding of the Generally Accepted Accounting Principles (GAAP).

- Definition: GAAP refers to a set of accounting rules and principles that guide how financial statements are prepared and presented.

- Objectives: GAAP aims to provide transparency, consistency, and comparability of financial information.

- Components: GAAP includes accounting standards, interpretations, and technical bulletins issued by various accounting bodies.

- Importance: Adherence to GAAP ensures the reliability and accuracy of financial statements and facilitates informed decision-making.

- Implementation: Proficiency in GAAP is crucial for accountants to prepare and interpret financial statements that comply with established standards.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Accounts Executive.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Accounts Executive‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

An Accounts Executive is responsible for managing the financial aspects of a business. Their key responsibilities include:

1. Accounts Receivable

Processing invoices, collecting payments, and managing customer accounts

- Maintaining accurate records of all receivables

- Reconciling customer payments

- Investigating and resolving discrepancies

2. Accounts Payable

Processing vendor invoices, making payments, and managing vendor accounts

- Verifying and approving invoices for payment

- Issuing payments to vendors

- Maintaining vendor relationships

3. General Ledger

Recording and classifying financial transactions, and preparing financial statements

- Maintaining general ledger accounts

- Preparing trial balances and financial statements

- Analyzing financial data

4. Budgeting and Forecasting

Developing and managing budgets and forecasts

- Creating and maintaining budgets

- Forecasting financial performance

- Tracking actual results against budgets and forecasts

Interview Tips

To ace an interview for an Accounts Executive position, it is important to:

1. Know the Company and the Role

Research the company, its financial performance, and the specific responsibilities of the Accounts Executive role. This will help you tailor your answers to the interviewer’s questions and demonstrate your interest in the position.

- Example: “I was impressed by your company’s recent acquisition of XYZ Company. I believe my experience in managing accounts receivable and payable would be a valuable asset to your team.”

2. Highlight Your Skills and Experience

Quantify your accomplishments and use specific examples to demonstrate your skills. For example, instead of saying “I am proficient in accounting software,” you could say “I have over 5 years of experience using QuickBooks and have successfully implemented a new accounting system that resulted in a 10% increase in efficiency.”

- Example: “In my previous role, I was responsible for managing a team of three accounts receivable specialists. We were able to reduce our average collection time by 15% by implementing a new process for dispute resolution.”

3. Be Prepared for Technical Questions

Be prepared to answer technical questions about accounting principles and procedures. This may include questions about debits and credits, journal entries, and financial ratios.

- Example: “What is the difference between a debit and a credit?” “What is the formula for calculating the current ratio?”

4. Ask Questions

Asking questions at the end of the interview shows that you are interested in the position and that you are taking the interview seriously. It also gives you an opportunity to learn more about the company and the role.

- Example: “I am very interested in learning more about your company’s financial strategies.” “What are the biggest challenges facing the accounting department right now?”

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Accounts Executive role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.