Feeling lost in a sea of interview questions? Landed that dream interview for Accounts Payable Representative but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Accounts Payable Representative interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

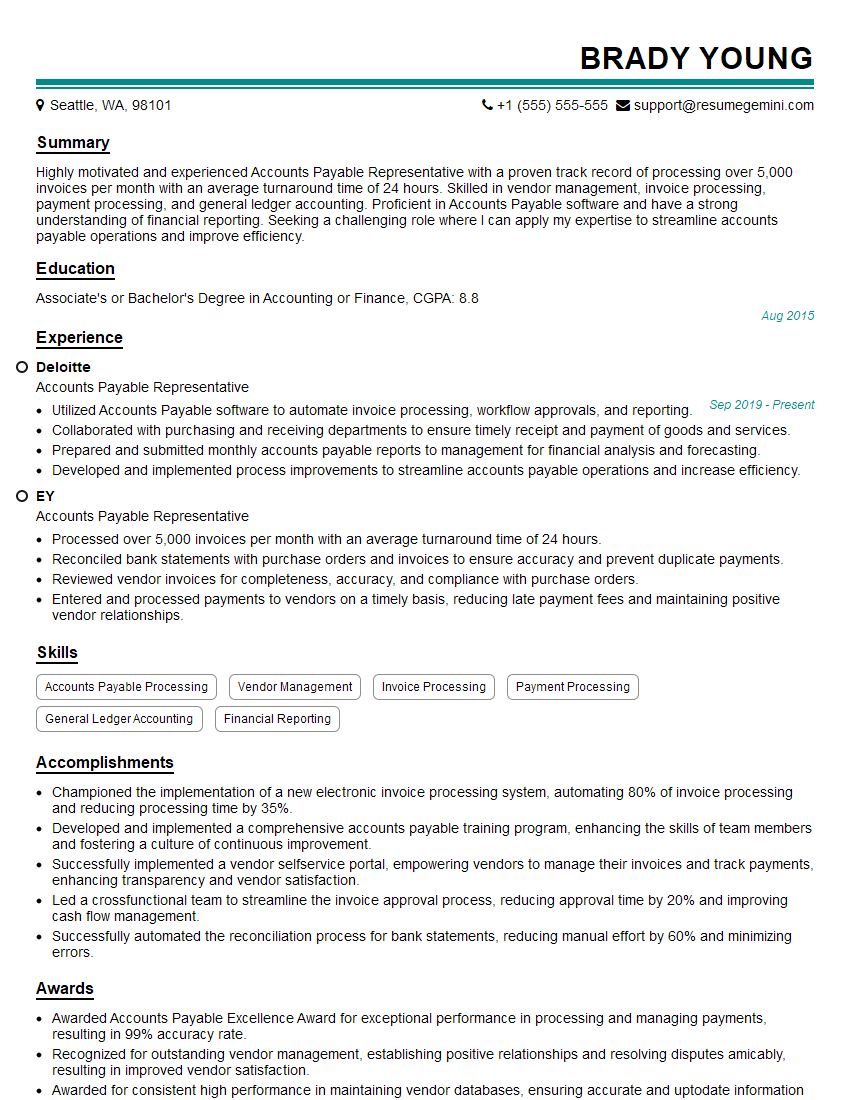

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Accounts Payable Representative

1. Explain the process of accounts payable from the moment an invoice is received to the moment the payment is made?

The accounts payable process from the moment an invoice is received to the moment the payment is made involves several key steps:

- Receipt and recording of invoice: When an invoice is received, it is logged and entered into the accounts payable system.

- Verification of invoice: The invoice is then verified for accuracy against the purchase order, receipt of goods or services, and pricing.

- Approval of invoice: Once verified, the invoice is routed for approval, typically by the department head or designated approver.

- Payment processing: Upon approval, the invoice is processed for payment. This includes generating a payment voucher and issuing a check or electronic payment.

- Recording of payment: The payment is recorded in the accounts payable system, updating the invoice status and accounting records.

2. What are the key controls you would implement to prevent duplicate payments?

Controls to Prevent Duplicate Payments

- Matching invoices to purchase orders: Ensuring that invoices match authorized purchase orders helps to prevent payments for goods or services not received.

- Three-way matching: Comparing invoices, purchase orders, and receiving reports provides an additional layer of verification.

- Automated invoice processing: Using software or systems to automate invoice processing reduces manual errors and improves accuracy.

- Vendor master file maintenance: Maintaining an accurate vendor master file with unique identifiers helps to prevent duplicate vendor accounts.

- Invoice reconciliation: Regularly reconciling invoices with accounts payable records helps to identify and resolve discrepancies.

3. How would you handle a situation where a vendor disputes the payment terms or amount of an invoice?

In case of a vendor dispute, I would take the following steps:

- Communication: Contact the vendor to understand their concerns and gather supporting documentation.

- Verification: Review the invoice and supporting documents to verify the accuracy of the payment terms and amount.

- Negotiation: Discuss the issue with the vendor and explore options for resolving the dispute amicably.

- Documentation: Keep a record of all communication and agreements reached.

- Resolution: Finalize the resolution and update the accounts payable records accordingly.

4. What is your experience in using accounting software for accounts payable processing?

I have extensive experience in using accounting software for accounts payable processing. I am proficient in using various software packages, including [Software Name 1], [Software Name 2], and [Software Name 3].

- In my previous role, I was responsible for managing accounts payable processes using [Software Name 1].

- I have implemented automated invoice processing, vendor management, and payment approval workflows within [Software Name 2].

5. How do you stay updated on changes in tax laws and regulations that may impact accounts payable?

To stay updated on changes in tax laws and regulations that may impact accounts payable, I follow these practices:

- Professional development: Attend industry conferences, webinars, and training sessions.

- Subscription to newsletters and alerts: Subscribe to reputable sources that provide updates on tax-related matters.

- Regular review of government websites: Monitor official websites of tax authorities for announcements and guidance.

- Consultation with tax professionals: Seek advice from certified public accountants or tax attorneys for complex issues.

6. What is your experience in managing vendor relationships?

In my previous roles, I have been responsible for managing vendor relationships and ensuring smooth accounts payable operations. I have:

- Negotiated payment terms, discounts, and delivery schedules with vendors.

- Established clear communication channels and maintained regular contact to resolve queries and address issues.

- Developed and implemented vendor onboarding processes to ensure compliance with company policies and regulations.

7. How would you ensure the confidentiality of sensitive financial information?

To ensure the confidentiality of sensitive financial information, I would implement the following measures:

- Access control: Limit access to financial information only to authorized personnel.

- Encryption: Encrypt sensitive data both in transit and at rest.

- Data security protocols: Adhere to established data security protocols, such as firewalls and intrusion detection systems.

- Regular audits: Conduct regular audits to identify and address any vulnerabilities.

- Employee training: Educate employees on the importance of data security and their responsibilities in protecting sensitive information.

8. What is your experience in analyzing accounts payable data to identify trends and improve processes?

I am skilled in analyzing accounts payable data to identify trends and improve processes. I have used data analytics tools to:

- Identify patterns in vendor spending and negotiate better terms.

- Optimize payment schedules to maximize early payment discounts.

- Automate invoice processing and reduce manual errors.

- Generate reports and dashboards to provide insights to management.

9. Describe your understanding of the Sarbanes-Oxley Act and its impact on accounts payable.

The Sarbanes-Oxley Act (SOX) is a crucial legislation that enhances the accuracy and reliability of financial reporting. Its impact on accounts payable includes:

- Internal controls: SOX requires companies to establish and maintain effective internal controls over financial reporting, including accounts payable processes.

- Documentation: Detailed documentation of accounts payable policies, procedures, and processes is essential for compliance.

- Segregation of duties: Key responsibilities in accounts payable, such as invoice approval and payment processing, should be segregated to prevent fraud.

- Audit trail: Maintaining a clear audit trail for all accounts payable transactions is necessary to facilitate internal and external audits.

10. How would you contribute to the overall efficiency and effectiveness of the accounts payable department?

To contribute to the overall efficiency and effectiveness of the accounts payable department, I would:

- Process automation: Implement automated solutions to streamline invoice processing, approval workflows, and payment schedules.

- Vendor management: Optimize vendor relationships to secure favorable terms, reduce invoice errors, and improve communication.

- Data analysis: Utilize data analytics to identify areas for improvement, reduce costs, and enhance decision-making.

- Continuous improvement: Regularly review and evaluate processes to identify opportunities for optimization.

- Collaboration: Foster collaboration with other departments, such as purchasing and finance, to ensure alignment and efficiency.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Accounts Payable Representative.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Accounts Payable Representative‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Processing invoices

This involves verifying invoices for accuracy, ensuring that all necessary documentation is present, and approving invoices for payment.

*Maintaining vendor relationships

This involves communicating with vendors to resolve any issues with invoices or payments, and negotiating payment terms.

*Managing accounts payable systems

This involves ensuring that the company’s accounts payable system is up-to-date and accurate, and that all transactions are processed correctly.

*Preparing reports

This involves generating reports on accounts payable activity, such as aging reports and payment summaries, to provide management with insights into the company’s financial health.

## Interview Tips 1. Research the company and the position Prior to the interview, spend time researching the company, its industry, its competitors, and the specific job requirements. This will help you understand the company’s culture, its business goals, and the specific skills and experience they are looking for in an Accounts Payable Representative. 2. Practice common interview questions Prepare for common interview questions, such as “Can you tell me about yourself?”, “Why are you interested in this position?”, and “What are your strengths and weaknesses?”. Practice answering these questions concisely and professionally, highlighting your relevant skills and experience. 3. Bring relevant examples When answering interview questions, provide concrete examples of your work experience that demonstrate your skills and abilities. For example, if you are asked about your experience with accounts payable systems, you could discuss a time when you implemented a new system or resolved a complex issue with an existing system. 4. Be prepared to ask questions At the end of the interview, take the opportunity to ask questions about the company, the position, and the team. This shows that you are engaged and interested in the opportunity, and it gives you a chance to gather more information to make an informed decision about the job. 5. Follow up After the interview, send a thank-you note to the interviewer, reiterating your interest in the position and thanking them for their time. This is a good opportunity to address any questions or concerns that you may have forgotten to discuss during the interview.Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Accounts Payable Representative interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!